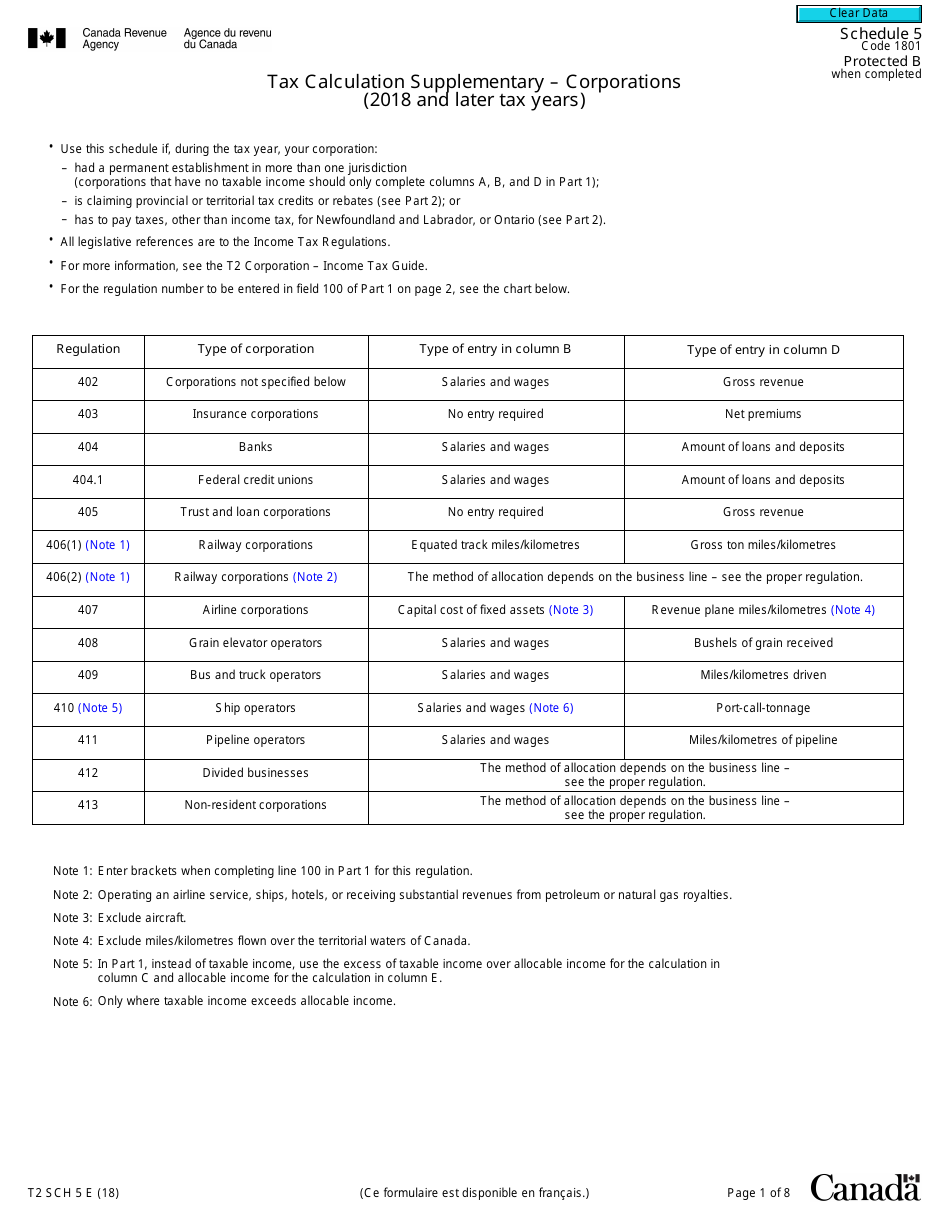

This version of the form is not currently in use and is provided for reference only. Download this version of

