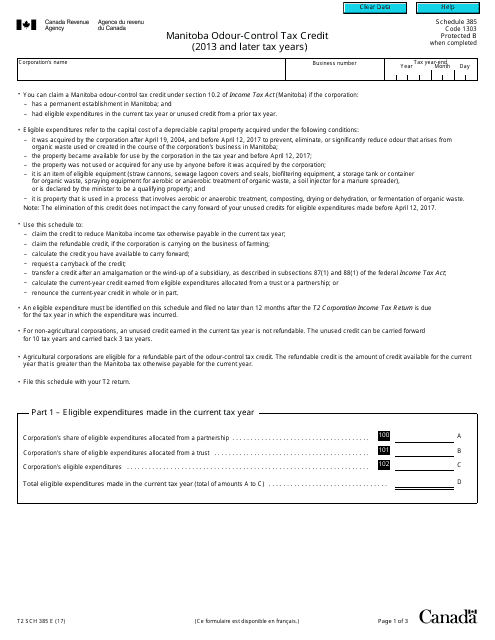

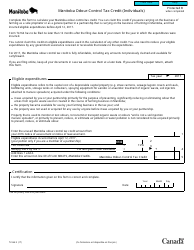

Form T2 Schedule 385 Manitoba Odour-Control Tax Credit (2013 and Later Tax Years) - Canada

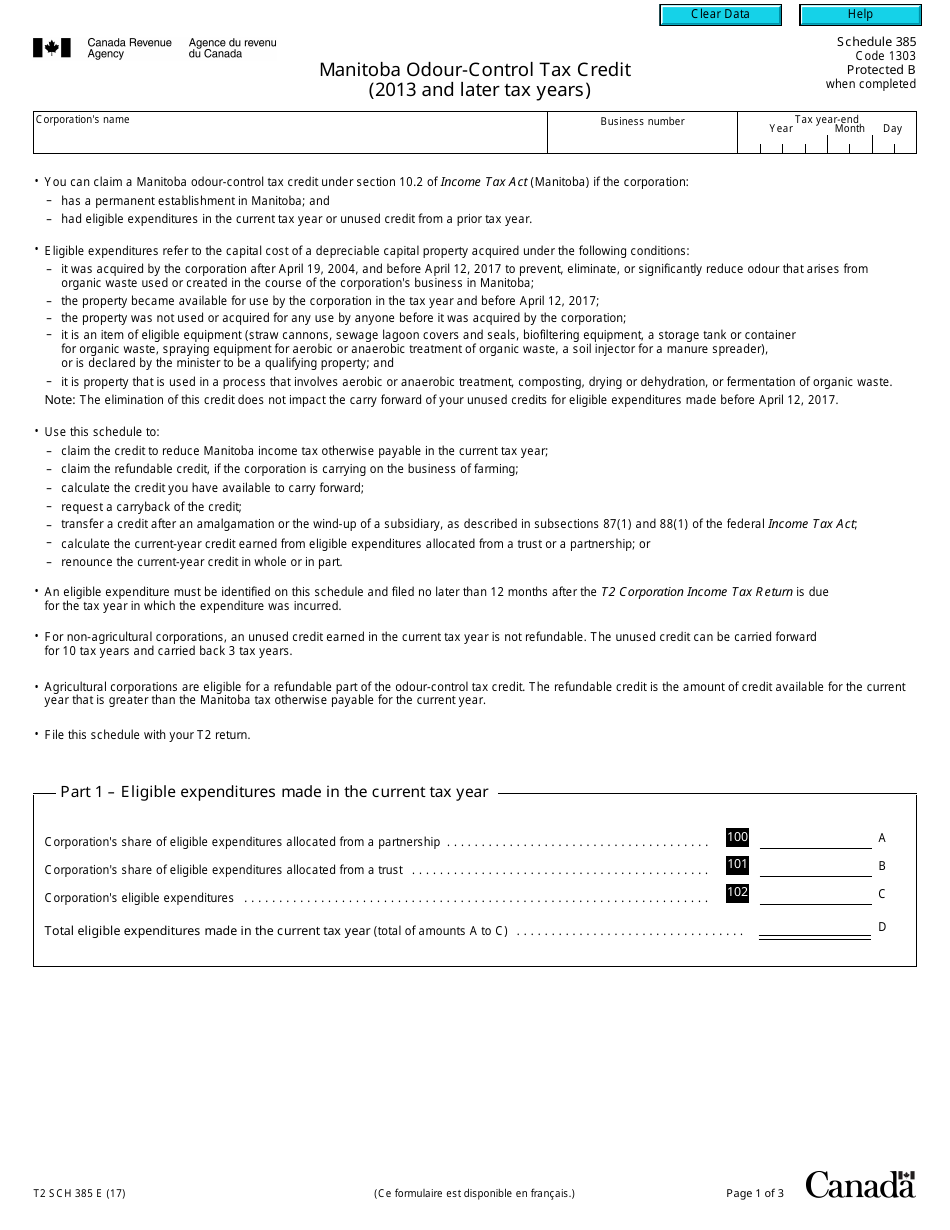

Form T2 Schedule 385 is used in Canada to claim the Manitoba Odour-Control Tax Credit for tax years 2013 and later. This credit is available to businesses in Manitoba that incur expenses related to odour-control equipment or systems.

The Form T2 Schedule 385 is filed by corporations in Canada that are eligible for the Manitoba Odour-Control Tax Credit.

FAQ

Q: What is the T2 Schedule 385?

A: The T2 Schedule 385 is a tax form used in Canada.

Q: What is the Manitoba Odour-Control Tax Credit?

A: The Manitoba Odour-Control Tax Credit is a tax credit available in Manitoba, Canada.

Q: Who is eligible for the Manitoba Odour-Control Tax Credit?

A: Companies that own or lease a facility that produces certain odours and have incurred eligible expenditures for odour-control equipment may be eligible for the credit.

Q: What tax years does the Manitoba Odour-Control Tax Credit apply to?

A: The tax credit applies to the 2013 tax year and later.

Q: What is the purpose of the Manitoba Odour-Control Tax Credit?

A: The purpose of the tax credit is to provide incentives for companies to reduce odours emitted from their facilities.