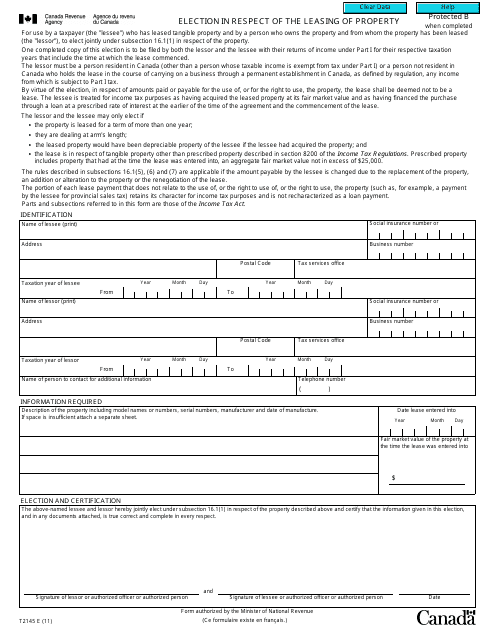

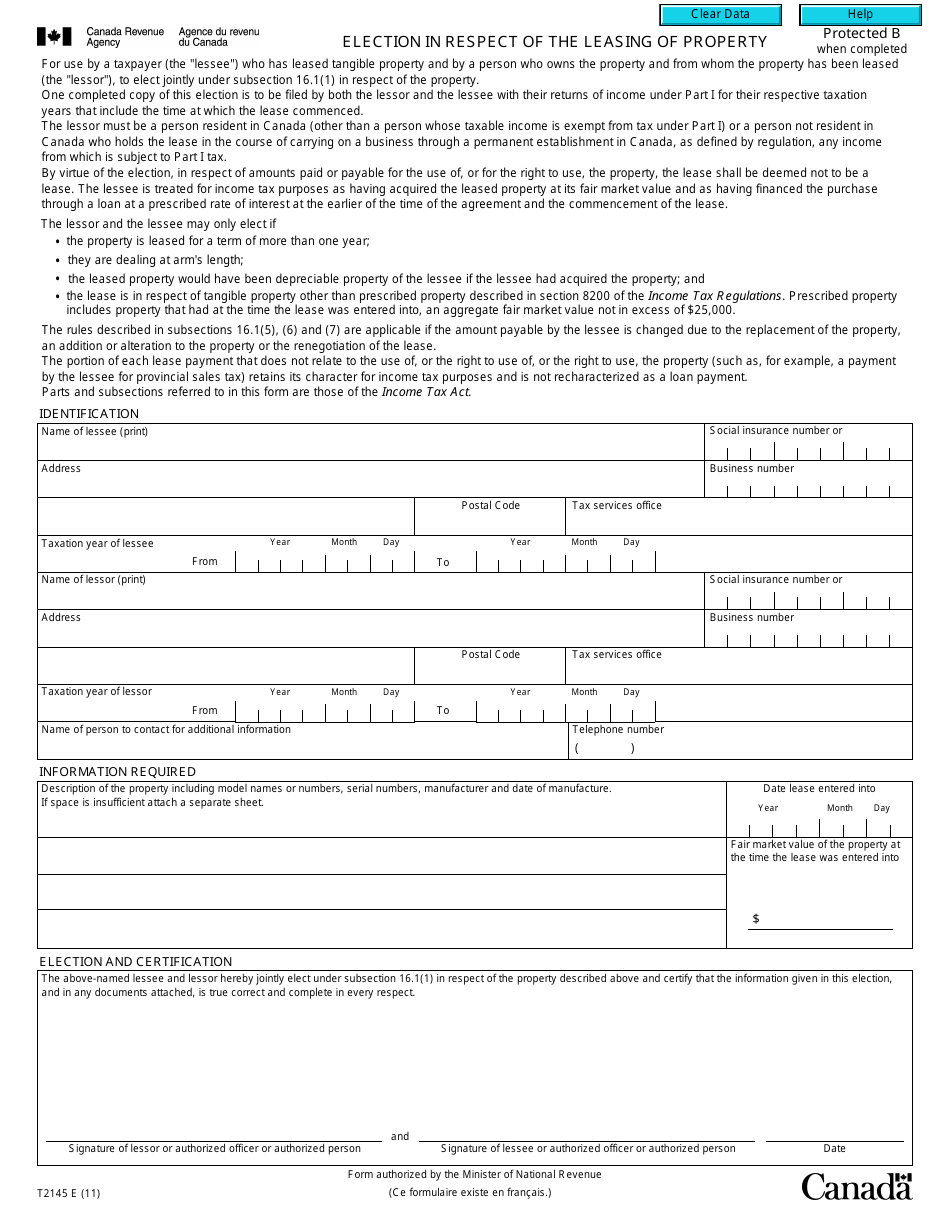

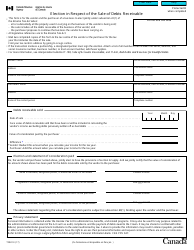

Form T2145 Election in Respect of the Leasing of Property - Canada

Form T2145 Election in Respect of the Leasing of Property is used in Canada for electing to include certain amounts in your income when leasing property.

In Canada, the form T2145 Election in Respect of the Leasing of Property is typically filed by the lessor (the owner) of the property.

FAQ

Q: What is a Form T2145?

A: Form T2145 is a form used in Canada to make an election in respect of the leasing of property.

Q: What is the purpose of Form T2145?

A: The purpose of Form T2145 is to elect whether to include or exclude the rental income and expenses from a rental property on your tax return.

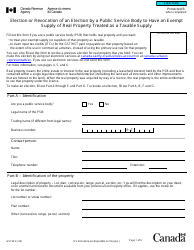

Q: When should I use Form T2145?

A: You should use Form T2145 if you want to make an election to include or exclude the rental income and expenses from a leasing property on your tax return.

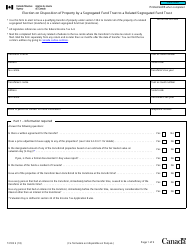

Q: How do I complete Form T2145?

A: You need to provide the necessary information about the property, the rental income, and the election you are making.

Q: Can I make multiple elections using Form T2145?

A: Yes, you can make multiple elections for different properties by completing separate copies of Form T2145 for each property.

Q: Are there any deadlines for submitting Form T2145?

A: Yes, Form T2145 must be filed with your tax return for the year in which the election is being made.

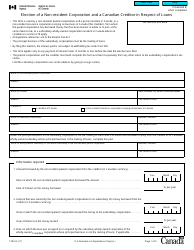

Q: What are the consequences of making an election using Form T2145?

A: Once you make an election using Form T2145, it generally cannot be changed for that taxation year and subsequent years.

Q: Do I need to keep a copy of Form T2145 for my records?

A: Yes, it is recommended to keep a copy of Form T2145 and any supporting documents for your records in case of future inquiries or audits.

Q: Can I get help in completing Form T2145?

A: Yes, you can seek assistance from a tax professional or refer to the CRA's instructions for Form T2145.