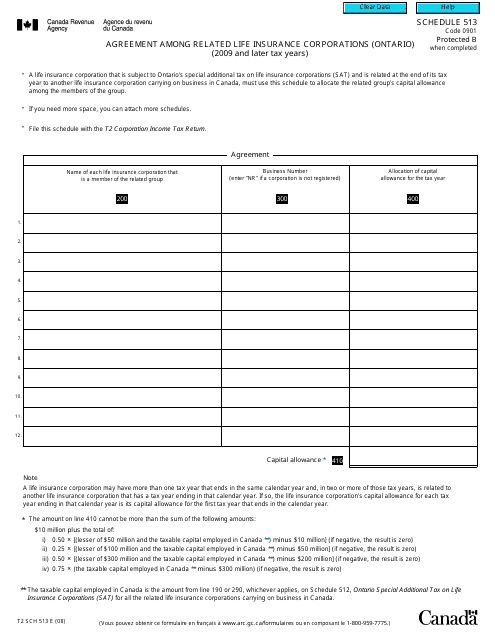

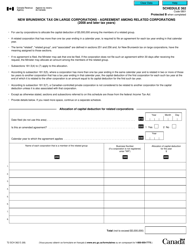

Form T2 Schedule 513 Agreement Among Related Life Insurance Corporations (Ontario) (2009 and Later Tax Years) - Canada

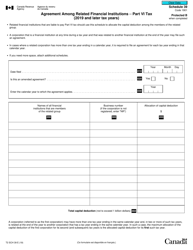

Form T2 Schedule 513 Agreement Among Related Life Insurance Corporations (Ontario) (2009 and Later Tax Years) is a specific form used in Canada for tax purposes. It is used by related life insurance corporations in Ontario to document any agreements or arrangements they have in place. These agreements could relate to the sharing of risk, assets, or other aspects of their business operations. The form helps to ensure compliance with tax laws and regulations.

The Form T2 Schedule 513 Agreement Among Related Life Insurance Corporations (Ontario) should be filed by Canadian life insurance corporations that are related to each other. This form is specifically for the tax years 2009 and later.

FAQ

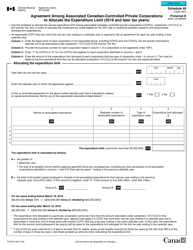

Q: What is Form T2 Schedule 513 Agreement Among Related Life Insurance Corporations?

A: Form T2 Schedule 513 Agreement Among Related Life Insurance Corporations is a tax form used by life insurance corporations in Ontario, Canada to report their agreements with related corporations.

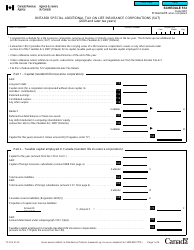

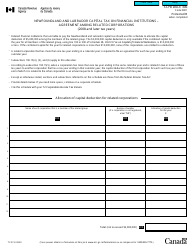

Q: What is the purpose of Form T2 Schedule 513?

A: The purpose of Form T2 Schedule 513 is to provide information about the agreements and transactions between related life insurance corporations in Ontario for tax assessment purposes.

Q: Who needs to file Form T2 Schedule 513?

A: Life insurance corporations operating in Ontario that have agreements with related corporations are required to file Form T2 Schedule 513 with their annual tax return.

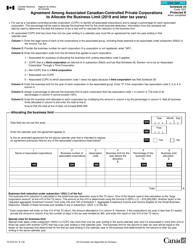

Q: What information is required on Form T2 Schedule 513?

A: Form T2 Schedule 513 requires information about the related corporations, the nature and terms of the agreements, and the transactions that occurred during the tax year.

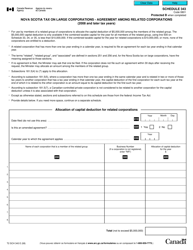

Q: When is the deadline to file Form T2 Schedule 513?

A: The deadline to file Form T2 Schedule 513 is the same as the deadline for the annual tax return of the life insurance corporation, which is generally six months after the end of the tax year.