This version of the form is not currently in use and is provided for reference only. Download this version of

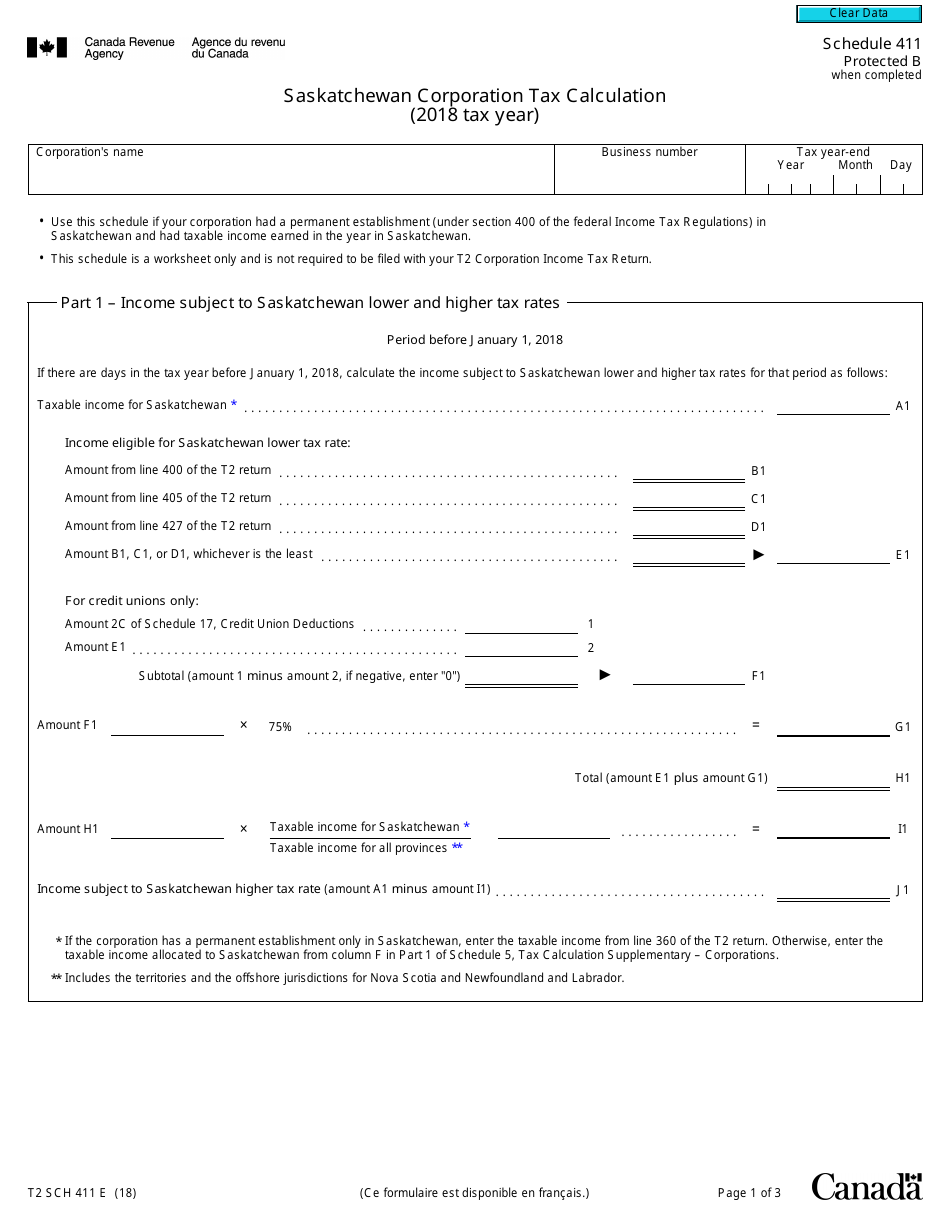

Form T2 Schedule 411

for the current year.

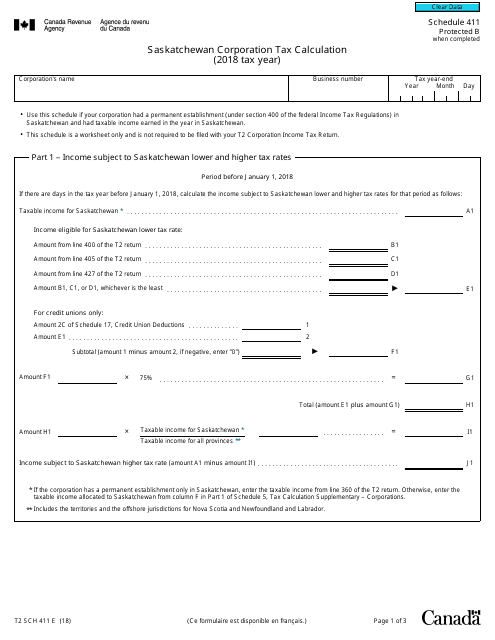

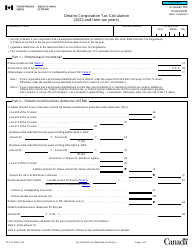

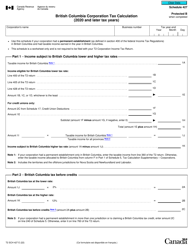

Form T2 Schedule 411 Saskatchewan Corporation Tax Calculation (2018 Tax Year) - Canada

