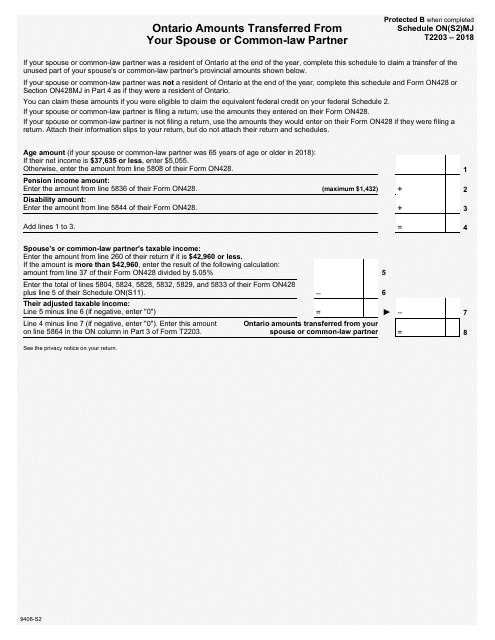

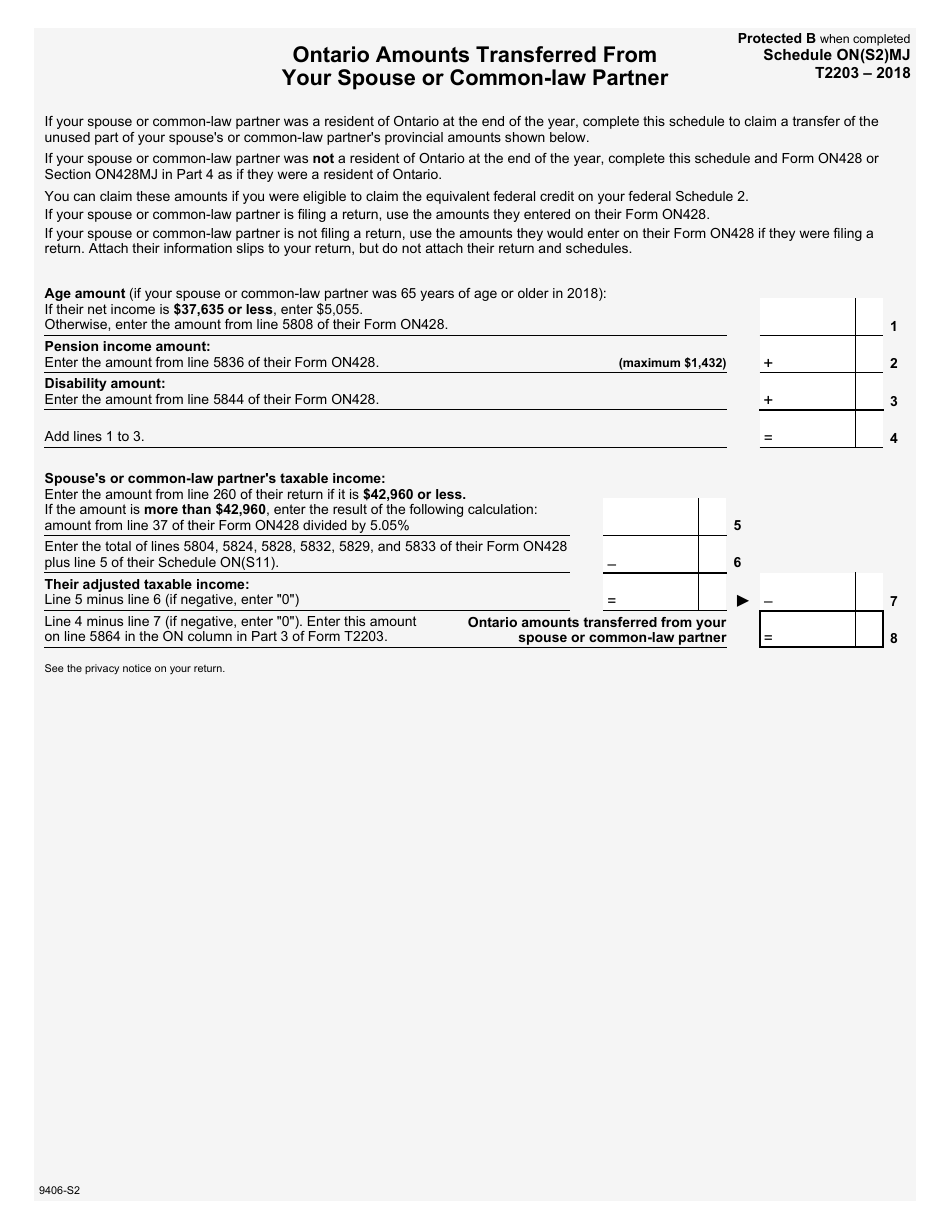

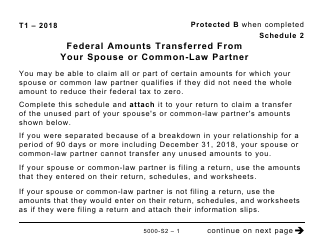

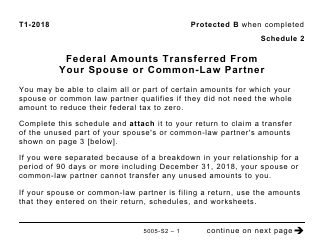

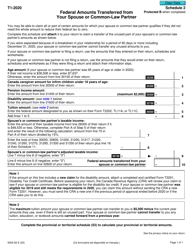

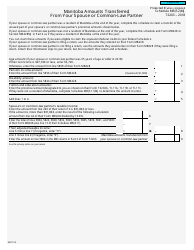

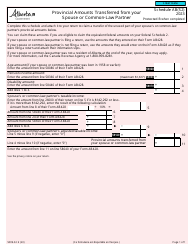

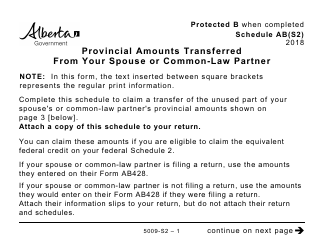

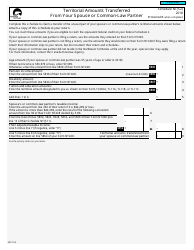

Form T2203 Schedule ON(S2)MJ Ontario Amounts Transferred From Your Spouse or Common-Law Partner - Canada

Form T2203 Schedule ON(S2)MJ Ontario Amounts Transferred From Your Spouse or Common-Law Partner is used to report the amounts transferred from your spouse or common-law partner for the Ontario tax credits. This form allows you to transfer certain credits, such as the Ontario education amount, tuition and education amounts, and the Ontario textbook amount to your spouse or common-law partner if you are unable to use them yourself.

The taxpayer who wants to claim amounts transferred from their spouse or common-law partner in Ontario would file Form T2203 Schedule ON(S2)MJ.

FAQ

Q: What is Form T2203 Schedule ON(S2)MJ?

A: Form T2203 Schedule ON(S2)MJ is a tax form used in Ontario, Canada.

Q: What is the purpose of Form T2203 Schedule ON(S2)MJ?

A: The purpose of Form T2203 Schedule ON(S2)MJ is to report amounts transferred from your spouse or common-law partner for tax purposes in Ontario.

