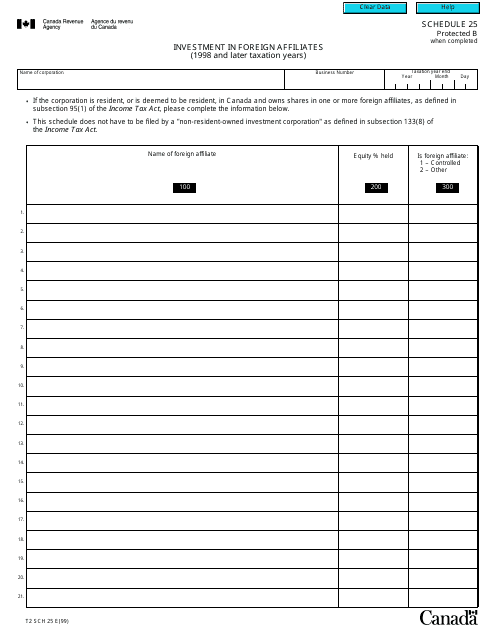

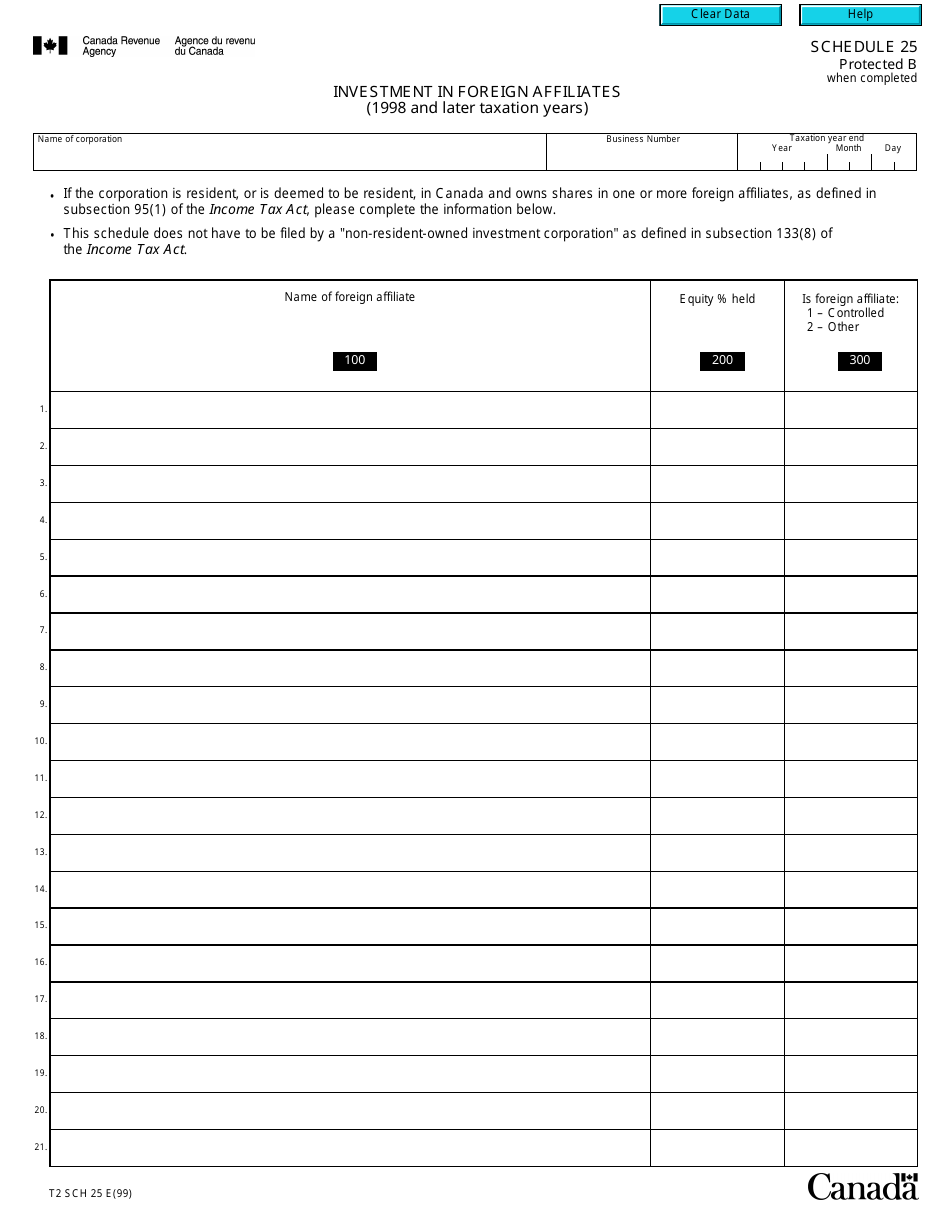

Form T2 Schedule 25 Investment in Foreign Affiliates (1998 and Later Taxation Years) - Canada

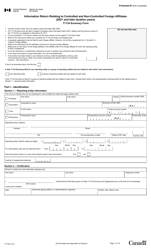

Form T2 Schedule 25 Investment in Foreign Affiliates (1998 and Later Taxation Years) in Canada is used by corporations to report their investments in foreign affiliates for taxation purposes. This schedule provides details on the corporation's investments, such as the country of the foreign affiliate, the type of investment, and the income earned from these investments. It helps the Canadian government assess the corporation's tax liability and ensure that appropriate taxes are paid on foreign investments.

The Form T2 Schedule 25 - Investment in Foreign Affiliates (1998 and Later Taxation Years) in Canada is filed by Canadian businesses that have investments in foreign affiliates. This form allows businesses to report information related to their investments in foreign companies and claim certain tax benefits or deductions based on those investments.

FAQ

Q: What is T2 Schedule 25?

A: T2 Schedule 25 is a form used by Canadian corporations to report their investments in foreign affiliates for tax purposes.

Q: Who needs to file T2 Schedule 25?

A: Canadian corporations that have investments in foreign affiliates need to file T2 Schedule 25.

Q: What information is required on T2 Schedule 25?

A: T2 Schedule 25 requires corporations to provide details about their investments in foreign affiliates, including the affiliate's name, country of residence, percentage of ownership, income earned, and taxes paid.

Q: When is T2 Schedule 25 due?

A: The due date for filing T2 Schedule 25 is the same as the filing deadline for the corporation's T2 tax return, which is generally within six months after the end of the corporation's fiscal year.

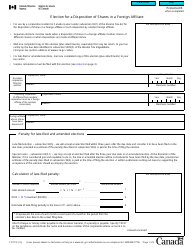

Q: What are the consequences of not filing T2 Schedule 25?

A: Failure to file T2 Schedule 25 or providing false or misleading information can result in penalties and interest charges imposed by the CRA.