This version of the form is not currently in use and is provided for reference only. Download this version of

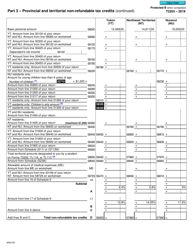

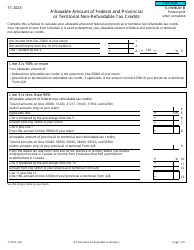

Form T2 Schedule 21

for the current year.

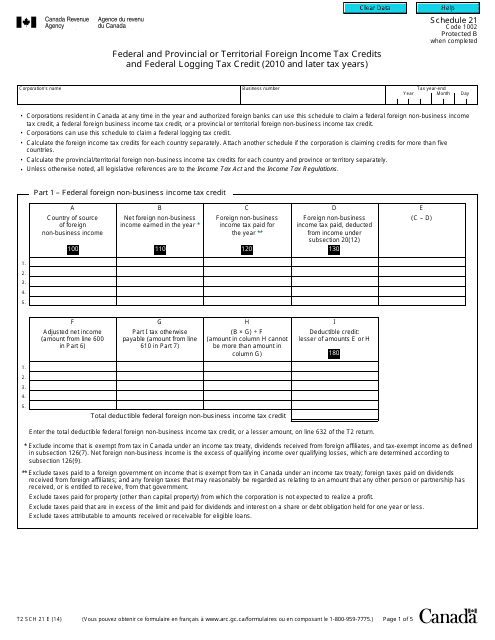

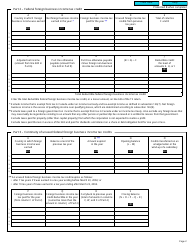

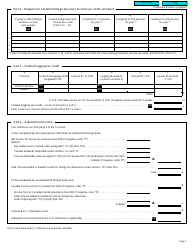

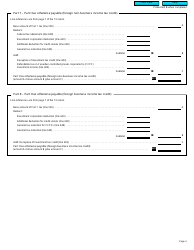

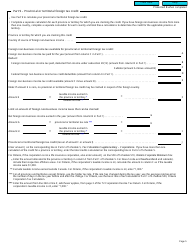

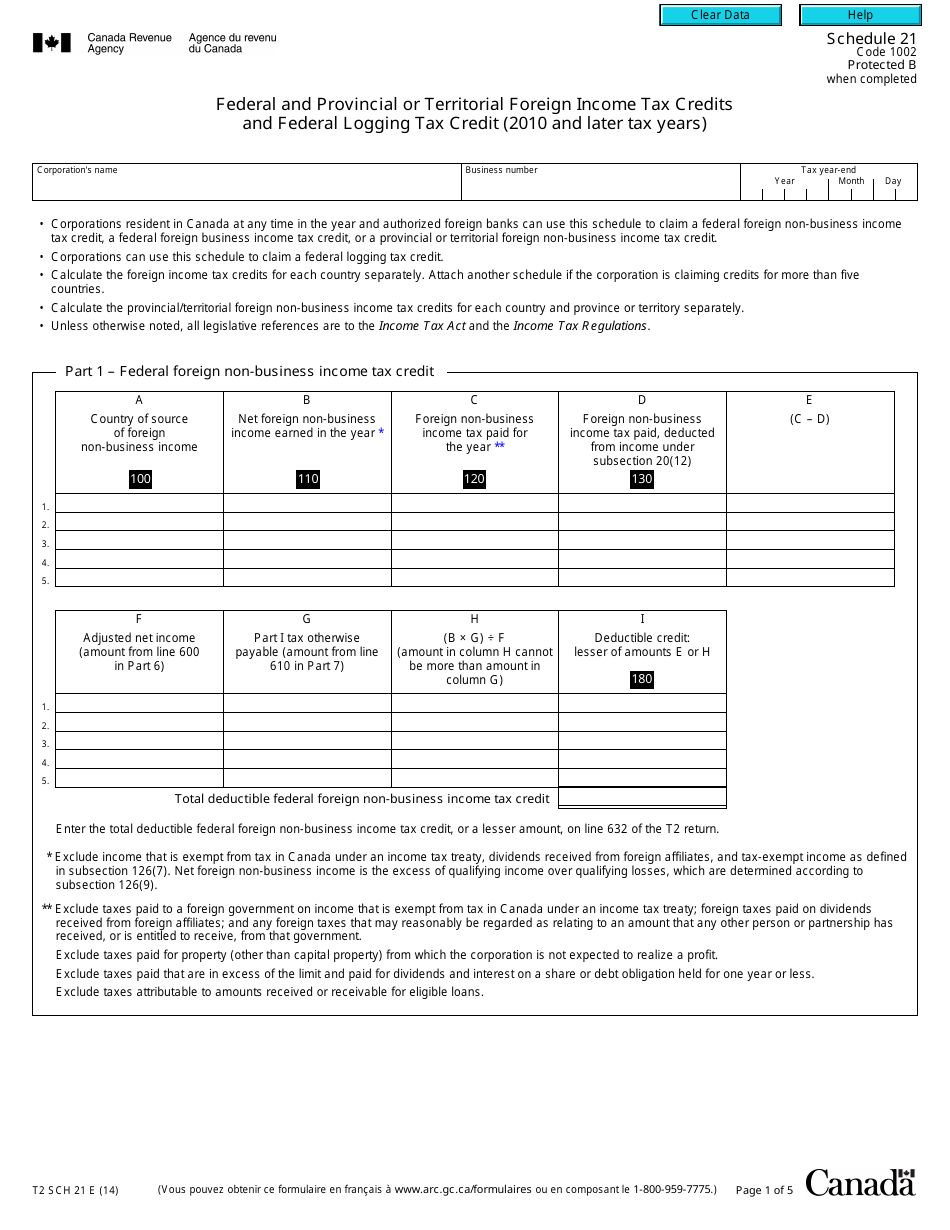

