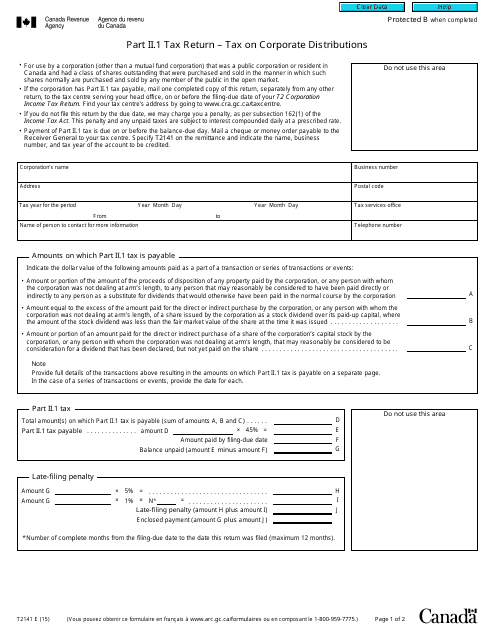

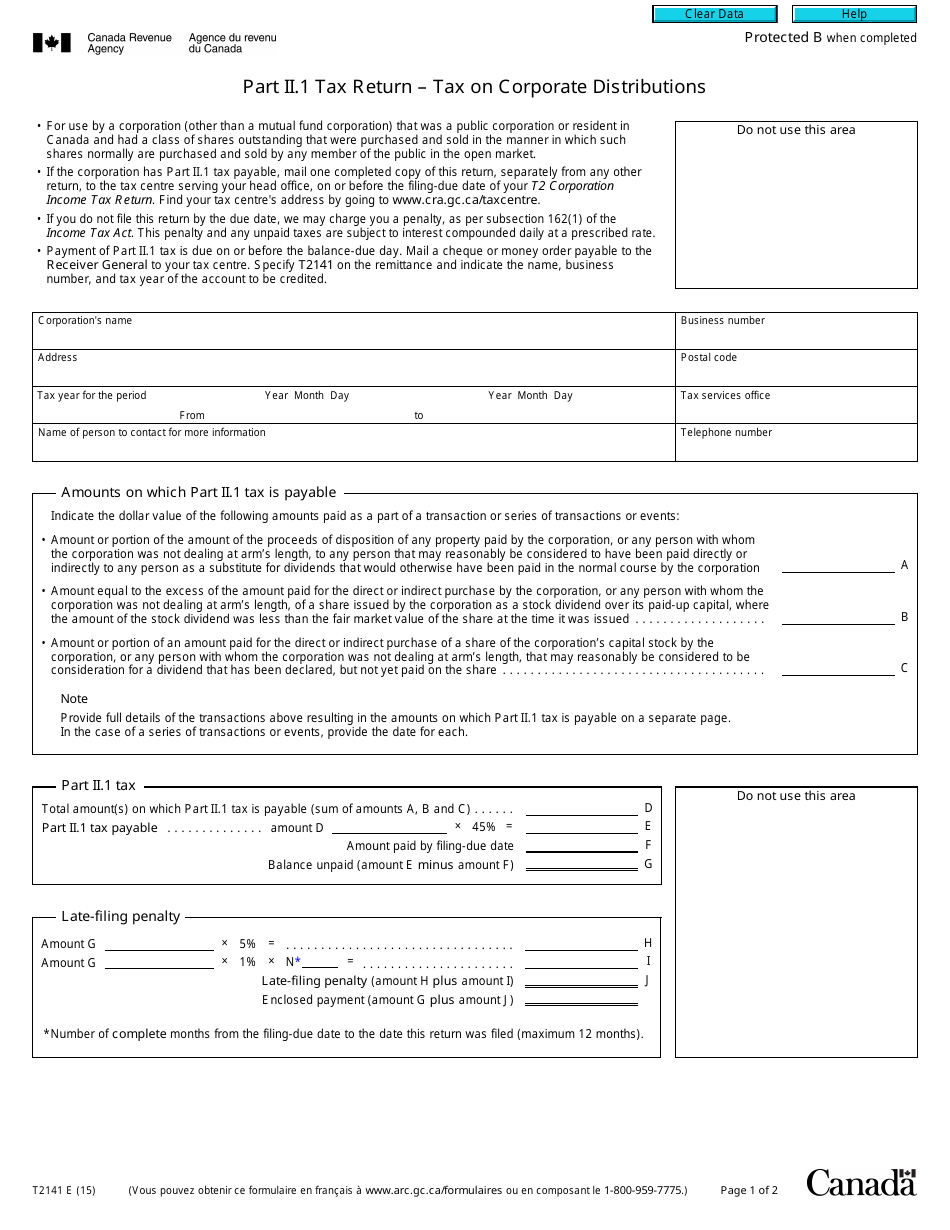

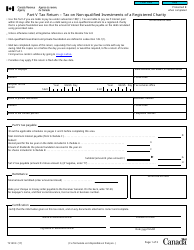

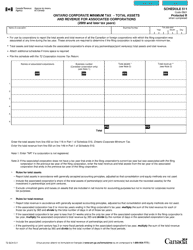

Form T2141 Part II.1 Tax Return - Tax on Corporate Distributions - Canada

Form T2141 Part II.1 Tax Return - Tax on Corporate Distributions in Canada is used to report and calculate the tax payable on certain distributions received from Canadian corporations.

The Form T2141 Part II.1 Tax Return for Tax on Corporate Distributions in Canada is filed by corporations that have made eligible dividends and need to report and pay tax on those distributions.

FAQ

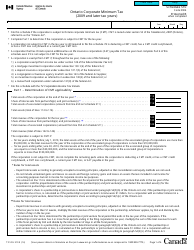

Q: What is Form T2141?

A: Form T2141 is a tax return form in Canada for reporting tax on corporate distributions.

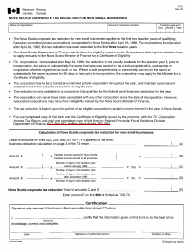

Q: What is Part II.1 of Form T2141?

A: Part II.1 of Form T2141 is specifically for reporting tax related to corporate distributions.

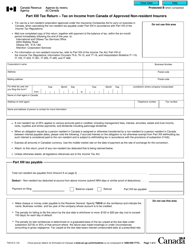

Q: What are corporate distributions?

A: Corporate distributions are payments made by a corporation to its shareholders, such as dividends.

Q: Why do I need to report tax on corporate distributions?

A: You need to report tax on corporate distributions to fulfill your tax obligations and determine the amount of tax payable.

Q: Is Form T2141 mandatory?

A: Yes, if you received corporate distributions, you are generally required to file Form T2141 and report the related tax.