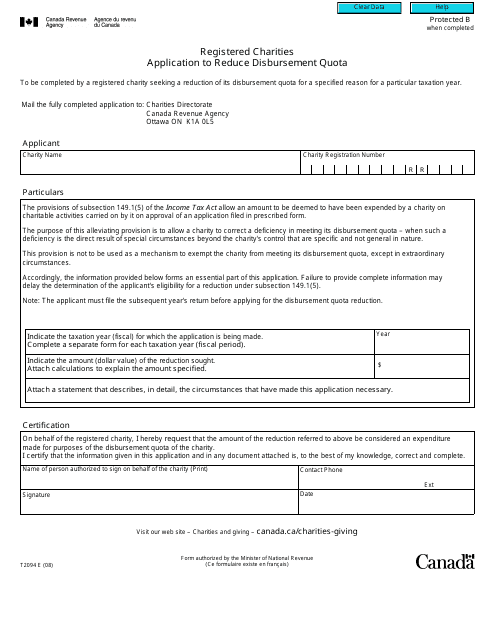

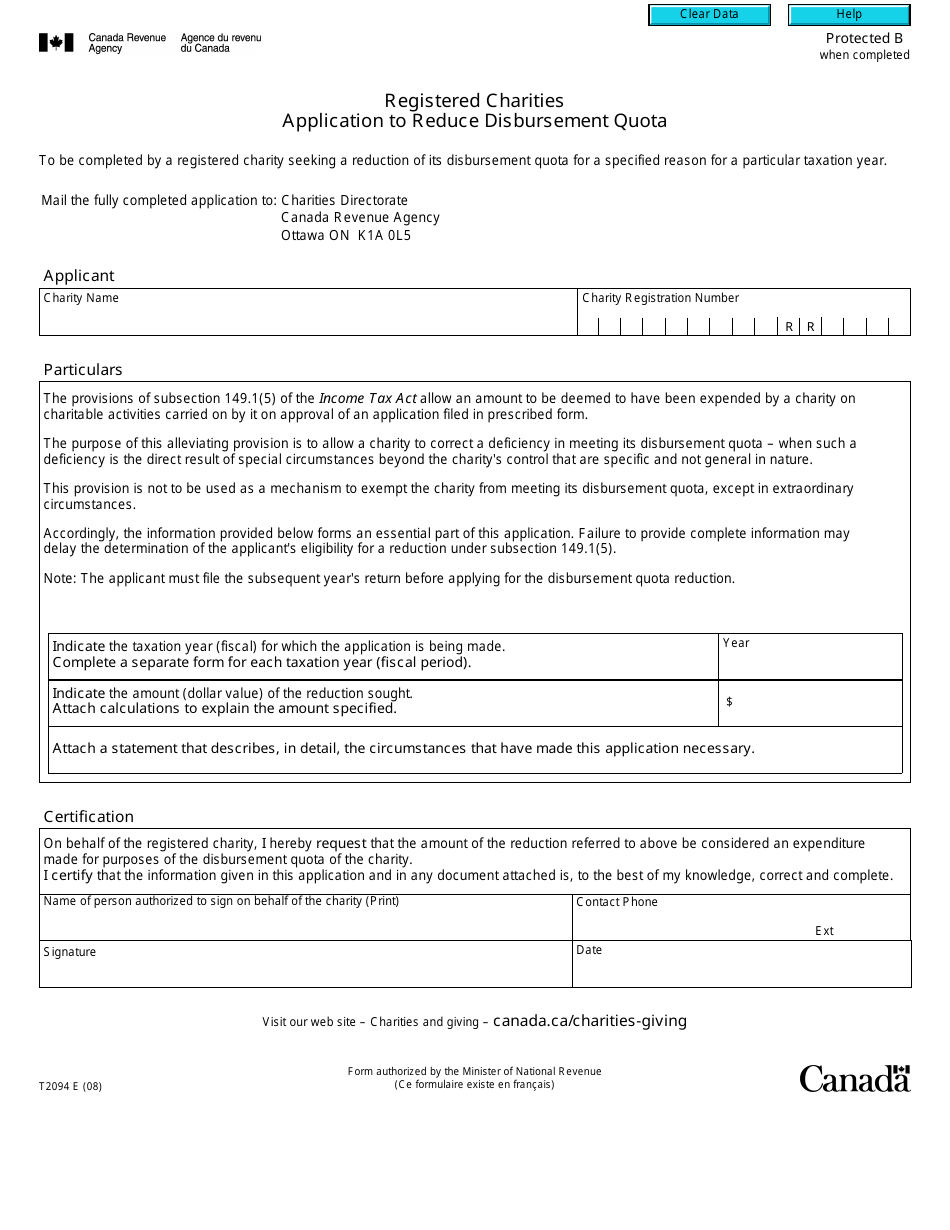

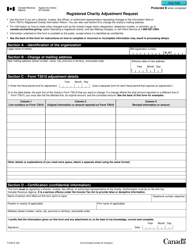

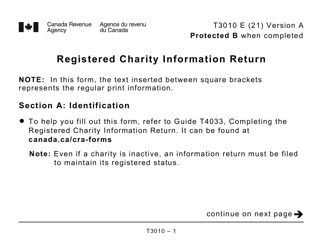

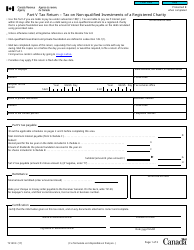

Form T2094 Registered Charities: Application to Reduce Disbursement Quota - Canada

Form T2094 is a Canadian Revenue Agency form also known as the "Form T2094 "registered Charities: Application To Reduce Disbursement Quota" - Canada" . The latest edition of the form was released in January 1, 2008 and is available for digital filing.

Download a PDF version of the Form T2094 down below or find it on Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2094?

A: Form T2094 is an application form used by registered charities in Canada to request a reduction in their disbursement quota.

Q: What is the disbursement quota?

A: The disbursement quota is the minimum amount that a registered charity is required to spend each year on its charitable activities.

Q: Who can use Form T2094?

A: Registered charities in Canada can use Form T2094 to apply for a reduction in their disbursement quota.

Q: Why would a charity want to reduce its disbursement quota?

A: A charity may want to reduce its disbursement quota if it is facing financial difficulties or if it has accumulated large reserves.

Q: How does the application process work?

A: The charity must complete and submit Form T2094 to the Canada Revenue Agency (CRA) along with any required supporting documentation. The CRA will review the application and make a decision.

Q: Are there any eligibility criteria for a reduction in disbursement quota?

A: Yes, there are criteria that the charity must meet in order to be eligible for a reduction. These criteria include financial hardship or exceptional circumstances.

Q: Is there a deadline for submitting the application?

A: The application must be submitted to the CRA within 90 days of the end of the charity's fiscal period for which the reduction is being requested.

Q: What happens if the application is approved?

A: If the application is approved, the charity's disbursement quota will be reduced for the specified fiscal period.

Q: What happens if the application is denied?

A: If the application is denied, the charity will be required to meet its full disbursement quota for the fiscal period.

Q: Can a charity reapply if its application is denied?

A: Yes, a charity can reapply in a future fiscal period if its application is denied.