Q: Who is required to file Form T2203 Schedule ON(S2)MJ?

A: Residents of Ontario who have transferred amounts from their spouse or common-law partner for tax purposes are required to file Form T2203 Schedule ON(S2)MJ.

Q: What information is needed to fill out Form T2203 Schedule ON(S2)MJ?

A: To fill out Form T2203 Schedule ON(S2)MJ, you will need information about the amounts transferred from your spouse or common-law partner, as well as their personal information.

Q: When is the deadline for filing Form T2203 Schedule ON(S2)MJ?

A: The deadline for filing Form T2203 Schedule ON(S2)MJ is usually the same as the deadline for filing your personal income tax return, which is April 30th of the following year.

Q: Are there any penalties for not filing Form T2203 Schedule ON(S2)MJ?

A: Yes, if you are required to file Form T2203 Schedule ON(S2)MJ and fail to do so, you may be subject to penalties and interest on any amounts owing.

Q: Can I file Form T2203 Schedule ON(S2)MJ electronically?

A: Yes, you can file Form T2203 Schedule ON(S2)MJ electronically using NETFILE, which is the electronic filing system provided by the CRA.

Q: Is Form T2203 Schedule ON(S2)MJ only for residents of Ontario?

A: Yes, Form T2203 Schedule ON(S2)MJ is specifically for residents of Ontario, as it is used to report amounts transferred for tax purposes in that province.