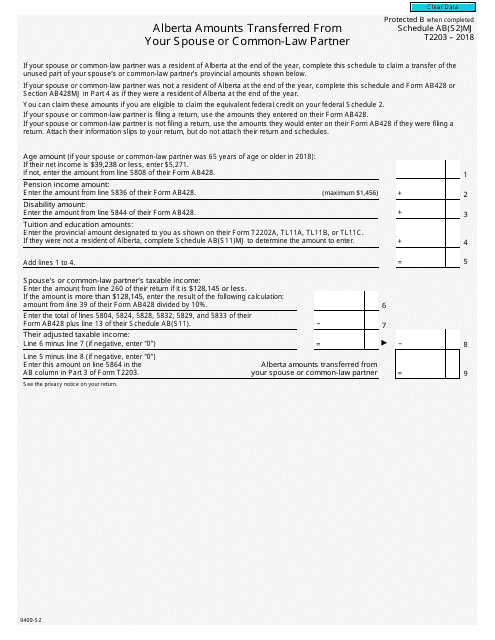

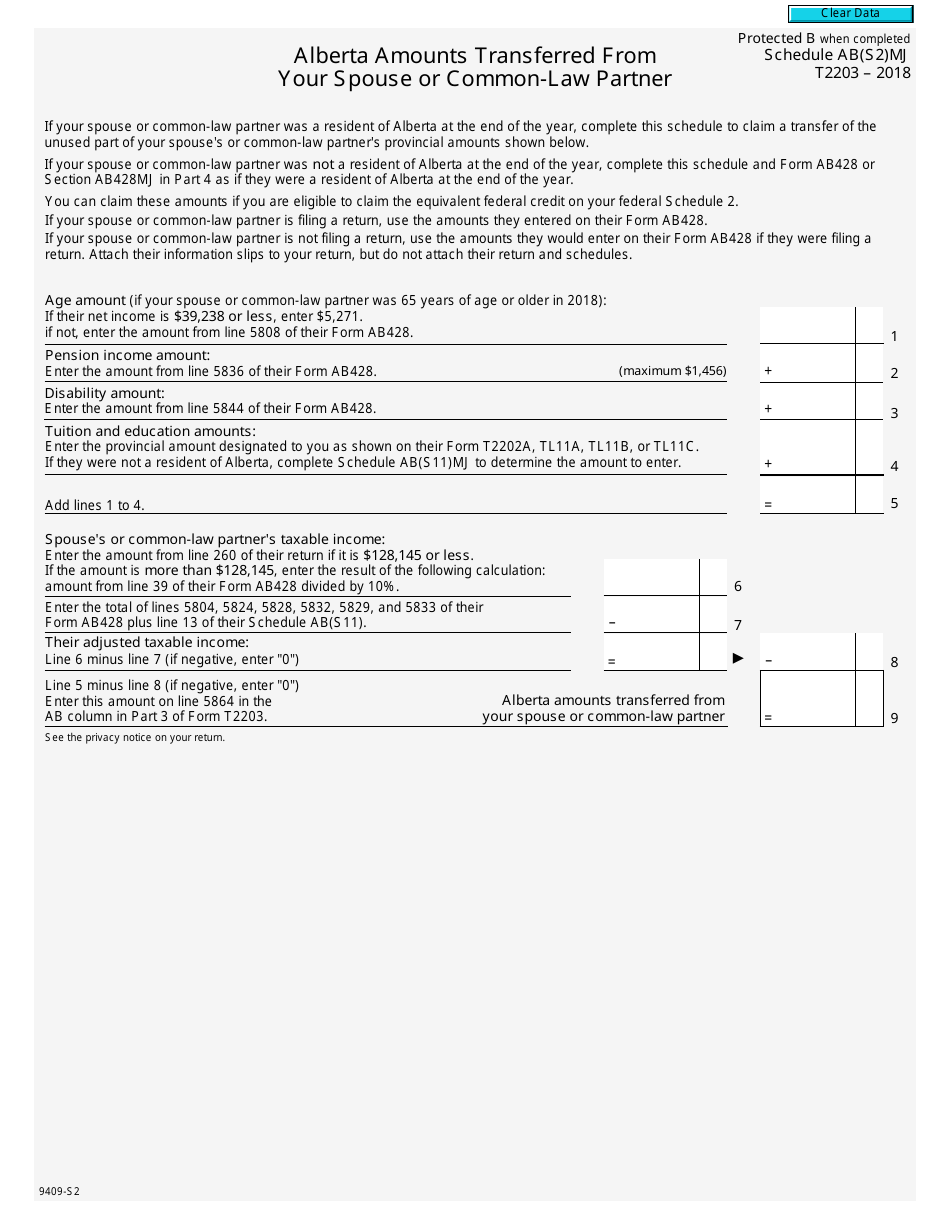

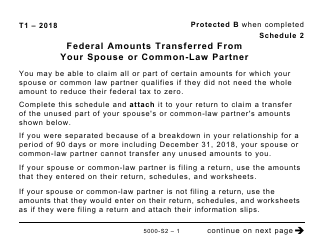

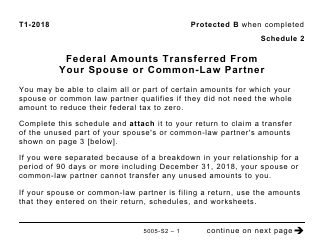

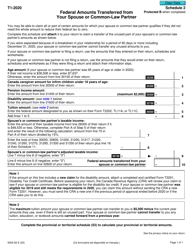

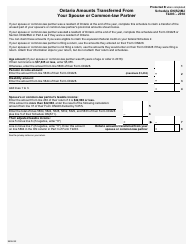

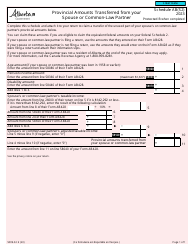

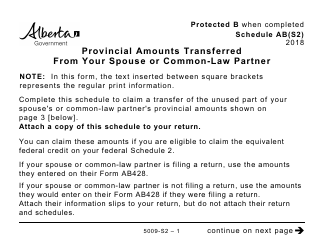

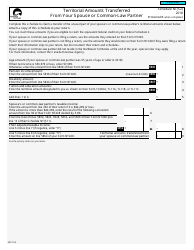

Form T2203 Schedule AB(S2)MJ Alberta Amounts Transferred From Your Spouse or Common-Law Partner - Canada

Form T2203 Schedule AB(S2)MJ is used in Canada to report amounts transferred from a spouse or common-law partner who resides in Alberta. This form is specifically for reporting the transfer of certain provincial nonrefundable tax credits.

The individual who files the Form T2203 Schedule AB(S2)MJ Alberta Amounts Transferred From Your Spouse or Common-Law Partner in Canada is the taxpayer who wants to claim amounts transferred from their spouse or common-law partner.

FAQ

Q: What is Form T2203 Schedule AB(S2)MJ Alberta Amounts Transferred From Your Spouse or Common-Law Partner?

A: Form T2203 Schedule AB(S2)MJ is a form used in Canada to report amounts transferred from your spouse or common-law partner to Alberta.

Q: Who needs to fill out Form T2203 Schedule AB(S2)MJ?

A: Form T2203 Schedule AB(S2)MJ needs to be filled out if you and your spouse or common-law partner have chosen to have certain amounts transferred to Alberta.

Q: What are the amounts transferred from your spouse or common-law partner?

