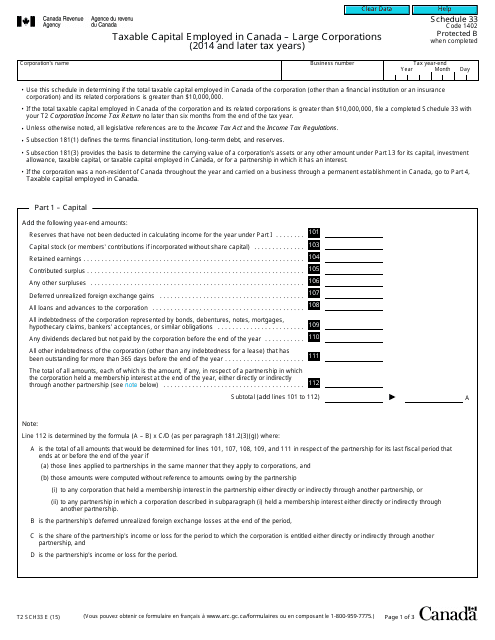

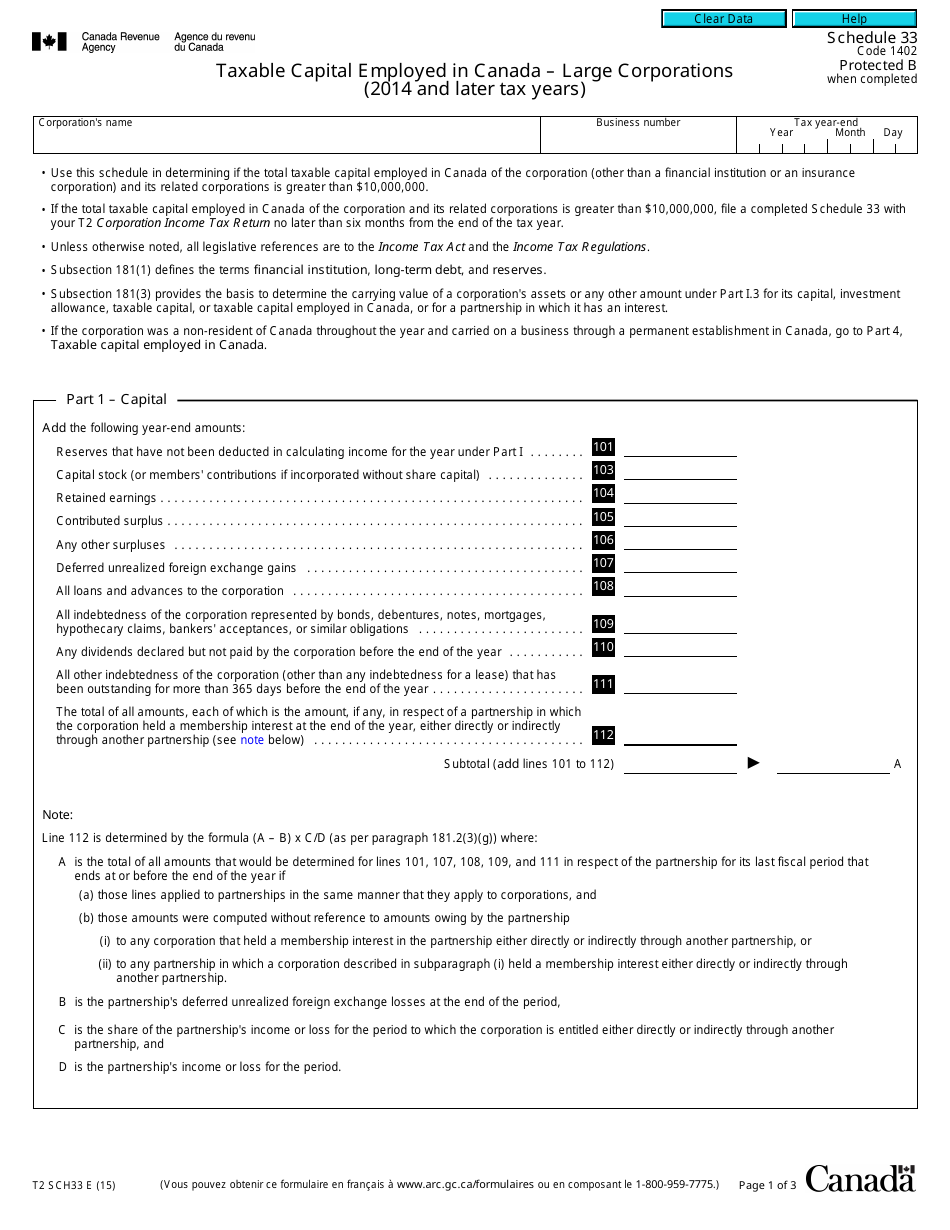

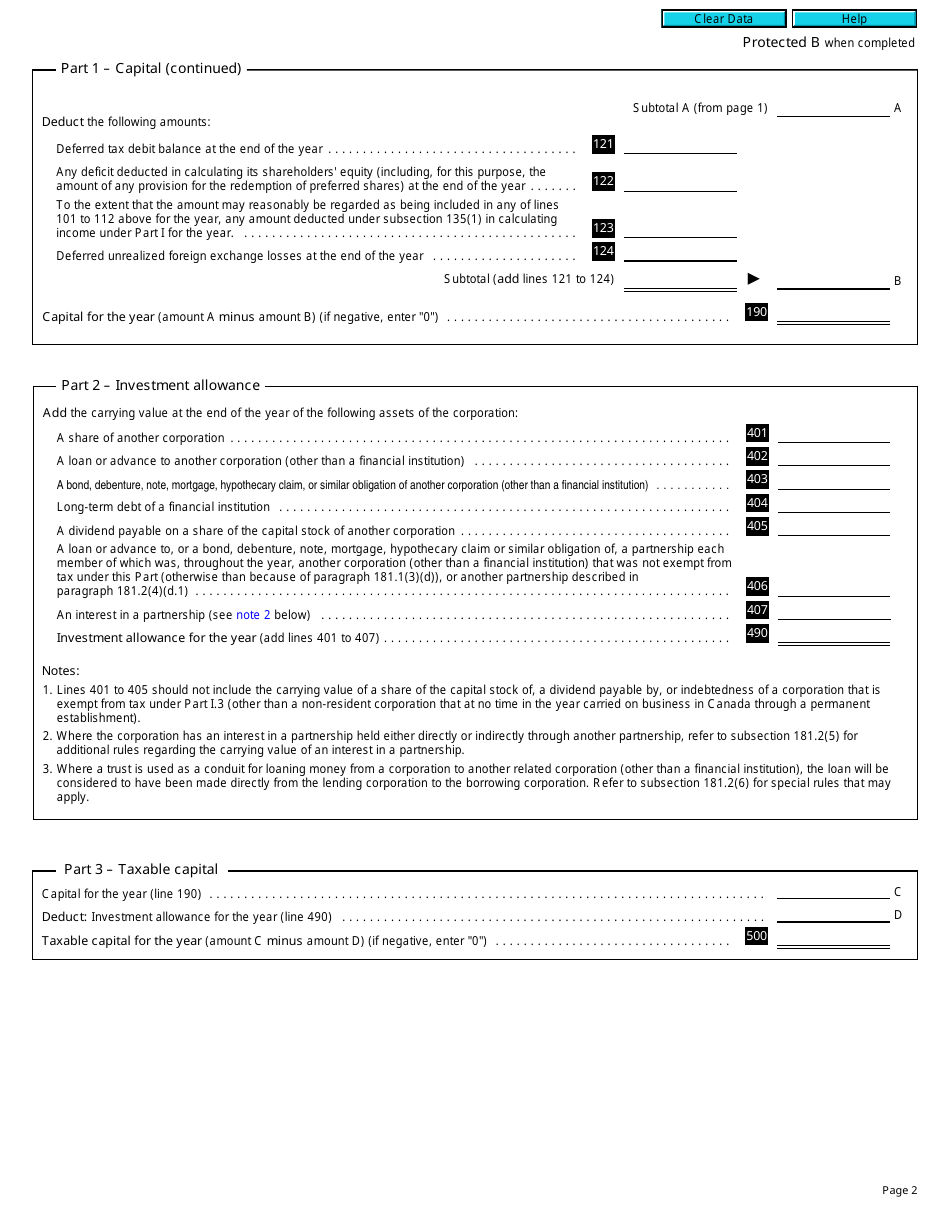

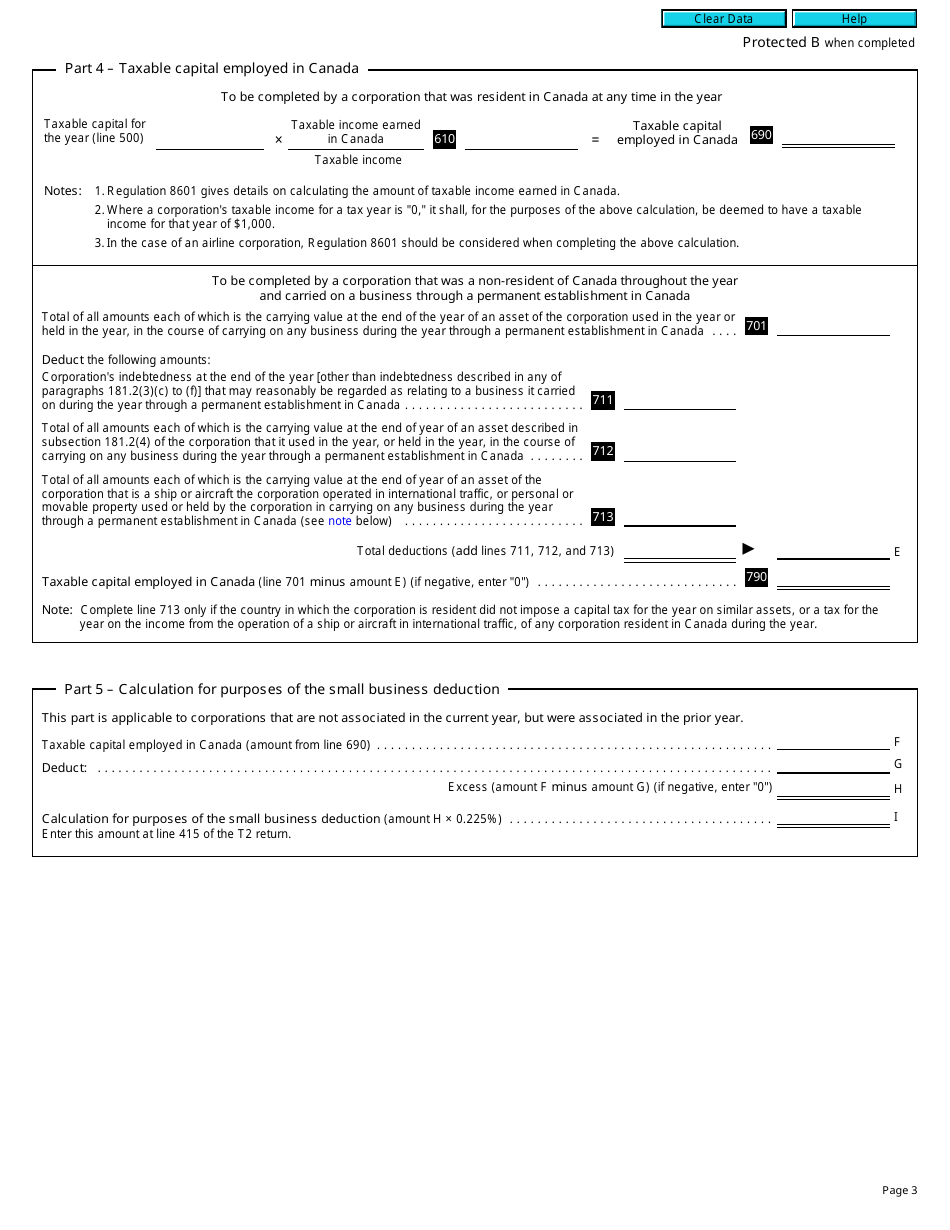

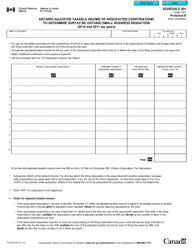

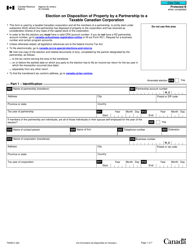

Form T2 Schedule 33 Taxable Capital Employed in Canada - Large Corporations (2014 and Later Tax Years) - Canada

Form T2 Schedule 33 is used by large corporations in Canada to calculate their taxable capital employed for the tax years 2014 and later. It helps determine the amount of tax they owe based on the capital they have invested in their business.

The large corporations in Canada are required to file the Form T2 Schedule 33 - Taxable Capital Employed.

FAQ

Q: What is Form T2 Schedule 33?

A: Form T2 Schedule 33 is a tax form used by large corporations to calculate their taxable capital employed in Canada.

Q: Who needs to file Form T2 Schedule 33?

A: Large corporations in Canada are required to file Form T2 Schedule 33.

Q: What is taxable capital employed in Canada?

A: Taxable capital employed in Canada is the amount of capital that a corporation has invested in its Canadian operations and is subject to taxation.

Q: What tax years does Form T2 Schedule 33 apply to?

A: Form T2 Schedule 33 applies to tax years starting in 2014 and later.