This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2 Schedule 430

for the current year.

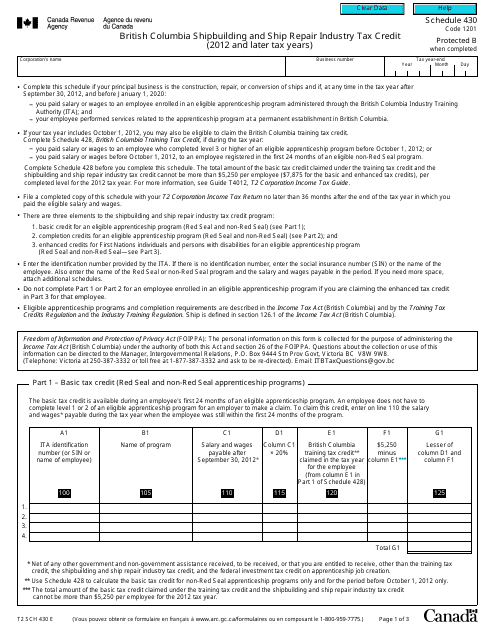

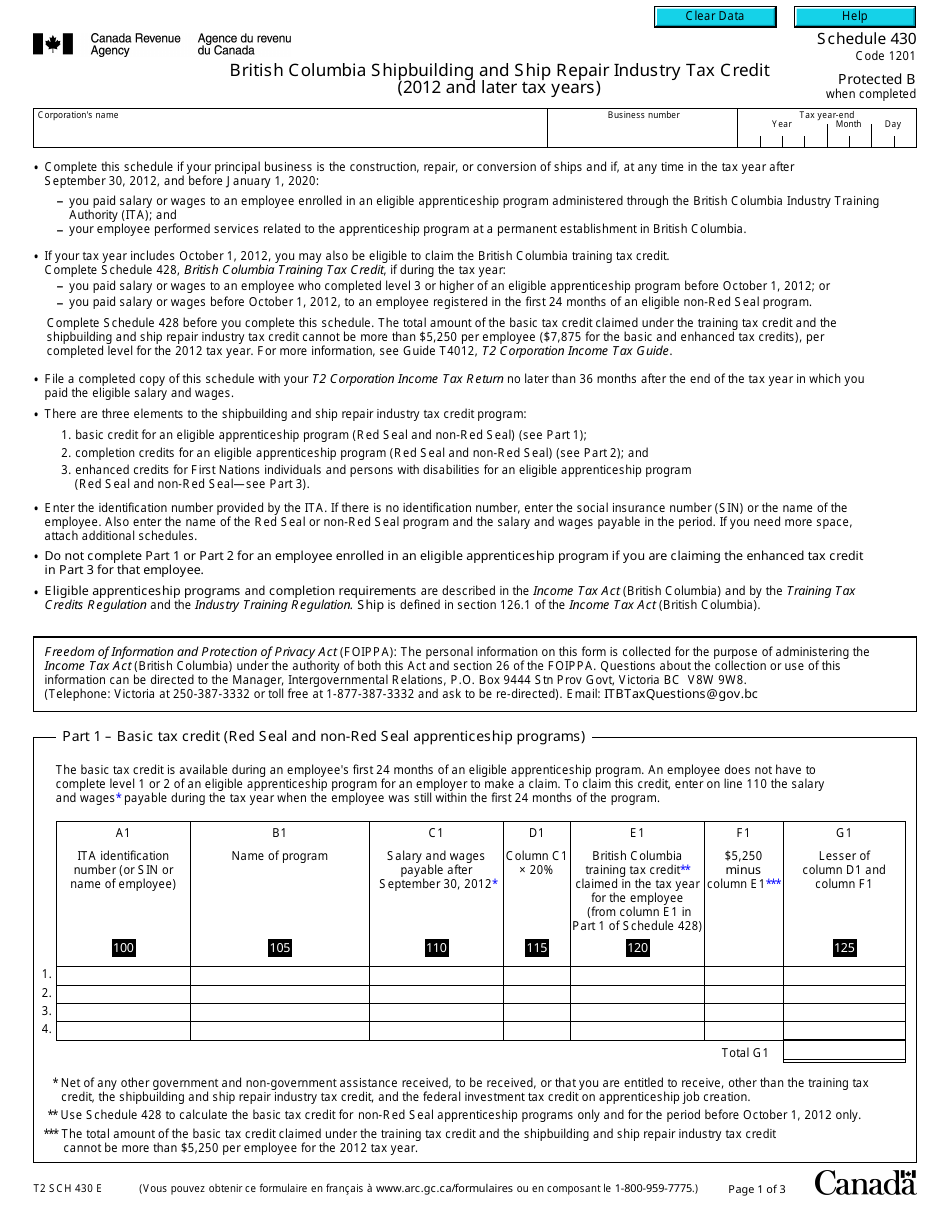

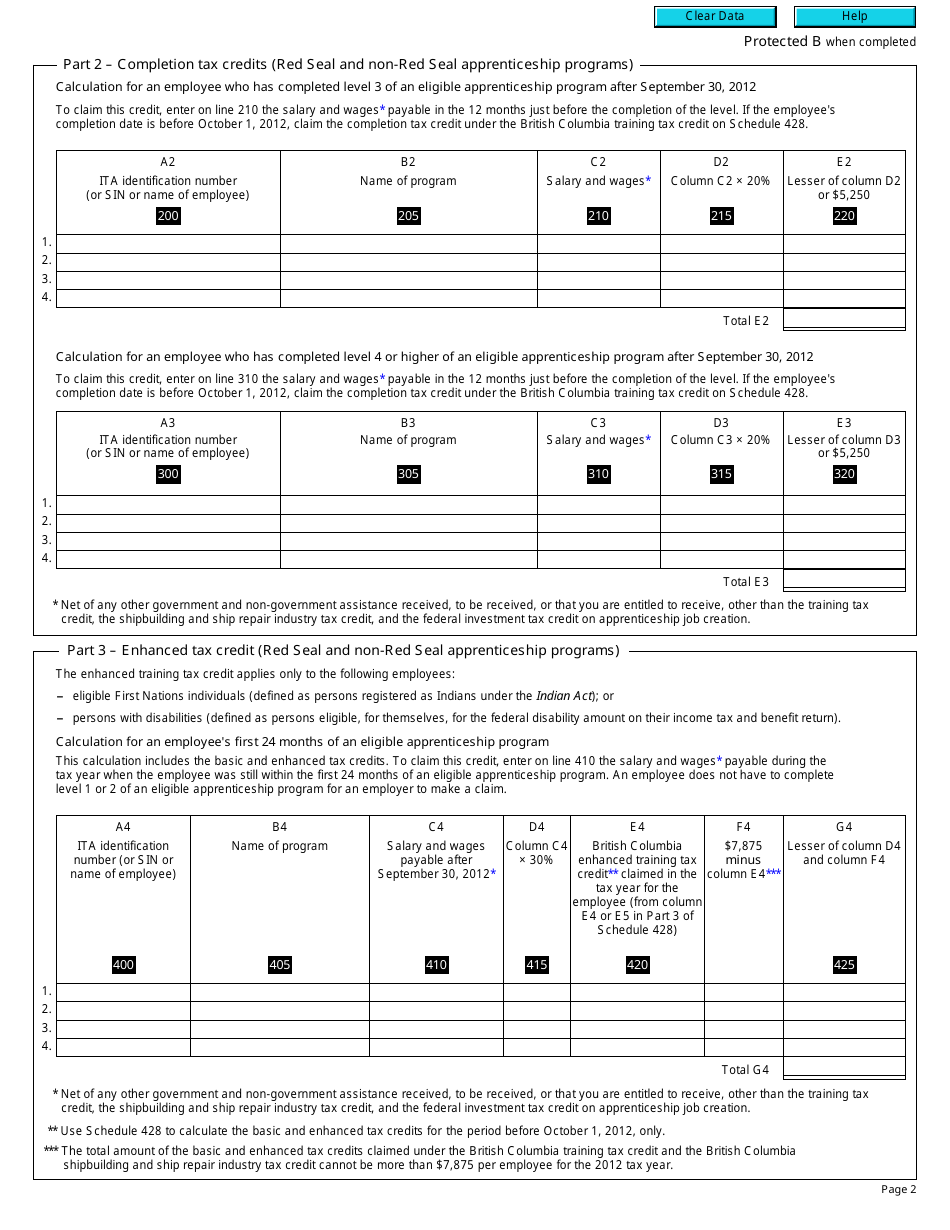

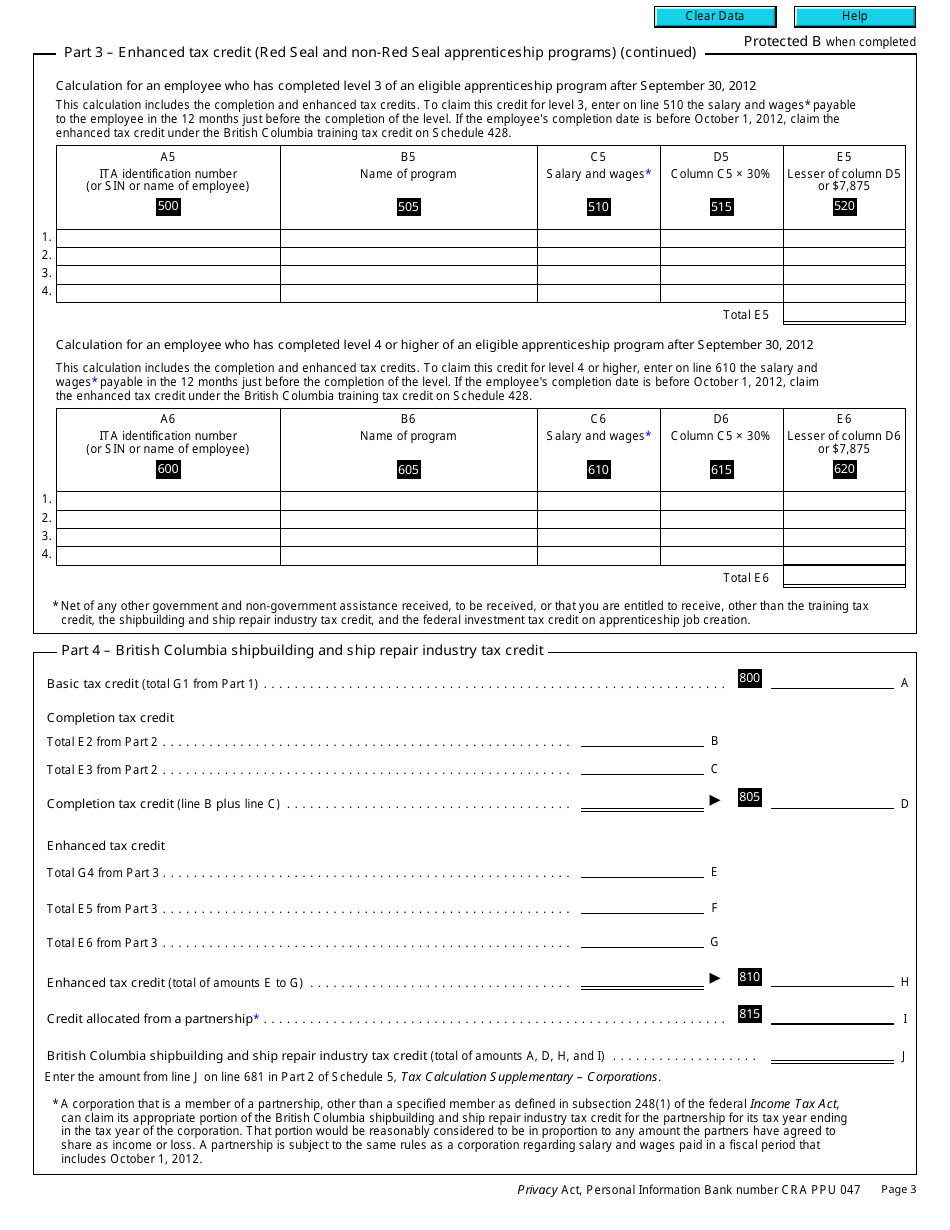

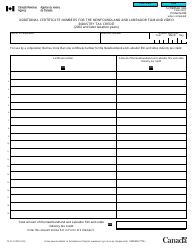

Form T2 Schedule 430 British Columbia Shipbuilding and Ship Repair Industry Tax Credit (2012 and Later Tax Years) - Canada

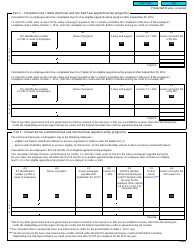

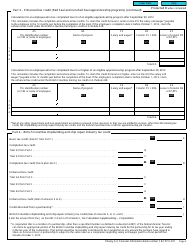

Form T2 Schedule 430 is used by corporations in Canada to claim the British Columbia Shipbuilding and Ship Repair Industry Tax Credit for the tax years 2012 and later. This tax credit is specific to the shipbuilding and ship repair industry in British Columbia.

