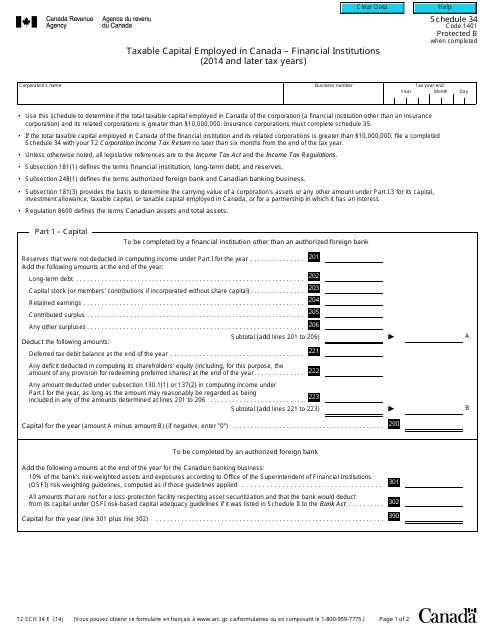

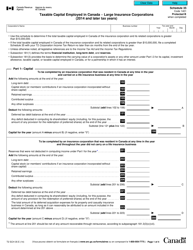

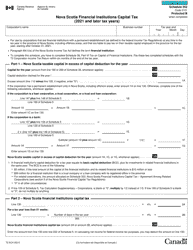

Form T2 Schedule 34 Taxable Capital Employed in Canada - Financial Institutions (2014 and Later Tax Years) - Canada

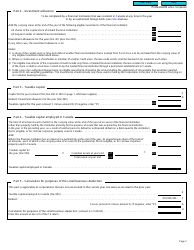

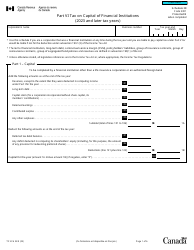

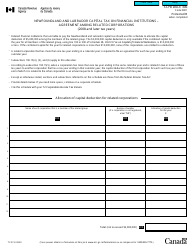

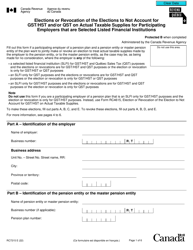

Form T2 Schedule 34 is used by financial institutions in Canada to calculate the taxable capital employed for tax purposes. It is applicable for the tax years 2014 and later.

The financial institutions in Canada are responsible for filing the Form T2 Schedule 34 Taxable Capital Employed.

FAQ

Q: What is Form T2 Schedule 34?

A: Form T2 Schedule 34 is a tax form used by financial institutions in Canada to report their taxable capital employed.

Q: Who is required to file Form T2 Schedule 34?

A: Financial institutions in Canada are required to file Form T2 Schedule 34.

Q: What is taxable capital employed?

A: Taxable capital employed refers to the amount of capital that a financial institution has at its disposal for income-earning purposes.

Q: What tax years does Form T2 Schedule 34 apply to?

A: Form T2 Schedule 34 applies to tax years starting in 2014 and later.

Q: What information is required on Form T2 Schedule 34?

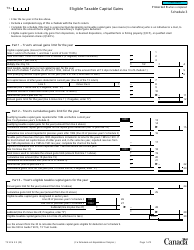

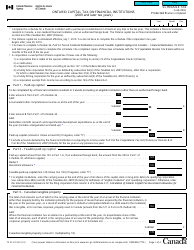

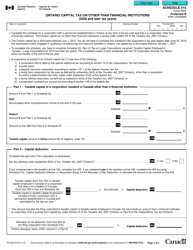

A: Form T2 Schedule 34 requires financial institutions to provide information about their capital structure, balance sheet items, and other relevant financial details.

Q: Is there a deadline for filing Form T2 Schedule 34?

A: Yes, financial institutions must file Form T2 Schedule 34 within six months after the end of their tax year.