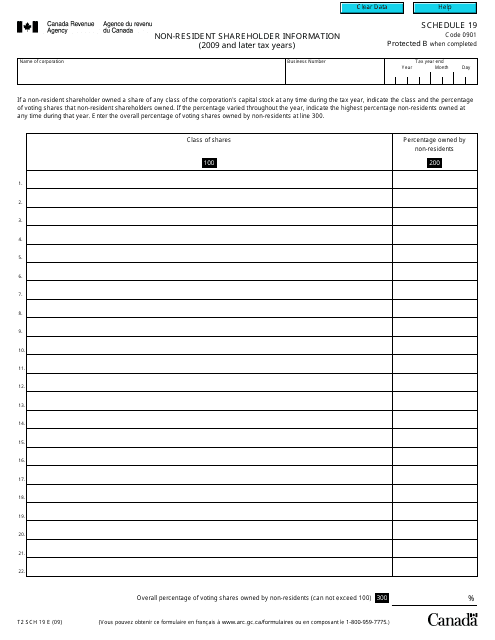

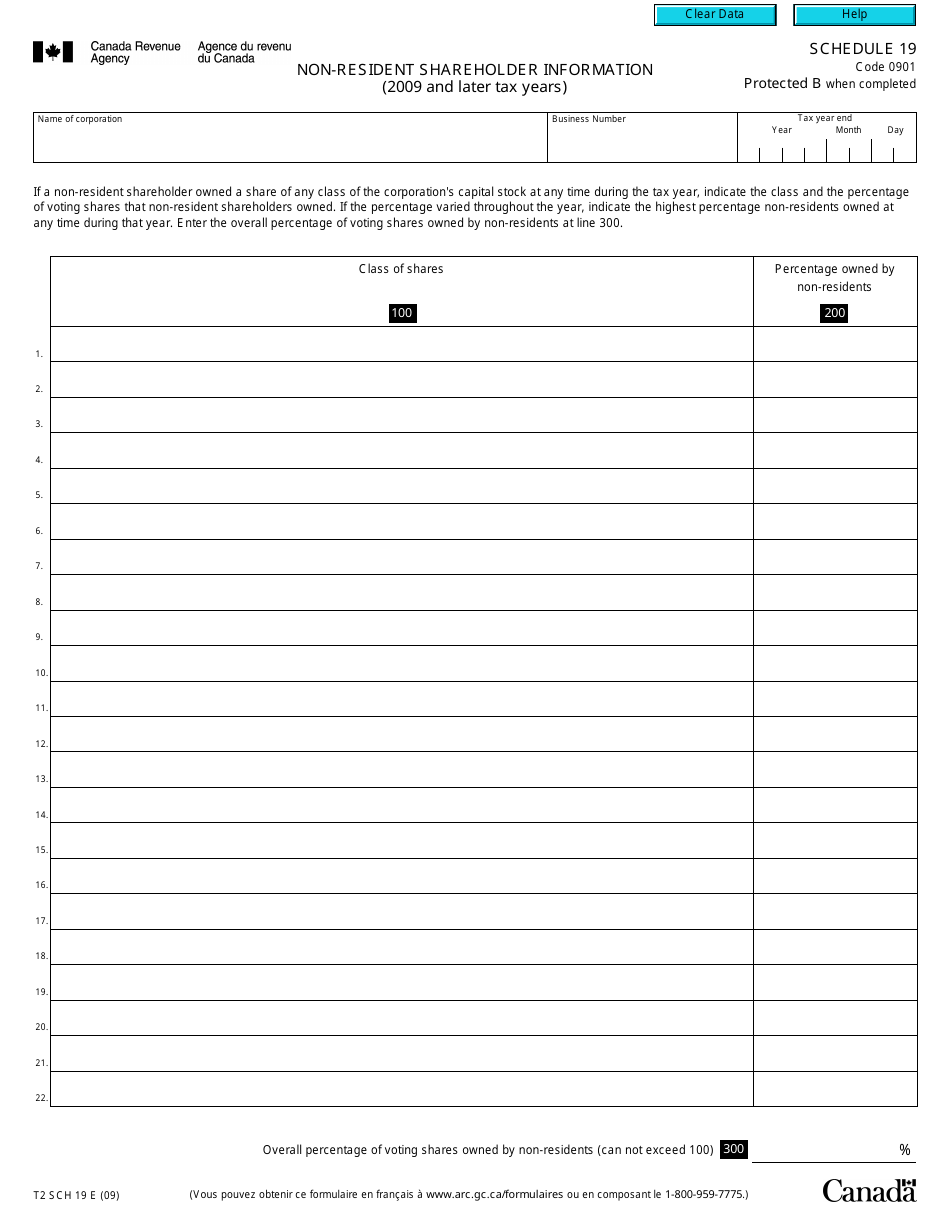

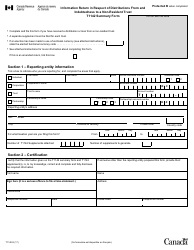

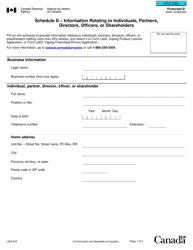

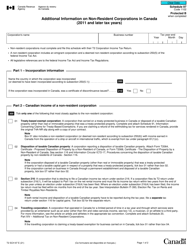

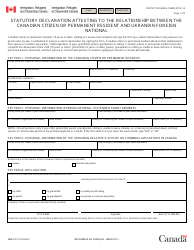

Form T2 Schedule 19 Non-resident Shareholder Information (2009 and Later Tax Years) - Canada

Form T2 SCH 19 is a Canadian Revenue Agency form also known as the "Form T2 Sch 19 Schedule 19 "non-resident Shareholder Information (2009 And Later Tax Years)" - Canada" . The latest edition of the form was released in January 1, 2009 and is available for digital filing.

Download a PDF version of the Form T2 SCH 19 down below or find it on Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2 Schedule 19?

A: Form T2 Schedule 19 is a tax form in Canada.

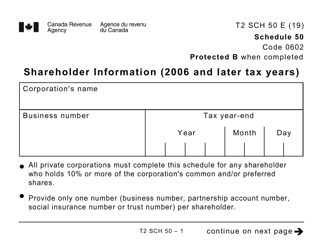

Q: Who needs to file Form T2 Schedule 19?

A: Non-resident shareholders in Canada need to file Form T2 Schedule 19.

Q: What is the purpose of Form T2 Schedule 19?

A: Form T2 Schedule 19 is used to provide information about non-resident shareholders.

Q: Which tax years does Form T2 Schedule 19 cover?

A: Form T2 Schedule 19 covers tax years from 2009 and later.

Q: Is Form T2 Schedule 19 applicable in the United States?

A: No, Form T2 Schedule 19 is specific to Canada.

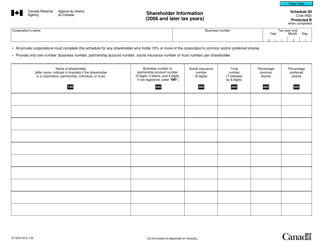

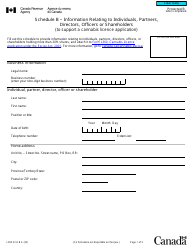

Q: What kind of information is required on Form T2 Schedule 19?

A: Form T2 Schedule 19 requires information about the non-resident shareholders, such as their names, addresses, and shareholdings.