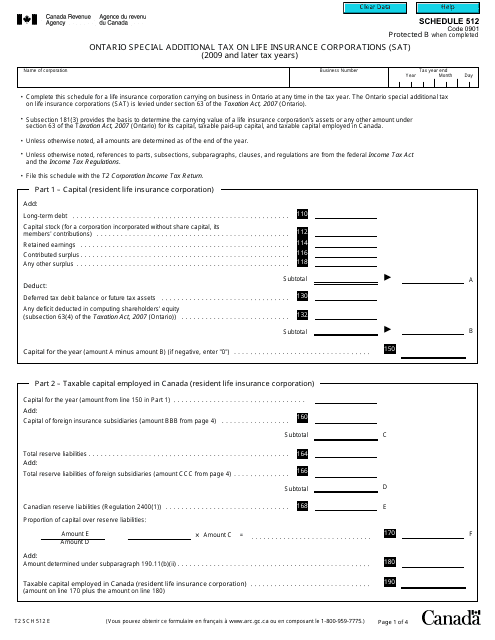

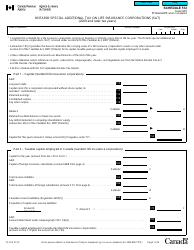

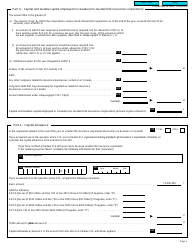

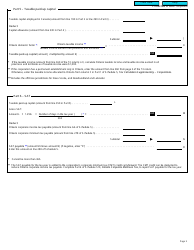

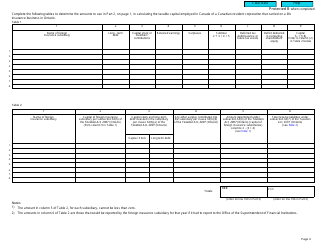

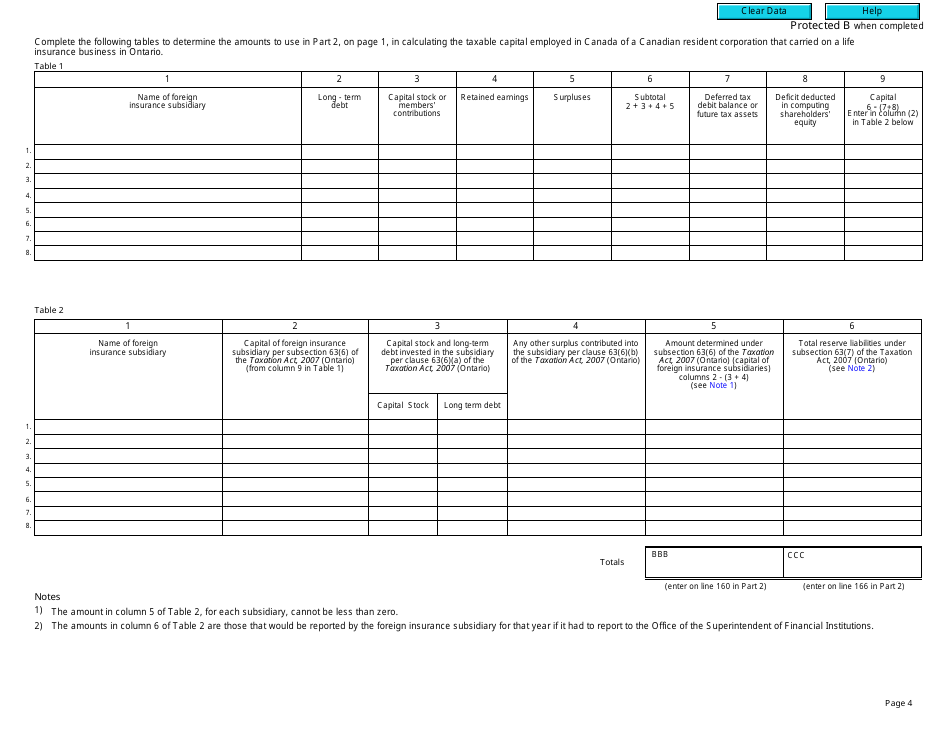

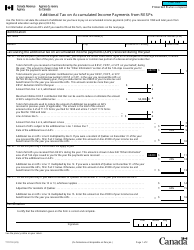

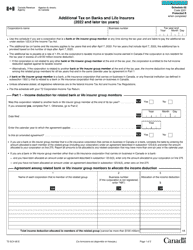

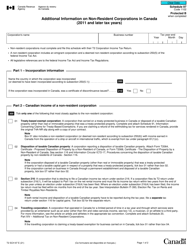

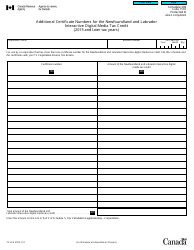

Form T2 Schedule 512 Ontario Special Additional Tax on Life Insurance Corporations (Sat) (2009 and Later Tax Years) - Canada

This Canada-specific " Ontario Special Life Insurance Corporations (sat) (2009 And Later Tax Years) " is a document released by the Canadian Revenue Agency .

