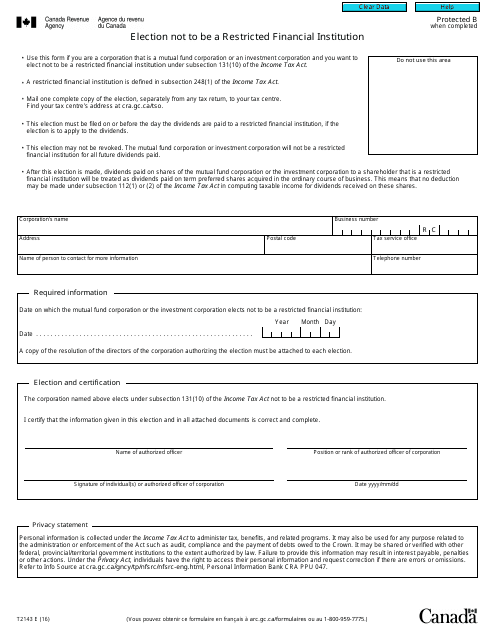

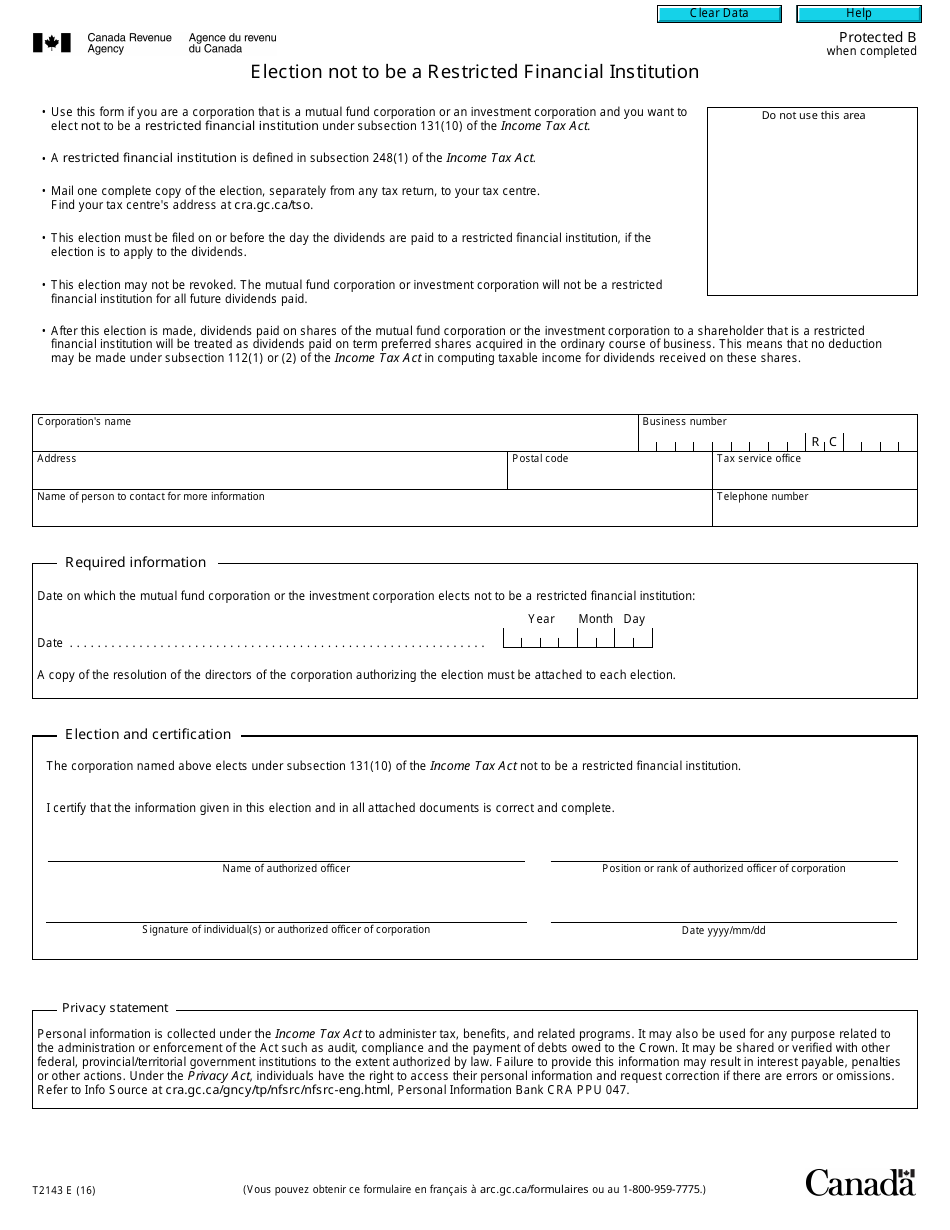

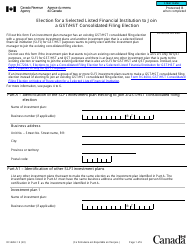

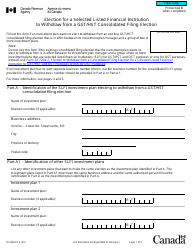

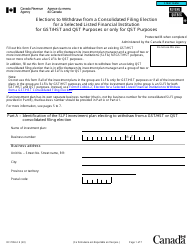

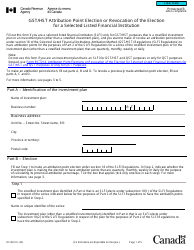

Form T2143 Election Not to Be a Restricted Financial Institution - Canada

Form T2143 Election Not to Be a Restricted Financial Institution in Canada is used by financial institutions to elect not to be considered as a restricted financial institution for the purposes of the Income Tax Act.

In Canada, the Form T2143 Election Not to Be a Restricted Financial Institution is filed by financial institutions that meet the eligibility criteria as specified by the Canada Revenue Agency (CRA). It is not filed by individuals.

FAQ

Q: What is Form T2143?

A: Form T2143 is a form used in Canada to elect not to be considered a restricted financial institution.

Q: What is a restricted financial institution?

A: A restricted financial institution is a type of financial institution that has certain tax obligations and reporting requirements.

Q: Who should use Form T2143?

A: Financial institutions in Canada that want to elect not to be considered restricted financial institutions should use Form T2143.

Q: What are the benefits of electing not to be a restricted financial institution?

A: By electing not to be a restricted financial institution, a financial institution may be able to avoid certain tax obligations and reporting requirements.

Q: Are there any deadlines for filing Form T2143?

A: Yes, Form T2143 should be filed by the due date of the financial institution's tax return for the year in which the election is being made.