This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2201

for the current year.

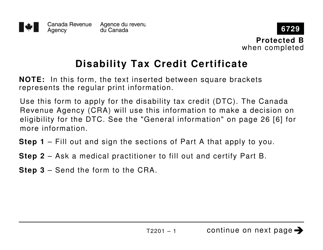

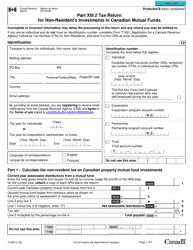

Form T2201 Disability Tax Credit Certificate - Canada

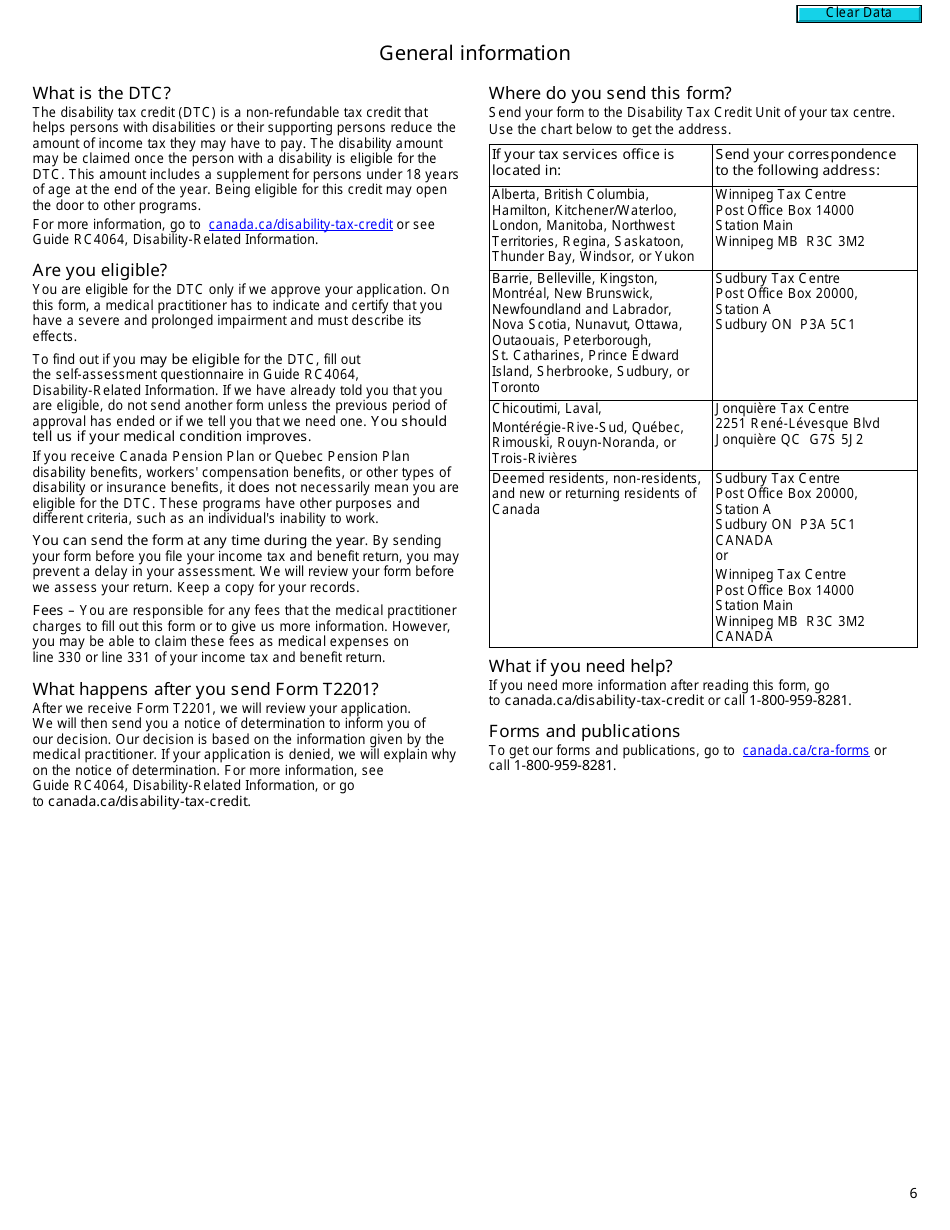

What Is a Disability Tax Credit Certificate?

