This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2 Schedule 2

for the current year.

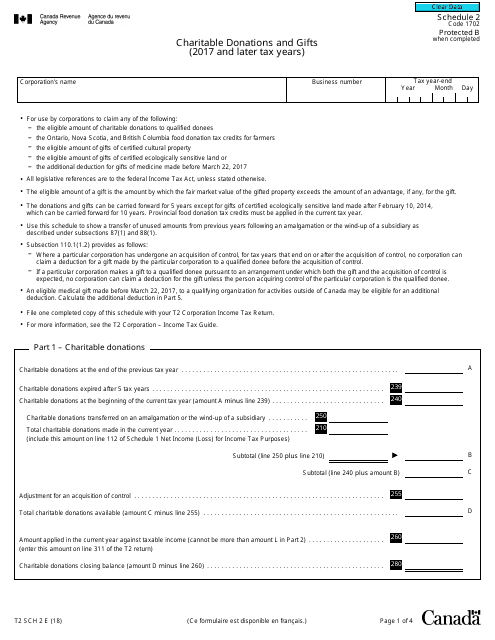

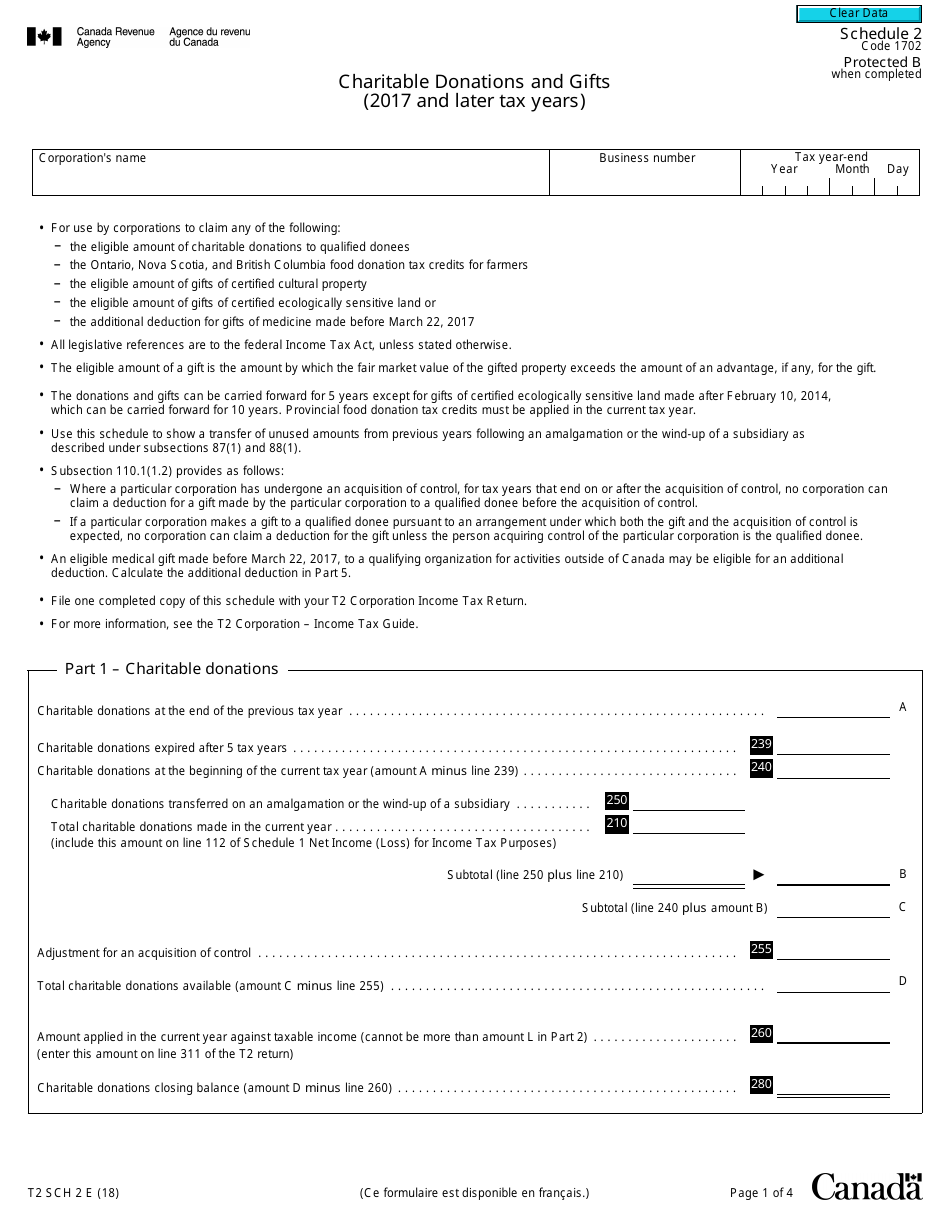

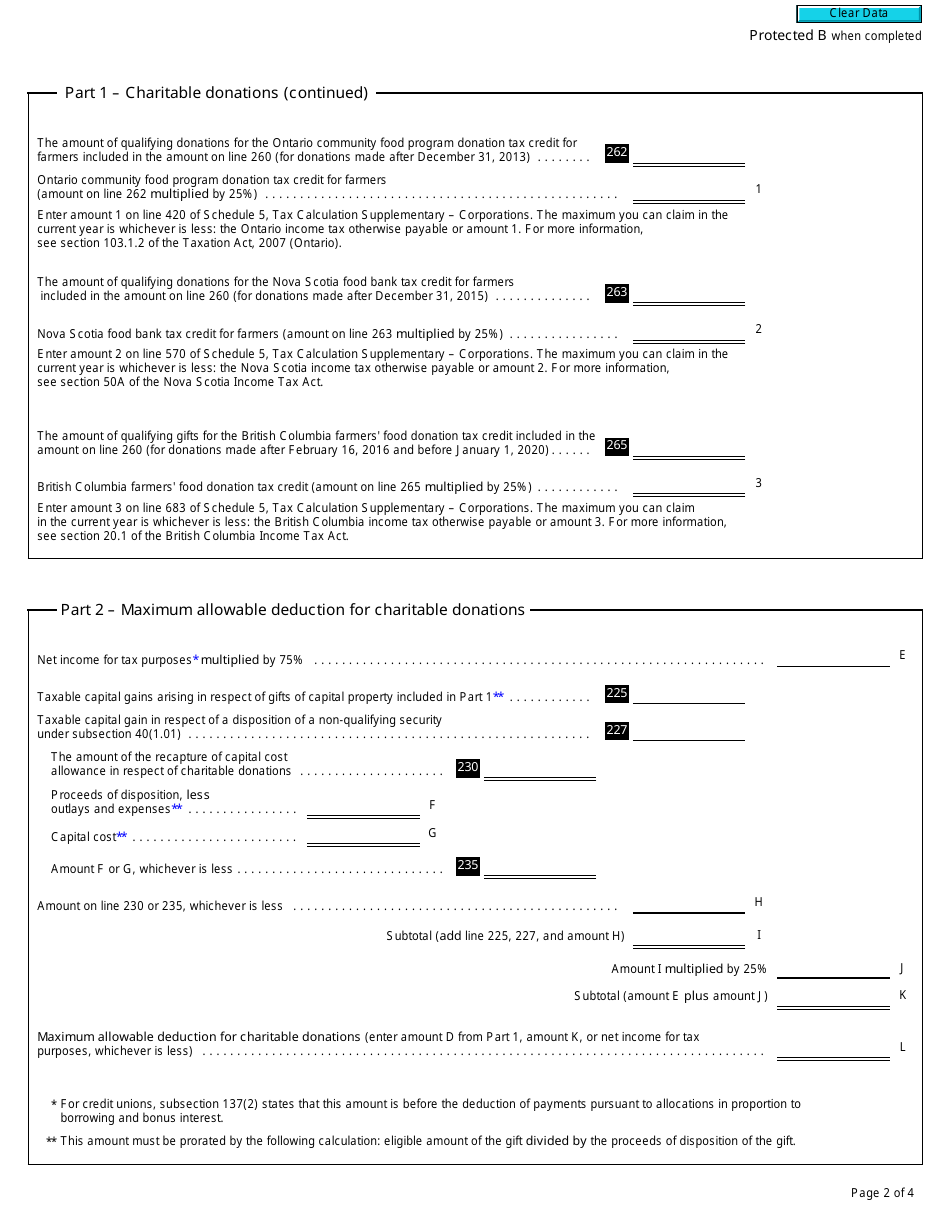

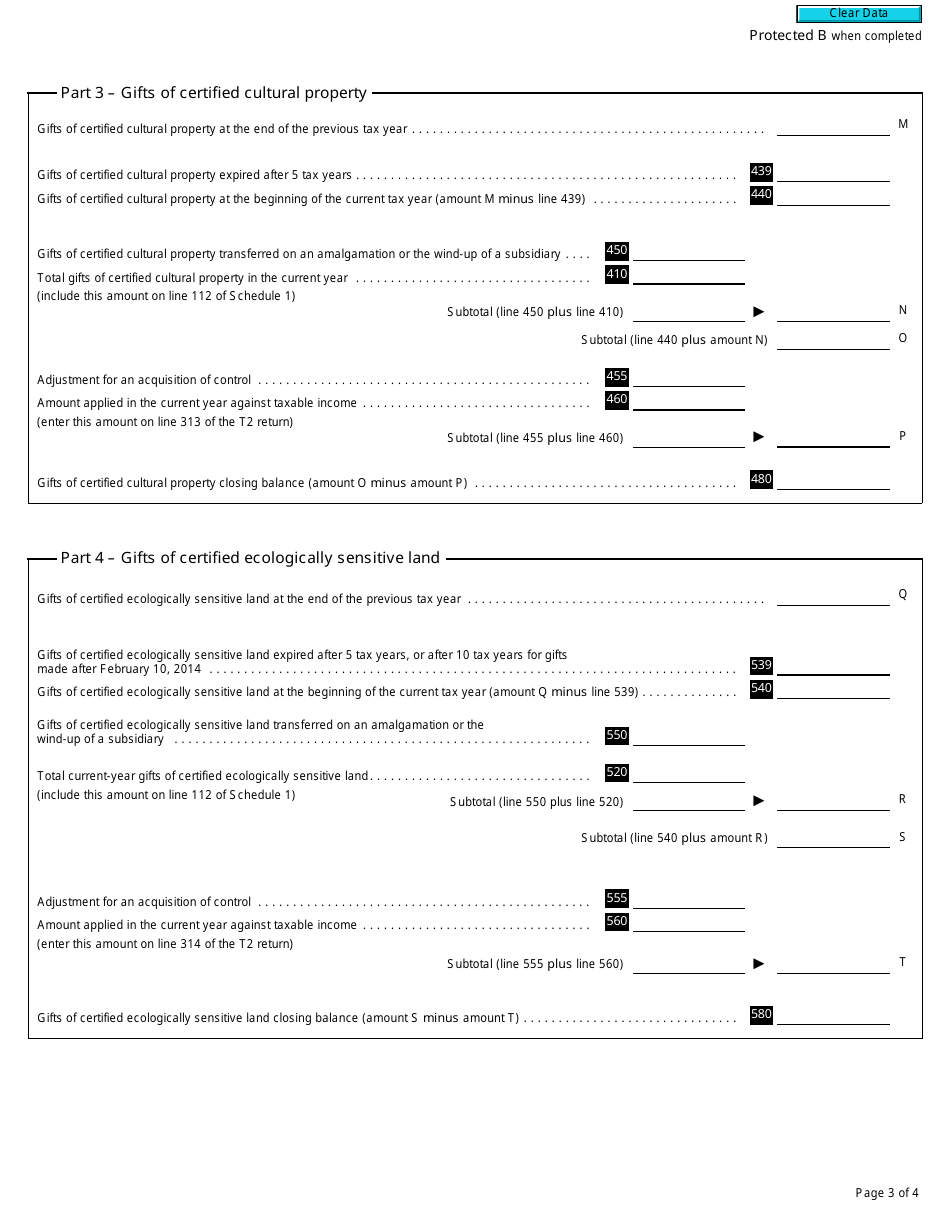

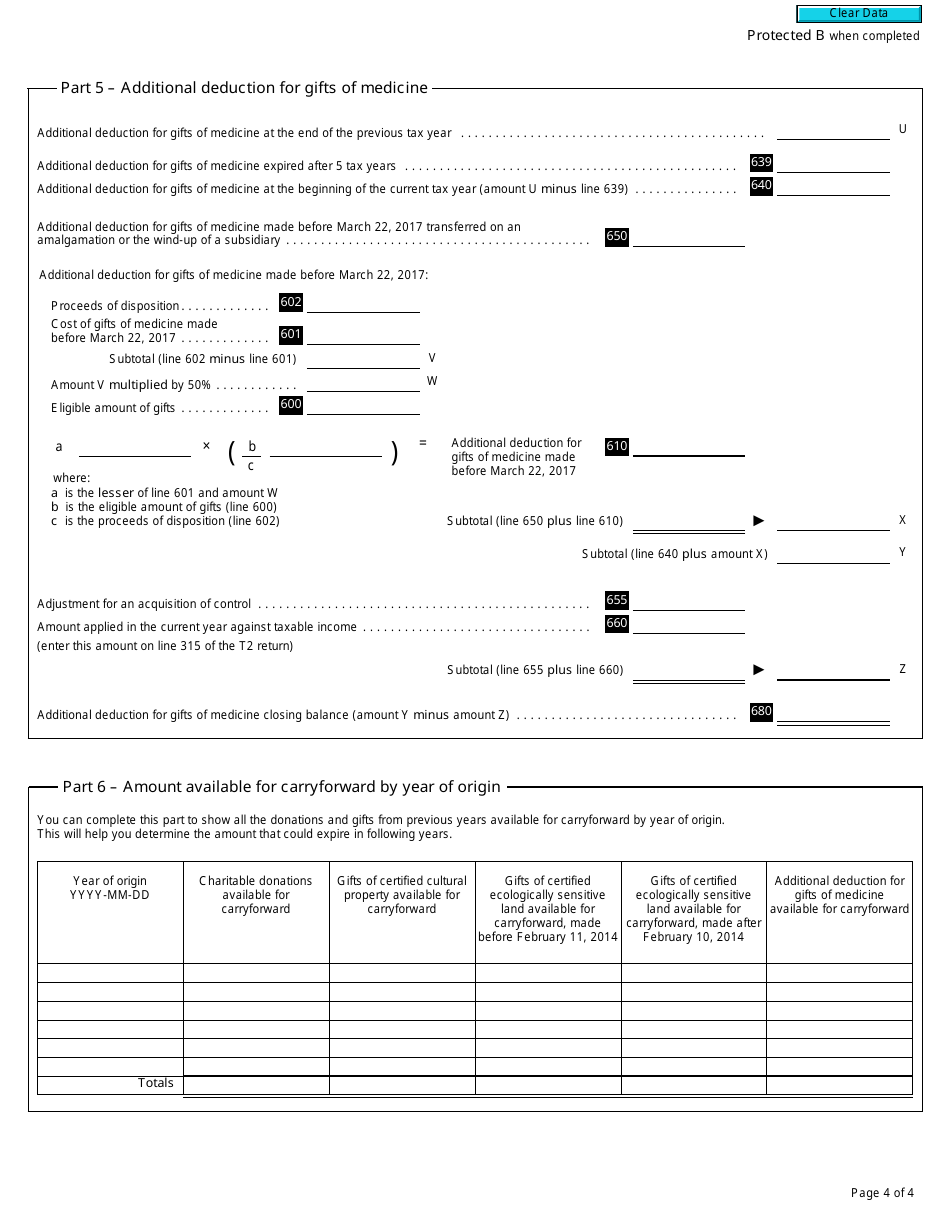

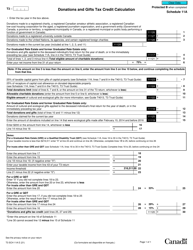

Form T2 Schedule 2 Charitable Donations and Gifts (2017 and Later Tax Years) - Canada

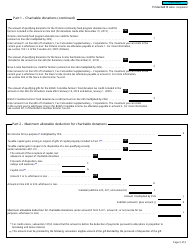

