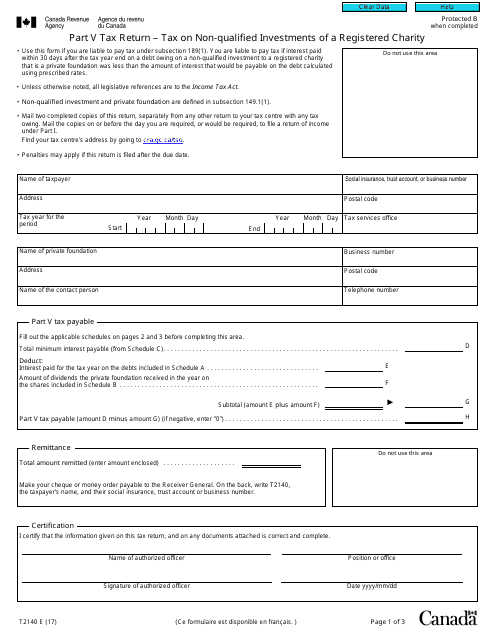

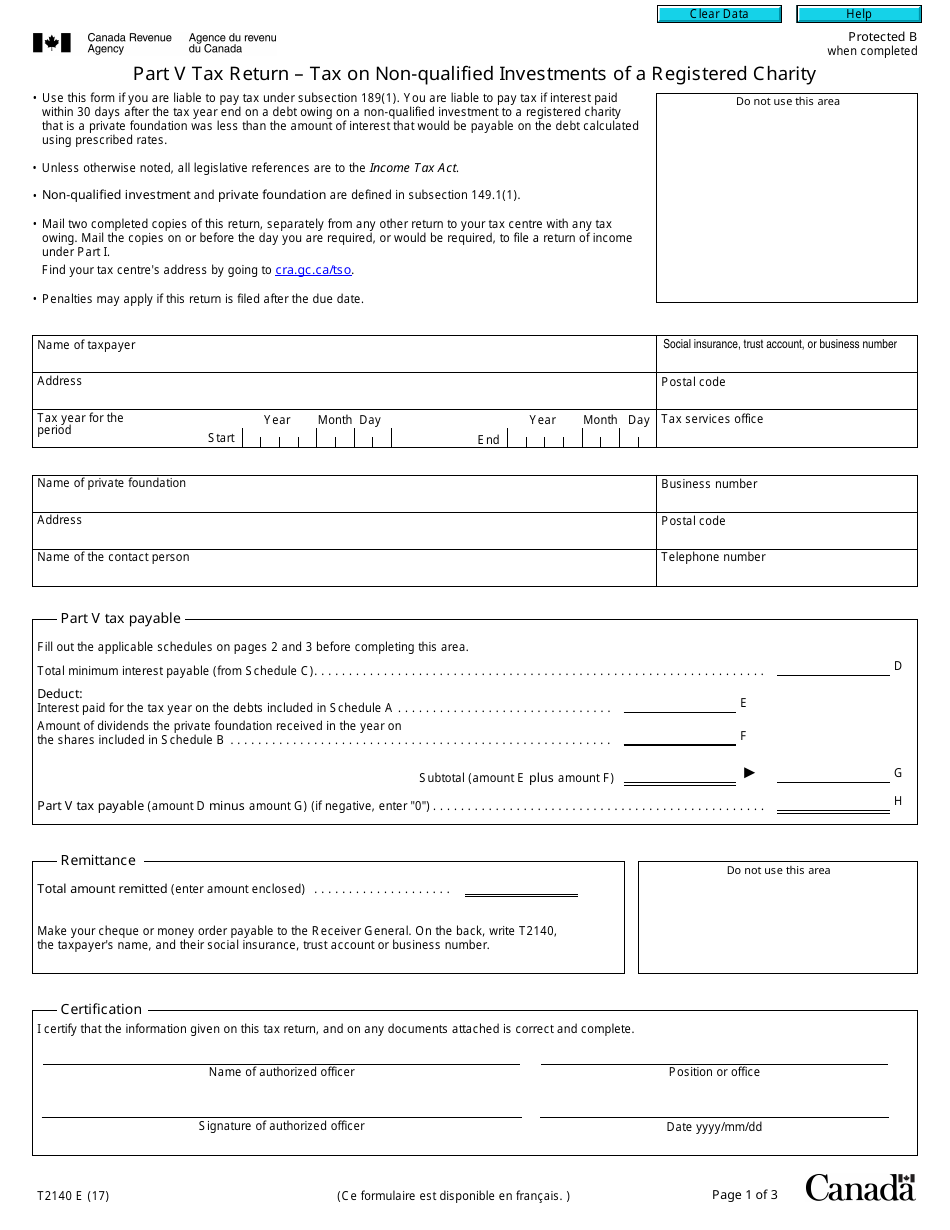

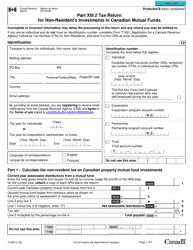

Form T2140 Part V Tax Return - Tax on Non-qualified Investments of a Registered Charity - Canada

