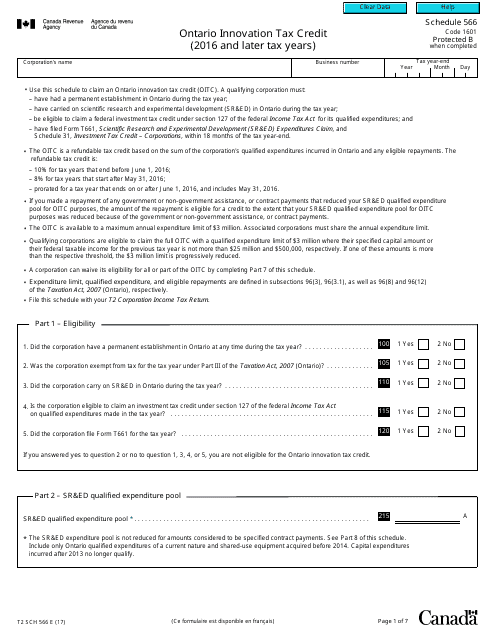

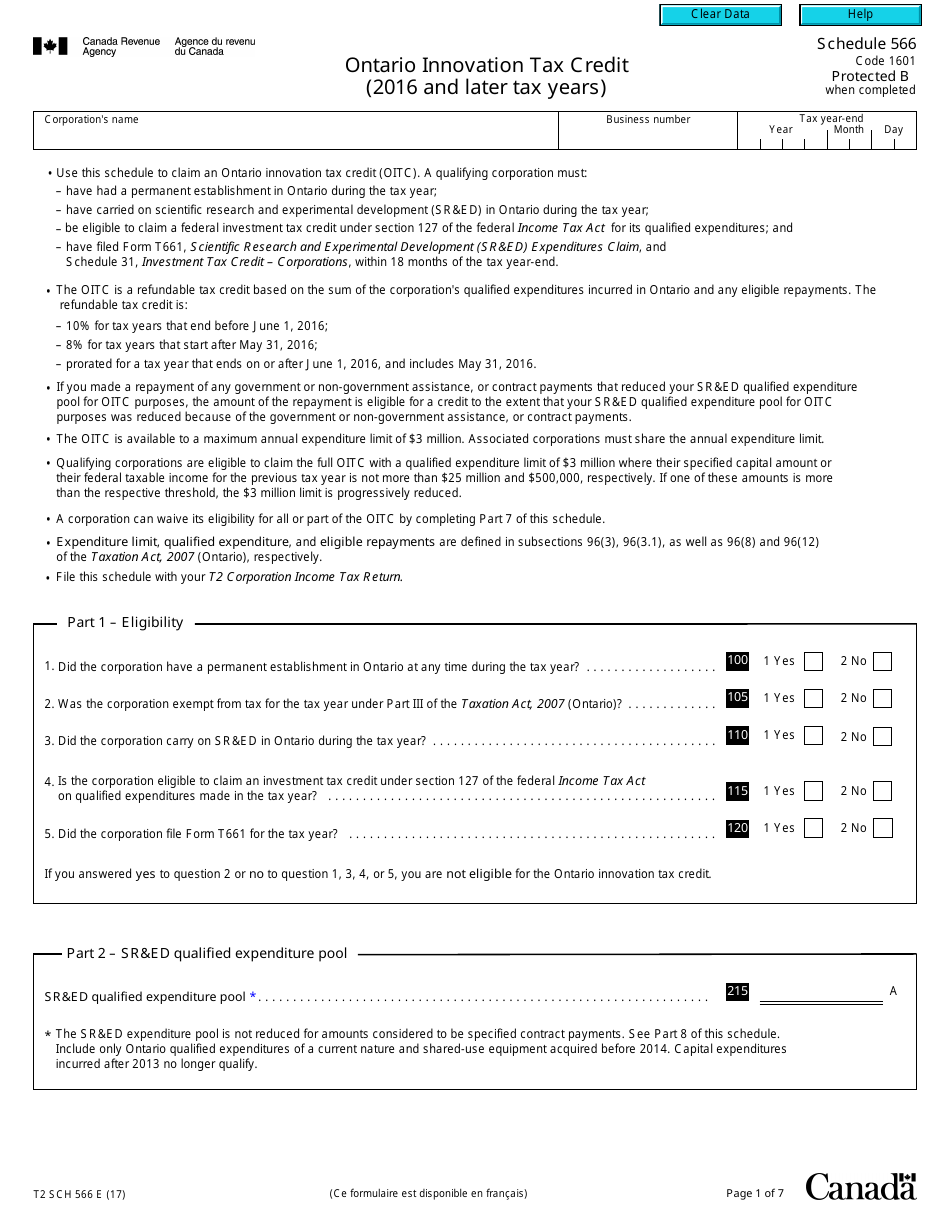

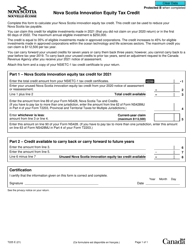

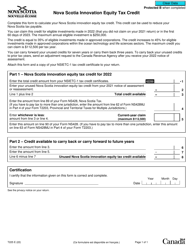

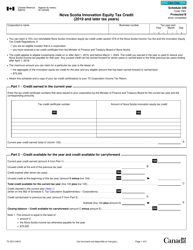

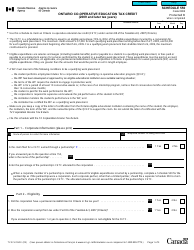

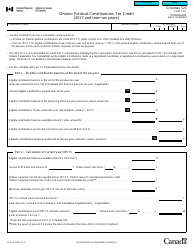

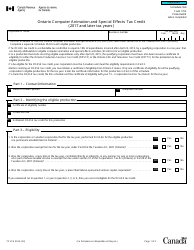

Form T2 Schedule 566 Ontario Innovation Tax Credit (2016 and Later Tax Years) - Canada

