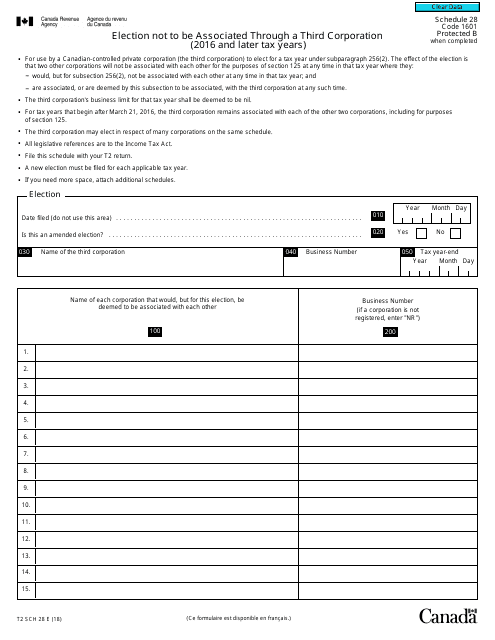

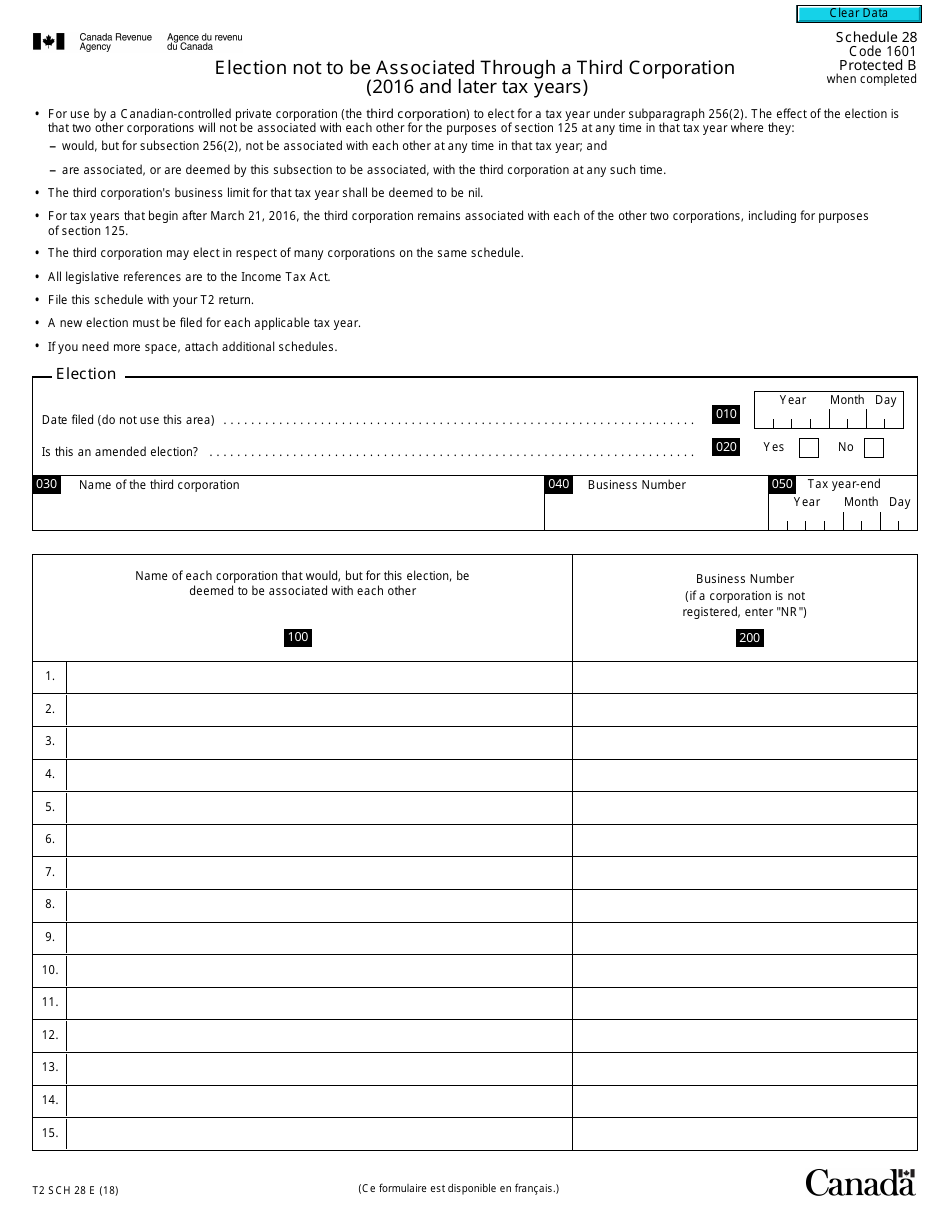

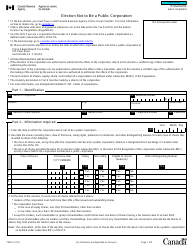

Form T2 Schedule 28 Election Not to Be Associated Through a Third Corporation (2016 and Later Tax Years) - Canada

Form T2 Schedule 28 Election Not to Be Associated Through a Third Corporation (2016 and Later Tax Years) in Canada is used to elect not to be associated with another corporation through a third corporation for tax purposes.

The Form T2 Schedule 28 Election Not to Be Associated Through a Third Corporation (2016 and Later Tax Years) in Canada is filed by corporations that want to elect not to be associated through a third corporation for tax purposes.

FAQ

Q: What is Form T2 Schedule 28?

A: Form T2 Schedule 28 is a form used by Canadian corporations to make an election not to be associated through a third corporation.

Q: What is the purpose of Form T2 Schedule 28?

A: The purpose of Form T2 Schedule 28 is to allow Canadian corporations to elect not to be associated through a third corporation for tax purposes.

Q: When is Form T2 Schedule 28 used?

A: Form T2 Schedule 28 is used for tax years 2016 and later.

Q: Who can use Form T2 Schedule 28?

A: Canadian corporations can use Form T2 Schedule 28.

Q: Is there a deadline for submitting Form T2 Schedule 28?

A: Yes, Form T2 Schedule 28 must be submitted by the corporation's filing due date for the tax year.

Q: Are there any penalties for not submitting Form T2 Schedule 28?

A: Failure to submit Form T2 Schedule 28 may result in penalties imposed by the CRA.

Q: Can Form T2 Schedule 28 be amended?

A: Yes, Form T2 Schedule 28 can be amended within the normal reassessment period for the tax year.

Q: Are there any fees associated with filing Form T2 Schedule 28?

A: There are no specific fees associated with filing Form T2 Schedule 28, but general filing fees may apply.

Q: Can I file Form T2 Schedule 28 electronically?

A: Yes, Form T2 Schedule 28 can be filed electronically using the CRA's Corporation Internet Filing service.