This version of the form is not currently in use and is provided for reference only. Download this version of

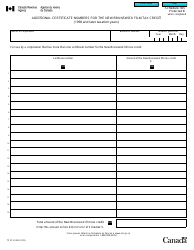

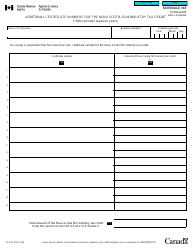

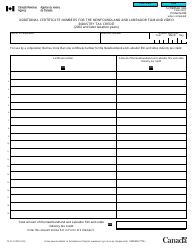

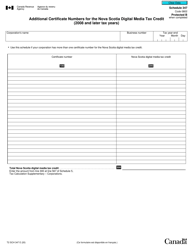

Form T2 Schedule 504

for the current year.

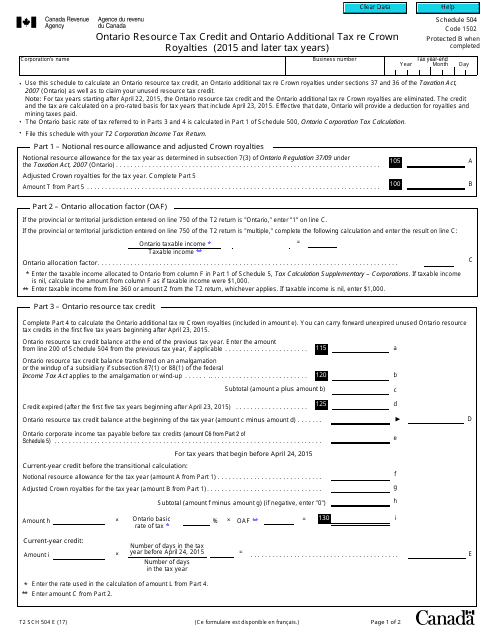

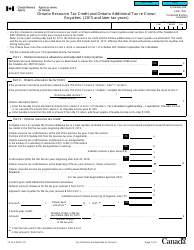

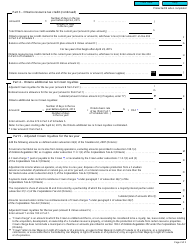

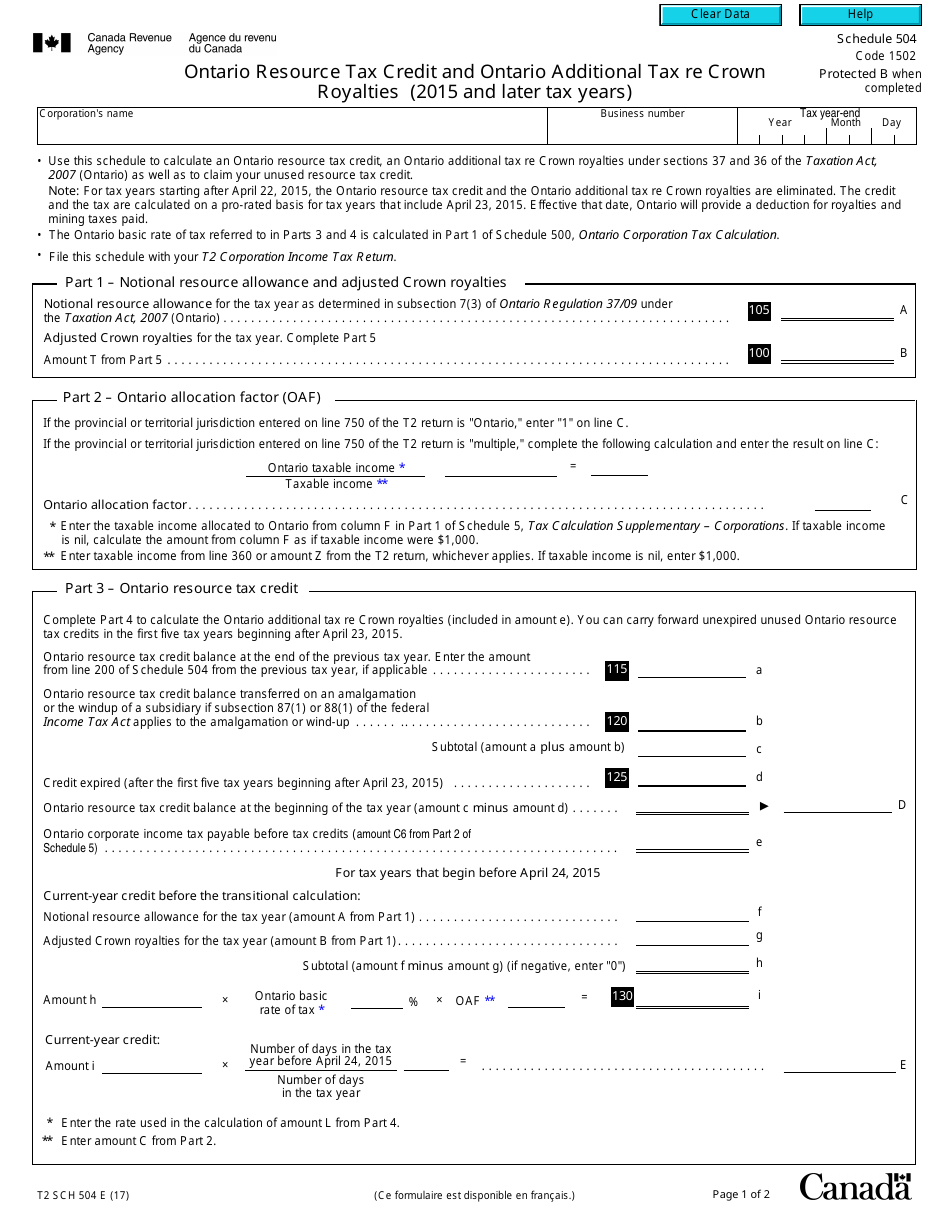

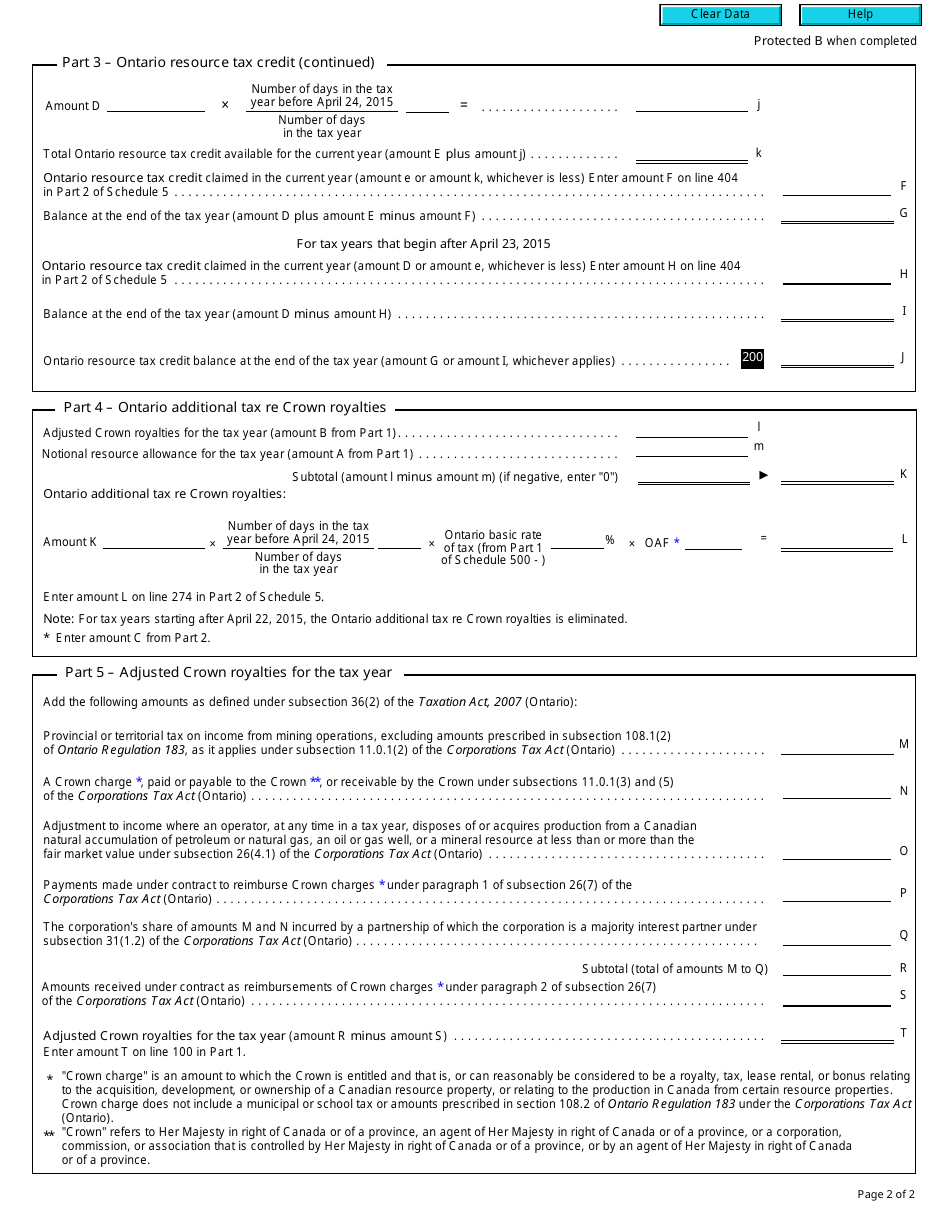

Form T2 Schedule 504 Ontario Resource Tax Credit and Ontario Additional Tax Re Crown Royalties (2015 and Later Tax Years) - Canada

Form T2 Schedule 504 Ontario Resource Tax Credit and Ontario Additional Tax Re Crown Royalties is a specific tax form used in Canada. This form is used by corporations to calculate their eligibility for the Ontario Resource Tax Credit and the Ontario Additional Tax Re Crown Royalties, for the tax years 2015 and later. These tax credits and tax reclaims are specific to corporations operating in Ontario and are related to the extraction and development of natural resources. They are designed to incentivize and support resource-based industries in the province. By filling out this form, corporations can determine their eligibility for these tax benefits and potentially reduce their overall tax liabilities.

