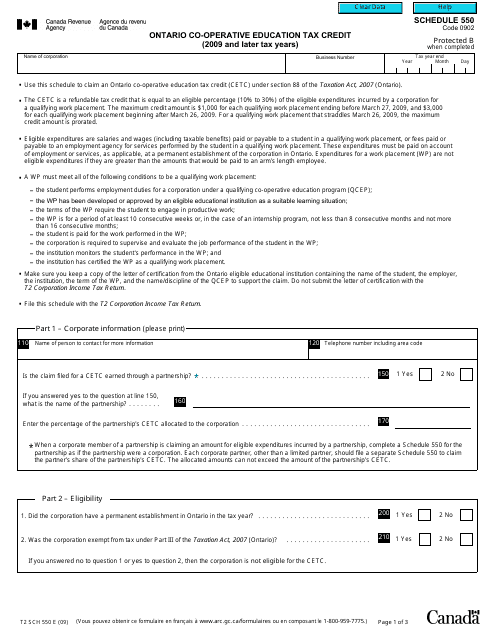

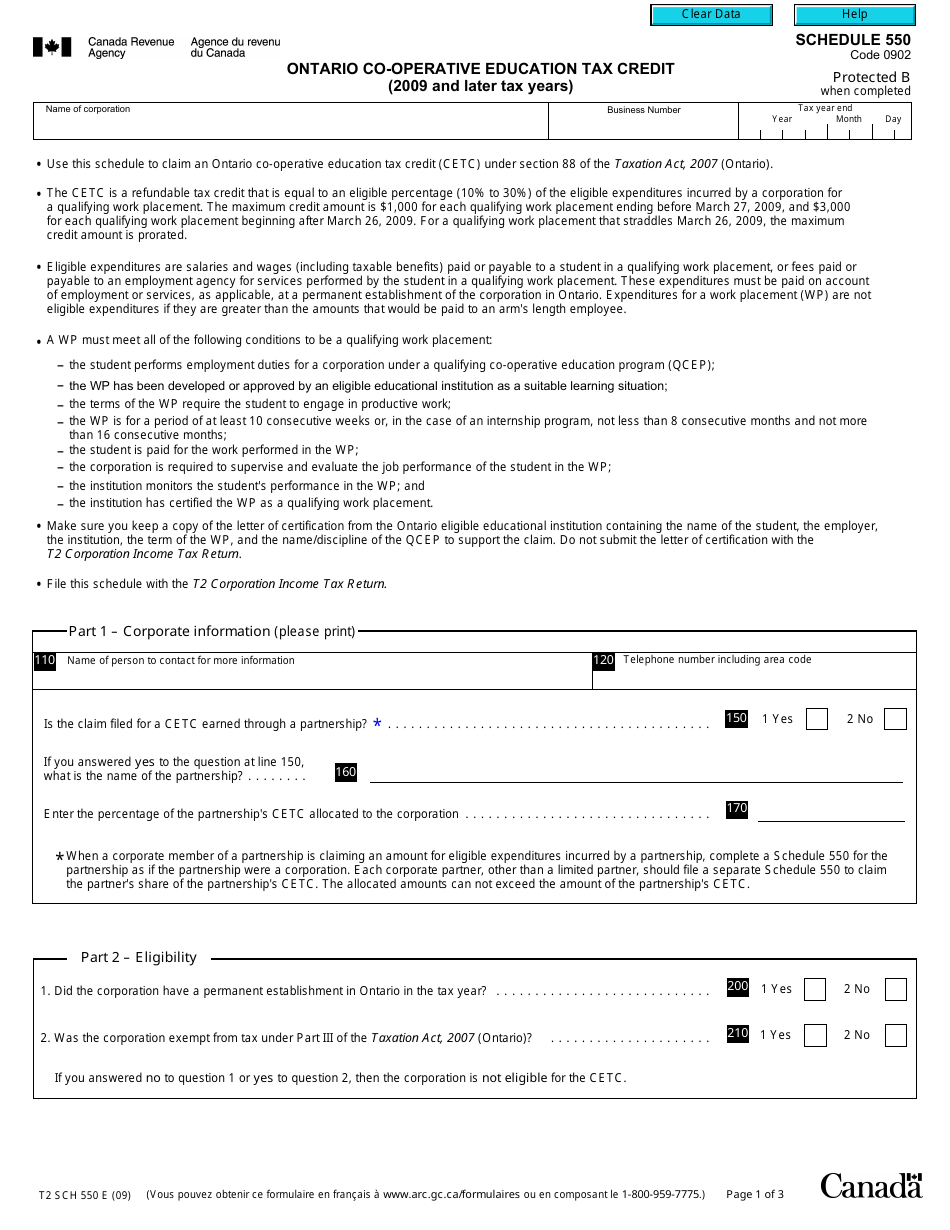

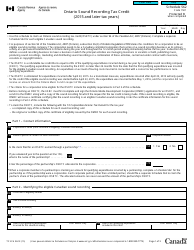

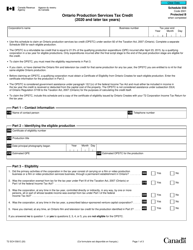

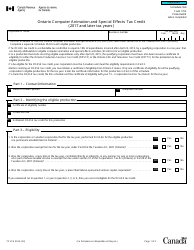

Form T2 Schedule 550 Ontario Co-operative Education Tax Credit (2009 and Later Tax Years) - Canada