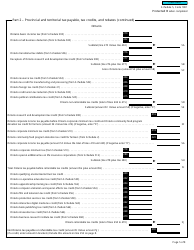

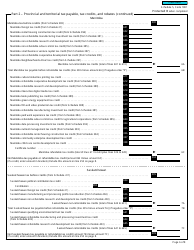

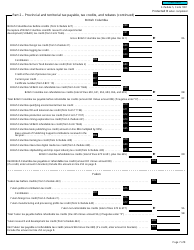

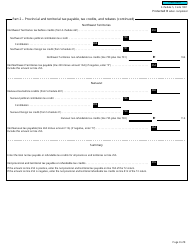

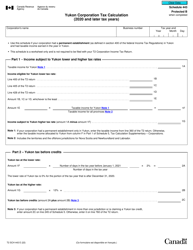

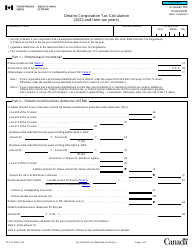

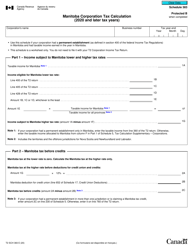

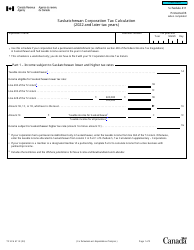

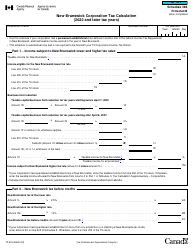

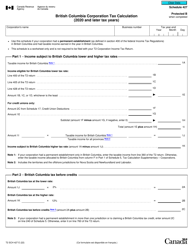

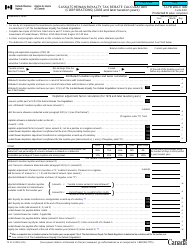

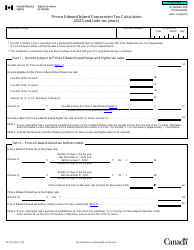

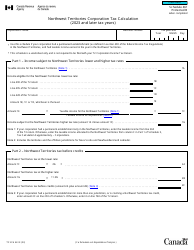

Form T2 Schedule 5

for the current year.

