This version of the form is not currently in use and is provided for reference only. Download this version of

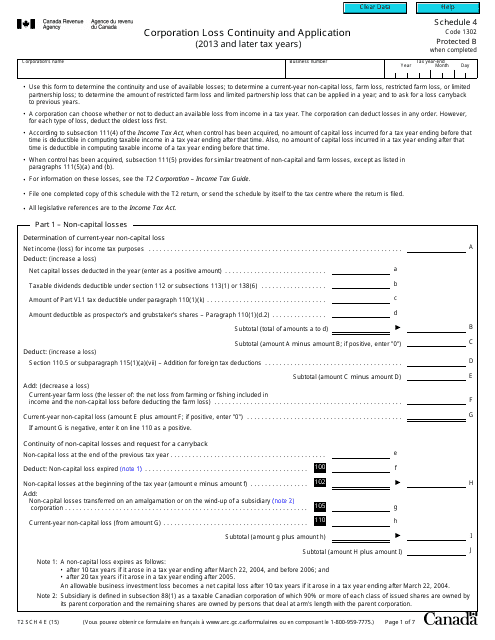

Form T2 Schedule 4

for the current year.

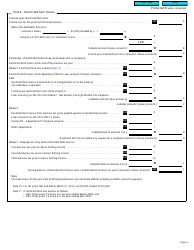

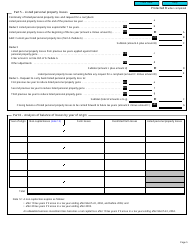

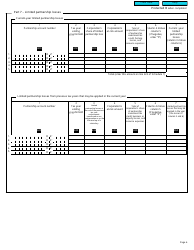

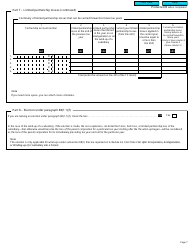

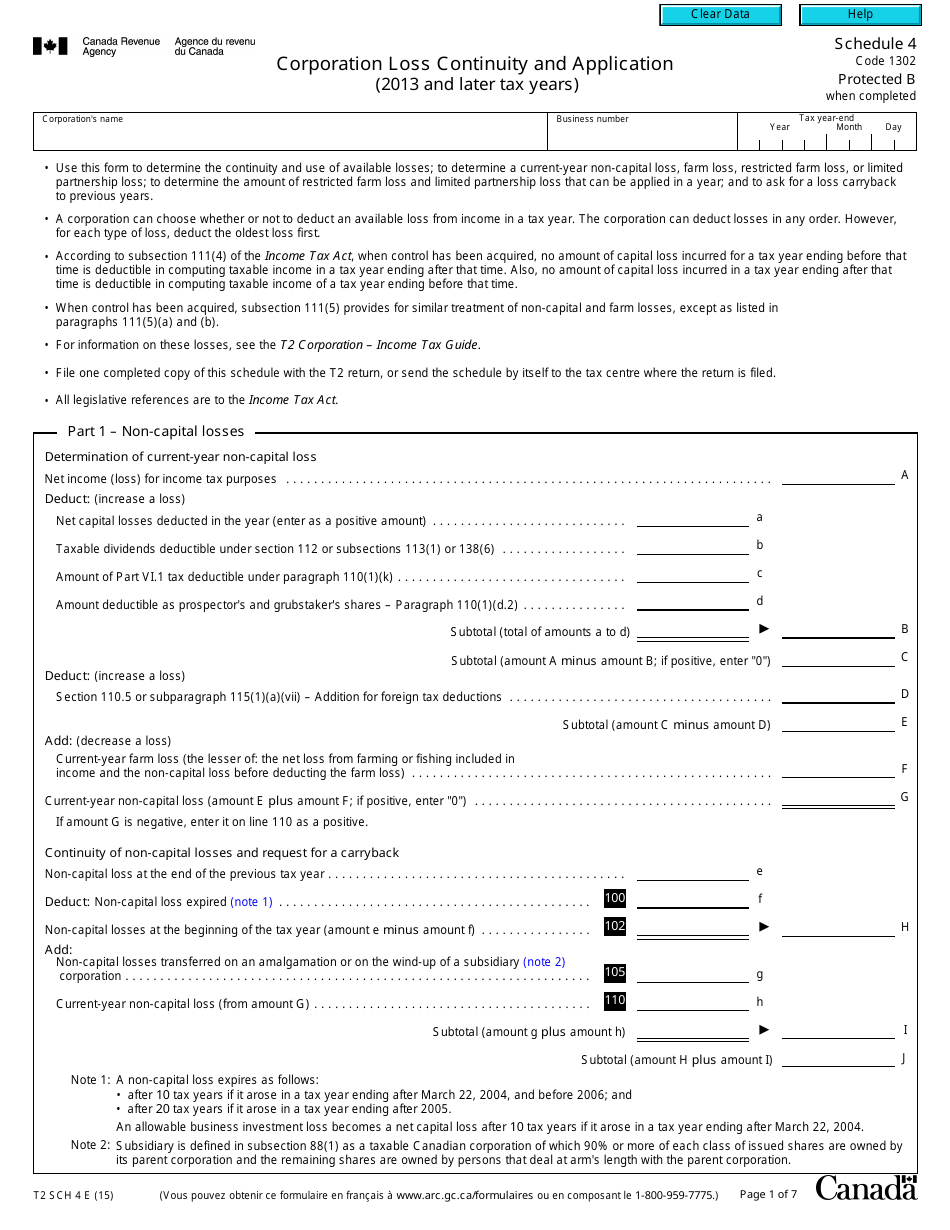

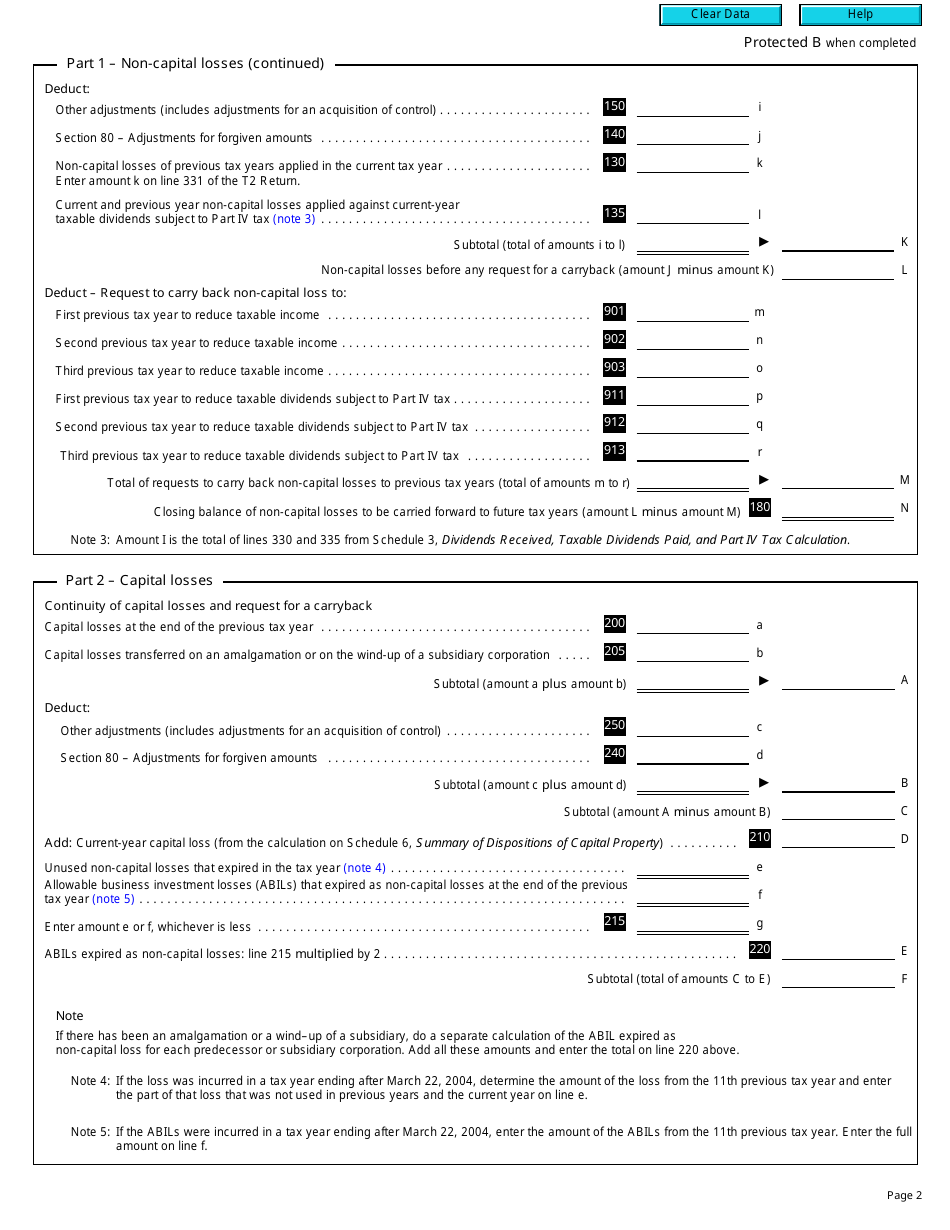

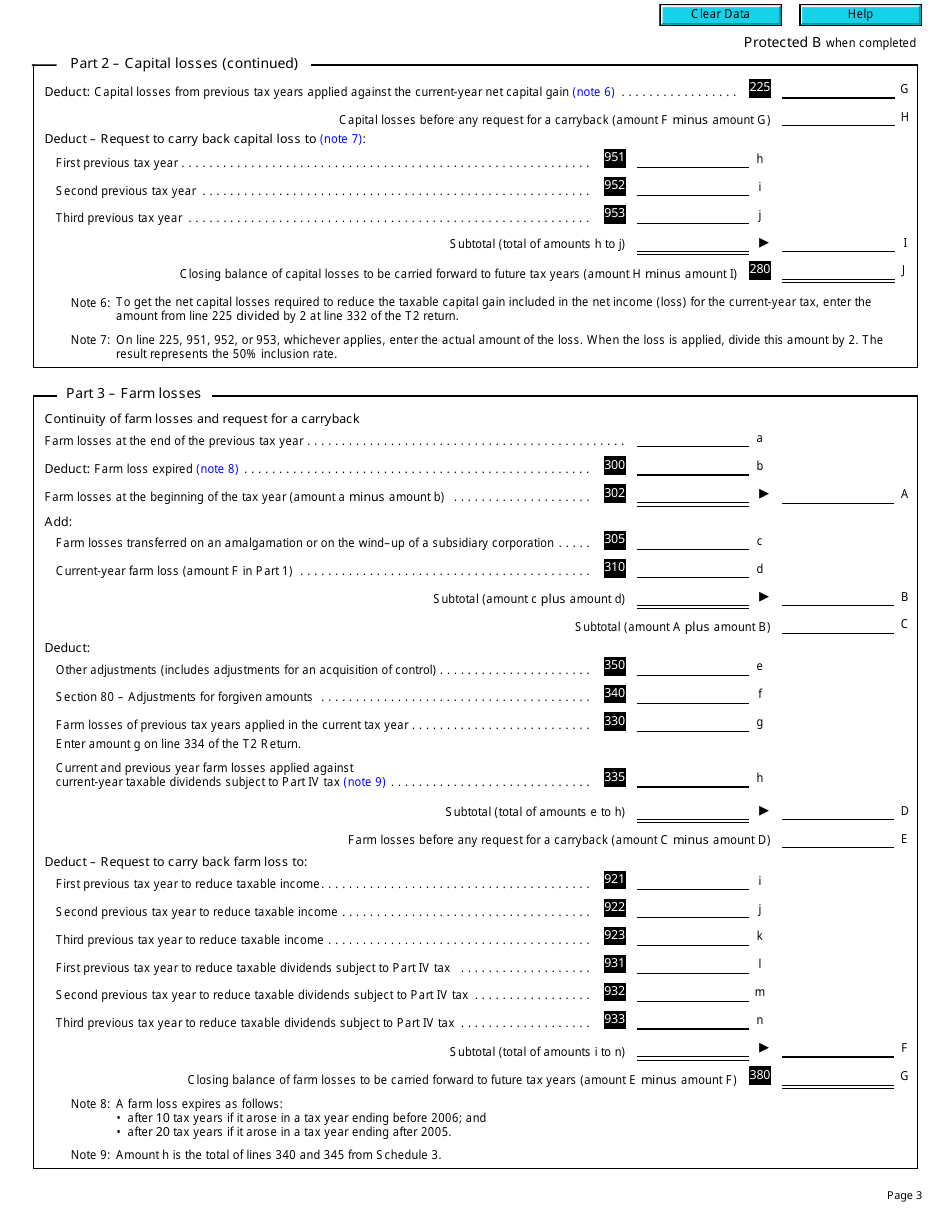

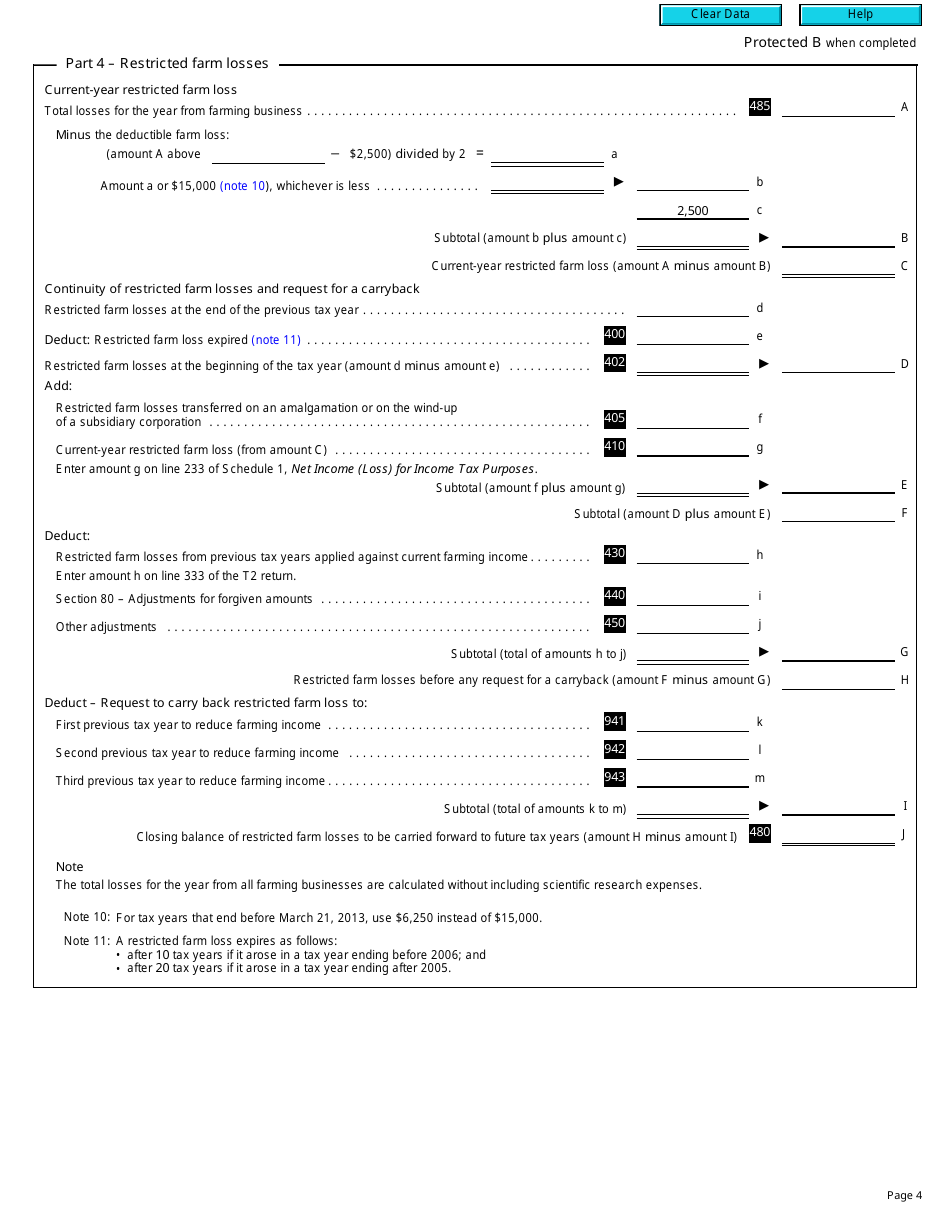

Form T2 Schedule 4 Corporation Loss Continuity and Application (2013 and Later Tax Years) - Canada

Form T2 Schedule 4 Corporation Loss Continuity and Application is a tax form used in Canada for corporations. It is used to calculate