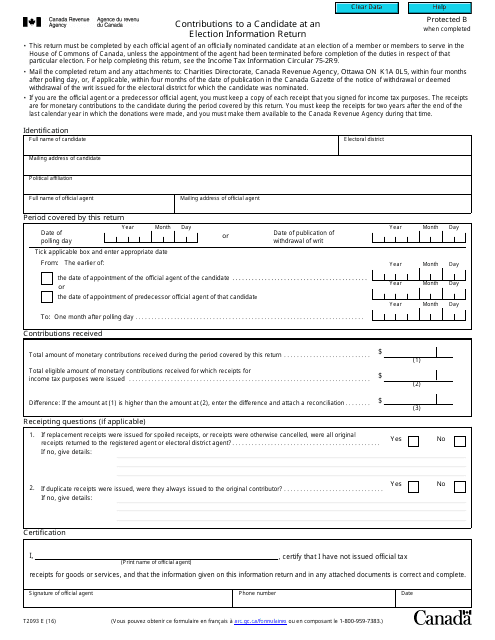

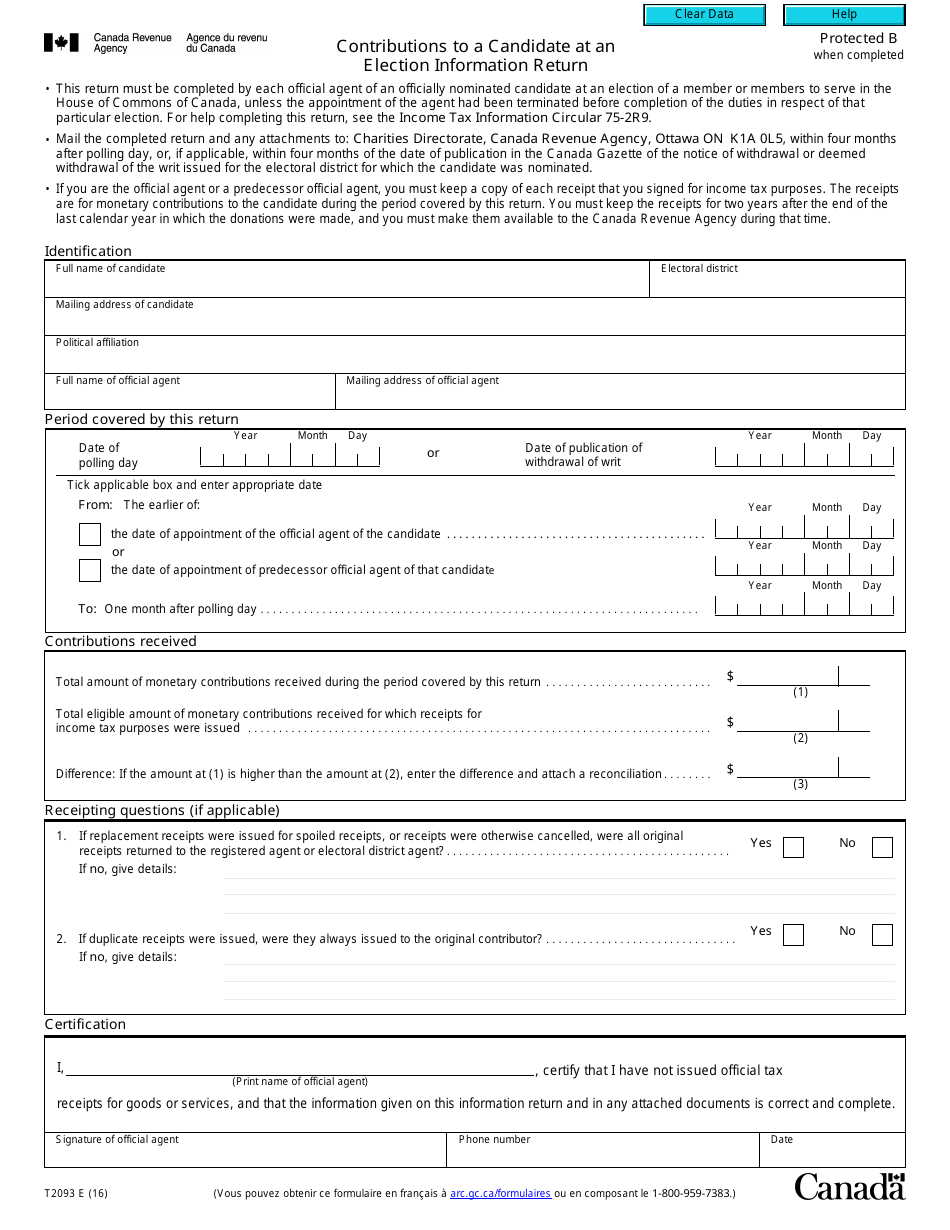

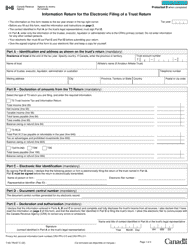

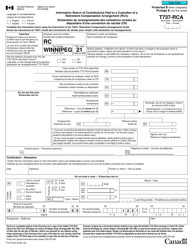

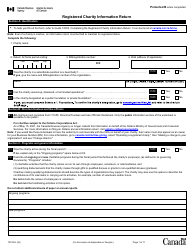

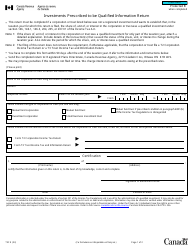

Form T2093 Contributions to a Candidate at an Election Information Return - Canada

Form T2093 or the "Form T2093 "contributions To A Candidate At An Election Information Return" - Canada" is a form issued by the Canadian Revenue Agency .

The form was last revised in January 1, 2016 and is available for digital filing. Download an up-to-date Form T2093 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2093?

A: Form T2093 is an Information Return used in Canada for reporting contributions made to a candidate in an election.

Q: Who needs to file Form T2093?

A: Anyone who has made contributions to a candidate at an election in Canada needs to file Form T2093.

Q: What information is required on Form T2093?

A: Form T2093 requires information about the contributor, the candidate, and the amount of the contribution.

Q: When is Form T2093 due?

A: Form T2093 is generally due within four months after the end of the taxation year in which the contributions were made.

Q: How can Form T2093 be filed?

A: Form T2093 can be filed electronically or by mail to the Canada Revenue Agency (CRA).

Q: Are there any penalties for not filing Form T2093?

A: Yes, failure to file Form T2093 or providing false information can result in penalties and possible legal consequences.