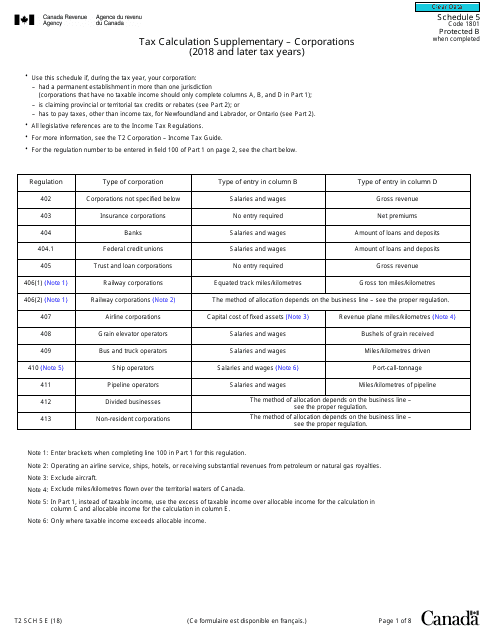

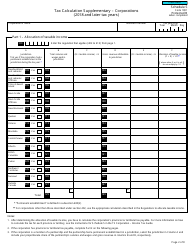

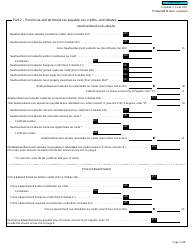

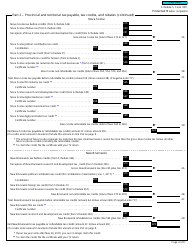