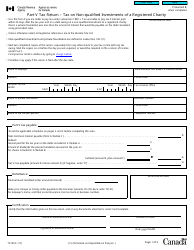

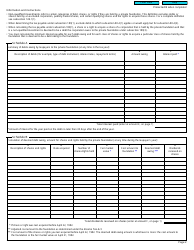

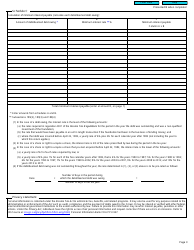

Form T2140 Part V Tax Return - Tax on Non-qualified Investments of a Registered Charity is used in Canada to calculate and report the tax payable on the income generated from non-qualified investments held by a registered charity. It helps the Canada Revenue Agency (CRA) determine the tax liability of the charity on these investments.

The registered charity is responsible for filing the Form T2140 Part V Tax Return in Canada.

FAQ

Q: What is Form T2140?

A: Form T2140 is a tax return form specifically for reporting tax on non-qualified investments of a registered charity in Canada.

Q: What is Part V of Form T2140?

A: Part V of Form T2140 is where you report information about the tax on non-qualified investments of a registered charity.

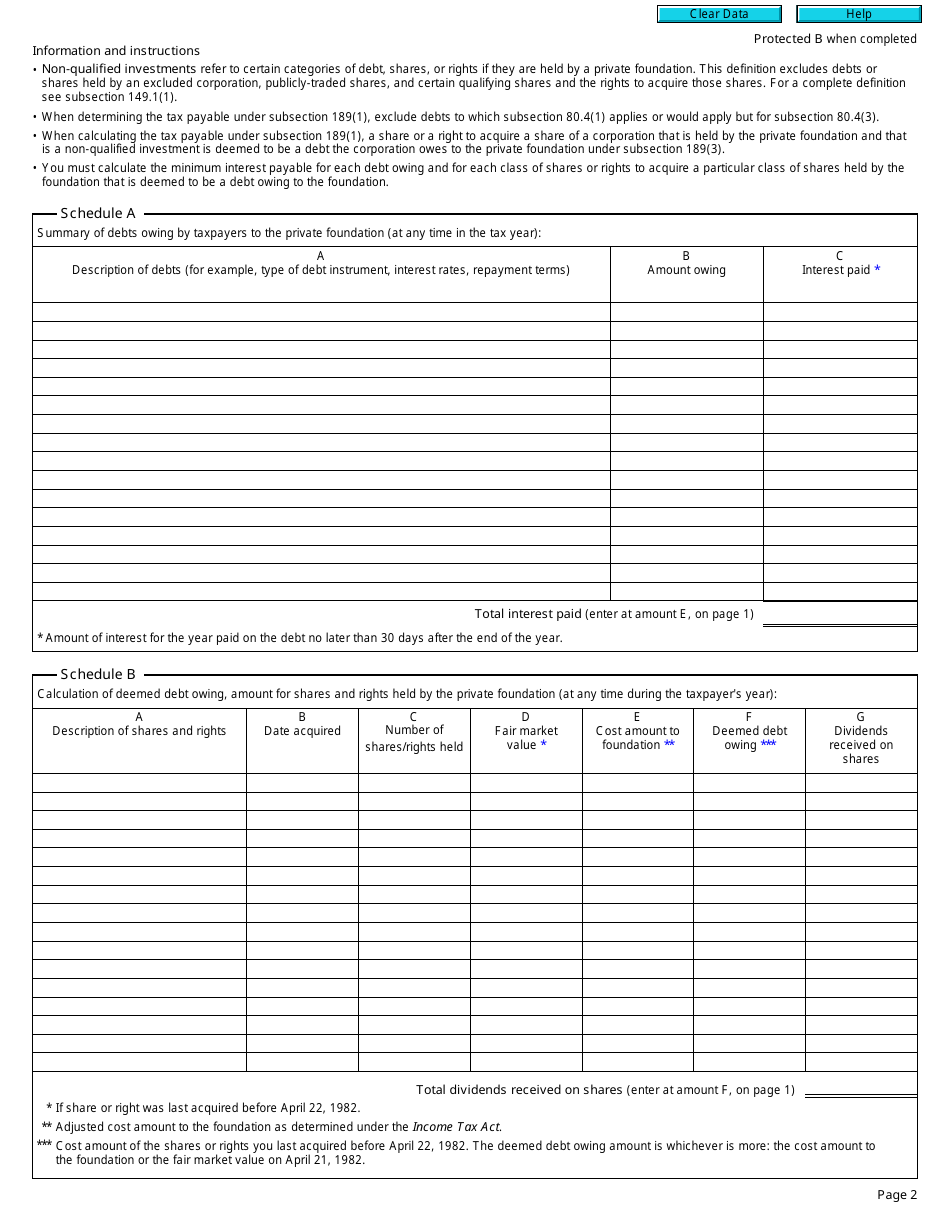

Q: What are non-qualified investments?