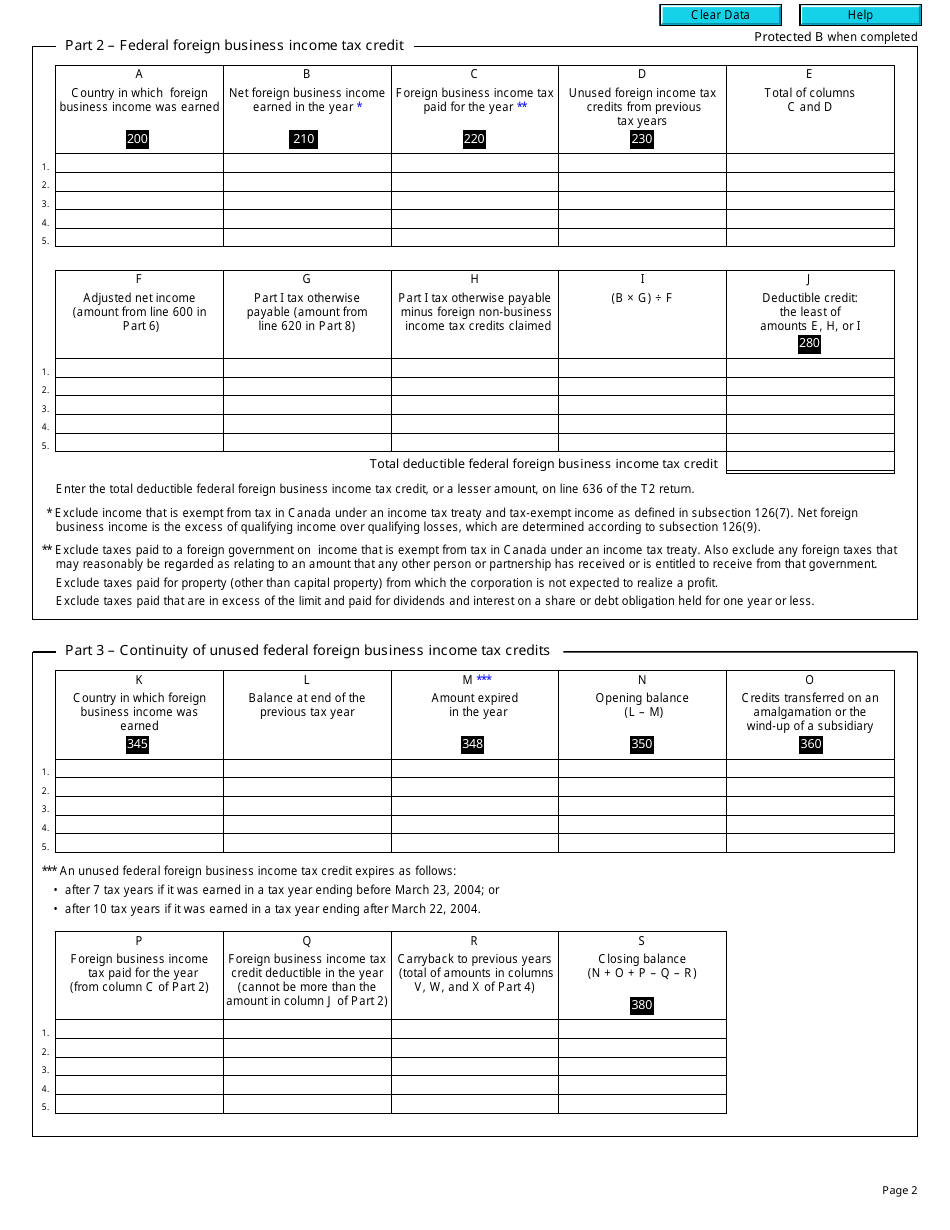

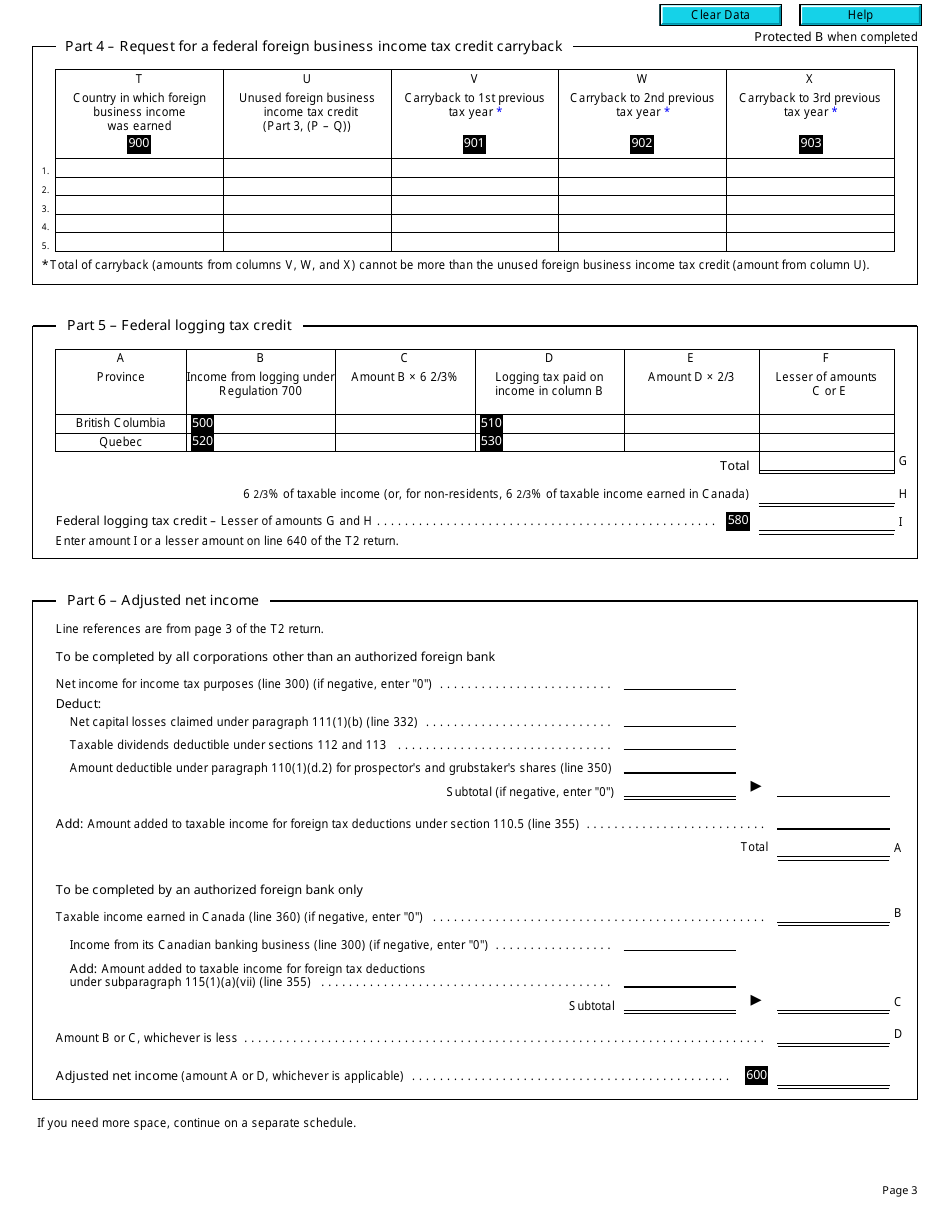

Form T2 Schedule 21 Federal and Provincial or Territorial Foreign Income Tax Credits and Federal Logging Tax Credit (2010 and Later Tax Years) - Canada