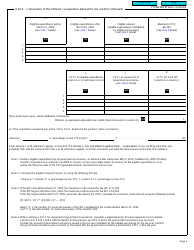

Form T2 Schedule 550 is used by businesses in Ontario, Canada, to claim the Ontario Co-operative Education Tax Credit for the tax years 2009 and later. This tax credit incentivizes businesses to hire co-op students by providing them with a tax credit based on eligible expenditures incurred during the co-op placements.

The Form T2 Schedule 550 Ontario Co-operative Education Tax Credit (2009 and Later Tax Years) is filed by corporations in Ontario, Canada.

FAQ

Q: What is the T2 Schedule 550 Ontario Co-operative Education Tax Credit?

A: The T2 Schedule 550 is a form used in Canada to claim the Ontario Co-operative Education Tax Credit.

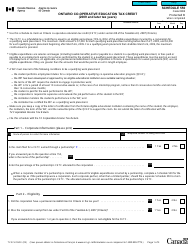

Q: Who is eligible for the Ontario Co-operative Education Tax Credit?

A: Eligible corporations in Ontario that hire students enrolled in approved co-operative education programs may be eligible for the tax credit.

Q: What is the purpose of the Ontario Co-operative Education Tax Credit?

A: The tax credit encourages corporations to hire students enrolled in co-operative education programs by providing a financial incentive.