Download the fillable PDF by clicking the link below and use it according to the applicable legal guidelines.

FAQ

Q: What is Form T2 Schedule 512?

A: Form T2 Schedule 512 is a tax form used in Canada.

Q: What is the purpose of Form T2 Schedule 512?

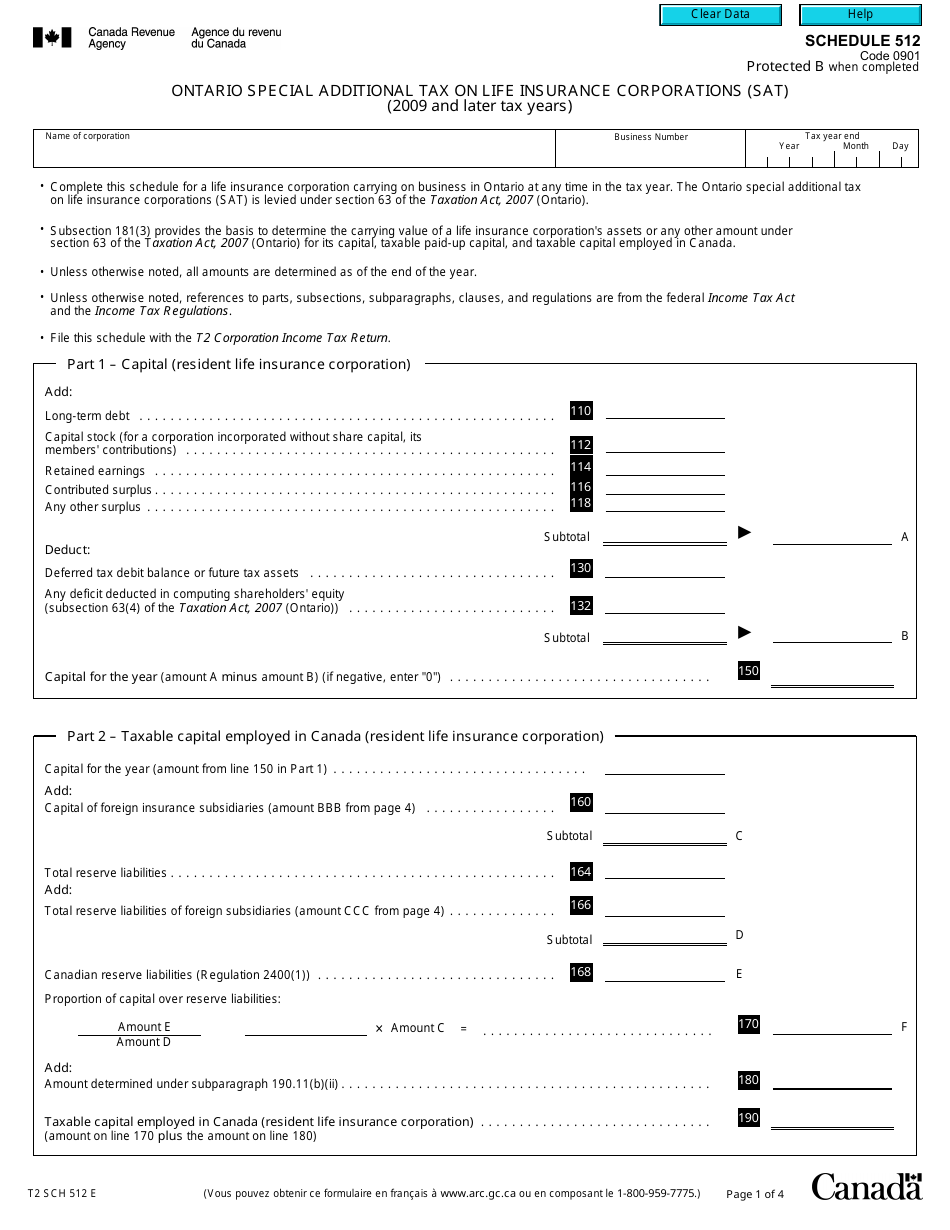

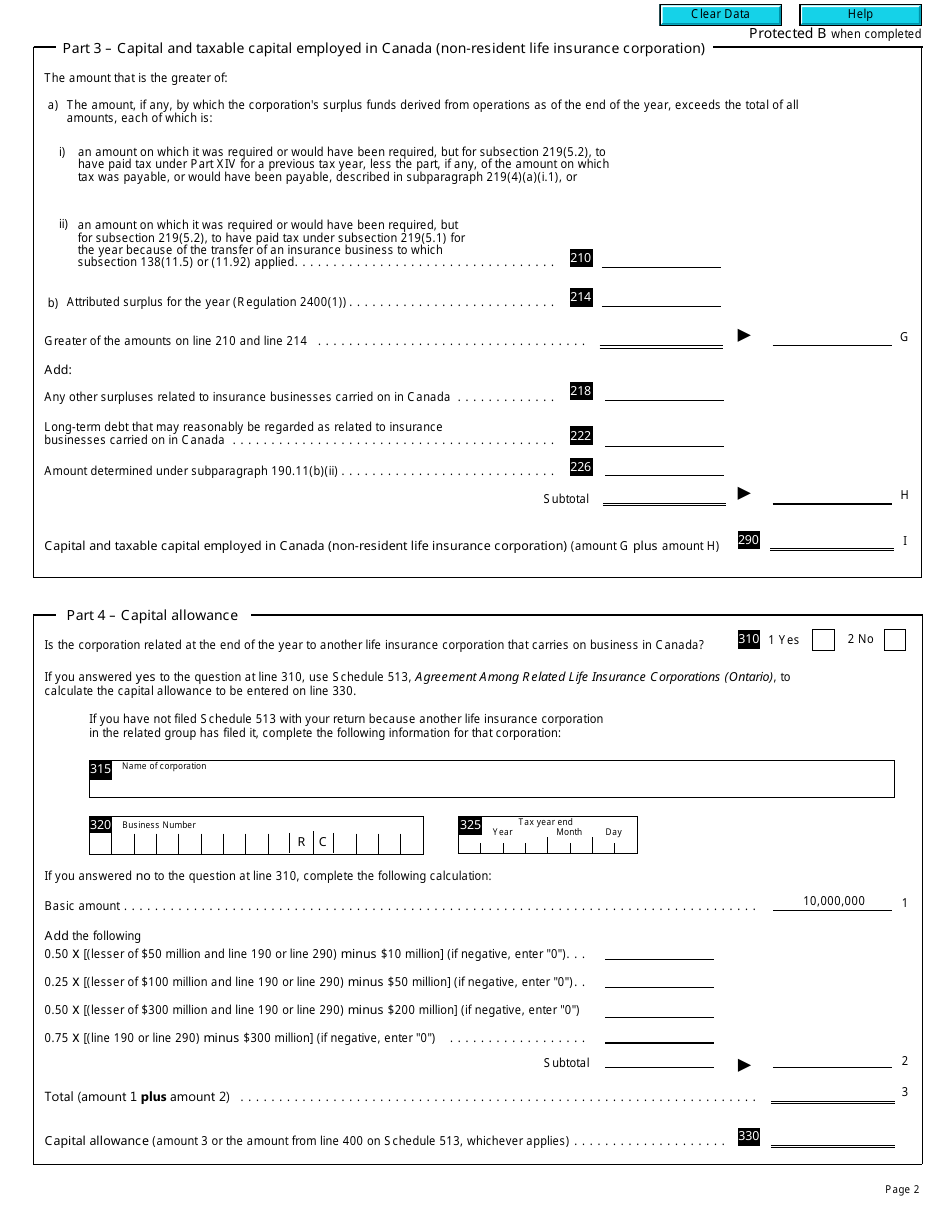

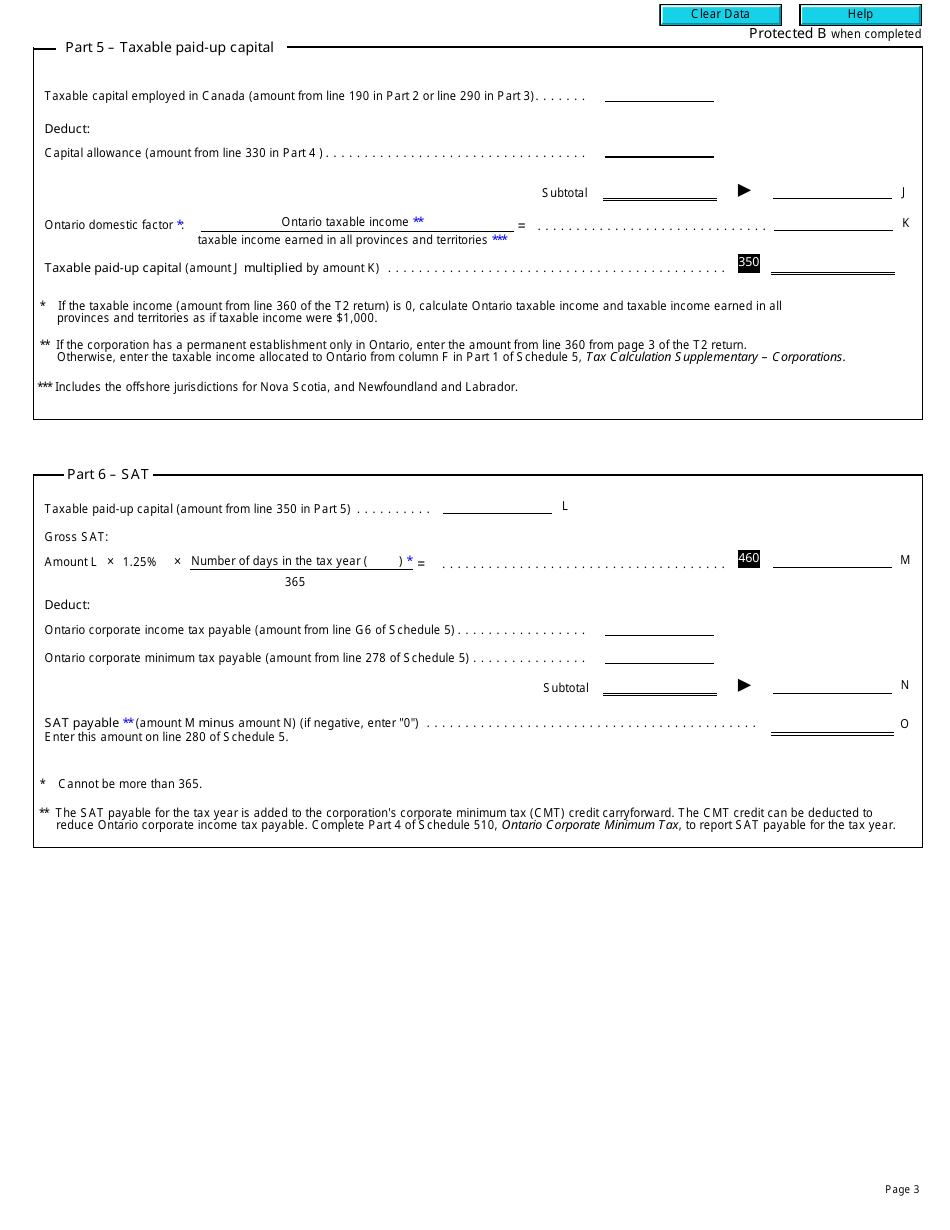

A: Form T2 Schedule 512 is used to calculate the Ontario Special Additional Tax on Life Insurance Corporations.

Q: What tax years does Form T2 Schedule 512 apply to?

A: Form T2 Schedule 512 applies to tax years starting from 2009 and later.

Q: Who needs to file Form T2 Schedule 512?

A: Life insurance corporations in the province of Ontario need to file Form T2 Schedule 512.

Q: What is the Ontario Special Additional Tax on Life Insurance Corporations?

A: The Ontario Special Additional Tax on Life Insurance Corporations is a tax imposed on life insurance corporations in Ontario.

Q: How do I fill out Form T2 Schedule 512?

A: You should follow the instructions provided on the form and enter the required information accurately.

Q: Is Form T2 Schedule 512 available for tax years before 2009?

A: No, Form T2 Schedule 512 is only applicable to tax years starting from 2009 and later.

Q: What happens if I don't file Form T2 Schedule 512?

A: If you are a life insurance corporation in Ontario required to file Form T2 Schedule 512 and you fail to do so, you may be subject to penalties and interest charges.

Q: Can I get help with filling out Form T2 Schedule 512?

A: Yes, you can seek assistance from a tax professional or contact the Canada Revenue Agency for guidance on filling out the form.