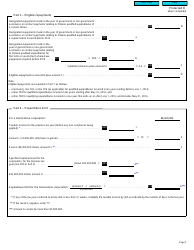

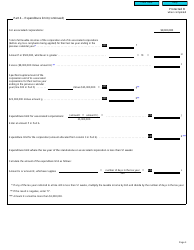

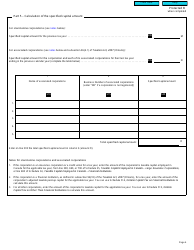

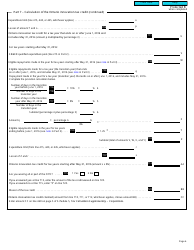

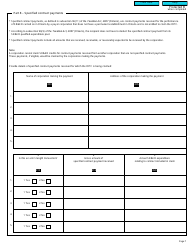

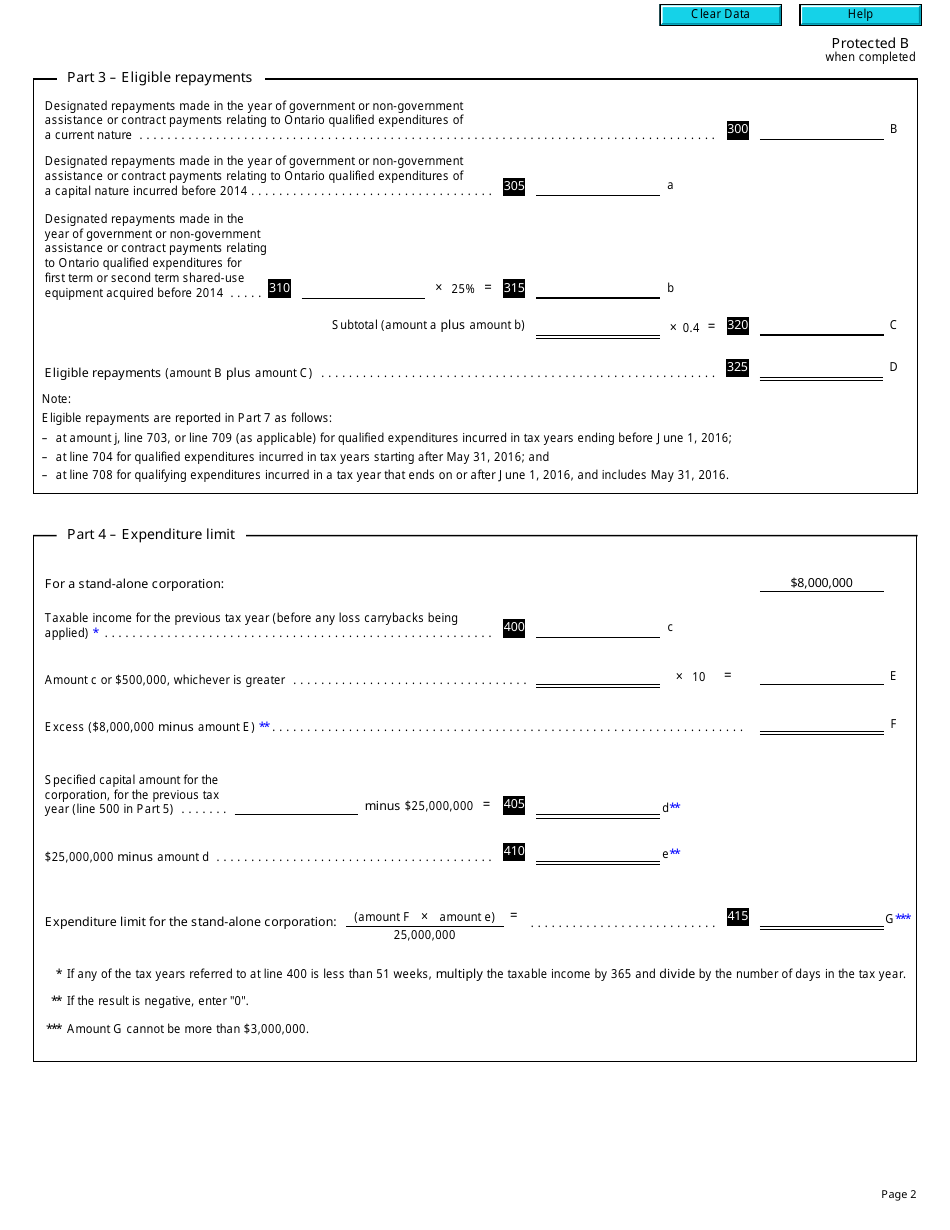

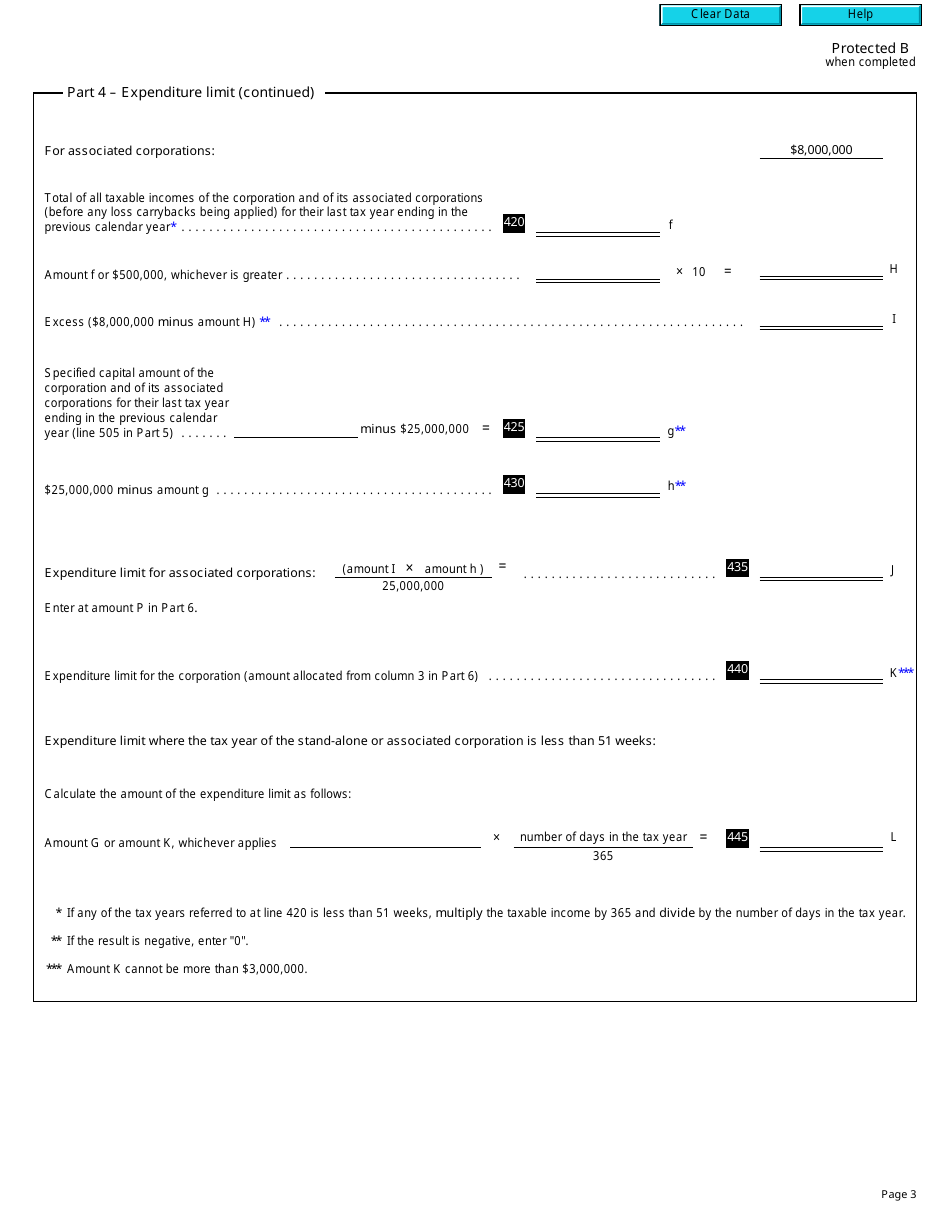