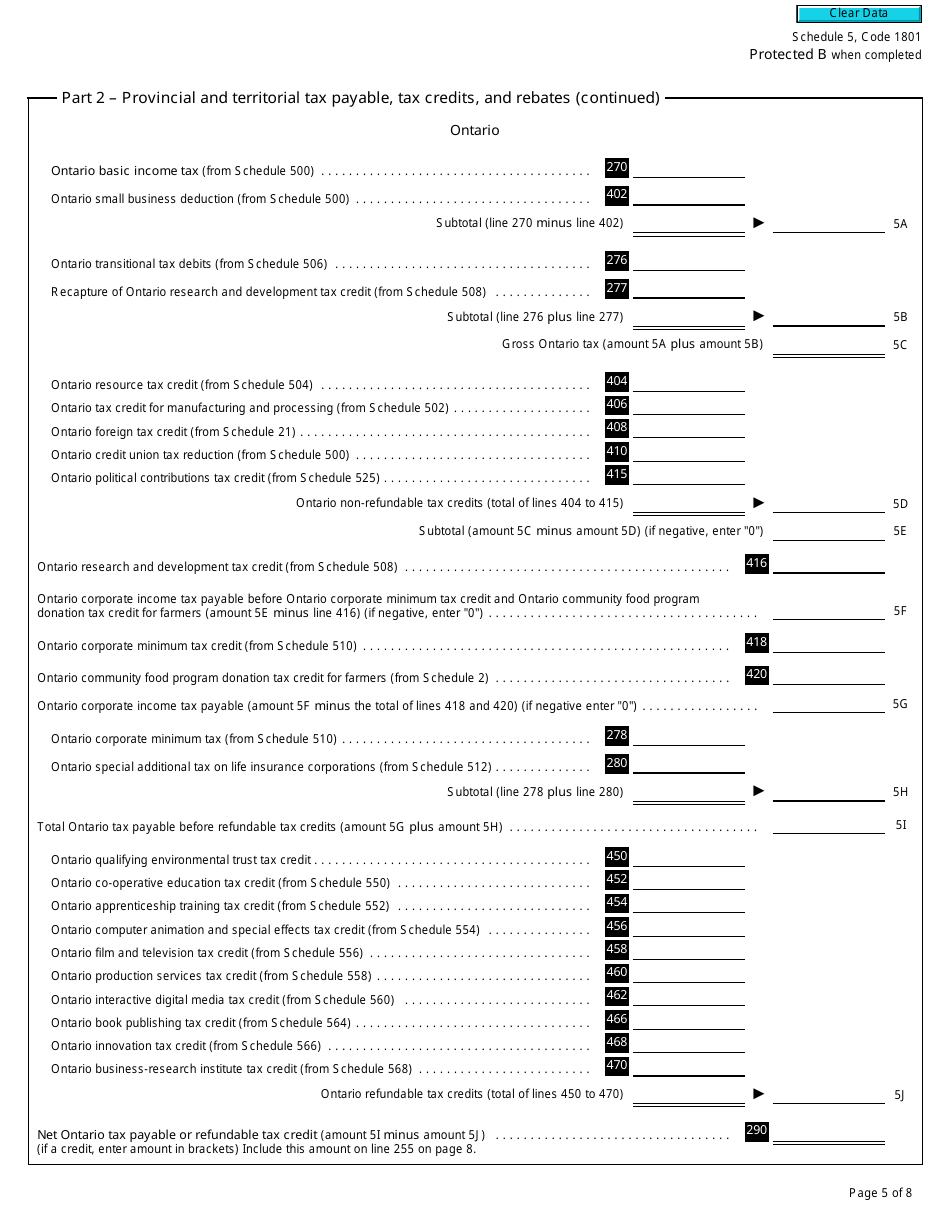

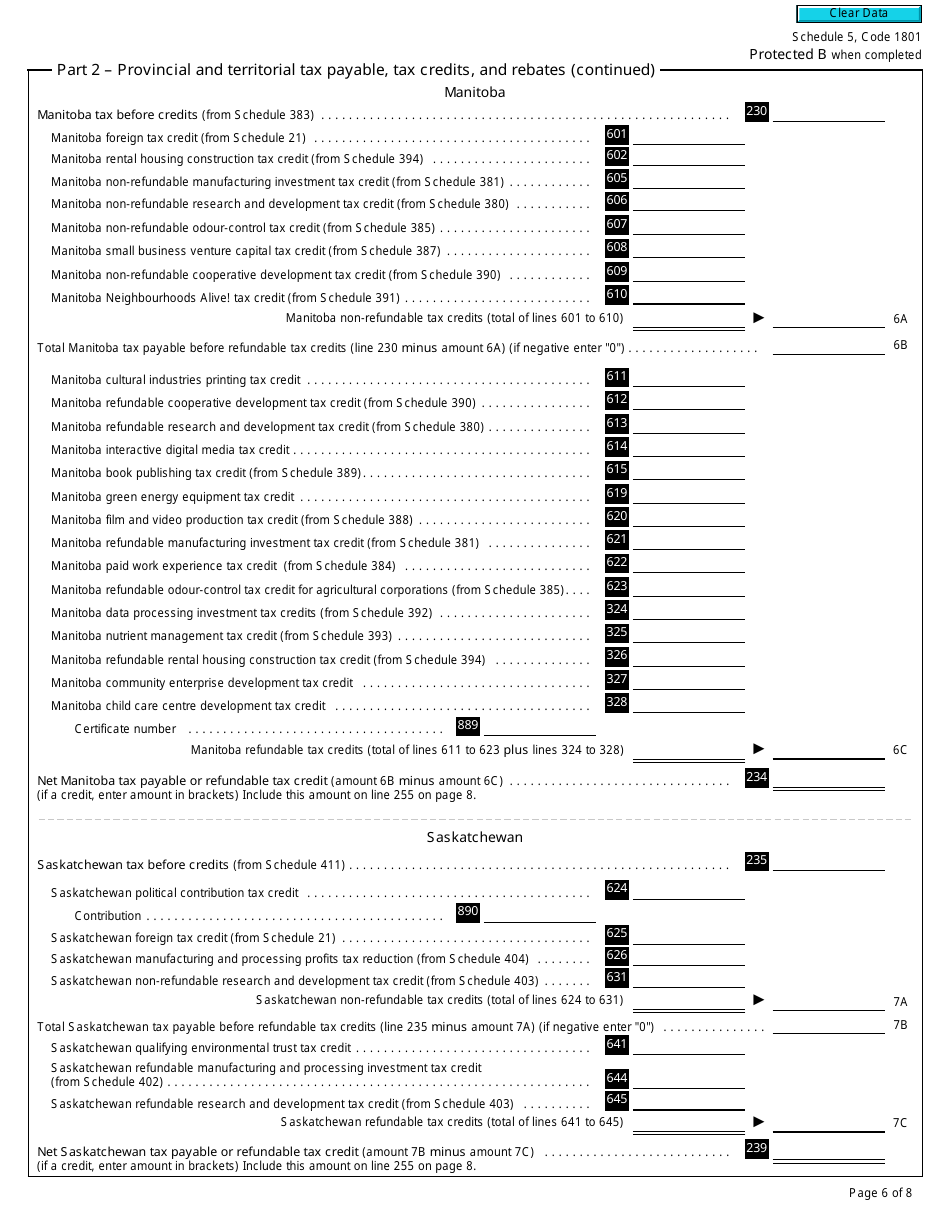

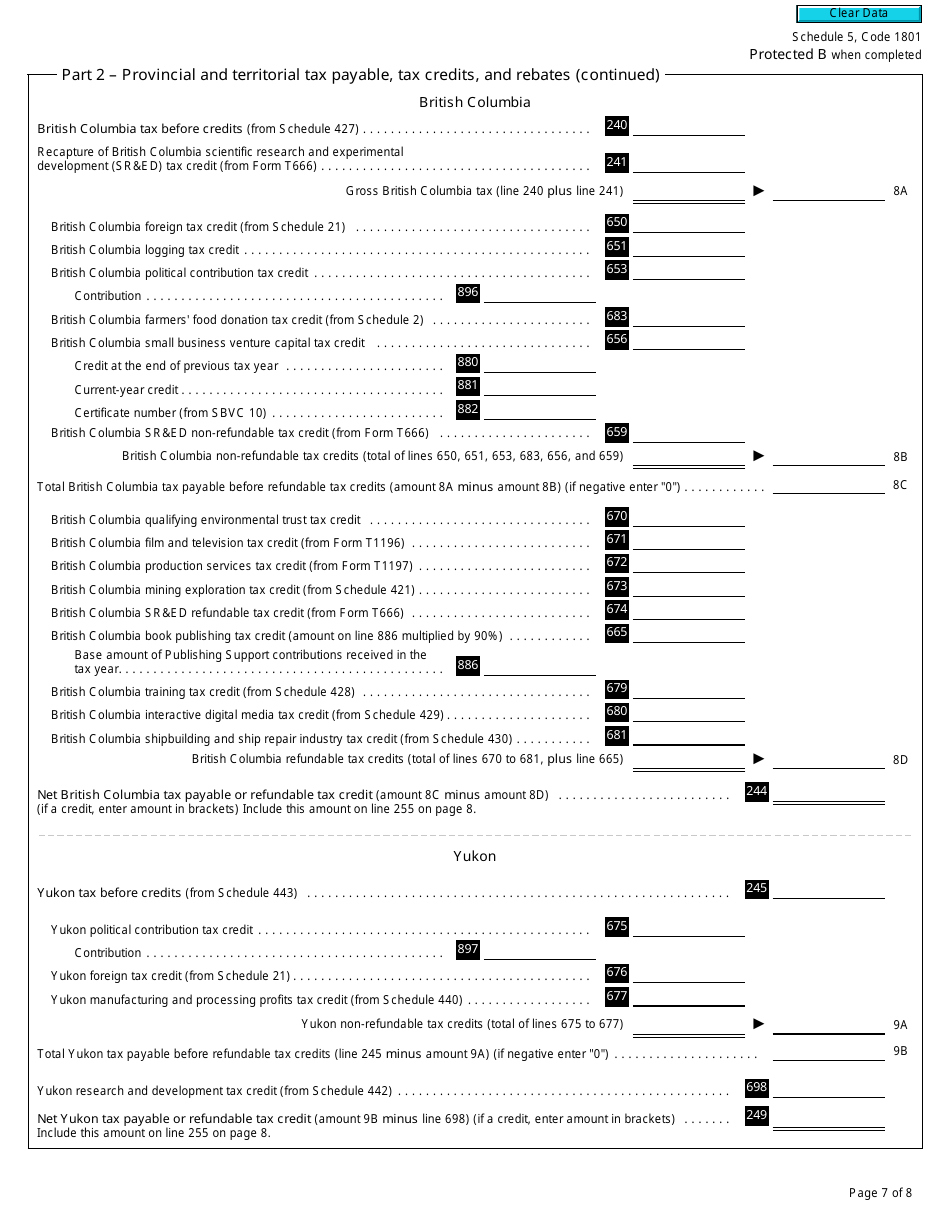

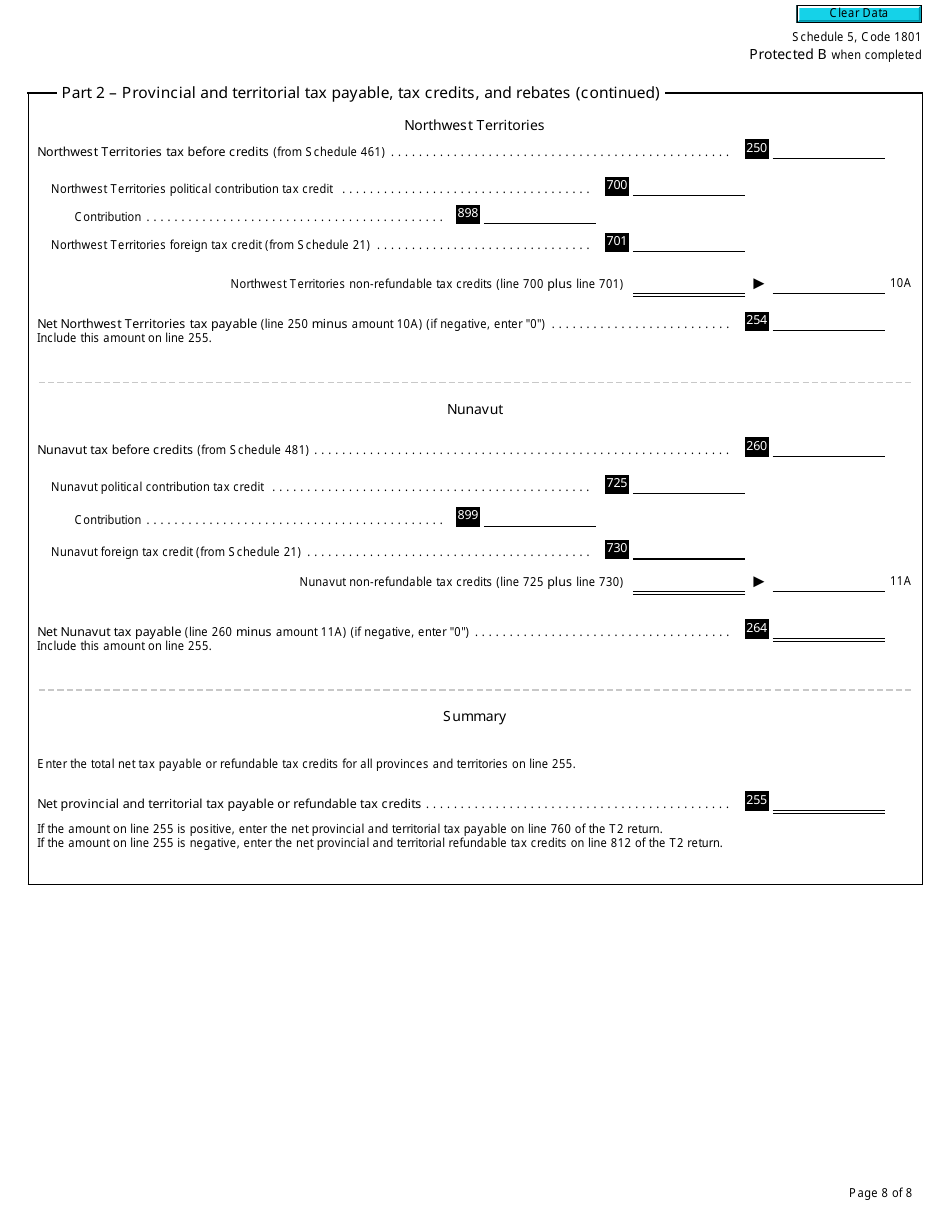

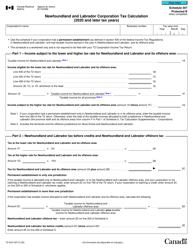

Form T2 Schedule 5 Tax Calculation Supplementary - Corporations (2018 and Later Tax Years) - Canada

