This version of the form is not currently in use and is provided for reference only. Download this version of

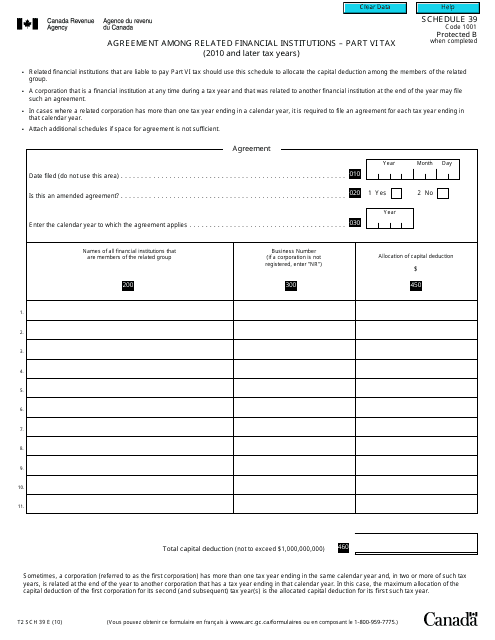

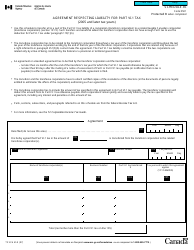

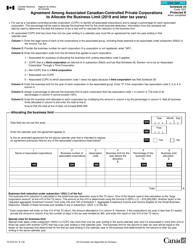

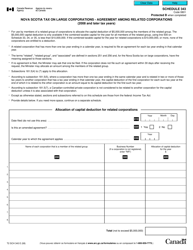

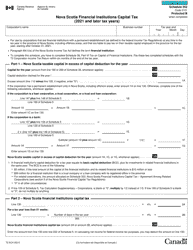

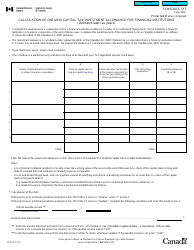

Form T2 Schedule 39

for the current year.

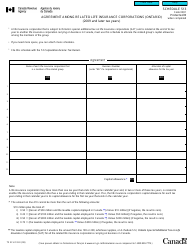

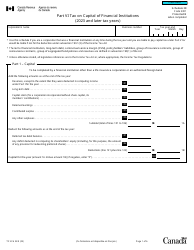

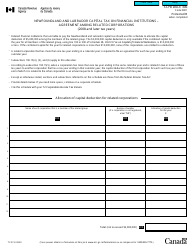

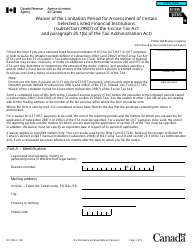

Form T2 Schedule 39 Agreement Among Related Financial Institutions - Part VI Tax (2010 and Later Tax Years) - Canada

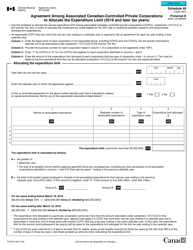

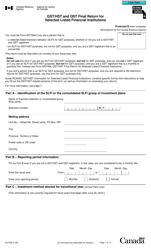

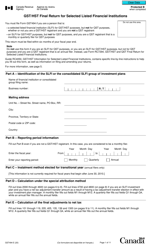

Form T2 Schedule 39 is used in Canada for related financial institutions to report and calculate Part VI Tax for tax years 2010 and later. It is used to determine the amount of tax payable by these institutions.

FAQ

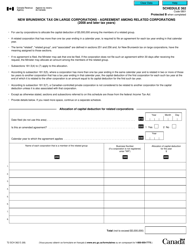

Q: What is Form T2 Schedule 39?

A: Form T2 Schedule 39 is an agreement among related financial institutions for Part VI tax purposes in Canada.

Q: Who needs to file Form T2 Schedule 39?

A: This form needs to be filed by related financial institutions in Canada.

Q: What is Part VI tax?

A: Part VI tax refers to the financial institution tax imposed under the Income Tax Act in Canada.

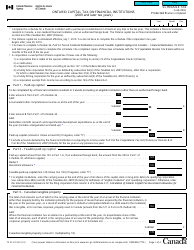

Q: What are the tax years for which Form T2 Schedule 39 is applicable?

A: Form T2 Schedule 39 is applicable for tax years starting in 2010 and later.

Q: What information is required to be reported on Form T2 Schedule 39?

A: Form T2 Schedule 39 requires reporting of specific information related to the agreement among related financial institutions.

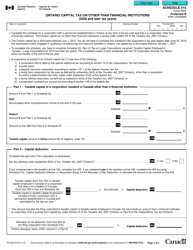

Q: Are there any penalties for not filing Form T2 Schedule 39?

A: Yes, there can be penalties for not filing or filing late, as per the guidelines of the CRA. It is important to file on time to avoid penalties.