The Form T2 Schedule 430 for the British Columbia Shipbuilding and Ship Repair Industry Tax Credit is filed by corporations in Canada that are eligible for this tax credit.

FAQ

Q: What is Form T2 Schedule 430?

A: Form T2 Schedule 430 is a tax form used in Canada to claim the British Columbia Shipbuilding and Ship Repair Industry Tax Credit.

Q: What is the British Columbia Shipbuilding and Ship Repair Industry Tax Credit?

A: The British Columbia Shipbuilding and Ship Repair Industry Tax Credit is a tax credit in Canada aimed at promoting and supporting the shipbuilding and ship repair industry in British Columbia.

Q: Who is eligible for the tax credit?

A: Businesses that are involved in shipbuilding and ship repair activities in British Columbia may be eligible for the tax credit.

Q: What are the tax years that the tax credit applies to?

A: The tax credit applies to tax years starting in 2012 and later.

Q: How do I claim the tax credit?

A: To claim the tax credit, you need to complete and file Form T2 Schedule 430 with your corporate tax return.

Q: Is there a deadline for claiming the tax credit?

A: Yes, you must claim the tax credit within the prescribed time limits for filing your corporate tax return.

Q: How much is the tax credit?

A: The amount of the tax credit depends on various factors, including the eligible expenditures incurred in the shipbuilding or ship repair activities.

Q: Is the tax credit refundable?

A: Yes, the tax credit is refundable, which means that if the credit exceeds the taxes owed, you may receive a refund.

Q: Are there any limitations or restrictions on the tax credit?

A: Yes, there are certain limitations and restrictions, such as a maximum credit amount that can be claimed for each tax year.