A: The amounts transferred may include tuition, education, and textbook amounts, provincial or territorial credits, and other transferable amounts.

Q: Is this form specific to Alberta?

A: Yes, this form is specific to Alberta. Other provinces and territories may have similar forms for reporting transferred amounts.

Q: How do I fill out Form T2203 Schedule AB(S2)MJ?

A: You need to provide information about yourself, your spouse or common-law partner, and the specific amounts being transferred. Follow the instructions provided on the form for complete guidance.

Q: Do I need to include supporting documents with Form T2203 Schedule AB(S2)MJ?

A: You may need to include supporting documents such as T2202A, T2202, TL11A, or other forms depending on the amounts being transferred. Refer to the instructions on the form for detailed requirements.

Q: When is the deadline for filing Form T2203 Schedule AB(S2)MJ?

A: The deadline for filing Form T2203 Schedule AB(S2)MJ is generally the same as the deadline for filing your annual income tax return, which is usually April 30th of the following year.

Q: Can I file Form T2203 Schedule AB(S2)MJ electronically?

A: Yes, you can file Form T2203 Schedule AB(S2)MJ electronically through the CRA's NetFile or EFILE systems, or by using certified tax software.

Q: What are the consequences of not filing Form T2203 Schedule AB(S2)MJ?

A: If you are eligible to transfer amounts to Alberta and do not file Form T2203 Schedule AB(S2)MJ, you may miss out on potential tax savings or credits.