Form T2201, Disability Tax Credit Certificate , is a document that individuals can use when they want to apply for a Disability Tax Credit (DTC). The DTC helps individuals with disabilities (or individuals who support them) to help decrease the amount of income tax they are supposed to pay.

Alternate Names:

- Canadian Disability Tax Credit Form;

- CRA Disability Tax Credit Form;

- CRA Form T2201.

This form was issued by the Canadian Revenue Agency (CRA) and was last revised in . A fillable Canadian Disability Tax Credit Form is available for download through the link below.

The purpose of this document is to provide the CRA with information that will be enough for them to make a decision whether an individual is eligible to receive DTC. Before filing Form T2201, individuals can check out the list of eligibility requirements that can be found on the official website of the Government of Canada.

How to Fill Out Disability Tax Credit Form?

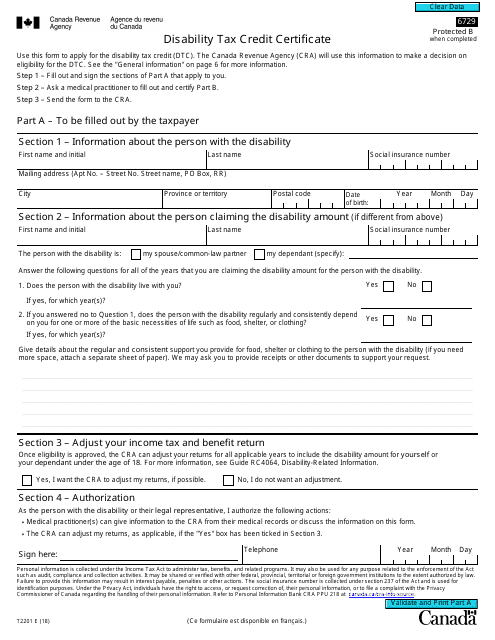

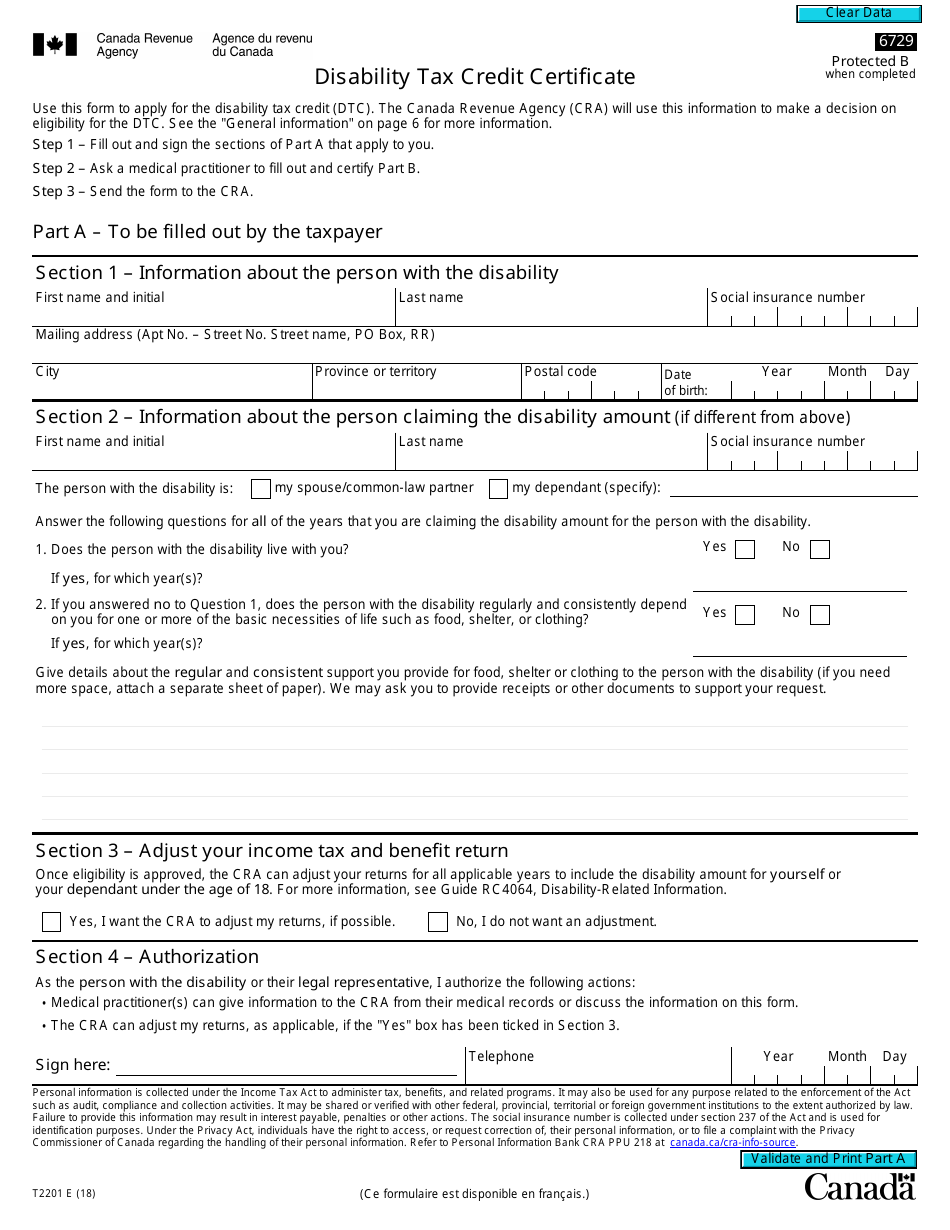

CRA Form T2201 is presented on six pages and includes three parts: "Part A," "Part B," and "Instructions." Part A is supposed to be filled out by the individual who wants to apply for the DTC. Here, they must complete four sections which include:

- Information About the Person With a Disability. In the first section of the form, the individual must designate the name of the person with a disability, their social insurance number, address, and date of birth.

- Information About the Person Claiming the Disability Amount. This section is supposed to be filled in when the individual who supports a person with a disability is filing for the DTC. In this case, they must state their name, social insurance number, as well as describe their relationship with the person with a disability, and how they depend on the individual.

- Adjust Income Tax and Benefit Return. Here, individuals can indicate whether they want to adjust their income tax returns to include the disability amount for applicable years, in case their eligibility will be approved).

- Authorization. In the last part, individuals must authorize a medical practitioner to share information from their medical records with the CRA and present it in this document. Additionally, they must sign and date the document.