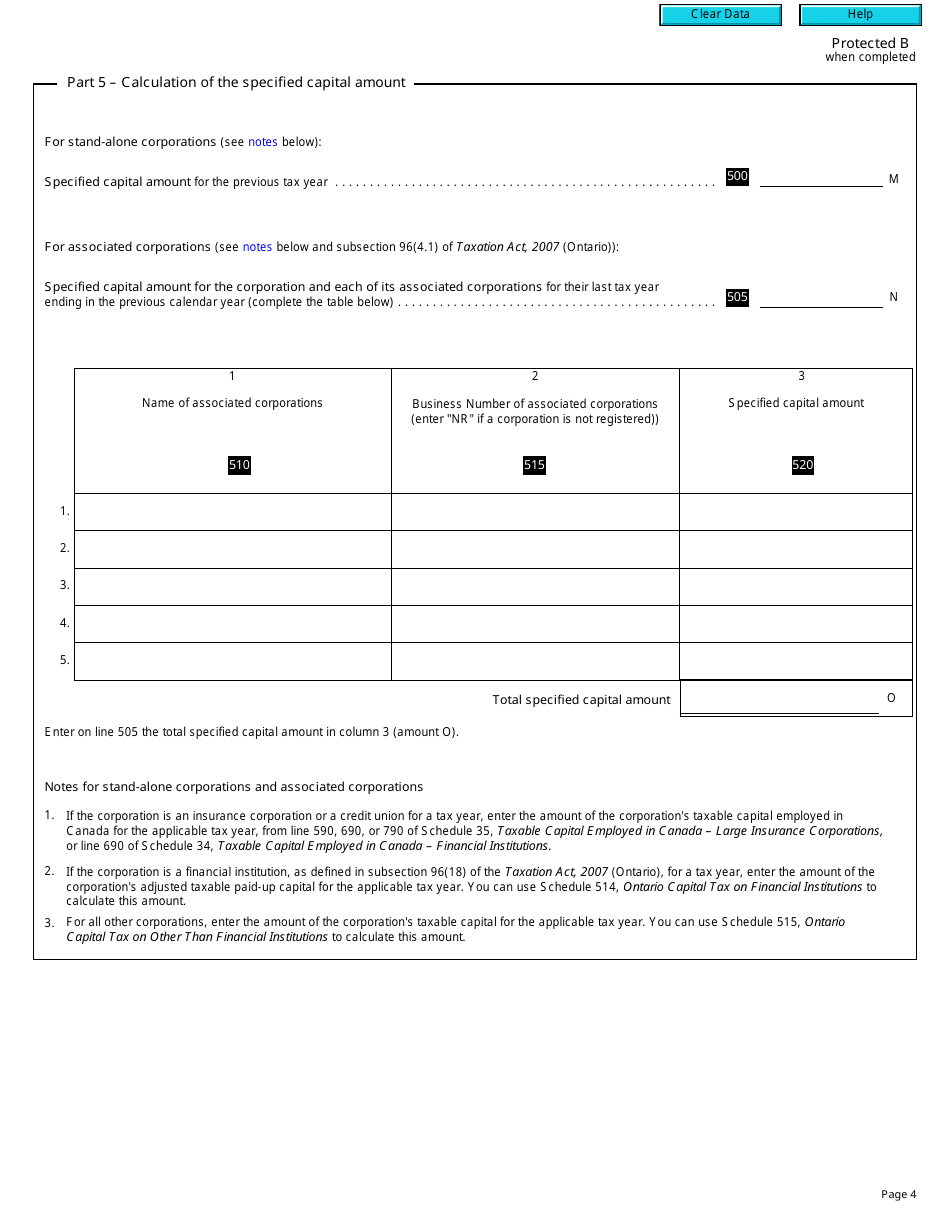

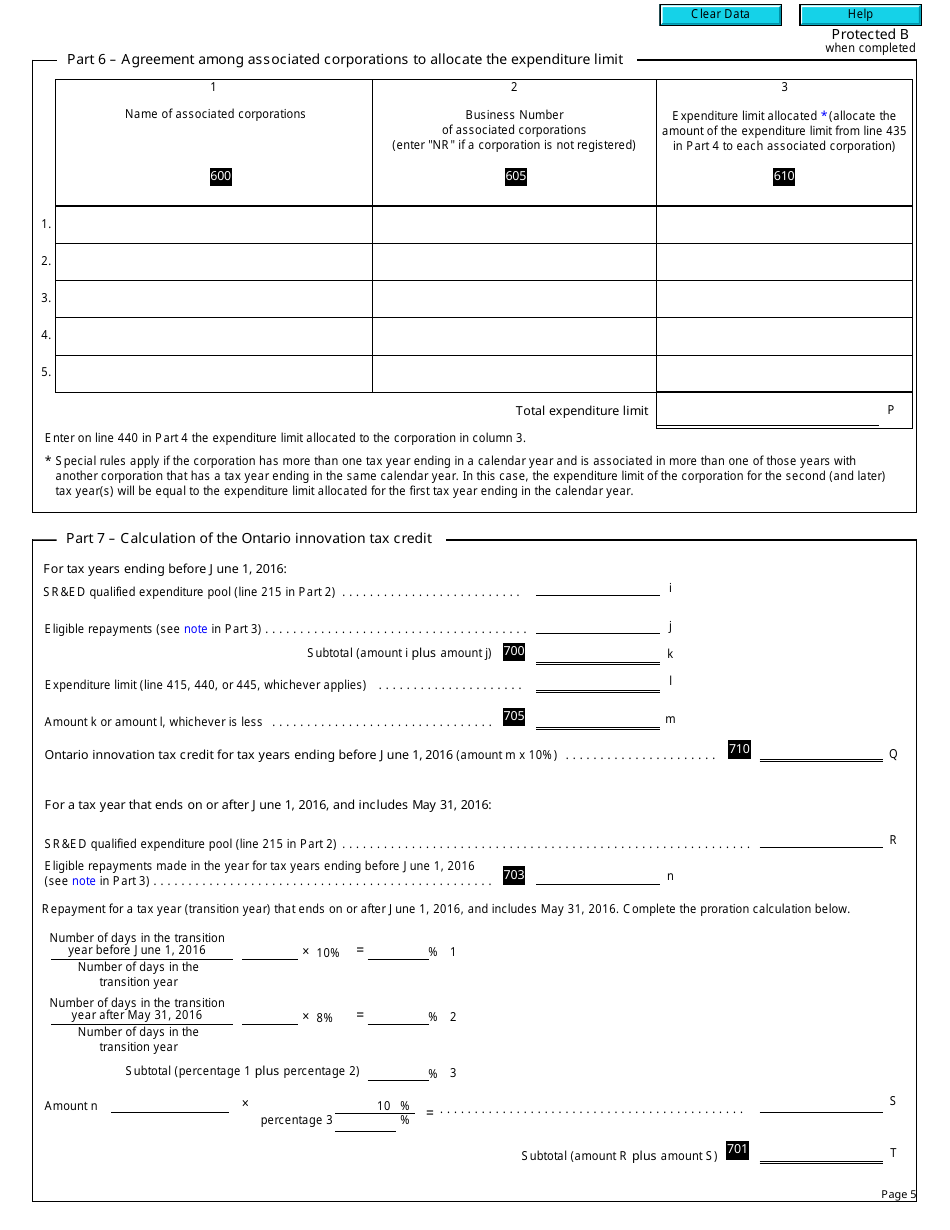

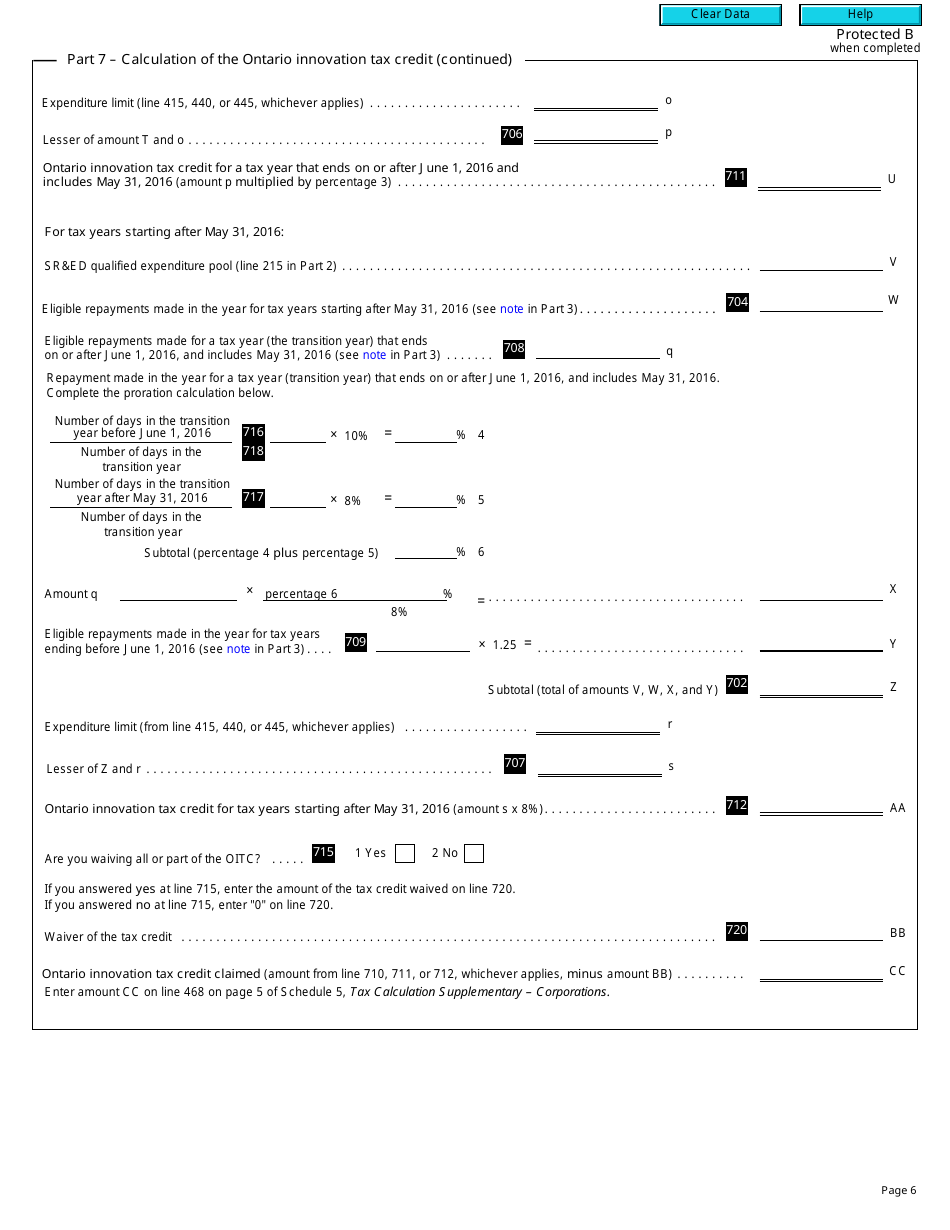

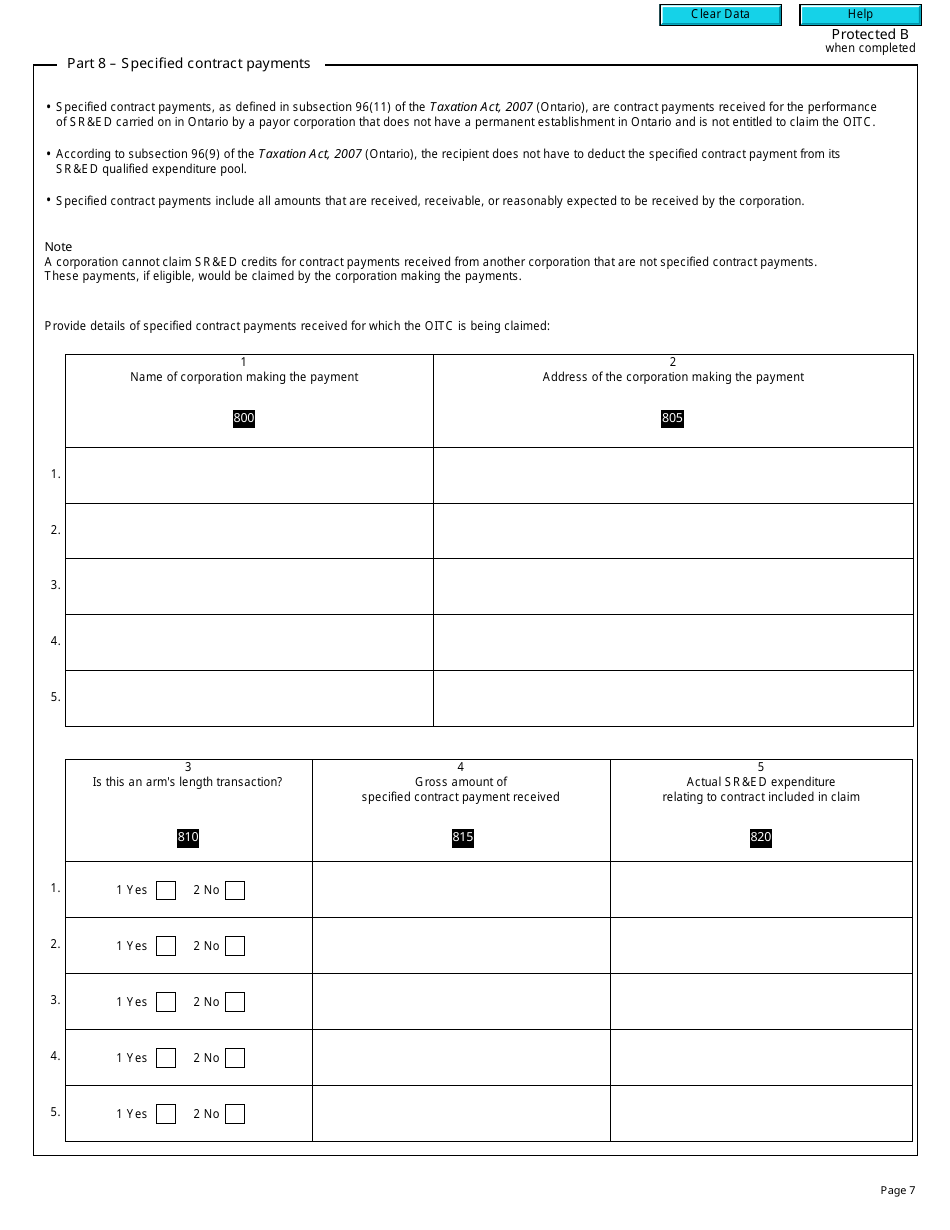

Form T2 Schedule 566 Ontario Innovation Tax Credit is used in Canada to claim the Ontario Innovation Tax Credit for the tax years 2016 and later. It allows eligible corporations in Ontario to claim a tax credit for their qualified expenditures related to scientific research and experimental development activities.

The Form T2 Schedule 566 Ontario Innovation Tax Credit is filed by corporations in Canada that meet the eligibility criteria for claiming the Ontario Innovation Tax Credit for tax years 2016 and onwards.

FAQ

Q: What is the T2 Schedule 566 Ontario Innovation Tax Credit?

A: The T2 Schedule 566 Ontario Innovation Tax Credit is a form used by Canadian corporations to claim the Ontario Innovation Tax Credit.

Q: Who can claim the Ontario Innovation Tax Credit?

A: Canadian corporations that meet certain criteria can claim the Ontario Innovation Tax Credit.

Q: What is the purpose of the Ontario Innovation Tax Credit?

A: The Ontario Innovation Tax Credit is designed to encourage research and development activities within the province.

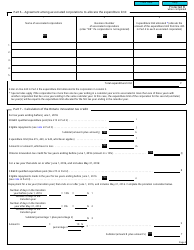

Q: What expenses qualify for the Ontario Innovation Tax Credit?

A: Qualifying expenses include eligible expenditures related to scientific research and experimental development activities.