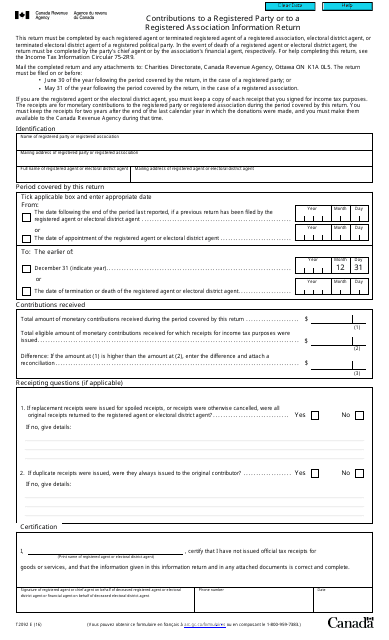

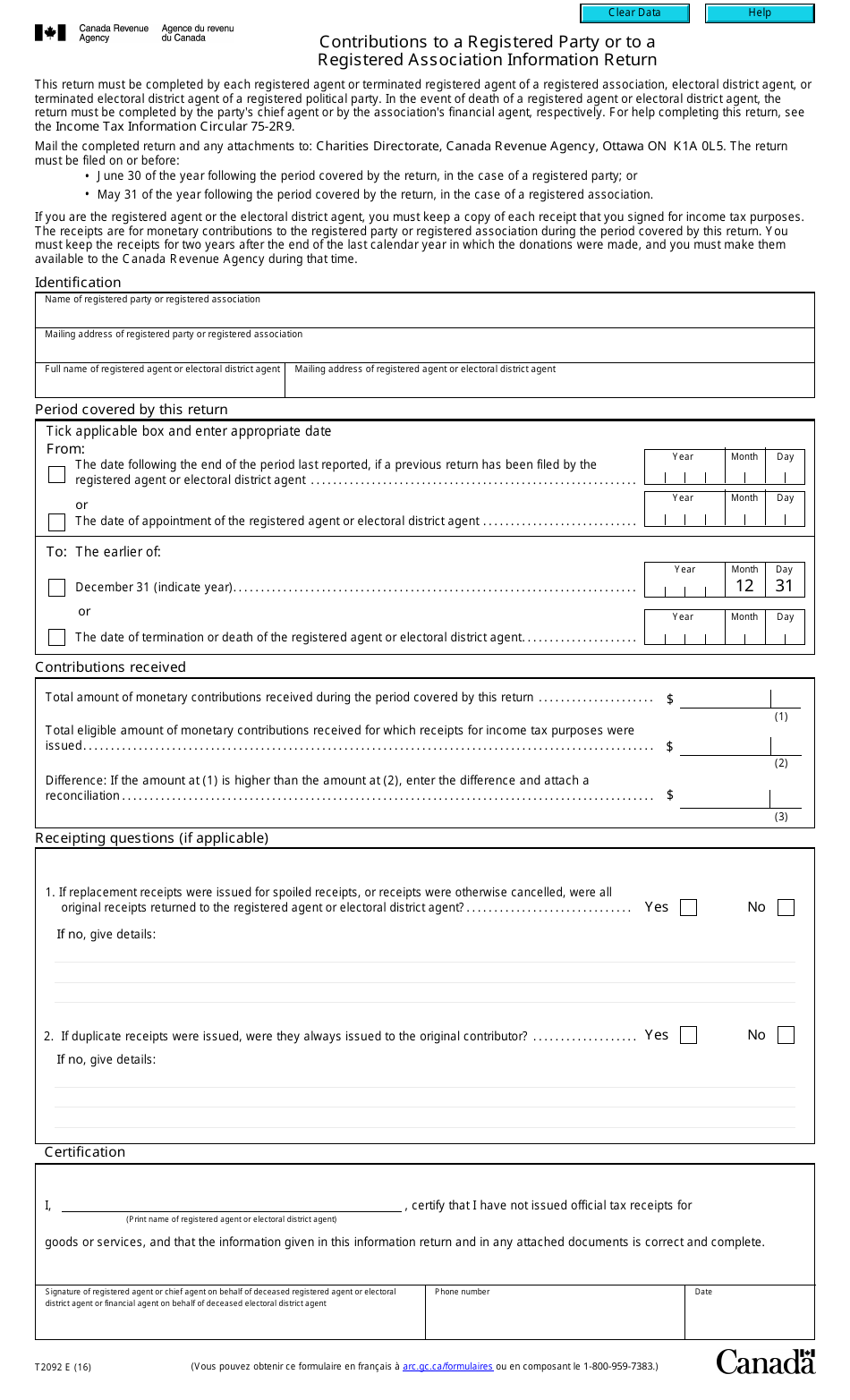

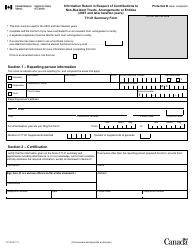

Form T2092 Contributions to a Registered Party or to a Registered Association Information Return - Canada

Form T2092 is a Canadian Revenue Agency form also known as the "Form T2092 "contributions To A Registered Party Or To A Registered Association Information Return" - Canada" . The latest edition of the form was released in January 1, 2016 and is available for digital filing.

Download an up-to-date Form T2092 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2092?

A: Form T2092 is the Contributions to a Registered Party or to a Registered Association Information Return in Canada.

Q: Who is required to file Form T2092?

A: Anyone who has made contributions to a registered party or registered association in Canada is required to file Form T2092.

Q: What is the purpose of Form T2092?

A: The purpose of Form T2092 is to report contributions made to a registered party or registered association in Canada for tax purposes.

Q: When is Form T2092 due?

A: Form T2092 is generally due within six months of the end of the taxation year in which the contributions were made.

Q: Are there any penalties for late filing of Form T2092?

A: Yes, there are penalties for late filing of Form T2092. The penalty amount depends on the number of days the form is overdue.