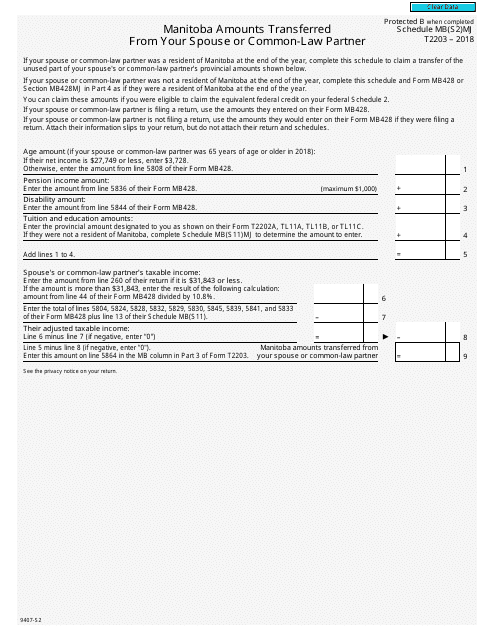

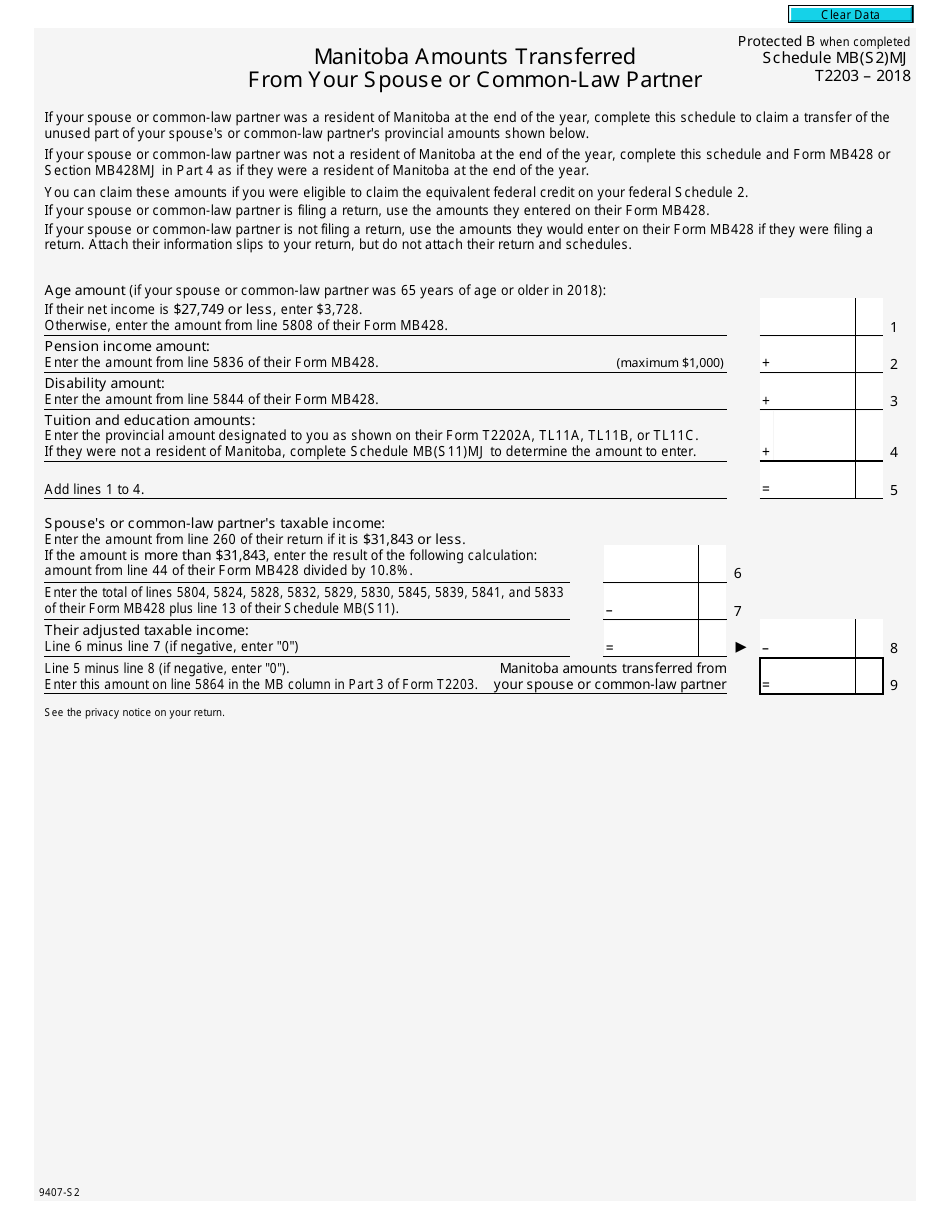

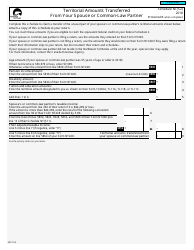

Form T2203 Schedule MB(S2)MJ Manitoba Amounts Transferred From Your Spouse or Common-Law Partner - Canada

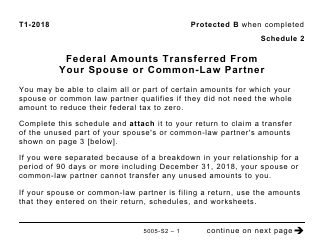

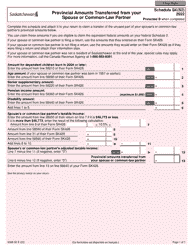

Form T2203, Schedule MB(S2)MJ, is used in Canada for claiming the Manitoba amounts transferred from your spouse or common-law partner. This form allows you to transfer certain tax credits, such as those for tuition, education, and adoption expenses, from your spouse or common-law partner to yourself, which can help reduce your overall tax liability in Manitoba.

The Form T2203 Schedule MB(S2)MJ is filed by residents of Manitoba, Canada who want to report amounts transferred from their spouse or common-law partner for tax purposes.

FAQ

Q: What is Form T2203 Schedule MB(S2)MJ?

A: Form T2203 Schedule MB(S2)MJ is a tax form used in Canada.

Q: What does Form T2203 Schedule MB(S2)MJ do?

A: Form T2203 Schedule MB(S2)MJ is used to report amounts transferred from your spouse or common-law partner in Manitoba.

Q: Who needs to fill out Form T2203 Schedule MB(S2)MJ?

A: Individuals in Manitoba who have transferred amounts from their spouse or common-law partner need to fill out this form.

Q: What kind of amounts are included in Form T2203 Schedule MB(S2)MJ?

A: Form T2203 Schedule MB(S2)MJ includes amounts transferred for medical expenses, charitable donations, political contributions, and tuition amounts.

Q: Do I need to submit Form T2203 Schedule MB(S2)MJ with my tax return?

A: Yes, you need to submit Form T2203 Schedule MB(S2)MJ along with your tax return if you have transferred amounts from your spouse or common-law partner in Manitoba.