This version of the form is not currently in use and is provided for reference only. Download this version of

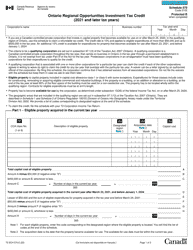

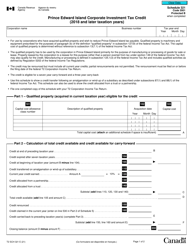

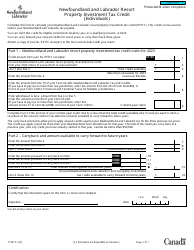

Form T2 Schedule 392

for the current year.

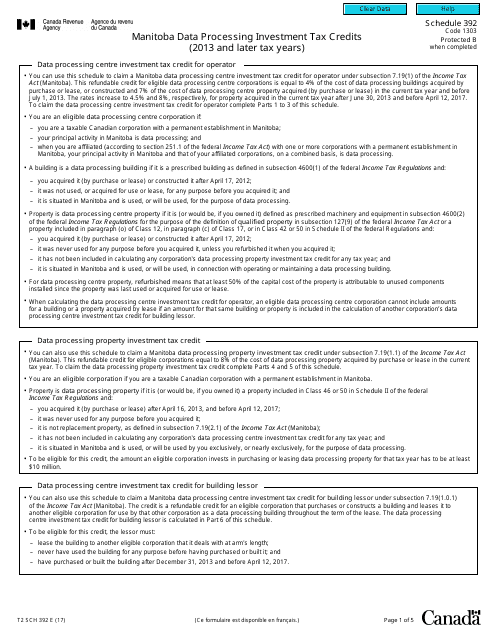

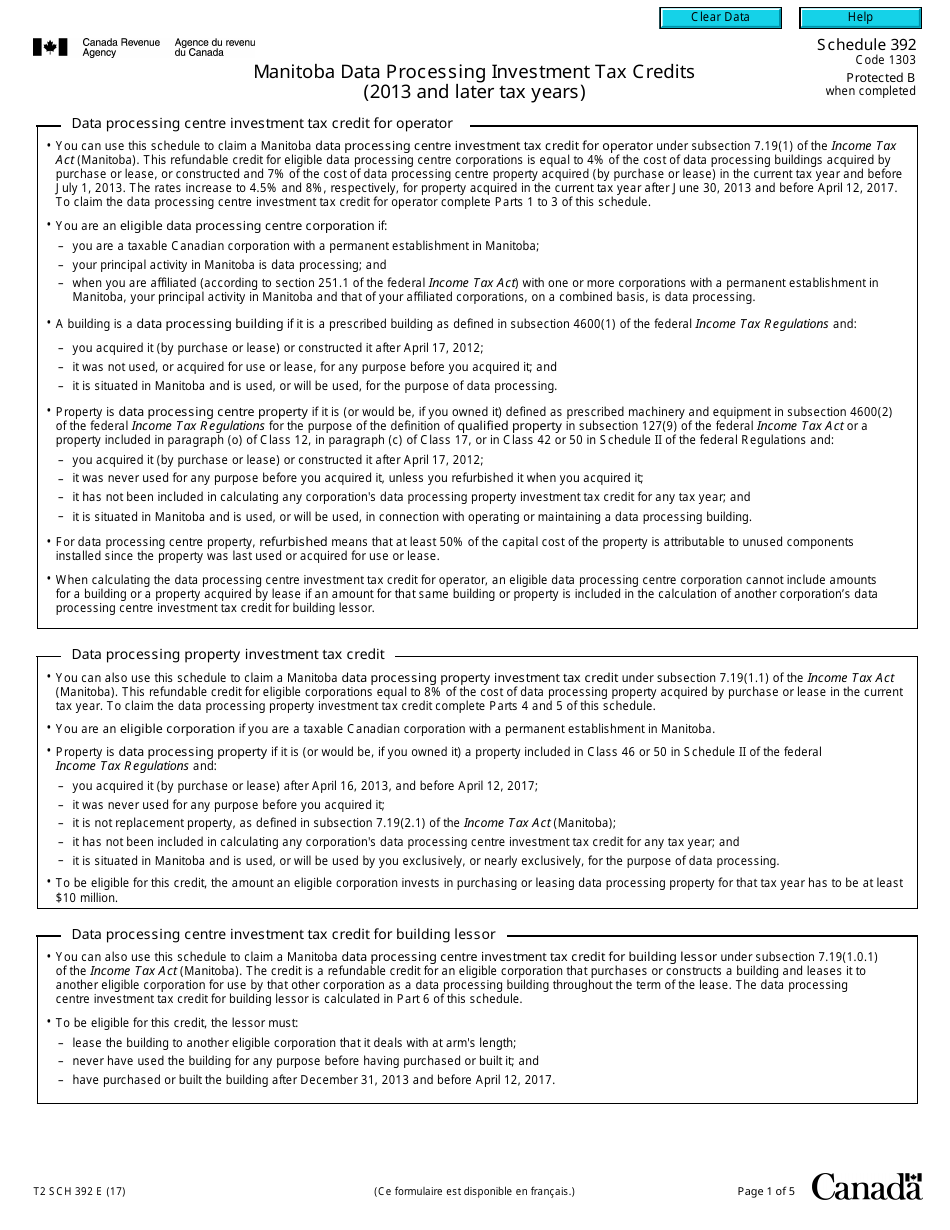

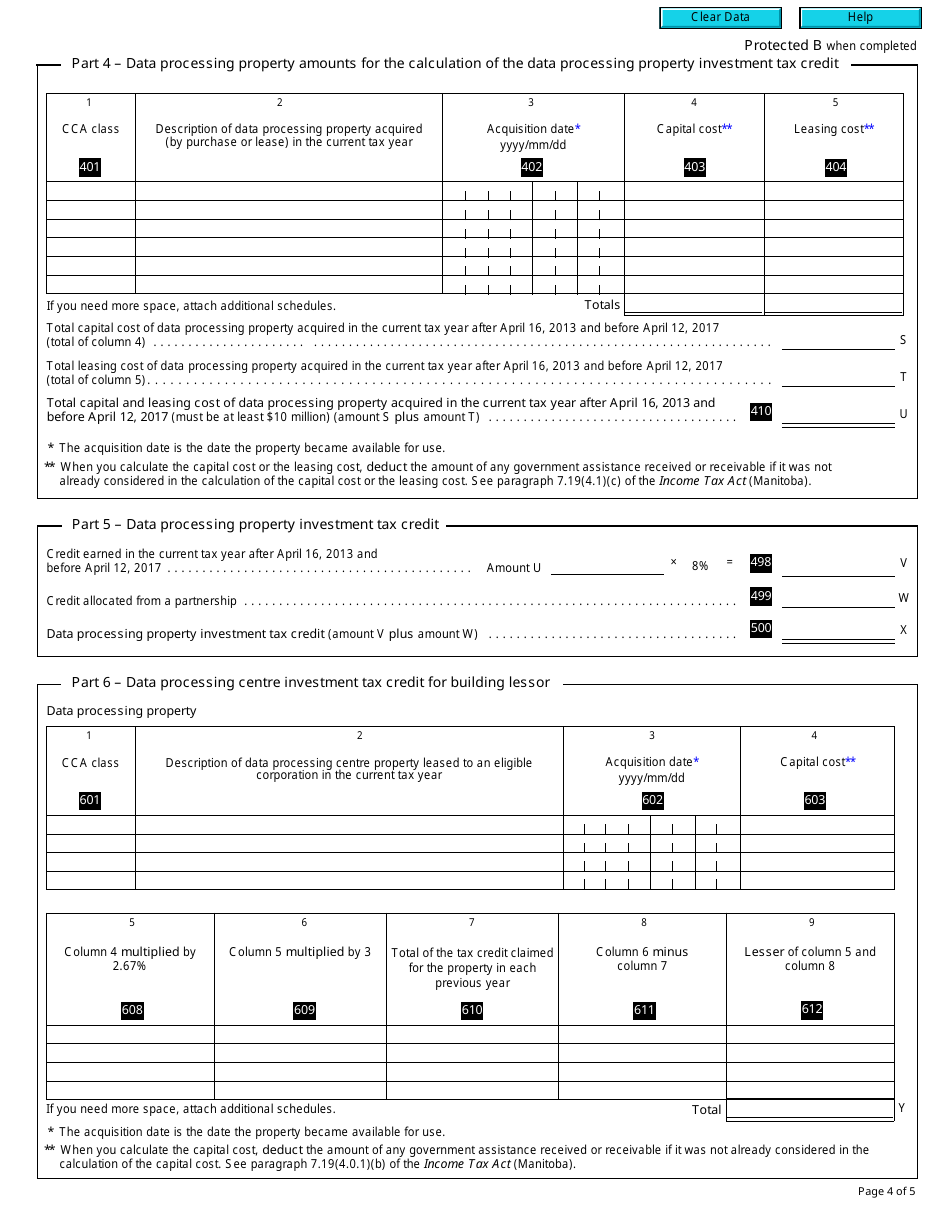

