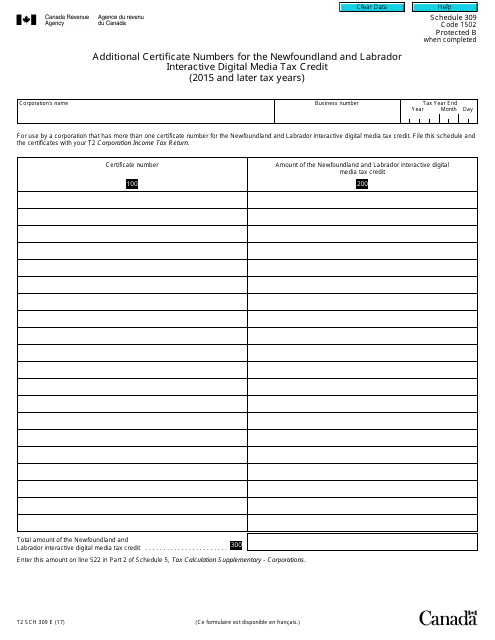

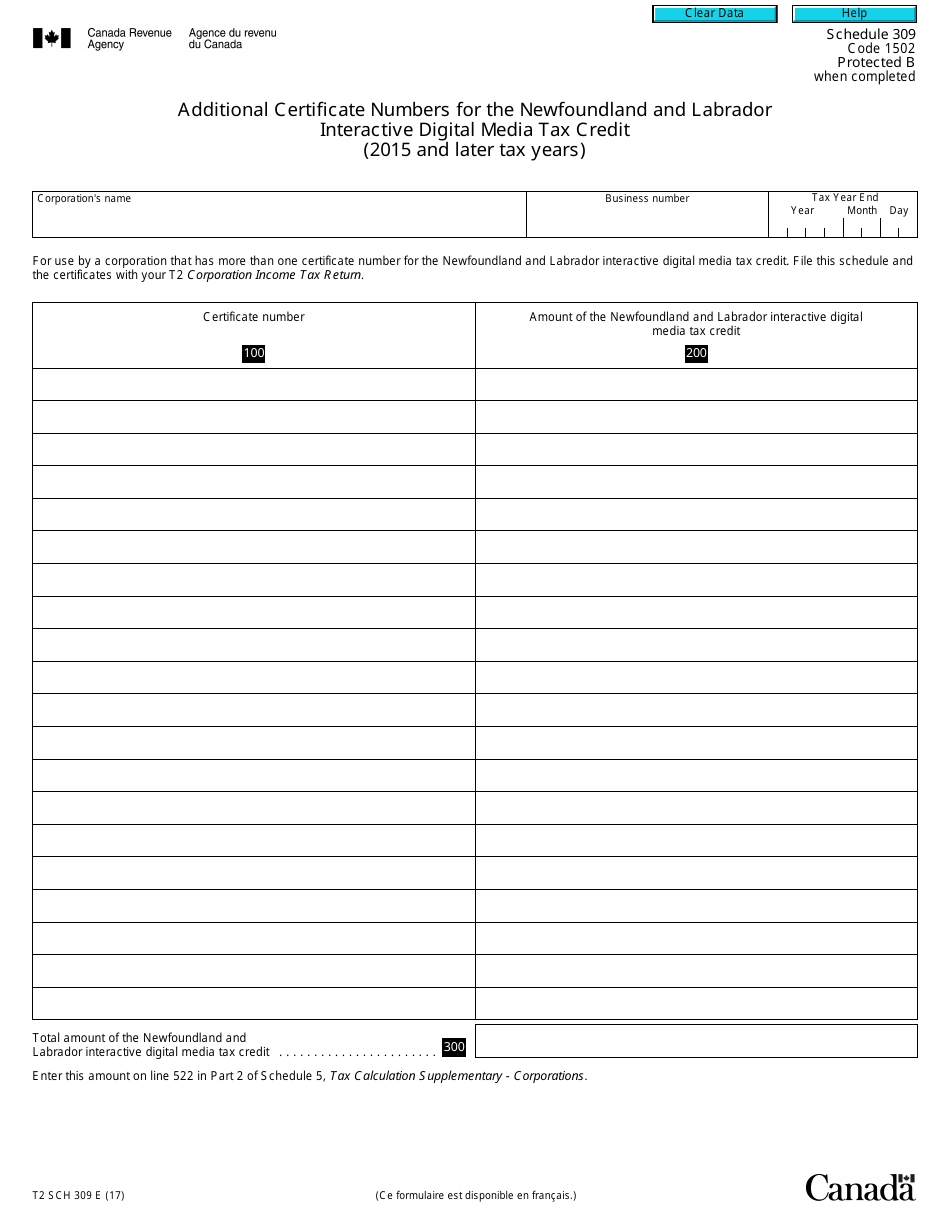

Form T2 Schedule 309 Additional Certificate Numbers for the Newfoundland and Labrador Interactive Digital Media Tax Credit (2015 and Later Tax Years) - Canada

Form T2 Schedule 309 is used in Canada for providing additional certificate numbers for the Newfoundland and Labrador Interactive Digital Media Tax Credit. This tax credit is applicable for the tax years 2015 and later. It allows businesses in the interactive digital media sector to claim tax benefits in Newfoundland and Labrador.

The Form T2 Schedule 309 is filed by companies that are applying for the Newfoundland and Labrador Interactive Digital Media Tax Credit in Canada for the tax years 2015 and later.

FAQ

Q: What is Form T2 Schedule 309?

A: Form T2 Schedule 309 is a tax form used in Canada for reporting additional certificate numbers for the Newfoundland and Labrador Interactive Digital Media Tax Credit.

Q: What is the purpose of the Newfoundland and Labrador Interactive Digital Media Tax Credit?

A: The Newfoundland and Labrador Interactive Digital Media Tax Credit is a tax credit program intended to support the development of interactive digital media products in the province.

Q: Who is eligible for the Newfoundland and Labrador Interactive Digital Media Tax Credit?

A: Eligibility for the tax credit is restricted to corporations that develop eligible interactive digital media products in Newfoundland and Labrador.

Q: What information is required on Form T2 Schedule 309?

A: Form T2 Schedule 309 requires the reporting of additional certificate numbers for the Newfoundland and Labrador Interactive Digital Media Tax Credit.

Q: Which tax years does Form T2 Schedule 309 apply to?

A: Form T2 Schedule 309 applies to tax years starting in 2015 and later.