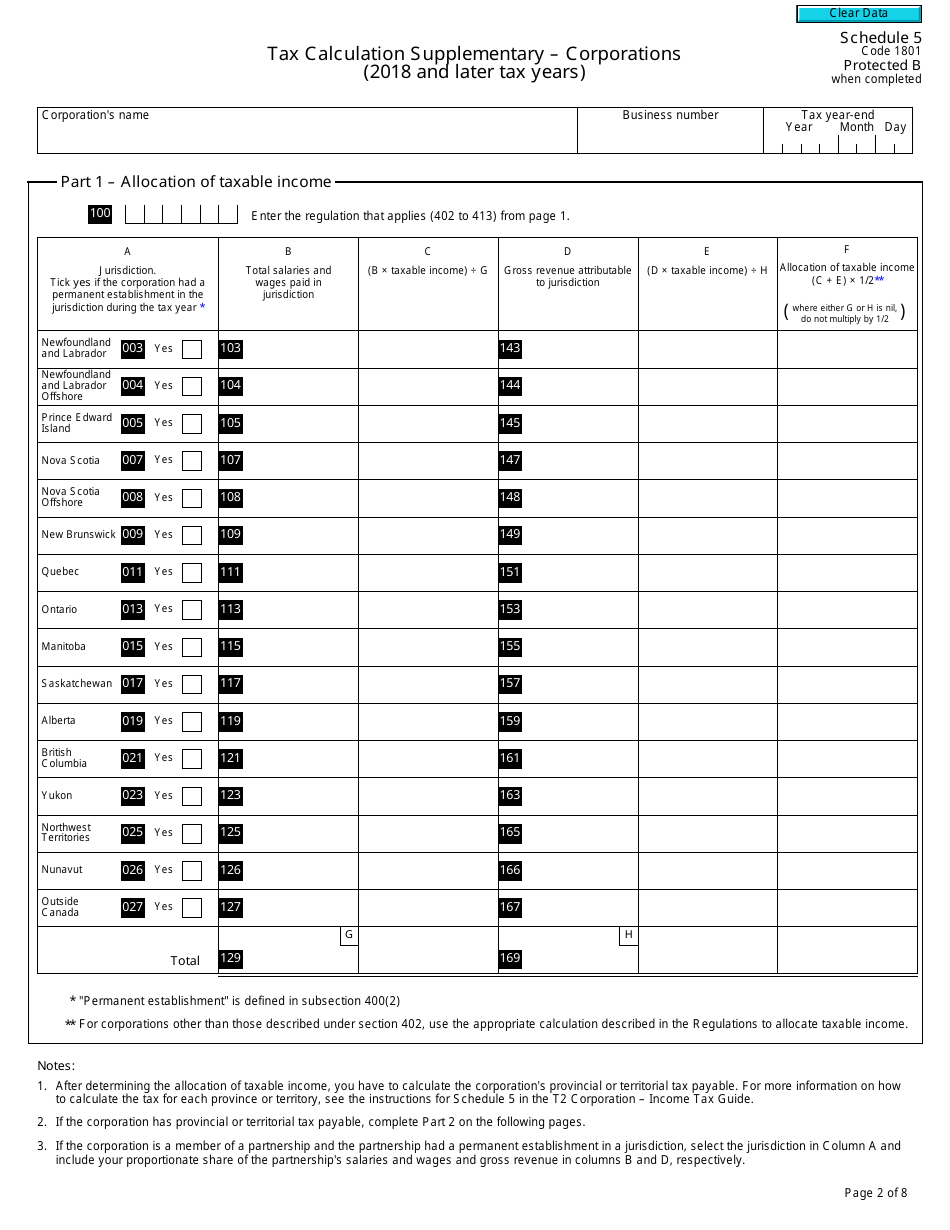

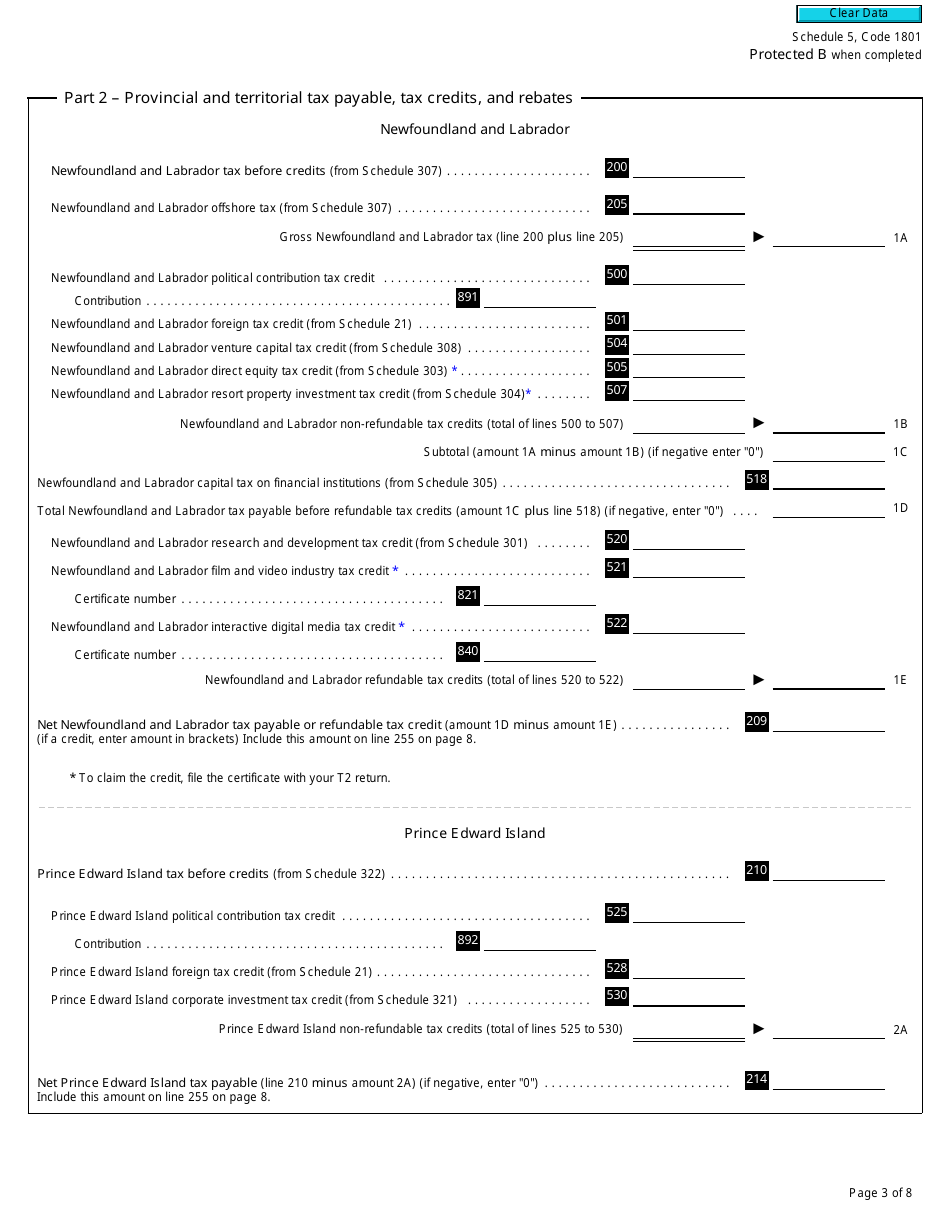

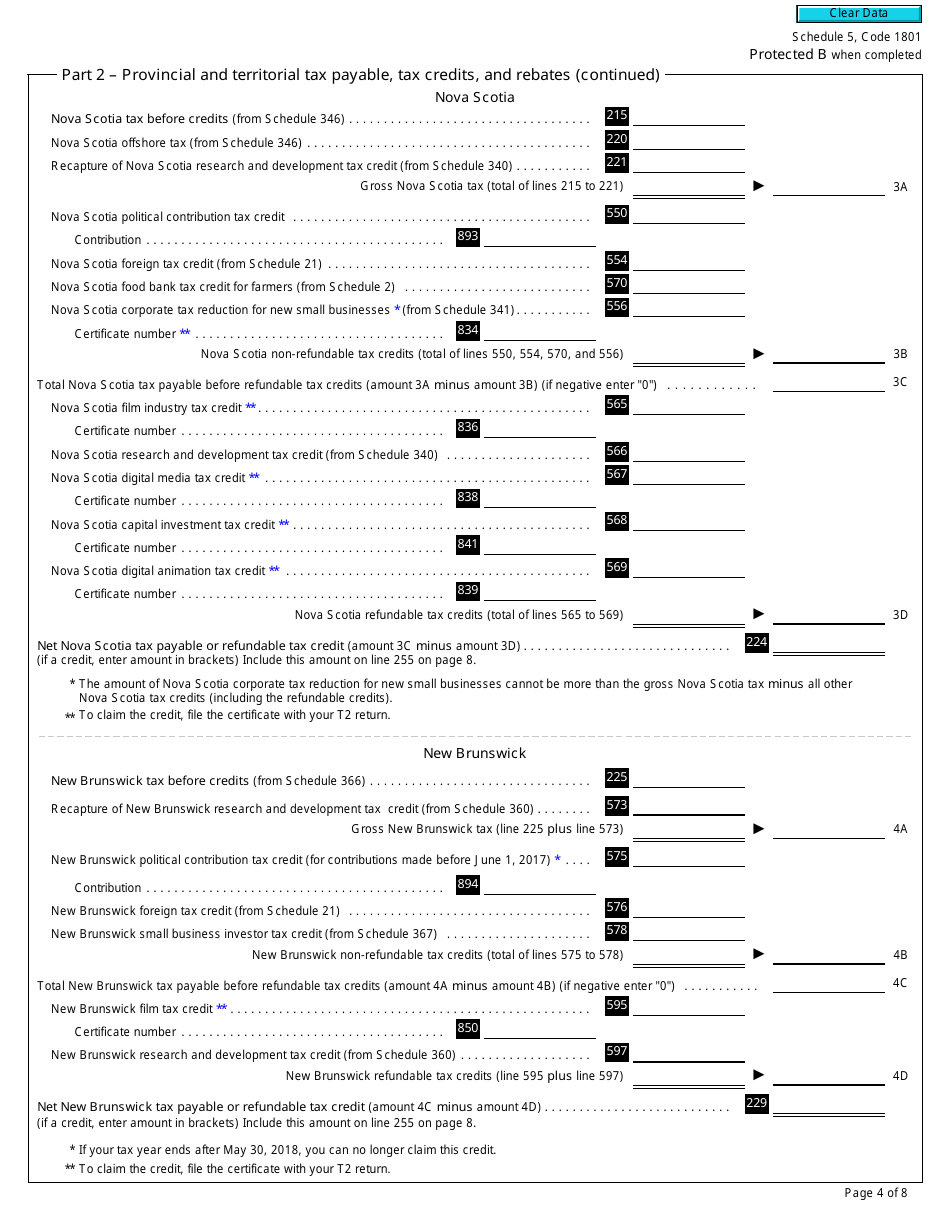

Form T2 Schedule 5 Tax Calculation Supplementary - Corporations (2018 and Later Tax Years) is used by corporations in Canada to calculate their federal income tax liability. It is a supplementary form that is filed along with the T2 Corporation Income Tax Return.

The Form T2 Schedule 5 Tax Calculation Supplementary - Corporations is filed by corporations in Canada for the tax years 2018 and later.

FAQ

Q: What is Form T2 Schedule 5?

A: Form T2 Schedule 5 is a supplementary form used by corporations in Canada to calculate their taxes.

Q: Who needs to file Form T2 Schedule 5?

A: Corporations in Canada need to file Form T2 Schedule 5 if they are required to file a T2 Corporation Income Tax Return.

Q: What is the purpose of Form T2 Schedule 5?

A: The purpose of Form T2 Schedule 5 is to calculate the amount of tax owed by a corporation based on its taxable income.

Q: What tax years is Form T2 Schedule 5 applicable for?

A: Form T2 Schedule 5 is applicable for tax years starting in 2018 and later.

Q: Are there any penalties for not filing Form T2 Schedule 5?

A: Yes, there can be penalties for not filing Form T2 Schedule 5 or filing it late. It is important to comply with the tax filing requirements to avoid any penalties or interest charges.

Q: Is there any additional documentation required with Form T2 Schedule 5?

A: Additional documentation may be required depending on the specific circumstances of the corporation. It is advisable to consult the instructions provided with the form or seek professional advice if necessary.

Q: Can I use Form T2 Schedule 5 for personal taxes?

A: No, Form T2 Schedule 5 is specifically for corporations in Canada. Individuals should use the appropriate forms for their personal tax filings.