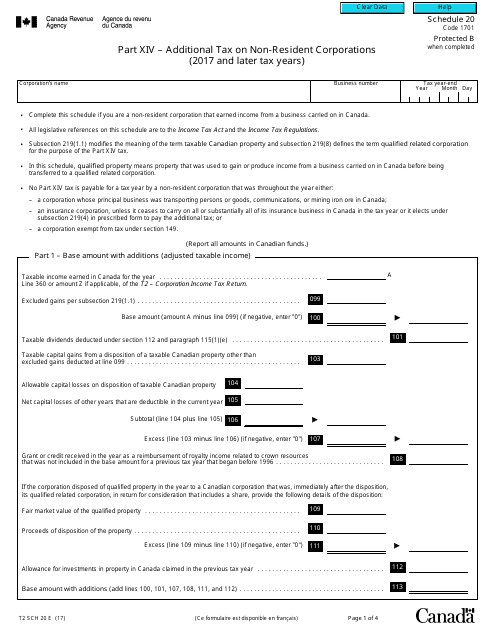

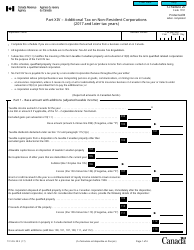

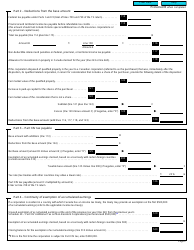

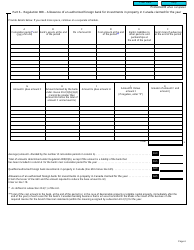

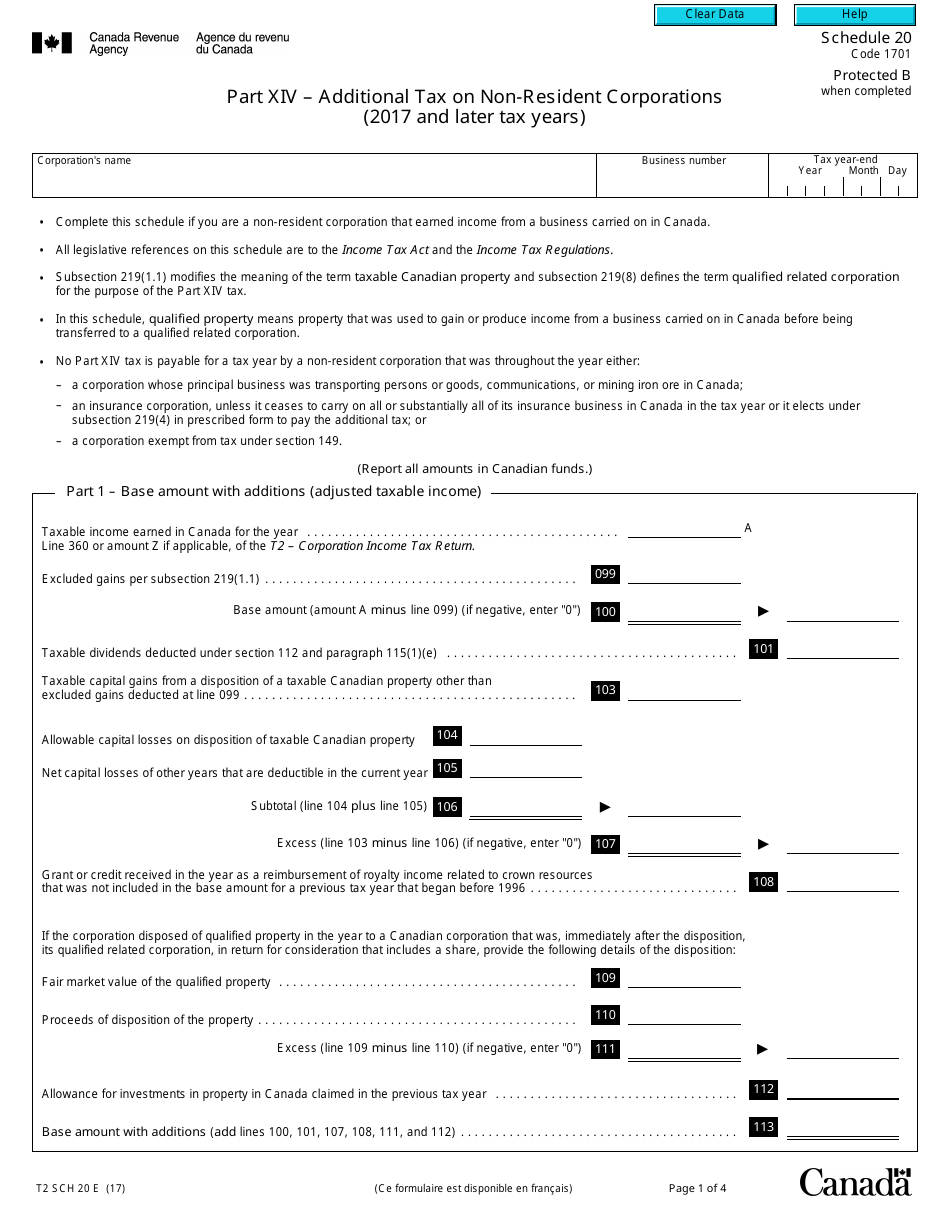

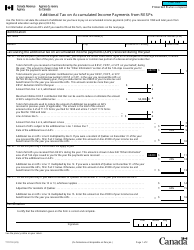

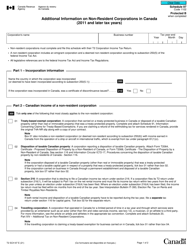

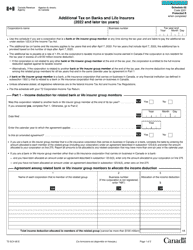

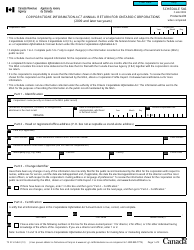

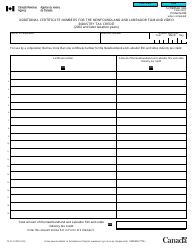

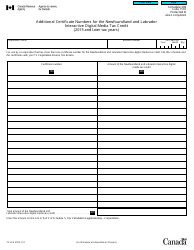

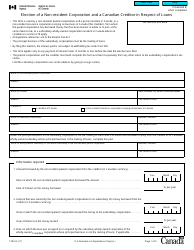

Form T2 Schedule 20 Part XIV - Additional Tax on Non-resident Corporations (2017 and Later Tax Years) - Canada