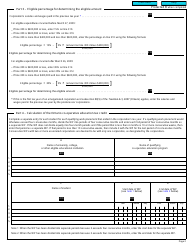

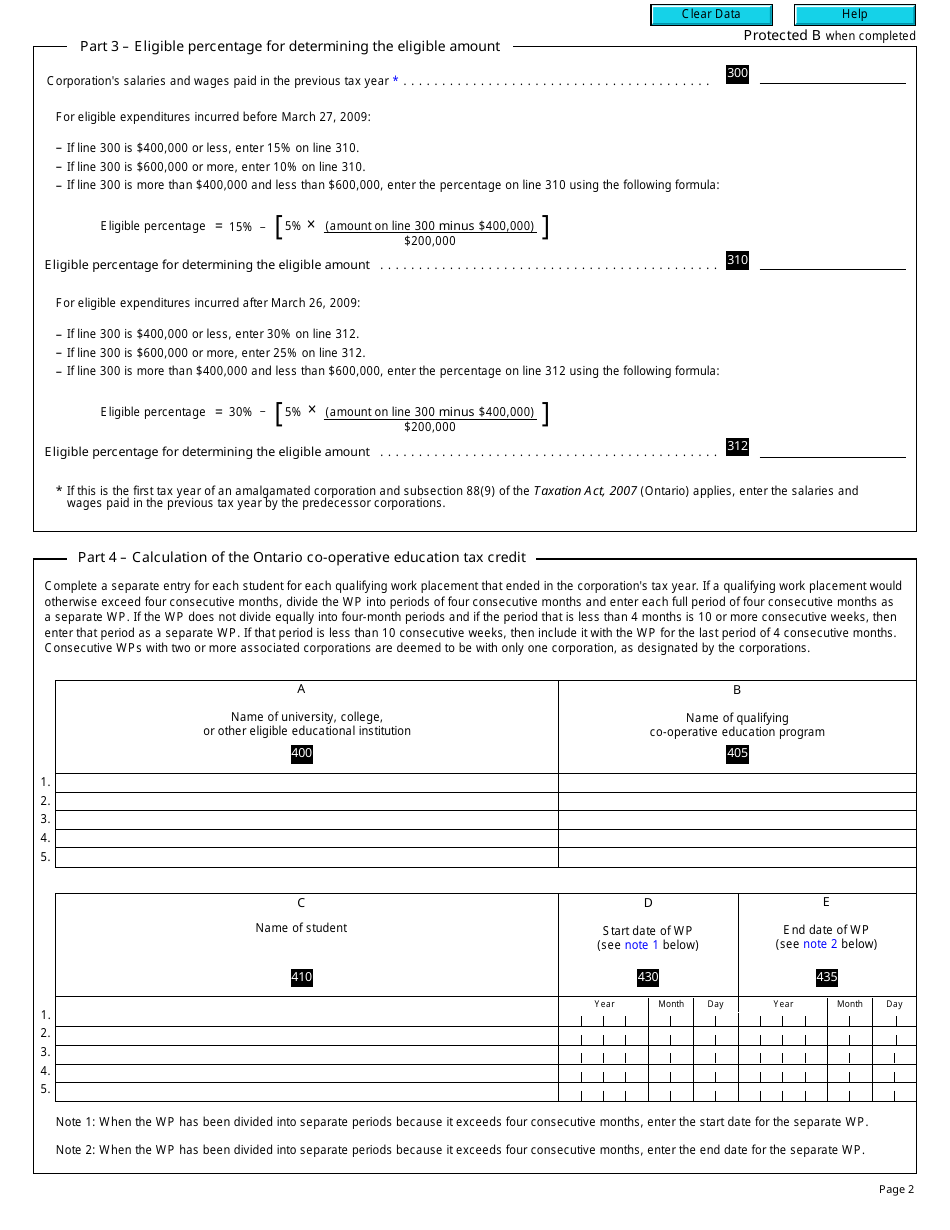

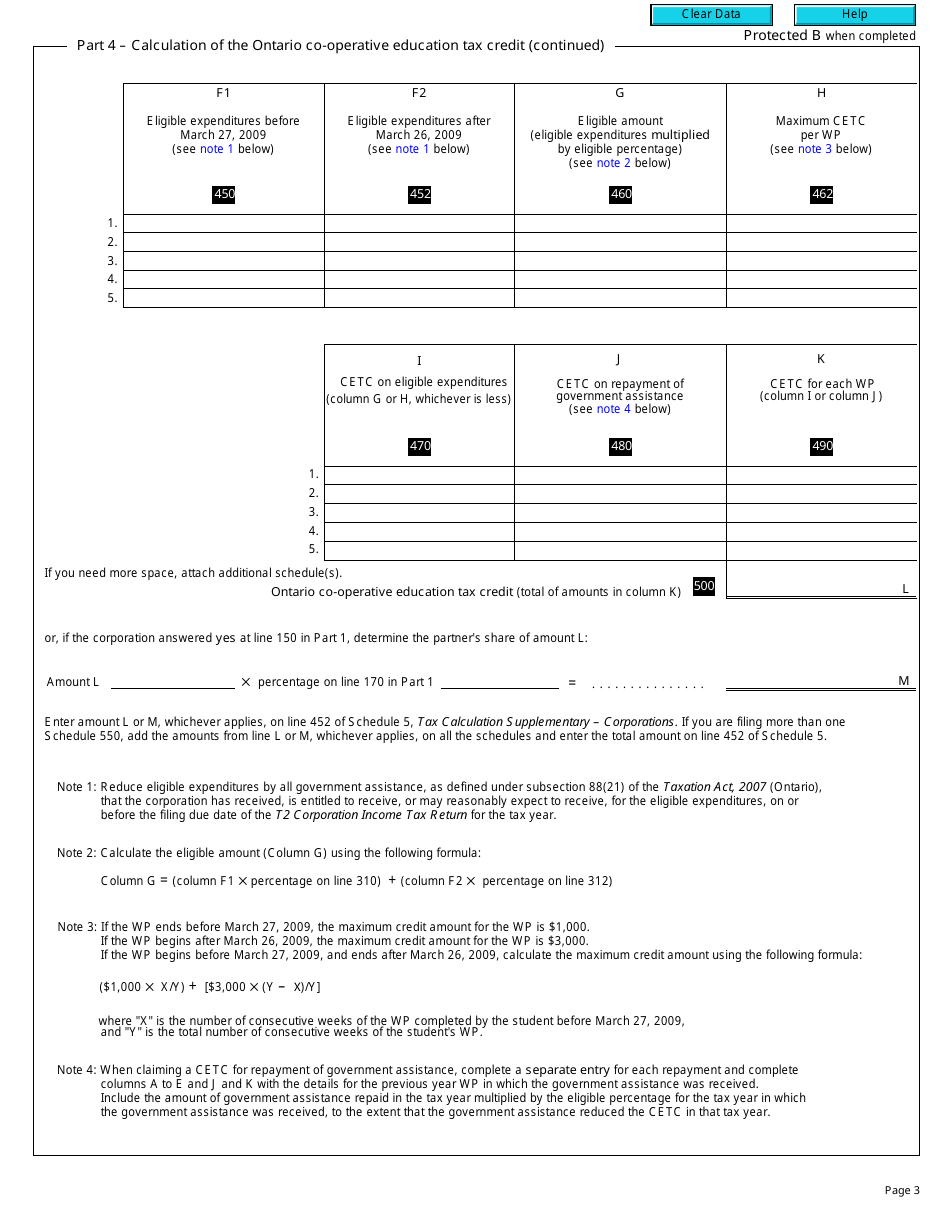

Q: What is the tax credit amount?

A: The tax credit is calculated as 25% of eligible expenditures.

Q: How is the Ontario Co-operative Education Tax Credit claimed?

A: The tax credit is claimed by completing and filing the T2 Schedule 550 form with the corporation's tax return.

Q: Are there any specific requirements for the co-operative education programs?

A: Yes, the co-operative education programs must be approved by the province of Ontario.

Q: Is there a limit to the amount of tax credit that can be claimed?

A: Yes, there is a limit of $3,000 per student per work placement.