This version of the form is not currently in use and is provided for reference only. Download this version of

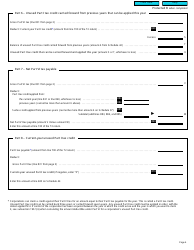

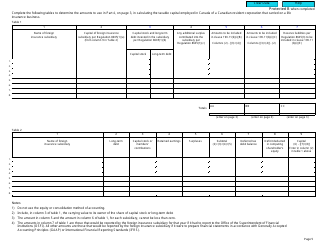

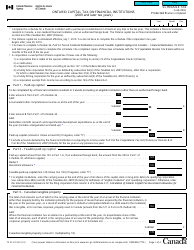

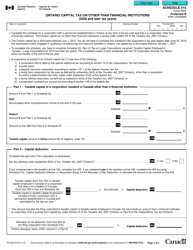

Form T2 Schedule 38

for the current year.

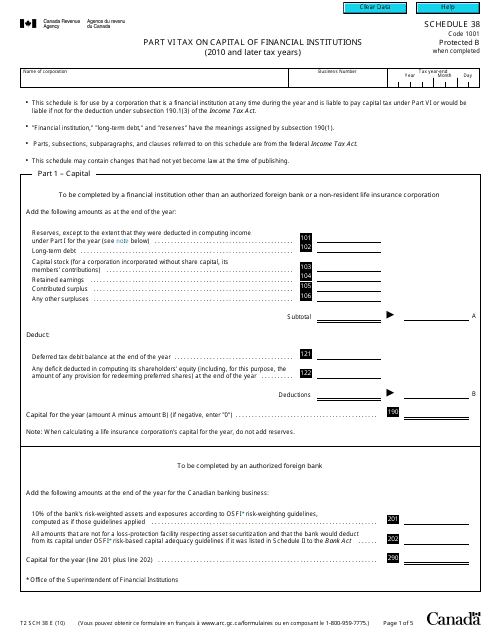

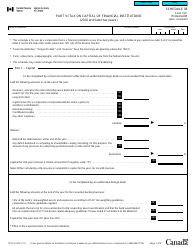