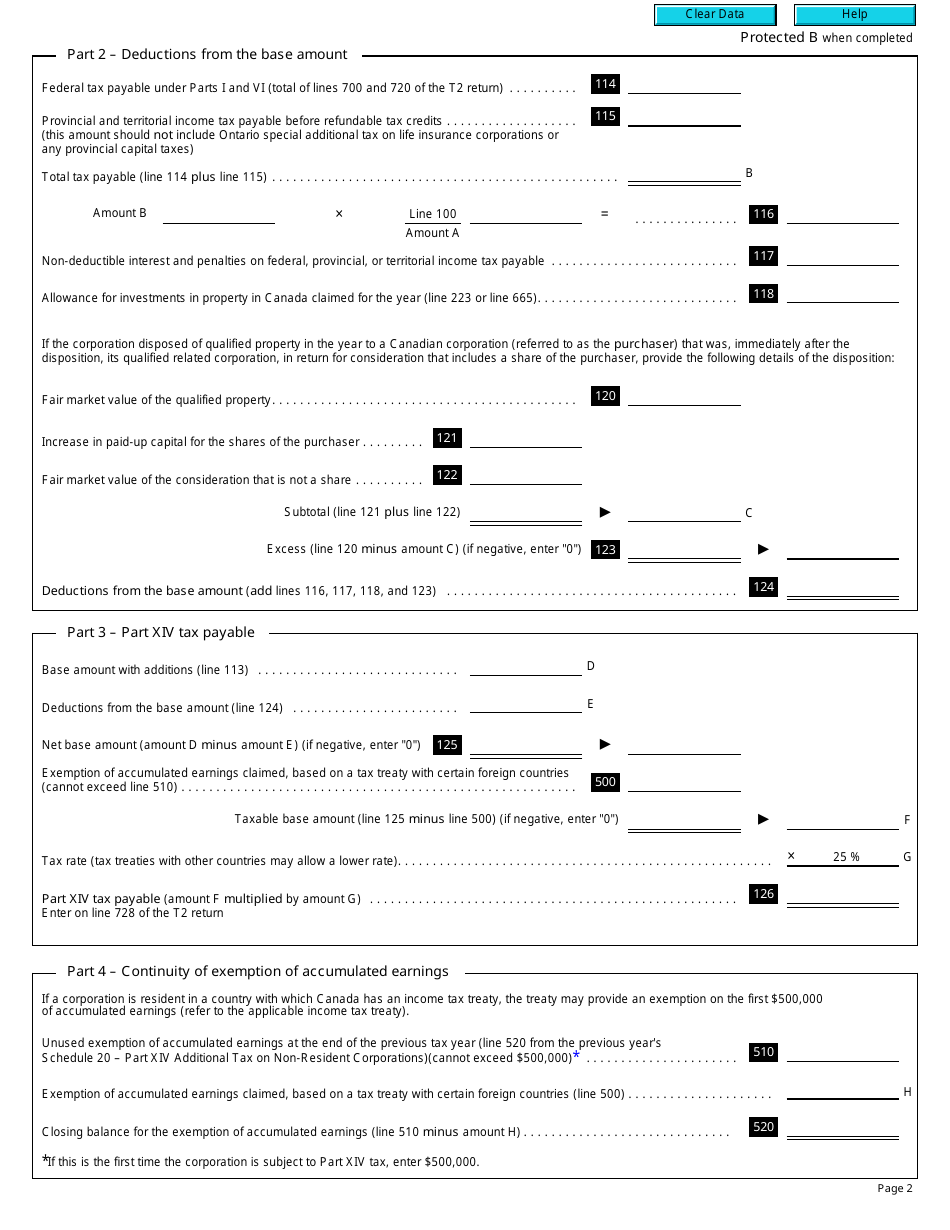

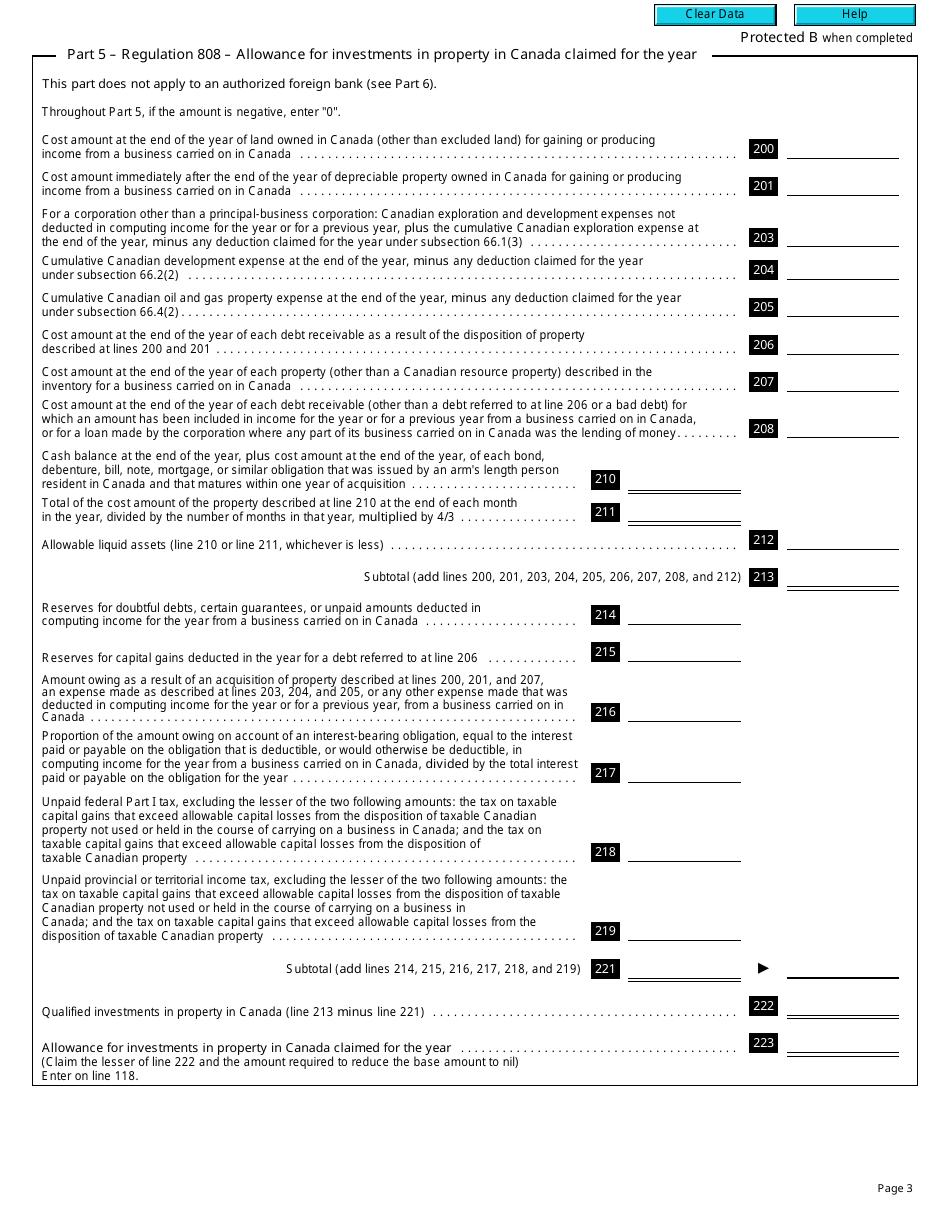

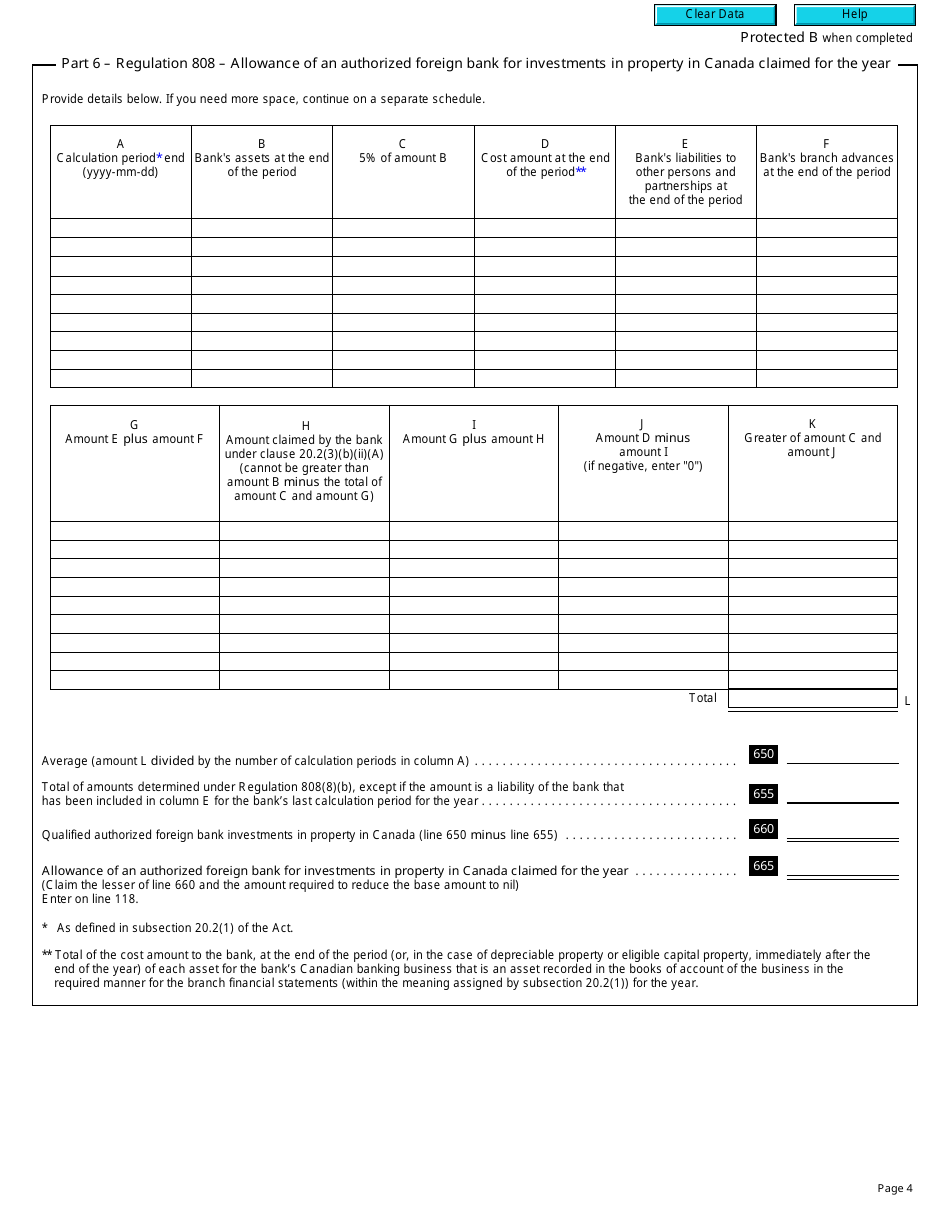

Form T2 Schedule 20 Part XIV in Canada is used to calculate the additional tax on non-resident corporations for the 2017 and later tax years. This form helps determine the amount of tax payable by non-resident corporations operating in Canada.

The Form T2 Schedule 20 Part XIV - Additional Tax on Non-resident Corporations (2017 and Later Tax Years) in Canada is filed by non-resident corporations that have taxable income from carrying on business in Canada.

FAQ

Q: What is Form T2 Schedule 20 Part XIV?

