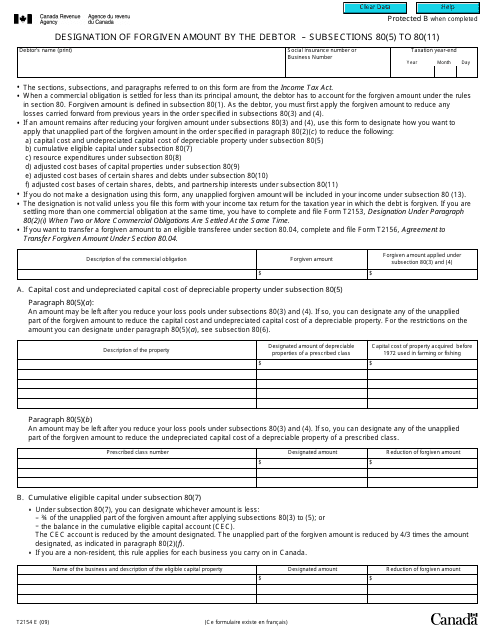

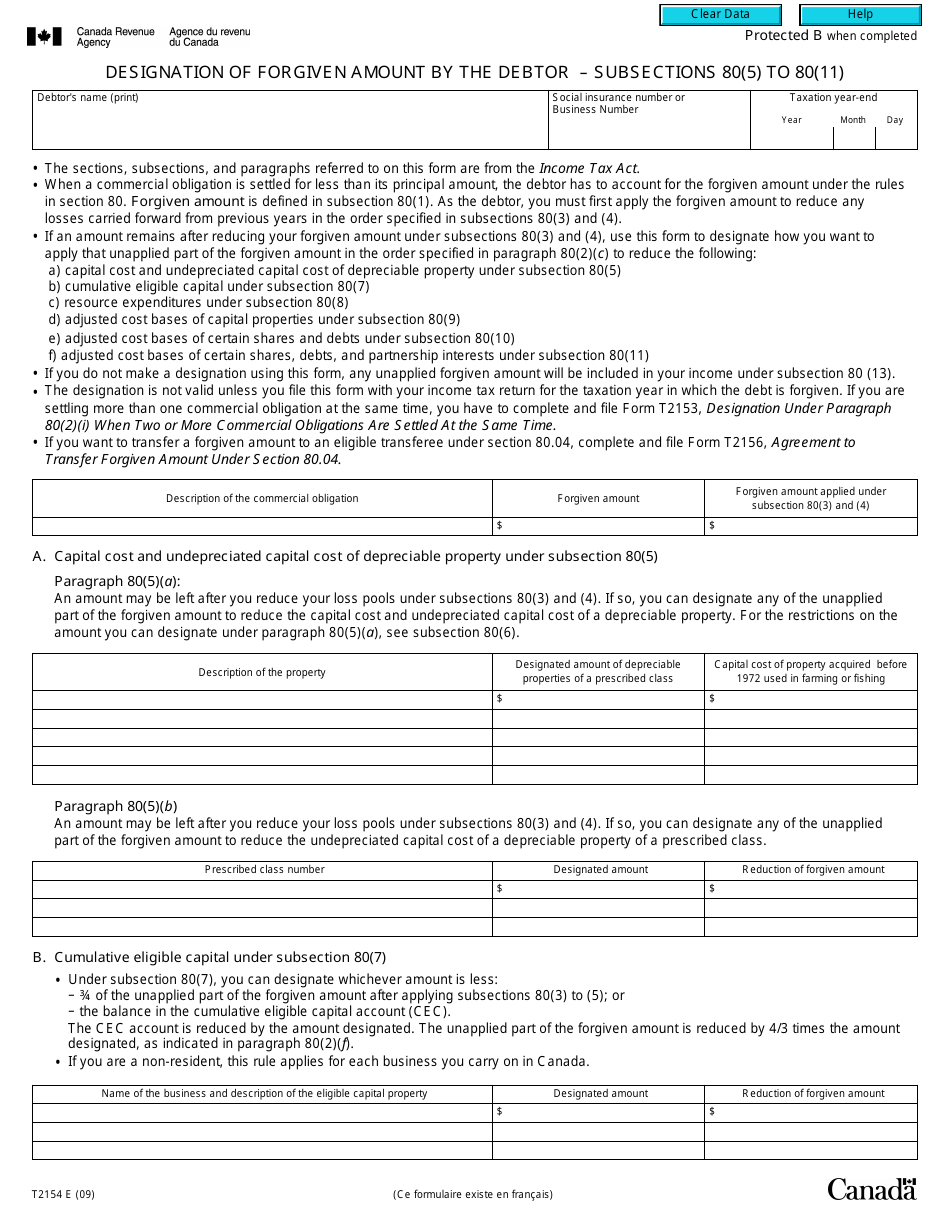

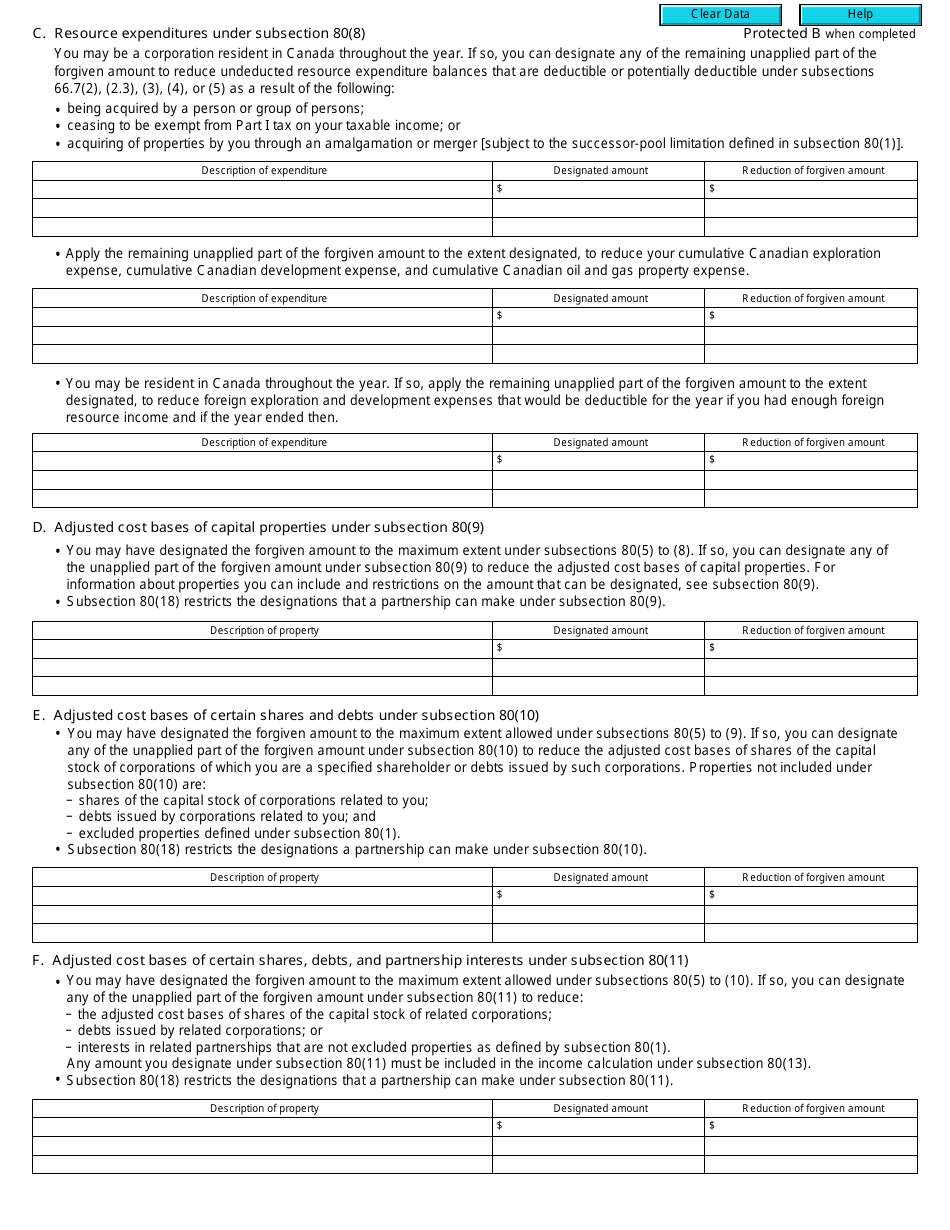

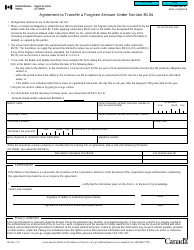

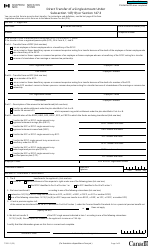

Form T2154 Designation of Forgiven Amount by the Debtor - Subsections 80(5) to 80(11) - Canada

Form T2154, "Designation of Forgiven Amount by the Debtor - Subsections 80(5) to 80(11)," is used in Canada for the purpose of designating certain amounts as forgiven under the Income Tax Act. This form helps individuals or corporations designate the amount of debt that has been forgiven by a creditor, and allows for potential tax implications related to the forgiven debt.

The debtor files the Form T2154 Designation of Forgiven Amount in Canada.

FAQ

Q: What is Form T2154?

A: Form T2154 is the Designation of Forgiven Amount by the Debtor form.

Q: What does Form T2154 designate?

A: Form T2154 is used to designate a forgiven amount by the debtor.

Q: What are Subsections 80(5) to 80(11) in Canada?

A: Subsections 80(5) to 80(11) are specific sections of the Canadian tax law that deal with the taxation of forgiven amounts.

Q: When should Form T2154 be used?

A: Form T2154 should be used when a debtor wants to designate a forgiven amount for tax purposes.

Q: Why is the designation of a forgiven amount important?

A: The designation of a forgiven amount is important for tax purposes, as it determines how the forgiven amount is treated for tax purposes.

Q: Is Form T2154 applicable only in Canada?

A: Yes, Form T2154 is specific to Canada and is not applicable in the United States.

Q: What information is required on Form T2154?

A: Form T2154 requires information such as the debtor's name, address, social insurance number, and the amount of forgiven debt.

Q: Are there any deadlines for filing Form T2154?

A: There are no specific deadlines mentioned for filing Form T2154. It should be filed in the year the forgiven amount is received.

Q: Who should I contact if I have questions about Form T2154?

A: If you have questions about Form T2154, you can contact the Canada Revenue Agency directly.