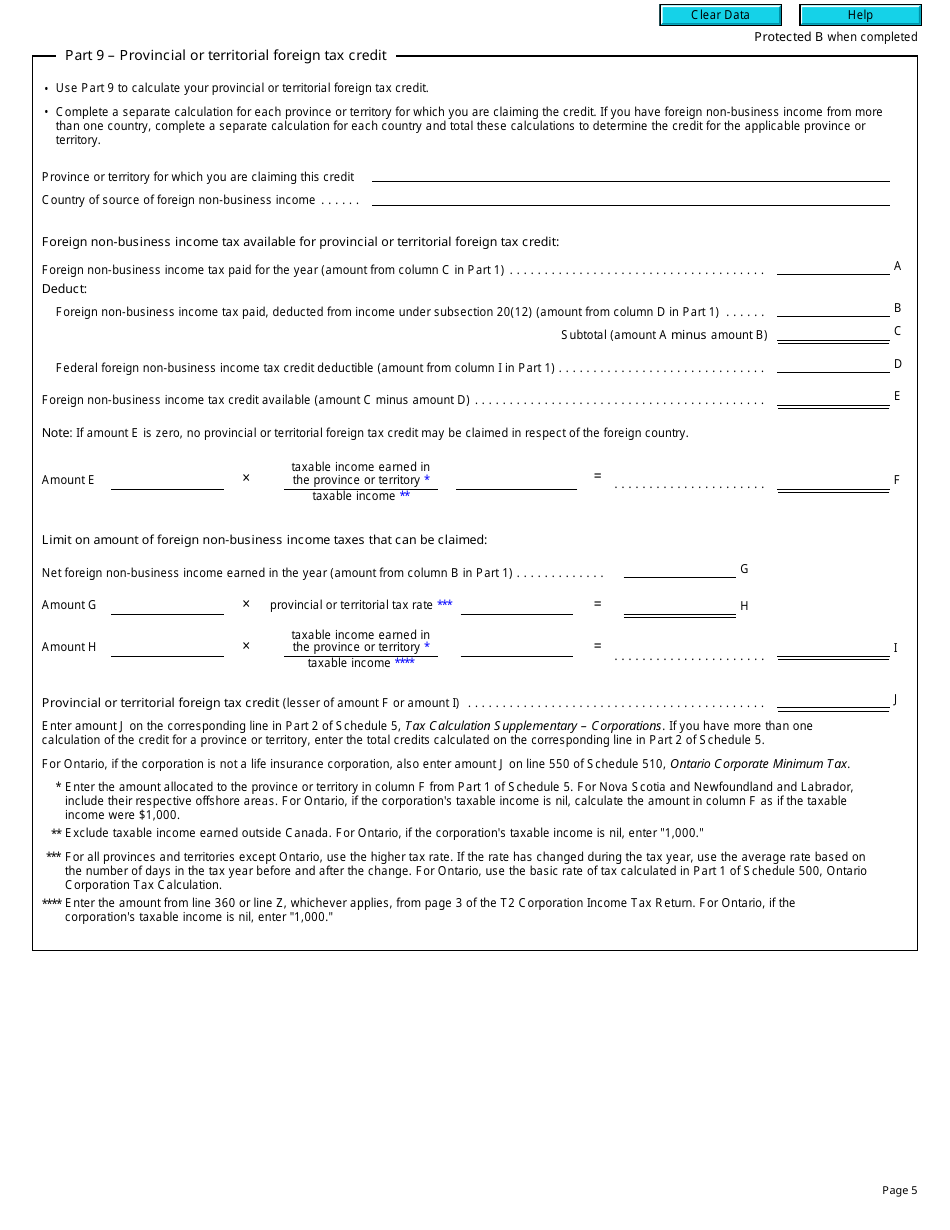

Form T2 SCH 21 or the "Form T2 Sch 21 Schedule 21 "federal And Provincial Or Territorial Foreign Tax Credit (2010 And Later Tax Years)" - Canada" is a form issued by the Canadian Revenue Agency .

Download a PDF version of the Form T2 SCH 21 down below or find it on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2 Schedule 21?

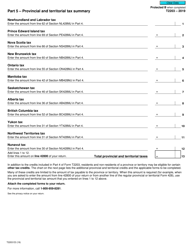

A: Form T2 Schedule 21 is a form used in Canada for reporting federal and provincial or territorial foreign income tax credits, as well as the federal logging tax credit.

Q: What tax years is Form T2 Schedule 21 used for?

A: Form T2 Schedule 21 is used for tax years 2010 and later.

Q: What does Form T2 Schedule 21 include?

A: Form T2 Schedule 21 includes information on federal and provincial or territorial foreign income tax credits, as well as the federal logging tax credit.

Q: Why would I need to fill out Form T2 Schedule 21?

A: You would need to fill out Form T2 Schedule 21 if you have foreign income tax credits or the federal logging tax credit that you want to claim.

Q: Are there any special instructions for filling out Form T2 Schedule 21?

A: Yes, there are specific instructions provided by the CRA on how to fill out Form T2 Schedule 21. It is important to follow these instructions carefully.

Q: Can I claim both federal and provincial or territorial foreign income tax credits on Form T2 Schedule 21?

A: Yes, you can claim both federal and provincial or territorial foreign income tax credits on Form T2 Schedule 21.

Q: Is the federal logging tax credit included on Form T2 Schedule 21?

A: Yes, the federal logging tax credit is included on Form T2 Schedule 21.

Q: Can Form T2 Schedule 21 be used for tax years prior to 2010?

A: No, Form T2 Schedule 21 is only used for tax years 2010 and later.