and report any losses incurred by the corporation in a tax year and how these losses can be carried forward or applied against future taxable income. The form helps corporations determine the amounts that can be used to reduce their tax liability in future years. The specific version you mentioned, for 2013 and later tax years, indicates that it is applicable for those particular tax years and onwards.

The Form T2 Schedule 4 Corporation Loss Continuity and Application (2013 and Later Tax Years) in Canada is filed by corporations.

FAQ

Q: What is T2 Schedule 4?

A: T2 Schedule 4 is a form used by corporations in Canada to calculate the continuity of losses from previous tax years and to apply those losses against taxable income in the current year.

Q: Who needs to file T2 Schedule 4?

A: Corporations in Canada that have incurred losses in previous tax years and wish to carry forward those losses or apply them against current taxable income need to file T2 Schedule 4.

Q: What is the purpose of T2 Schedule 4?

A: The purpose of T2 Schedule 4 is to determine the amount of loss that can be carried forward from previous tax years and to calculate the amount of loss that can be applied against current taxable income.

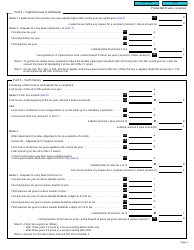

Q: What information is required to complete T2 Schedule 4?

A: To complete T2 Schedule 4, you will need to provide information about the previous tax years in which the losses were incurred, the amount of those losses, and any adjustments that may have been made.