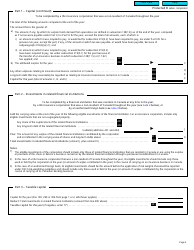

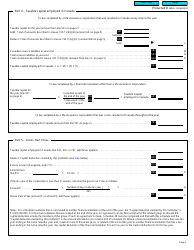

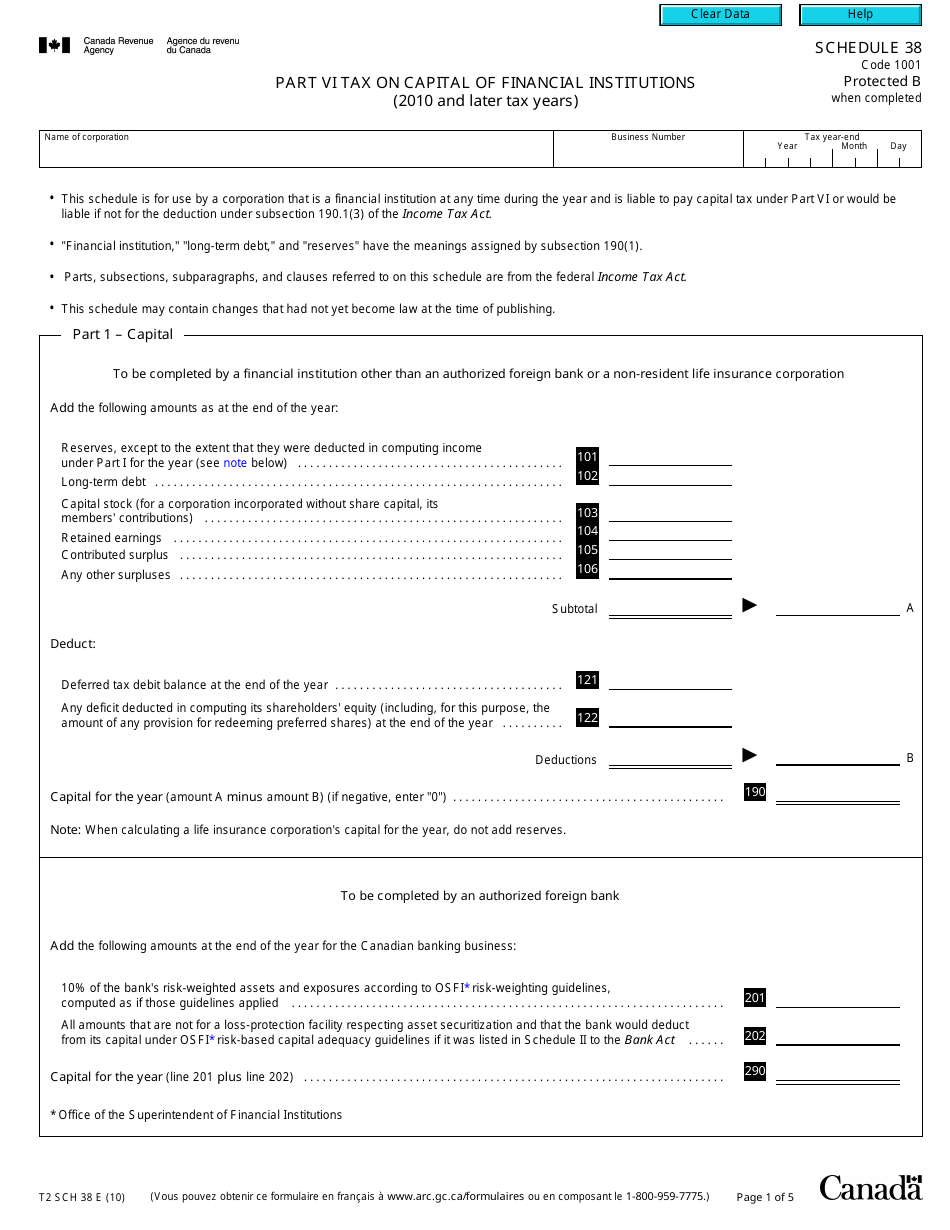

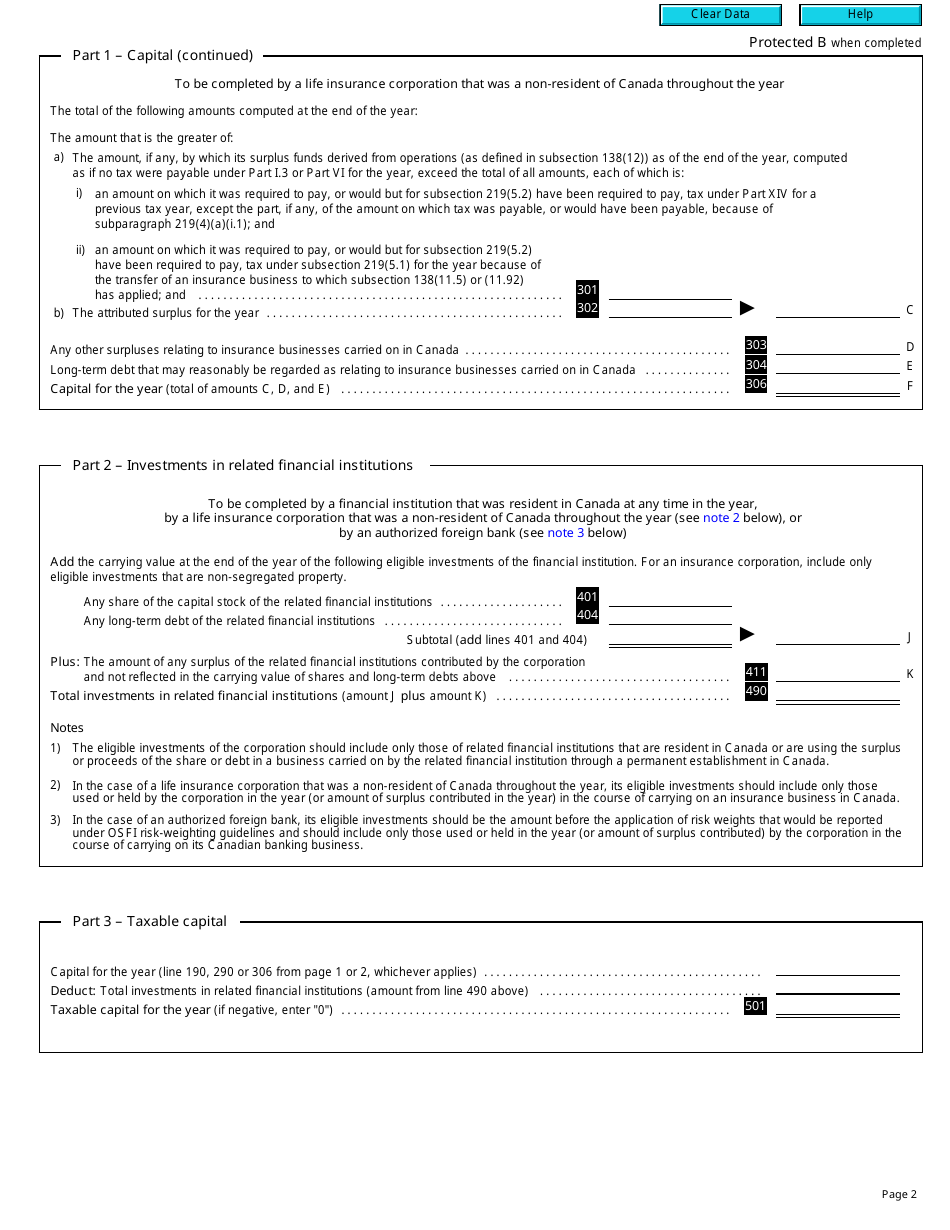

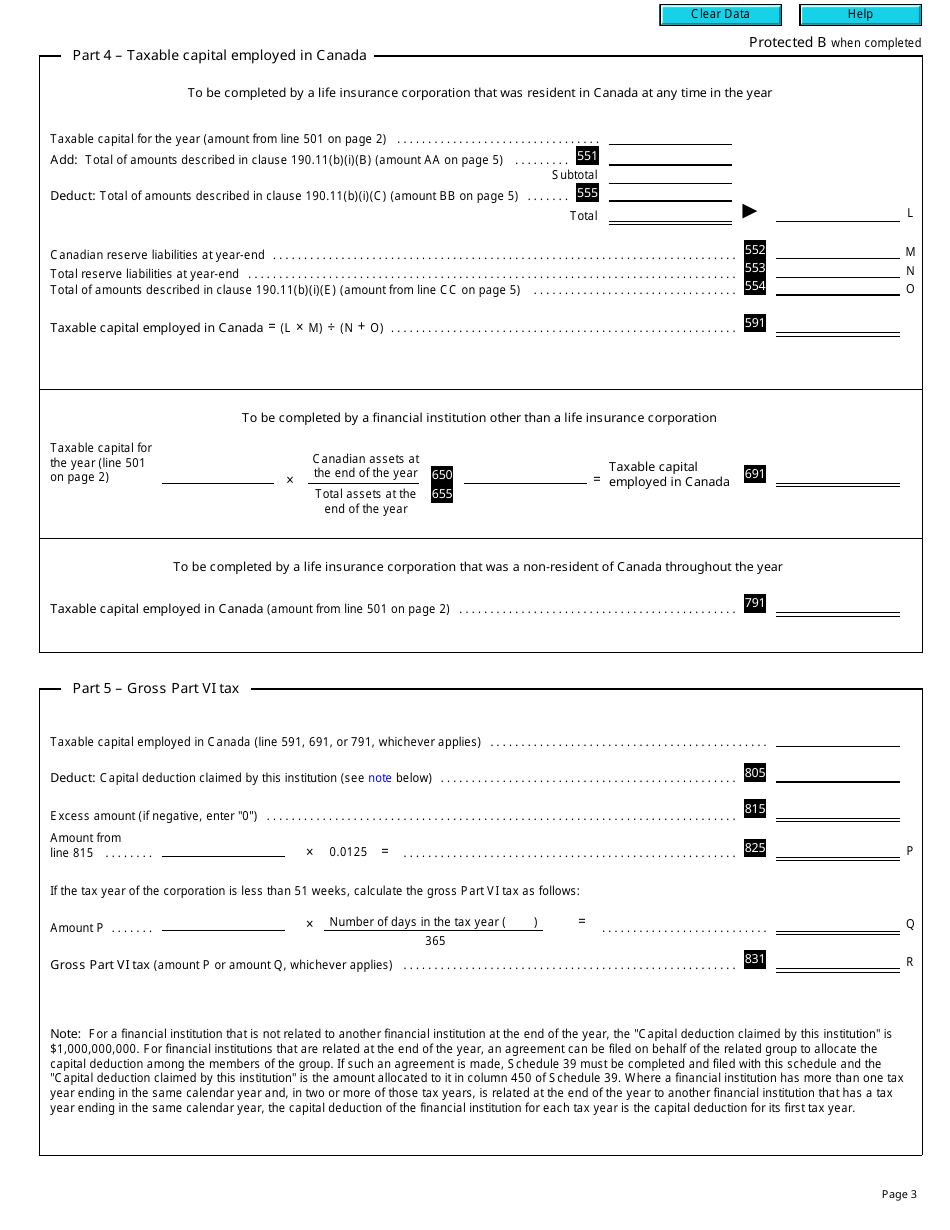

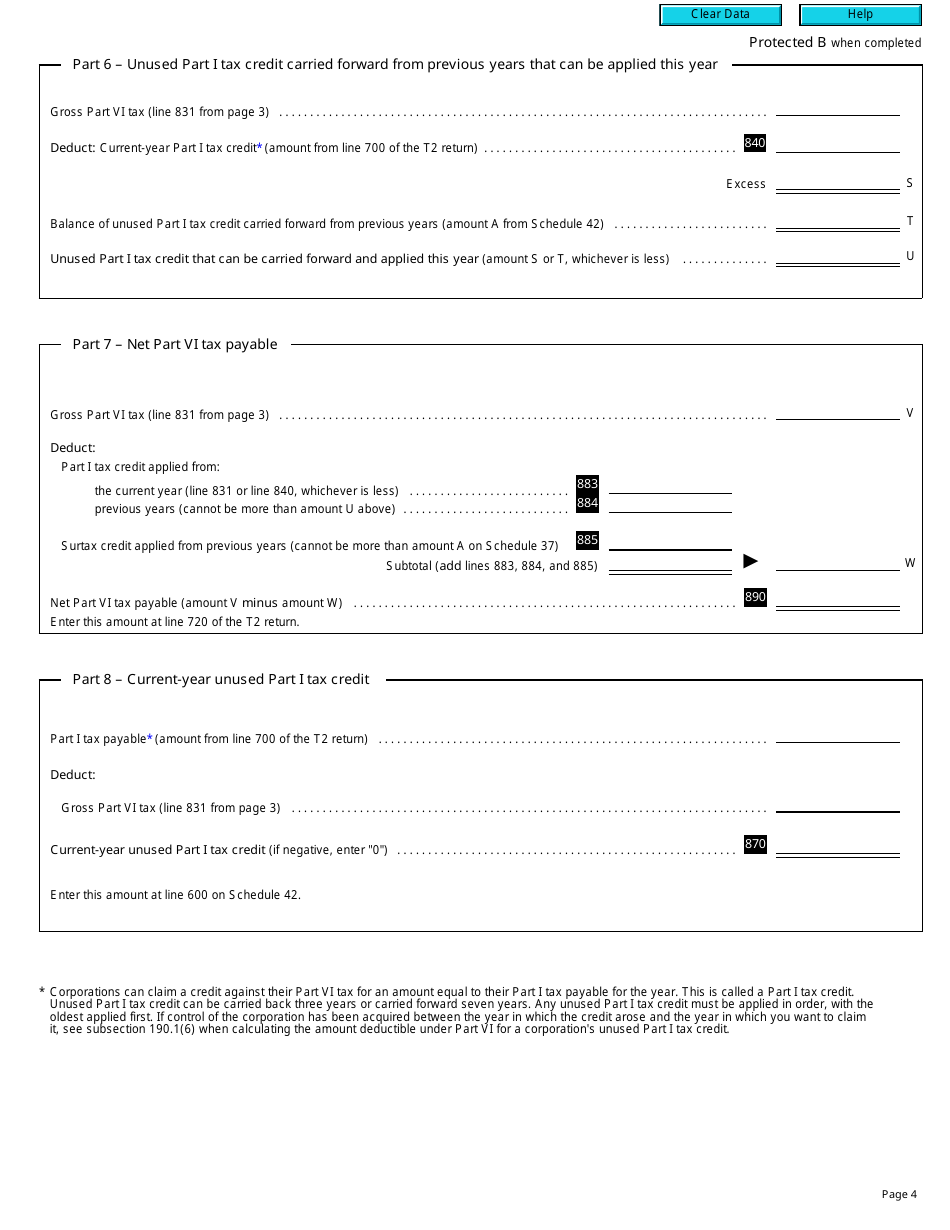

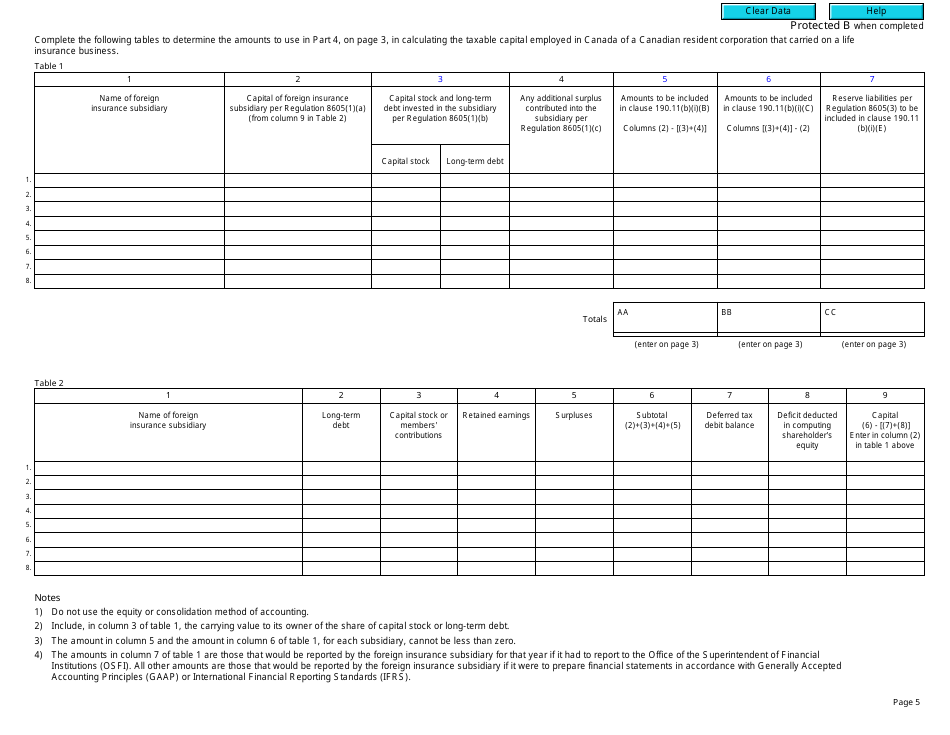

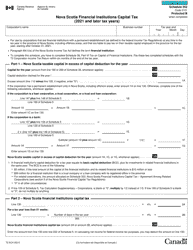

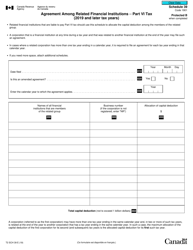