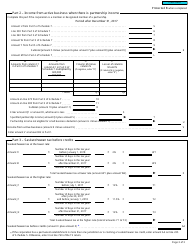

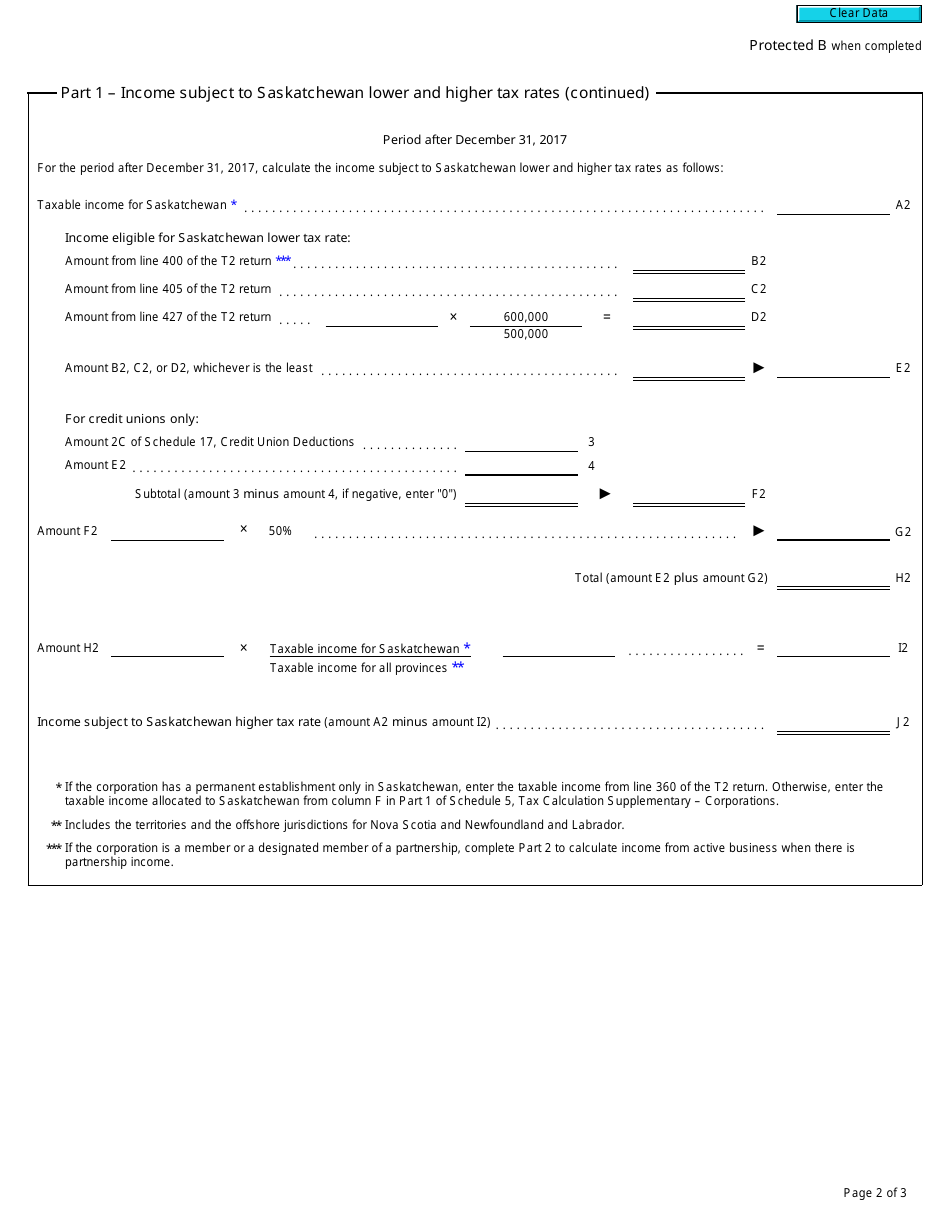

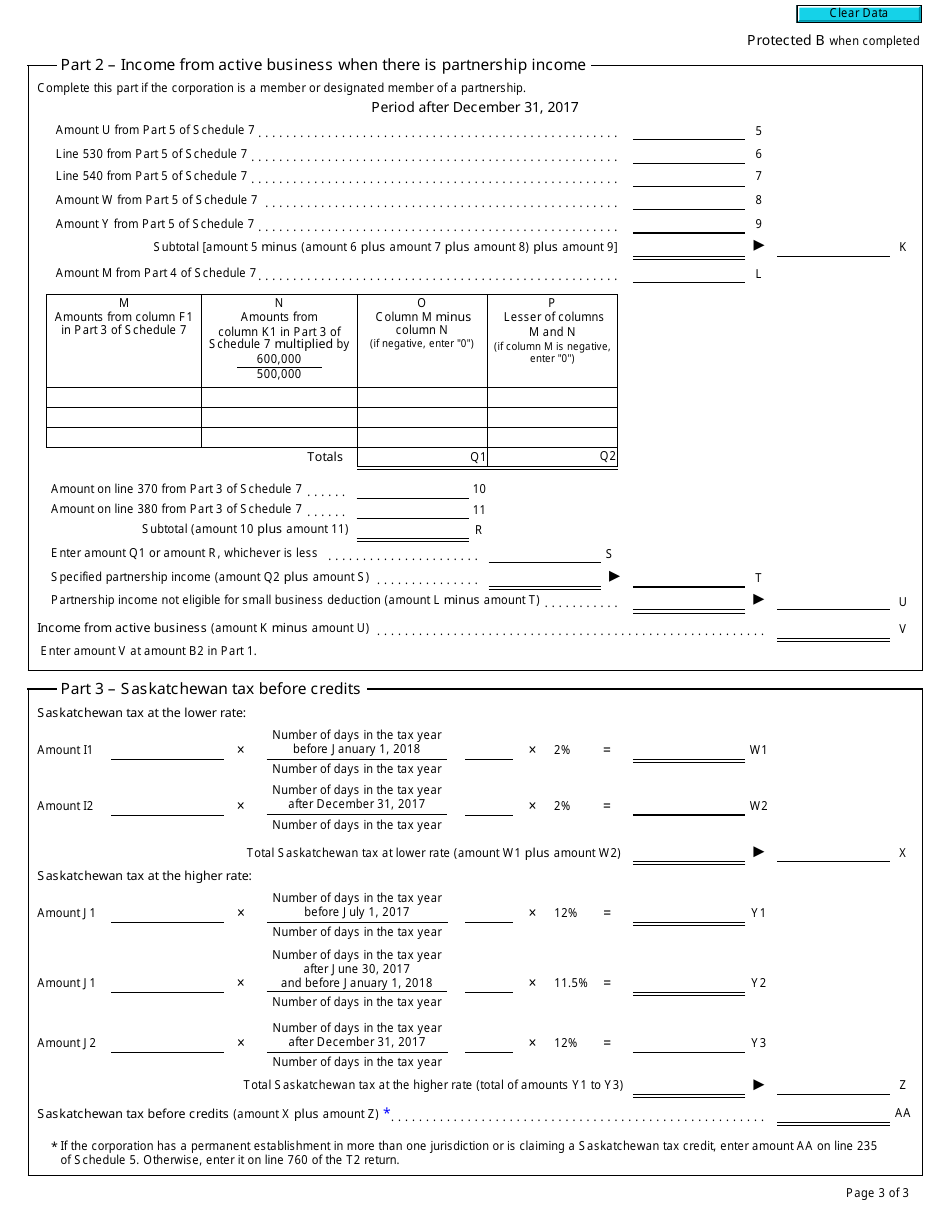

Form T2 Schedule 411 is used for calculating the corporation tax owed by a Saskatchewan corporation in Canada for the 2018 tax year. It helps determine the amount of tax the corporation needs to pay based on its taxable income.

The corporation filing its taxes in Saskatchewan would file the Form T2 Schedule 411 for the 2018 tax year in Canada.

FAQ

Q: What is Form T2 Schedule 411?

A: Form T2 Schedule 411 is a tax form used by Saskatchewan corporations to calculate their corporation tax for the 2018 tax year.

Q: Who uses Form T2 Schedule 411?

A: Saskatchewan corporations use Form T2 Schedule 411.

Q: What is the purpose of Form T2 Schedule 411?

A: The purpose of Form T2 Schedule 411 is to calculate the amount of corporation tax owed by a Saskatchewan corporation for the 2018 tax year.

Q: What tax year is Form T2 Schedule 411 for?

A: Form T2 Schedule 411 is for the 2018 tax year.

Q: Is Form T2 Schedule 411 only for Saskatchewan corporations?

A: Yes, Form T2 Schedule 411 is specifically for Saskatchewan corporations.

Q: What information is required to fill out Form T2 Schedule 411?

A: To fill out Form T2 Schedule 411, you will need information about the corporation's income, expenses, and any applicable deductions or credits.

Q: When is the deadline to file Form T2 Schedule 411?

A: The deadline to file Form T2 Schedule 411 is generally within six months after the end of the corporation's tax year. However, it's recommended to check with the Canada Revenue Agency for any specific deadlines.

Q: What happens if I don't file Form T2 Schedule 411?

A: If you don't file Form T2 Schedule 411 or file it late, you may be subject to penalties or interest charges imposed by the Canada Revenue Agency.