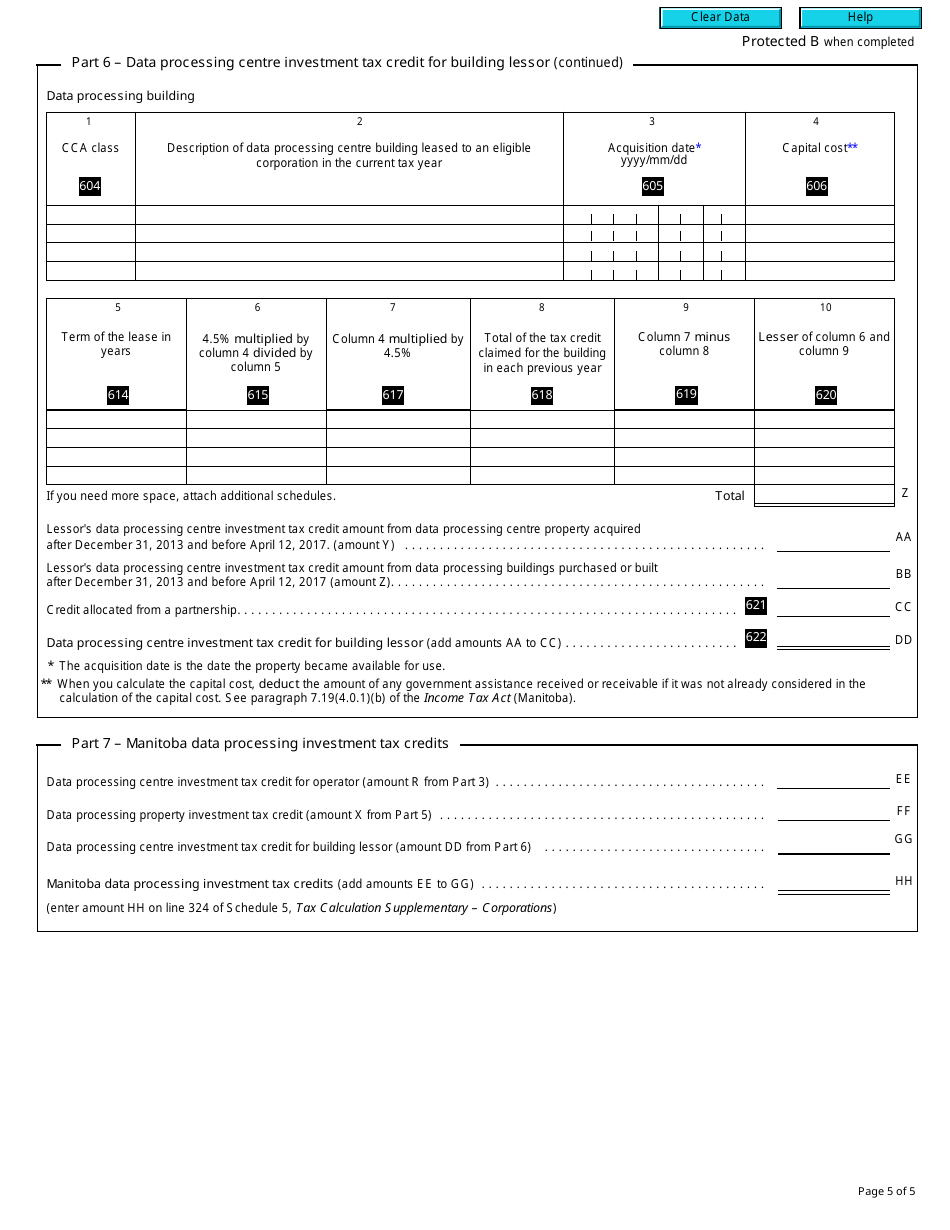

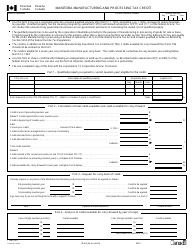

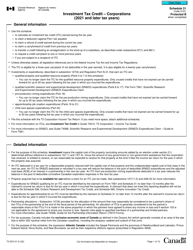

Form T2 Schedule 392 Manitoba Data Processing Investment Tax Credits (2013 and Later Tax Years) - Canada