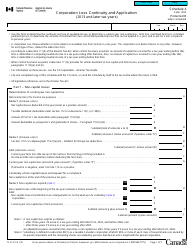

Q: How do I calculate the continuity of losses for T2 Schedule 4?

A: To calculate the continuity of losses for T2 Schedule 4, you need to determine the balance of unapplied losses from previous tax years, taking into account any adjustments or deductions that may have been made in subsequent years.

Q: Can I carry forward losses from previous tax years?

A: Yes, you can carry forward losses from previous tax years and apply them against future taxable income. T2 Schedule 4 helps you calculate the amount of loss that can be carried forward.

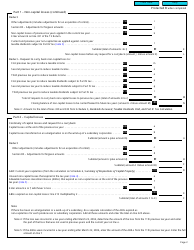

Q: Can I apply losses against current taxable income?

A: Yes, you can apply losses from previous tax years against current taxable income to reduce or eliminate your tax liability. T2 Schedule 4 provides the necessary calculations for applying losses.

Q: Are there any limitations on carrying forward or applying losses?

A: There may be certain limitations on the amount of losses that can be carried forward or applied against current taxable income. These limitations are outlined in the Income Tax Act and should be taken into account when completing T2 Schedule 4.

Q: When is the deadline for filing T2 Schedule 4?

A: The deadline for filing T2 Schedule 4 is generally the same as the corporate tax return deadline, which is six months after the end of the tax year. However, it is advisable to check the specific deadline for your corporation with the CRA.