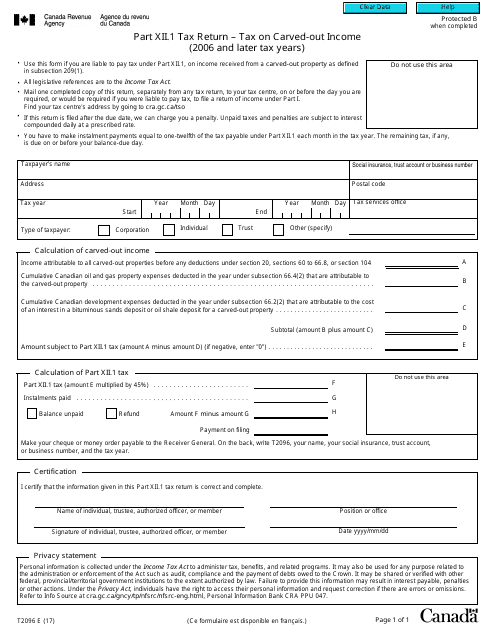

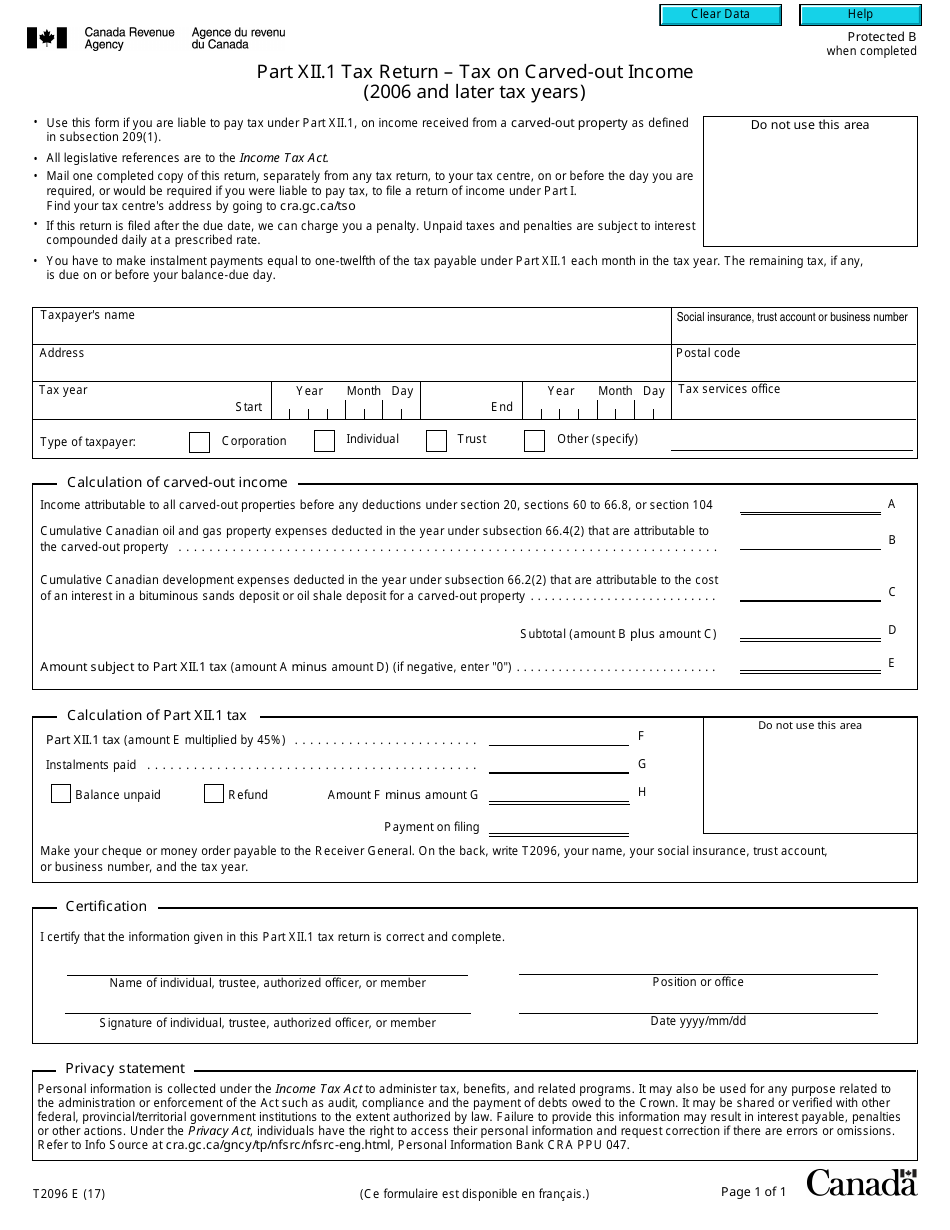

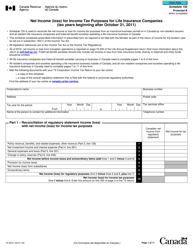

Form T2096 Part XII.1 Tax on Carved-Out Income (2006 and Later Tax Years) - Canada

Form T2096 is a Canadian Revenue Agency form also known as the "Form T2096 Part Xii.1 "tax On Carved-out Income (2006 And Later Tax Years)" - Canada" . The latest edition of the form was released in January 1, 2017 and is available for digital filing.

Download an up-to-date Form T2096 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2096?

A: Form T2096 is a tax form used in Canada.

Q: What does Part XII.1 refer to?

A: Part XII.1 refers to a specific section of the tax form.

Q: What is Carved-Out Income?

A: Carved-Out Income refers to income that is subject to special tax rules.

Q: When did the tax rules for Carved-Out income start?

A: The tax rules for Carved-Out income started in 2006.

Q: What is the purpose of Part XII.1?

A: Part XII.1 is used to calculate and report the tax on Carved-Out Income.