A: Form T2 Schedule 20 Part XIV is a tax form in Canada for non-resident corporations.

Q: What is the purpose of Form T2 Schedule 20 Part XIV?

A: The purpose of Form T2 Schedule 20 Part XIV is to calculate the additional tax owed by non-resident corporations.

Q: Who needs to file Form T2 Schedule 20 Part XIV?

A: Non-resident corporations that earn income in Canada need to file Form T2 Schedule 20 Part XIV.

Q: What is the additional tax on non-resident corporations?

A: The additional tax on non-resident corporations is a tax imposed on their Canadian income.

Q: When should Form T2 Schedule 20 Part XIV be filed?

A: Form T2 Schedule 20 Part XIV should be filed along with the corporation's Canadian income tax return.

Q: Are there any penalties for not filing Form T2 Schedule 20 Part XIV?

A: Yes, there can be penalties for not filing Form T2 Schedule 20 Part XIV, including interest charges on the additional tax owed.

Q: Can non-resident corporations claim any deductions or credits on Form T2 Schedule 20 Part XIV?

A: No, non-resident corporations cannot claim deductions or credits on Form T2 Schedule 20 Part XIV.

Q: Is Form T2 Schedule 20 Part XIV the only form non-resident corporations need to file?

A: No, non-resident corporations also need to file a T2 Corporation Income Tax Return along with Form T2 Schedule 20 Part XIV.