The Form T2 Schedule 504, specifically the Ontario Resource Tax Credit and Ontario Additional Tax Re Crown Royalties section, is filed by corporations that have earned income from resource activities in Ontario and paid crown royalties. This form is applicable for the tax years 2015 and onwards.

FAQ

Q: What is Form T2 Schedule 504?

A: Form T2 Schedule 504 is a tax form used in Canada for the purpose of calculating the Ontario Resource Tax Credit and the Ontario Additional Tax on Crown Royalties.

Q: What is the Ontario Resource Tax Credit?

A: The Ontario Resource Tax Credit is a tax credit available to corporations in Ontario who have resource income from specified mining and resource activities. It is designed to encourage investment in the development of natural resources in the province.

Q: What are Crown Royalties?

A: Crown royalties are payments made to the government for the right to extract natural resources, such as minerals, oil, and gas, from Crown land. The Ontario Additional Tax on Crown Royalties is an extra tax imposed on corporations that pay Crown royalties in Ontario.

Q: Who is required to file Form T2 Schedule 504?

A: Corporations in Canada who have resource income from specified mining and resource activities in Ontario, and who pay Crown royalties, are required to file Form T2 Schedule 504.

Q: What are the specified mining and resource activities?

A: Specified mining and resource activities include the extraction of minerals, oil, gas, and other natural resources from the land, as well as the processing and refining of these resources.

Q: Are there any eligibility criteria for the Ontario Resource Tax Credit?

A: Yes, there are eligibility criteria for the Ontario Resource Tax Credit. Corporations must meet certain conditions, such as having a permanent establishment in Ontario, being engaged in eligible mining or resource activities, and having income from those activities.

Q: How do I calculate the Ontario Resource Tax Credit?

A: The Ontario Resource Tax Credit is calculated based on a percentage of eligible resource income from specified mining and resource activities. The specific calculation method can be found in the instructions provided with Form T2 Schedule 504.