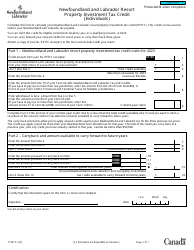

This version of the form is not currently in use and is provided for reference only. Download this version of

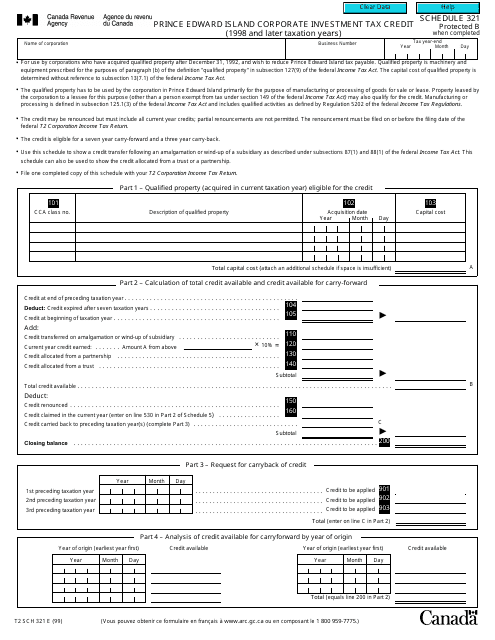

Form T2 Schedule 321

for the current year.

Form T2 Schedule 321 Prince Edward Island Corporate Investment Tax Credit (1998 and Later Taxation Years) - Canada

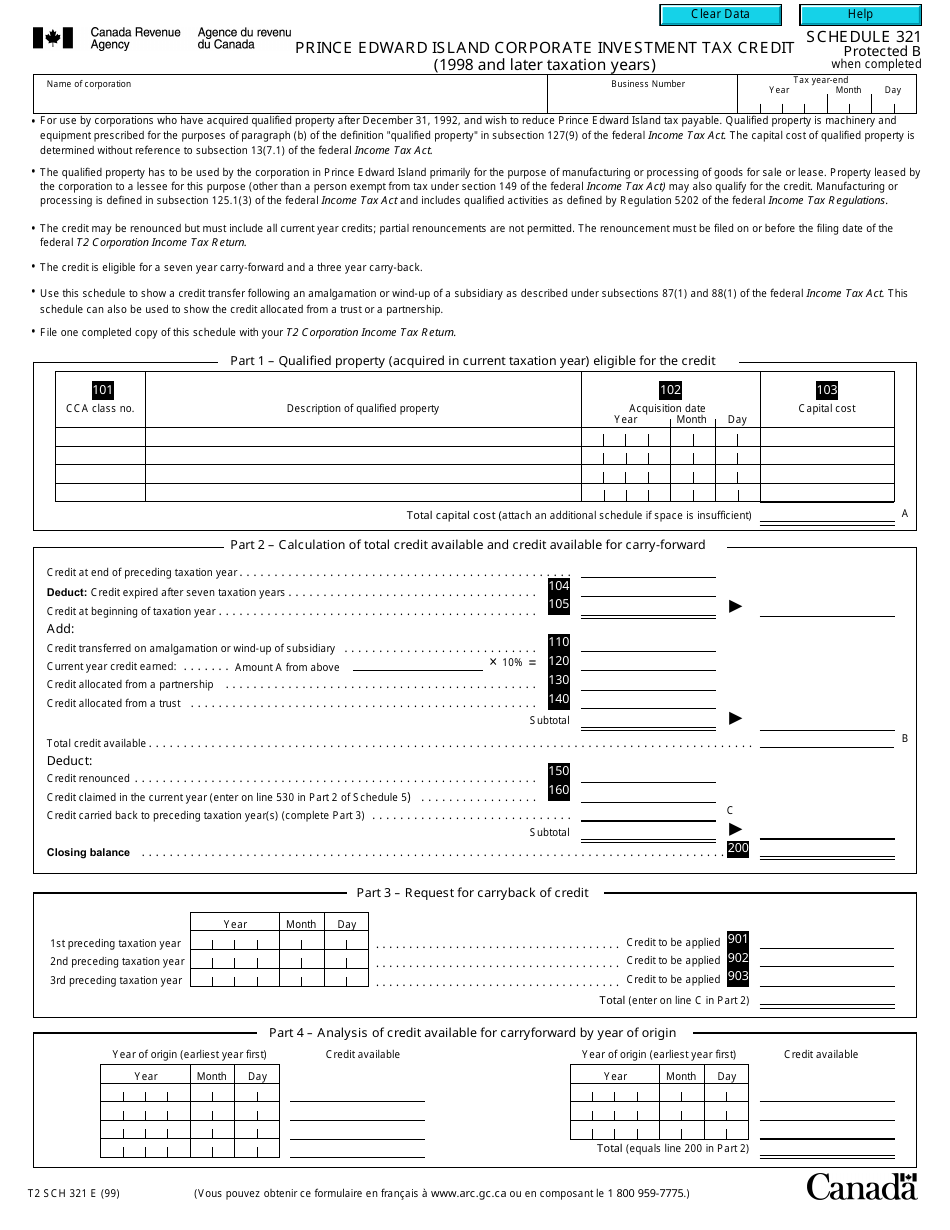

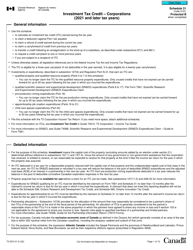

Form T2 Schedule 321 is used in Canada for claiming the Prince Edward Island Corporate Investment Tax Credit. It is applicable for taxation years starting in 1998 and onwards. The credit is aimed at encouraging corporate investment in Prince Edward Island.

FAQ

Q: What is Form T2 Schedule 321?

A: Form T2 Schedule 321 is a tax form used in Canada.

Q: What is the Prince Edward Island Corporate Investment Tax Credit?

A: The Prince Edward Island Corporate Investment Tax Credit is a tax credit available in Prince Edward Island.

Q: Who is eligible for the Prince Edward Island Corporate Investment Tax Credit?

A: Companies in Prince Edward Island are eligible for this tax credit.

Q: What years does the tax credit apply to?

A: The tax credit applies to taxation years from 1998 and later.