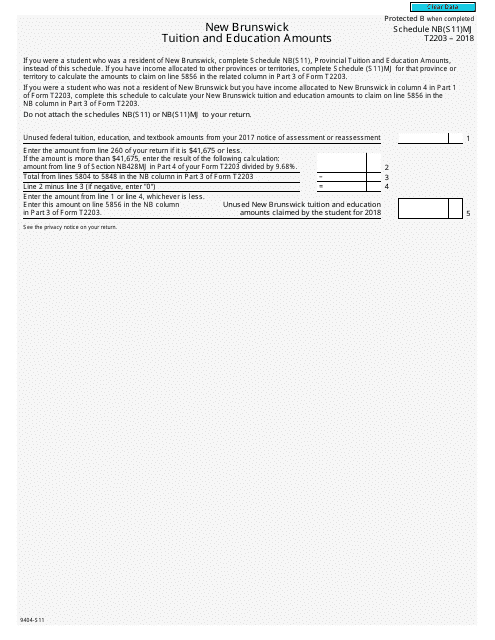

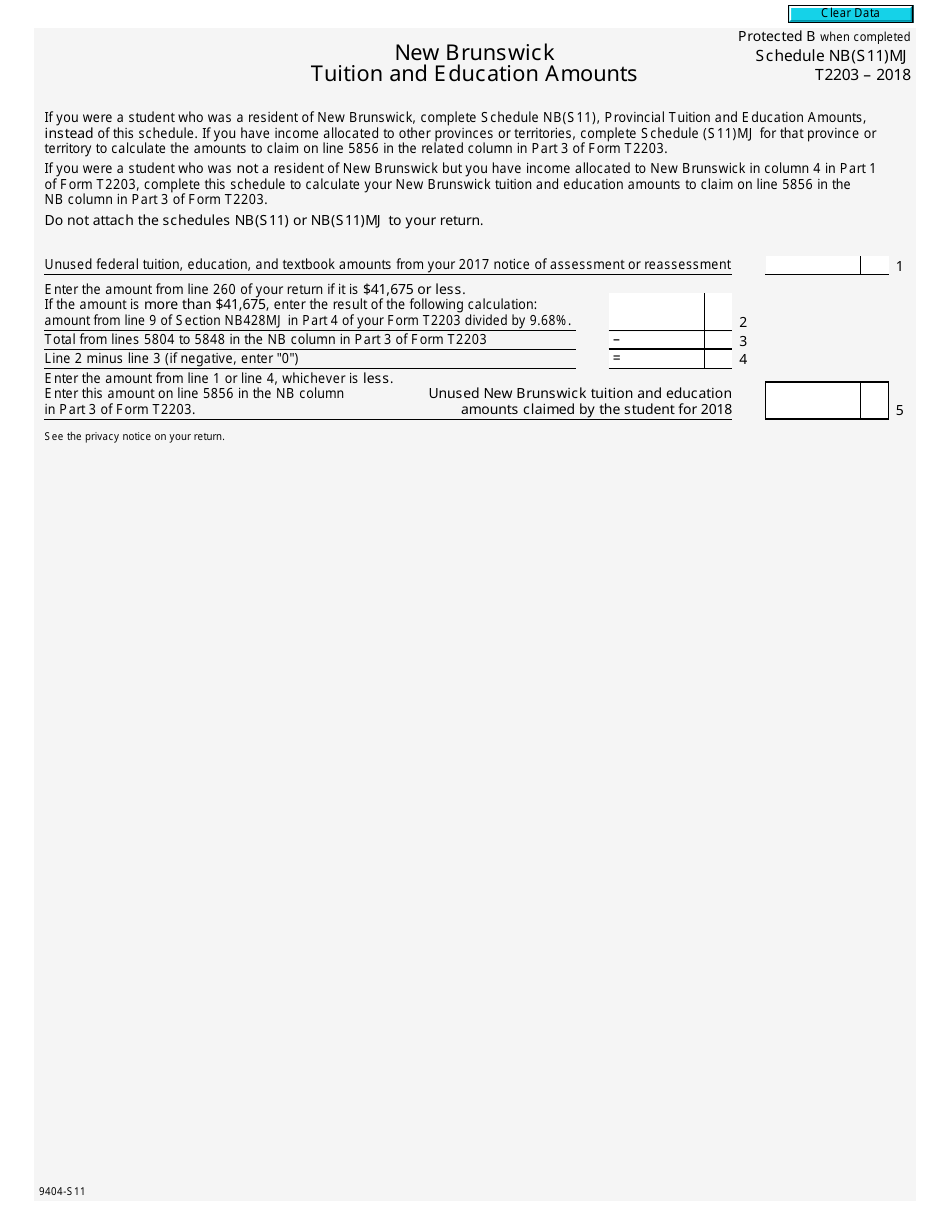

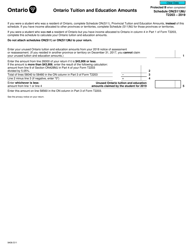

Form T2203 Schedule NB(S11)MJ New Brunswick Tuition and Education Amounts - Canada

Form T2203 Schedule NB(S11)MJ is used in Canada to claim the New Brunswick Tuition and Education Amounts. This form is specifically for residents of New Brunswick who want to claim these amounts on their tax return.

The taxpayer who is a resident of New Brunswick, Canada files the Form T2203 Schedule NB(S11)MJ for reporting tuition and education amounts.

FAQ

Q: What is Form T2203?

A: Form T2203 is a tax form used in Canada for claiming the Tuition and Education Amounts.

Q: What is Schedule NB(S11)MJ?

A: Schedule NB(S11)MJ refers to the specific provincial schedule for claiming the Tuition and Education Amounts in New Brunswick.

Q: What are the Tuition and Education Amounts?

A: The Tuition and Education Amounts are tax credits that can be claimed for eligible education expenses paid to attend a post-secondary institution.

Q: Who can claim the Tuition and Education Amounts?

A: Students or their spouses or common-law partners can claim the Tuition and Education Amounts if they meet the eligibility criteria.

Q: What expenses can be claimed under the Tuition and Education Amounts?

A: Eligible expenses include tuition fees, fees paid to a university or college for occupational skills courses, and examination fees.

Q: How do I claim the Tuition and Education Amounts?

A: To claim the Tuition and Education Amounts, you need to complete Form T2203 and include it with your income tax return.

Q: Do I need to submit Schedule NB(S11)MJ?

A: If you are a resident of New Brunswick and are claiming the Tuition and Education Amounts, you need to complete and submit Schedule NB(S11)MJ with Form T2203.

Q: Are the Tuition and Education Amounts refundable?

A: No, the Tuition and Education Amounts are non-refundable tax credits that can only be used to reduce your tax payable.

Q: Can I carry forward unused Tuition and Education Amounts?

A: Yes, if you are unable to use the full amount of your Tuition and Education Amounts in the current year, you can carry forward any unused amounts to future years.