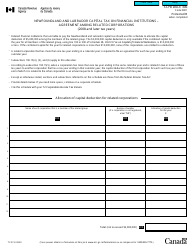

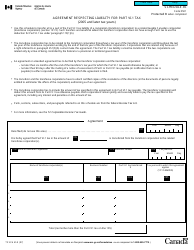

Form T2 Schedule 38 Part VI Tax on Capital of Financial Institutions (2010 and Later Tax Years) - Canada

Form T2 Schedule 38 Part VI Tax on Capital of Financial Institutions (2010 and Later Tax Years) in Canada is used to calculate the tax on capital for financial institutions. The form helps calculate the tax obligation for these institutions based on their capital.

FAQ

Q: What is Form T2 Schedule 38?

A: Form T2 Schedule 38 is a document used by Canadian financial institutions to calculate the tax on their capital.

Q: What is Part VI of Schedule 38?

A: Part VI of Schedule 38 is a section that specifically relates to the tax on the capital of financial institutions.

Q: What tax years does Part VI apply to?

A: Part VI applies to tax years starting from 2010 and later.

Q: Who needs to file Form T2 Schedule 38?

A: Canadian financial institutions are required to file Form T2 Schedule 38 if they are subject to the tax on their capital.

Q: What is the purpose of the tax on capital?

A: The tax on capital is designed to ensure that financial institutions contribute their fair share of taxes based on their capital holdings.