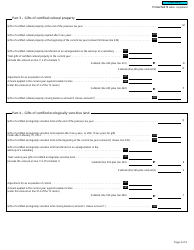

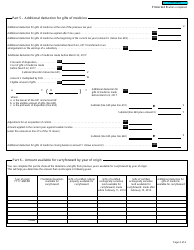

Form T2 Schedule 2 Charitable Donations and Gifts (2017 and Later Tax Years) in Canada is used by corporations to claim tax deductions for charitable donations and gifts made during the tax year.

The Form T2 Schedule 2 Charitable Donations and Gifts is filed by corporations in Canada.

FAQ

Q: What is Form T2 Schedule 2?

A: Form T2 Schedule 2 is a tax form used in Canada to report charitable donations and gifts for tax purposes.

Q: Who needs to fill out Form T2 Schedule 2?

A: Corporations in Canada that have made charitable donations or gifts in the tax year need to fill out Form T2 Schedule 2.

Q: What information is required on Form T2 Schedule 2?

A: Form T2 Schedule 2 requires details about the charity or registered donee, the amount of the donation or gift, and the date it was made.

Q: Can individuals use Form T2 Schedule 2?

A: No, Form T2 Schedule 2 is specifically for corporations. Individuals should use Form T1 Schedule 9 to claim charitable donations and gifts.

Q: Is there a deadline for filing Form T2 Schedule 2?

A: Yes, Form T2 Schedule 2 must be filed within six months from the end of the tax year to which it applies.

Q: Are there any penalties for not filing Form T2 Schedule 2?

A: Yes, there may be penalties for not filing Form T2 Schedule 2 on time or for providing false or misleading information.