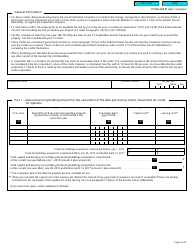

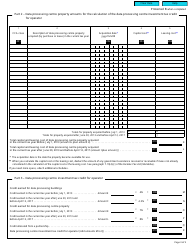

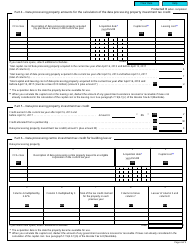

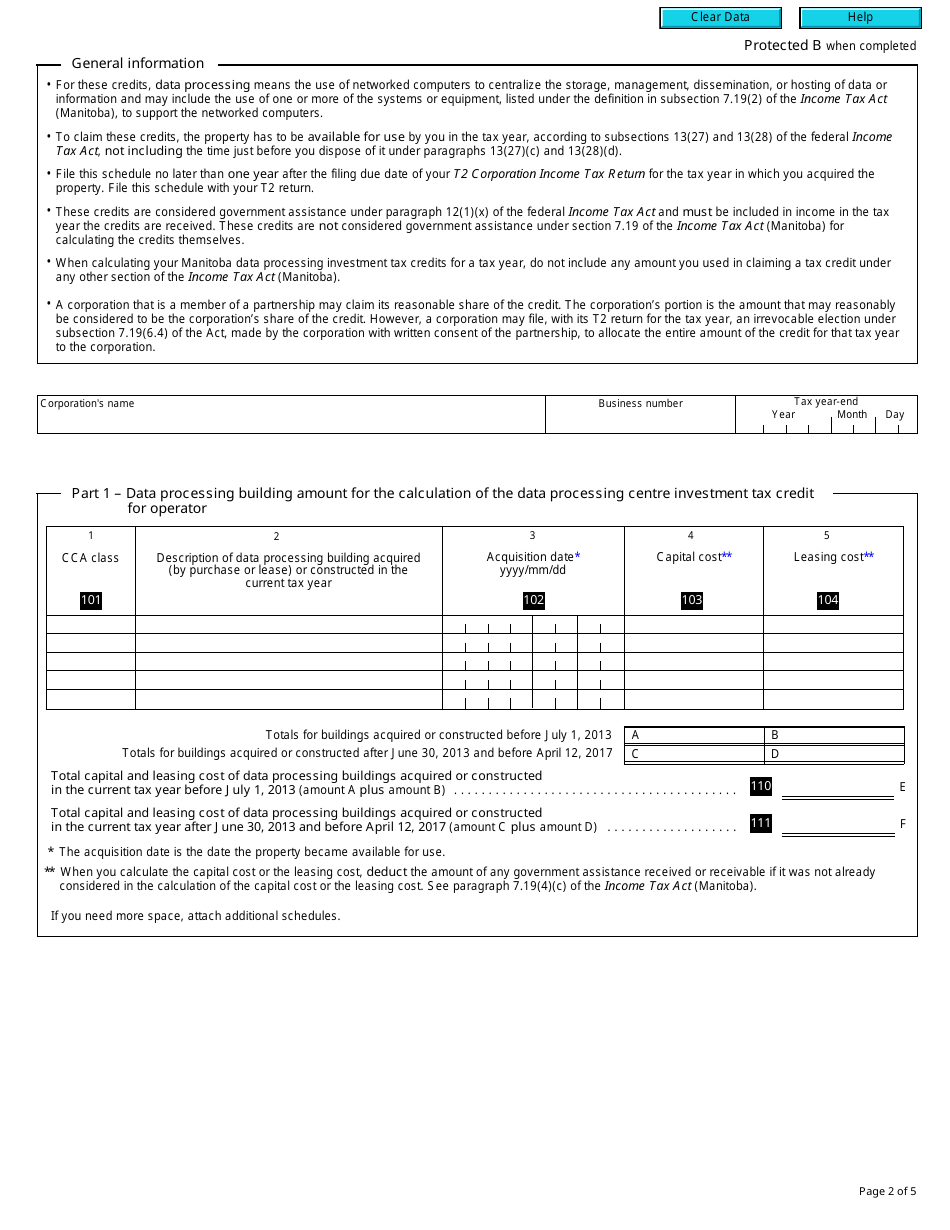

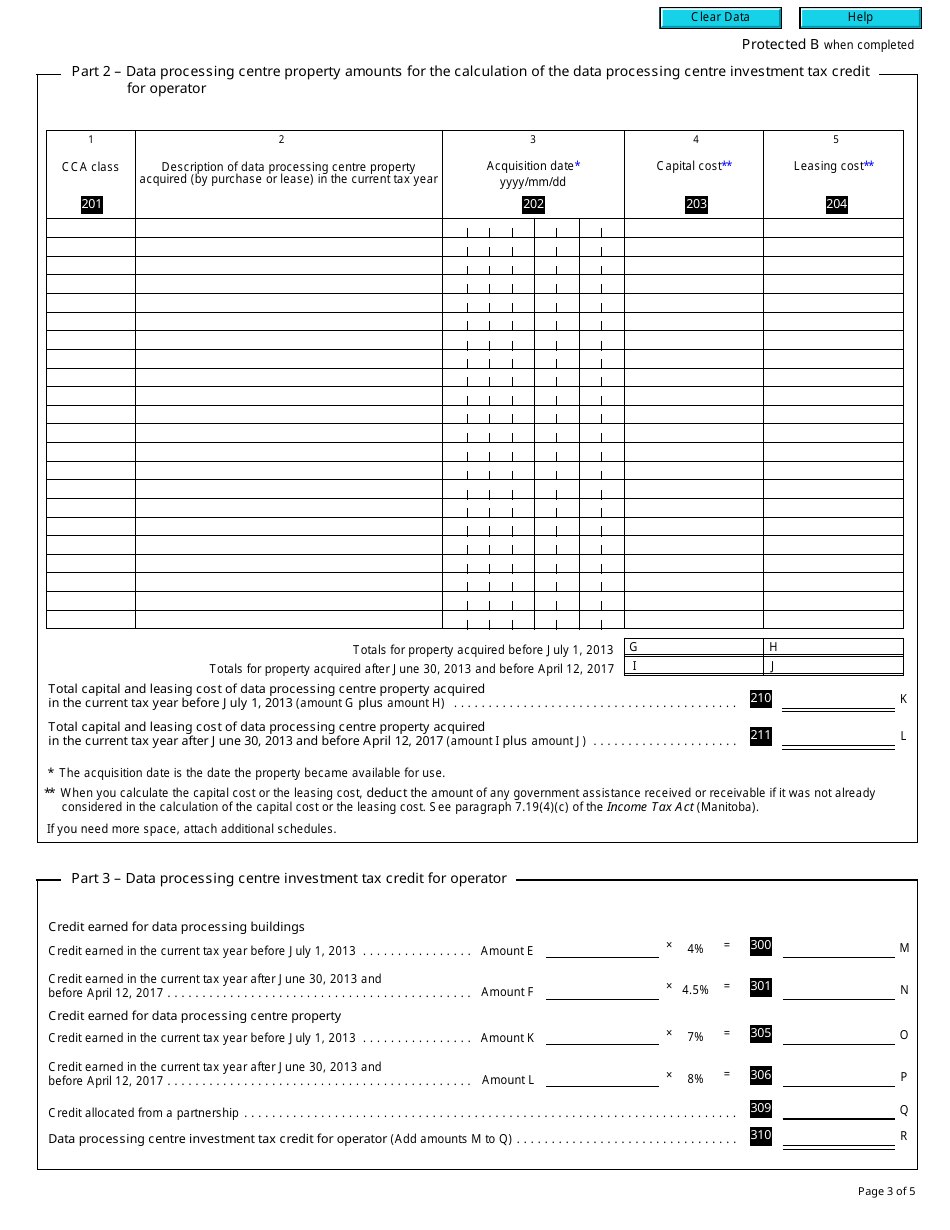

Form T2 Schedule 392 is used in Canada for claiming the Manitoba Data ProcessingInvestment Tax Credits for the tax years 2013 and later. It is used by businesses to calculate and report their eligible expenses for the tax credit program in Manitoba.

The Form T2 Schedule 392 Manitoba Data ProcessingInvestment Tax Credits (2013 and Later Tax Years) in Canada is filed by corporations that are eligible for the Manitoba Data Processing Investment Tax Credit.

FAQ

Q: What is Form T2 Schedule 392?

A: Form T2 Schedule 392 is a tax form used in Canada for claiming Manitoba Data Processing Investment Tax Credits.