A: Non-qualified investments are certain types of investments that do not meet the requirements for special tax treatment for registered charities in Canada.

Q: Why do registered charities have to pay tax on non-qualified investments?

A: Registered charities have to pay tax on non-qualified investments to ensure that they are using their funds in accordance with the rules and regulations set out by the Canada Revenue Agency.

Q: How do I report tax on non-qualified investments on Form T2140?

A: You report tax on non-qualified investments in Part V of Form T2140 by providing details of the investments and calculating the amount of tax owed.

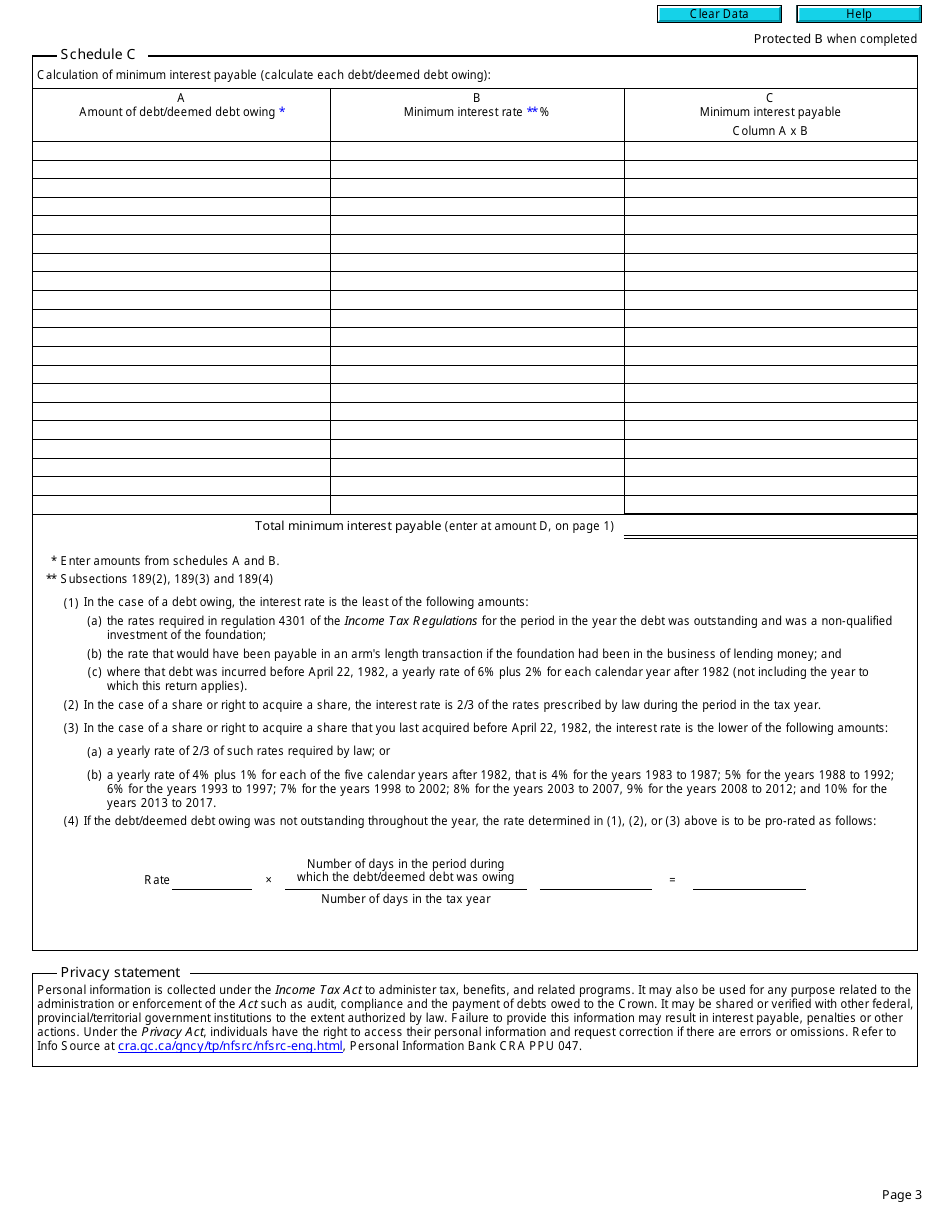

Q: Is there a specific tax rate for non-qualified investments of registered charities?

A: Yes, there is a specific tax rate for non-qualified investments of registered charities in Canada. The tax rate is 100% of the income earned from those investments.

Q: Can I deduct the tax paid on non-qualified investments?

A: No, you cannot deduct the tax paid on non-qualified investments of a registered charity.