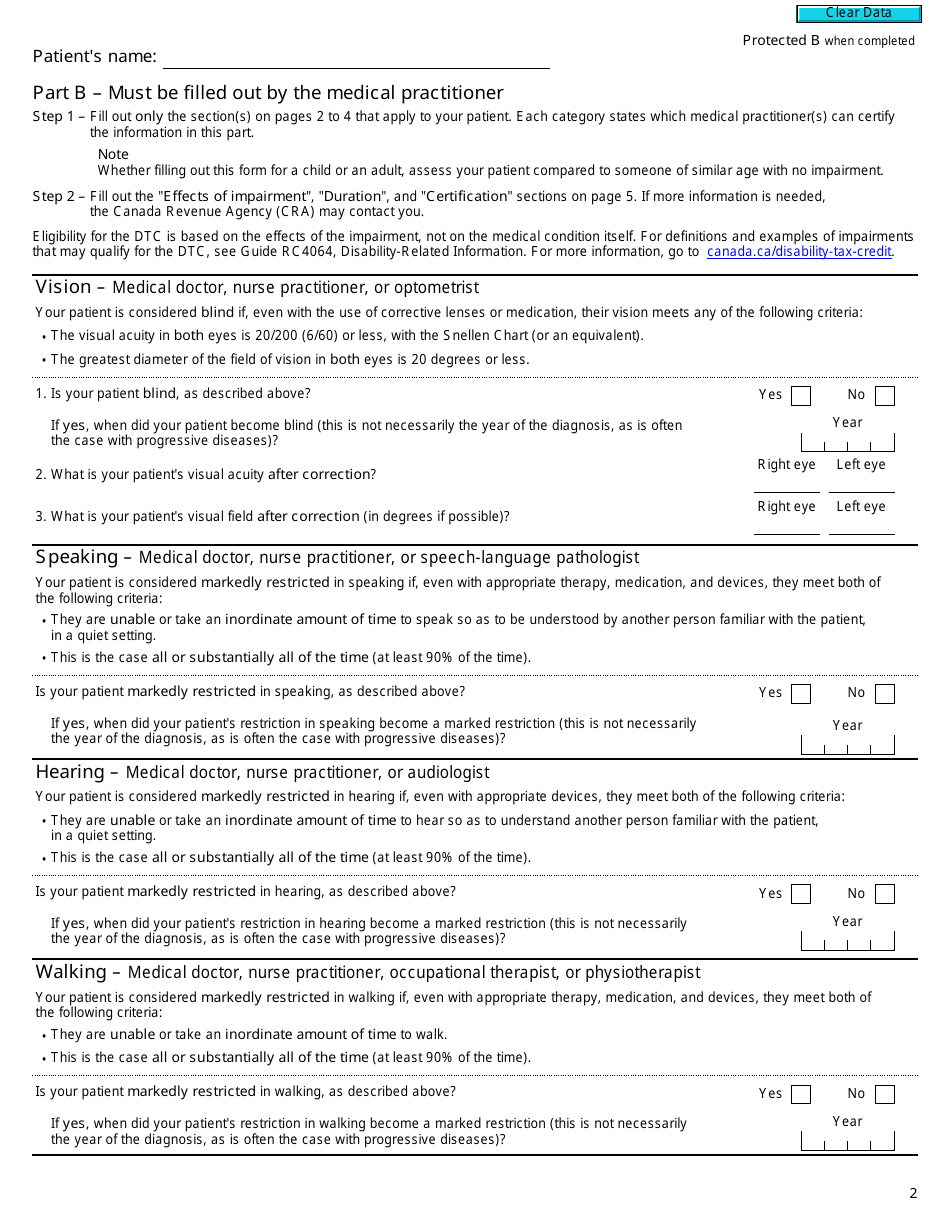

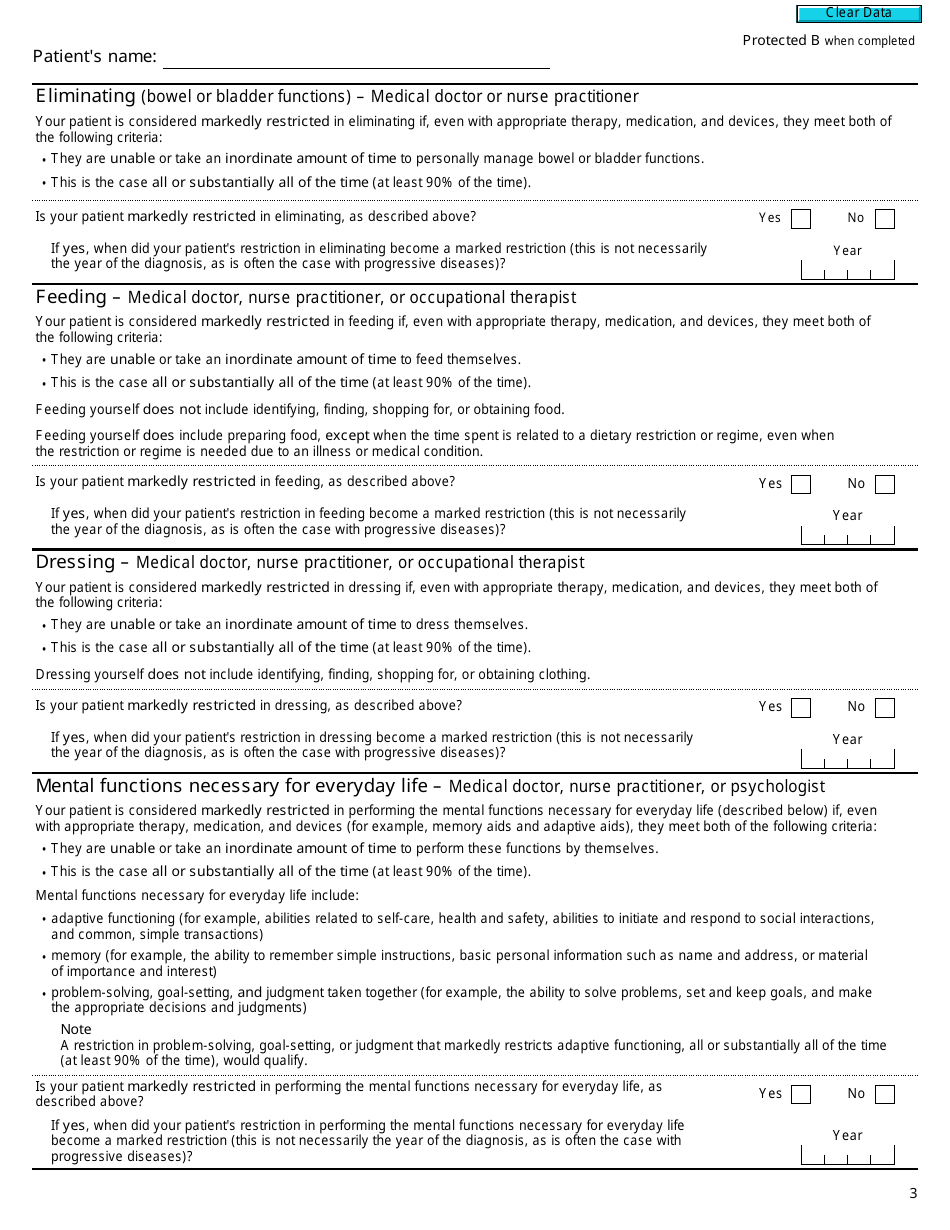

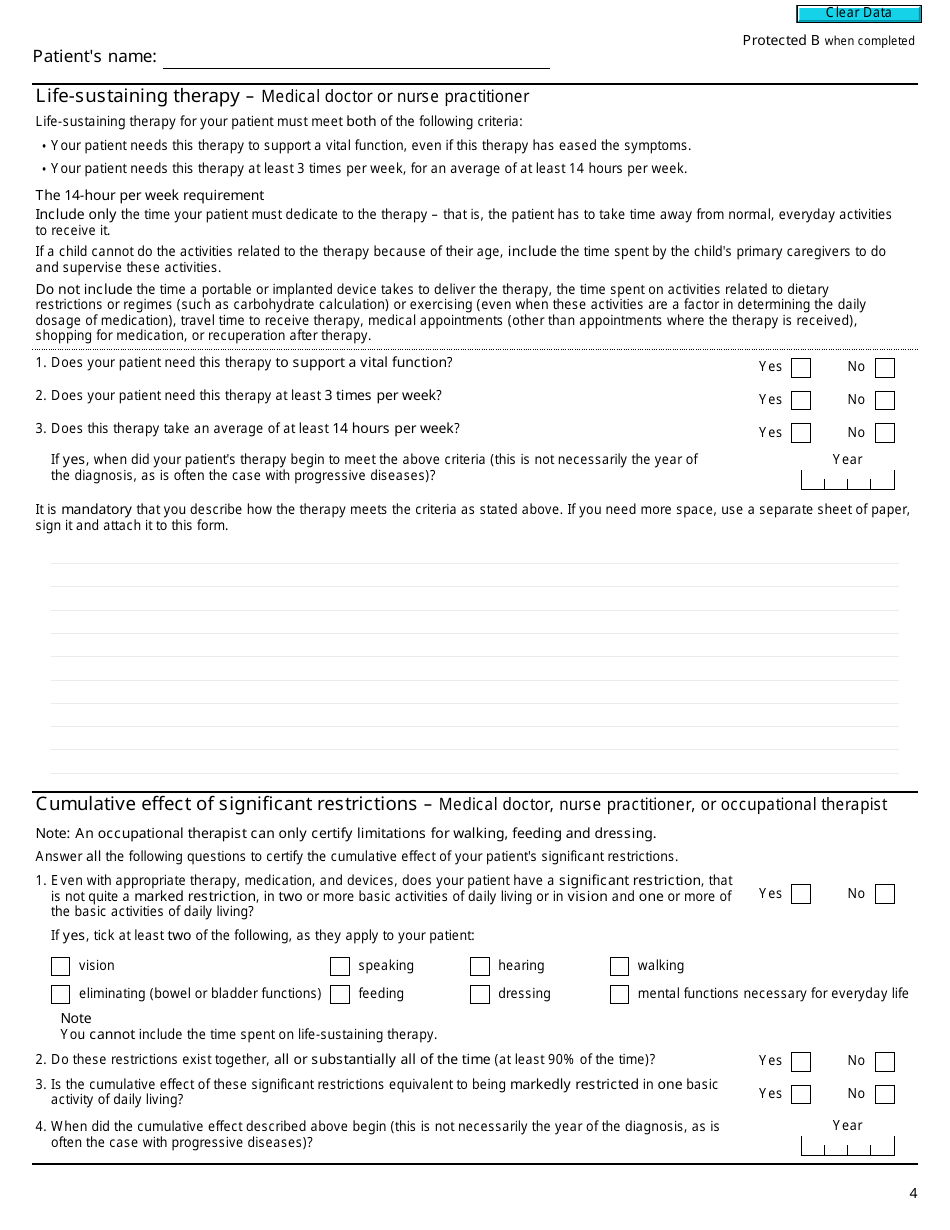

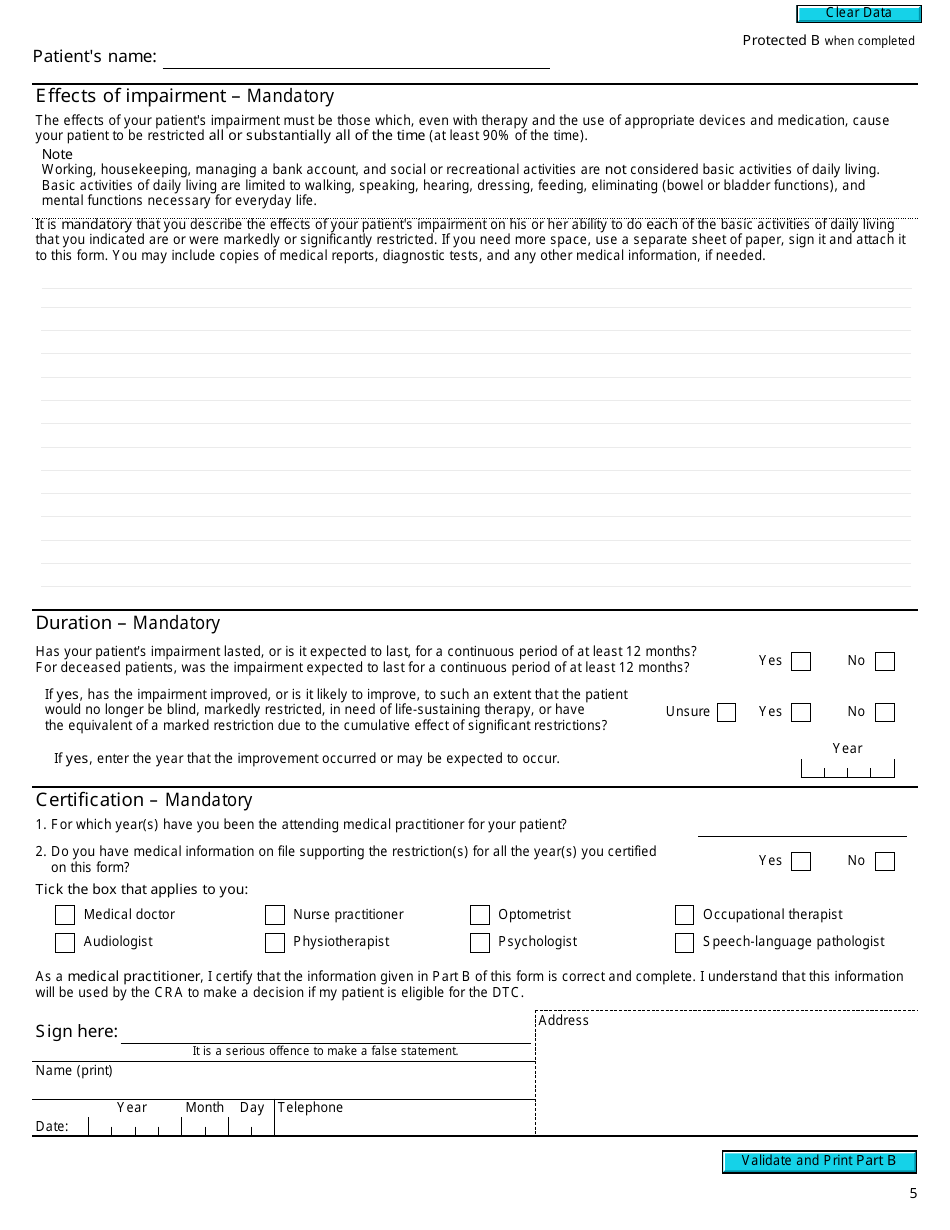

Part B of the CRA Disability Tax Credit Form is supposed to be filled in by a nurse or a doctor who is treating the person with a disability. They can only complete the sections that are applicable for their patient, such as information about their vision, speaking, hearing, walking, etc. Each section provides guidelines on what kind of specialist can certify information for a specific part. Doctors and nurses are also required to provide identifying information, such as their name, address, and signature.

The last part provides individuals with general information about what a DTC is, who is eligible for it, and which documents can be used to help understand if someone is eligible. Individuals can also read about what is going to happen after they have applied for the tax credit and what to do if they need more information.

After a medical specialist fills out their part of the form and hands it to the individual, they can file it at the CRA. The address where the form must be sent depends on where the individual's tax service office is located. The document's guidelines also include a timetable where the individual can find the appropriate address.