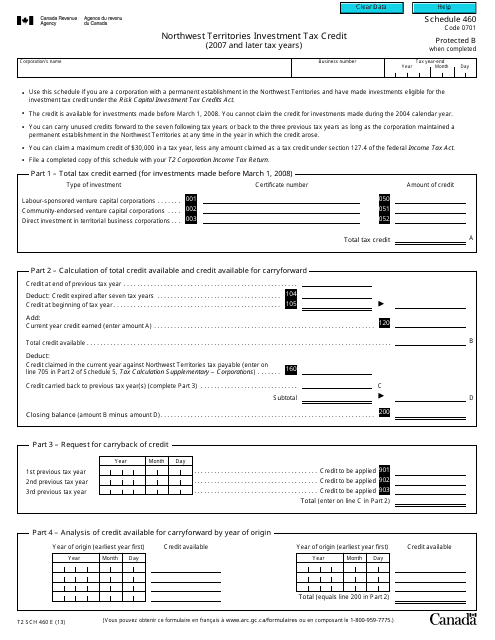

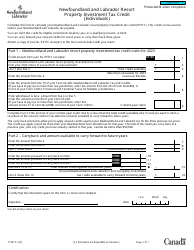

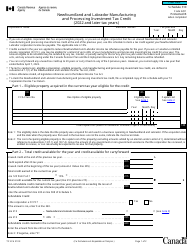

Form T2 Schedule 460 Northwest Territories Investment Tax Credit (2007 and Later Tax Years) - Canada

Form T2 Schedule 460 Northwest Territories Investment Tax Credit is used to claim the investment tax credit for eligible investments made in the Northwest Territories in Canada. It is applicable for the 2007 and later tax years.

The companies operating in the Northwest Territories in Canada file the Form T2 Schedule 460 for the Investment Tax Credit (2007 and later tax years).

FAQ

Q: What is Form T2 Schedule 460?

A: Form T2 Schedule 460 is a tax form used in Canada for claiming the Northwest Territories Investment Tax Credit.

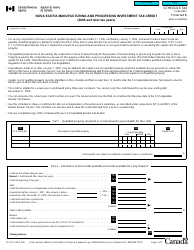

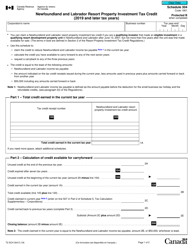

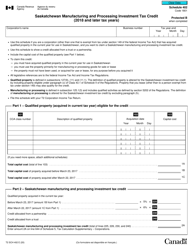

Q: What is the Northwest Territories Investment Tax Credit?

A: The Northwest Territories Investment Tax Credit is a tax credit available to businesses that make qualifying investments in the Northwest Territories.

Q: Who can claim the Northwest Territories Investment Tax Credit?

A: Businesses that make qualifying investments in the Northwest Territories can claim the tax credit.

Q: What kind of investments qualify for the tax credit?

A: Qualifying investments include those made in eligible resource properties, certain business properties, or exploration and development expenses.

Q: What is the purpose of this tax credit?

A: The Northwest Territories Investment Tax Credit is designed to encourage investment and economic development in the Northwest Territories.