Q: What are Manitoba Data Processing Investment Tax Credits?

A: Manitoba Data Processing Investment Tax Credits are tax credits provided by the Canadian government to encourage investment in data processing in Manitoba.

Q: Who can use Form T2 Schedule 392?

A: Businesses that have made eligible investments in data processing in Manitoba can use Form T2 Schedule 392 to claim the tax credits.

Q: What are the eligibility requirements for claiming Manitoba Data Processing Investment Tax Credits?

A: The eligibility requirements for claiming the tax credits include making eligible investments in qualifying property in Manitoba.

Q: What is the purpose of Form T2 Schedule 392?

A: The purpose of Form T2 Schedule 392 is to calculate and claim the Manitoba Data Processing Investment Tax Credits.

Q: What is the deadline for submitting Form T2 Schedule 392?

A: The deadline for submitting Form T2 Schedule 392 depends on the tax year. It is usually due with the corporate tax return.

Q: Can individuals use Form T2 Schedule 392?

A: No, Form T2 Schedule 392 is specifically for businesses and cannot be used by individuals.

Q: Are Manitoba Data Processing Investment Tax Credits refundable?

A: Yes, Manitoba Data Processing Investment Tax Credits are refundable tax credits.

Q: Are there any other forms or schedules related to Manitoba Data Processing Investment Tax Credits?

A: Yes, there may be other forms and schedules related to Manitoba Data Processing Investment Tax Credits, depending on the specific circumstances of the taxpayer. It is recommended to consult the CRA or a tax professional for more information.