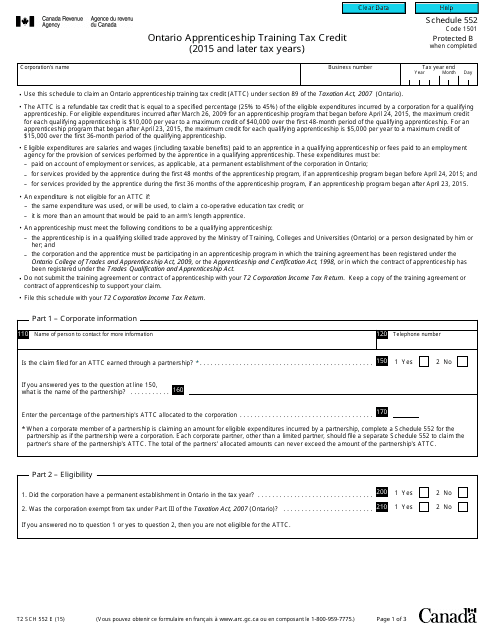

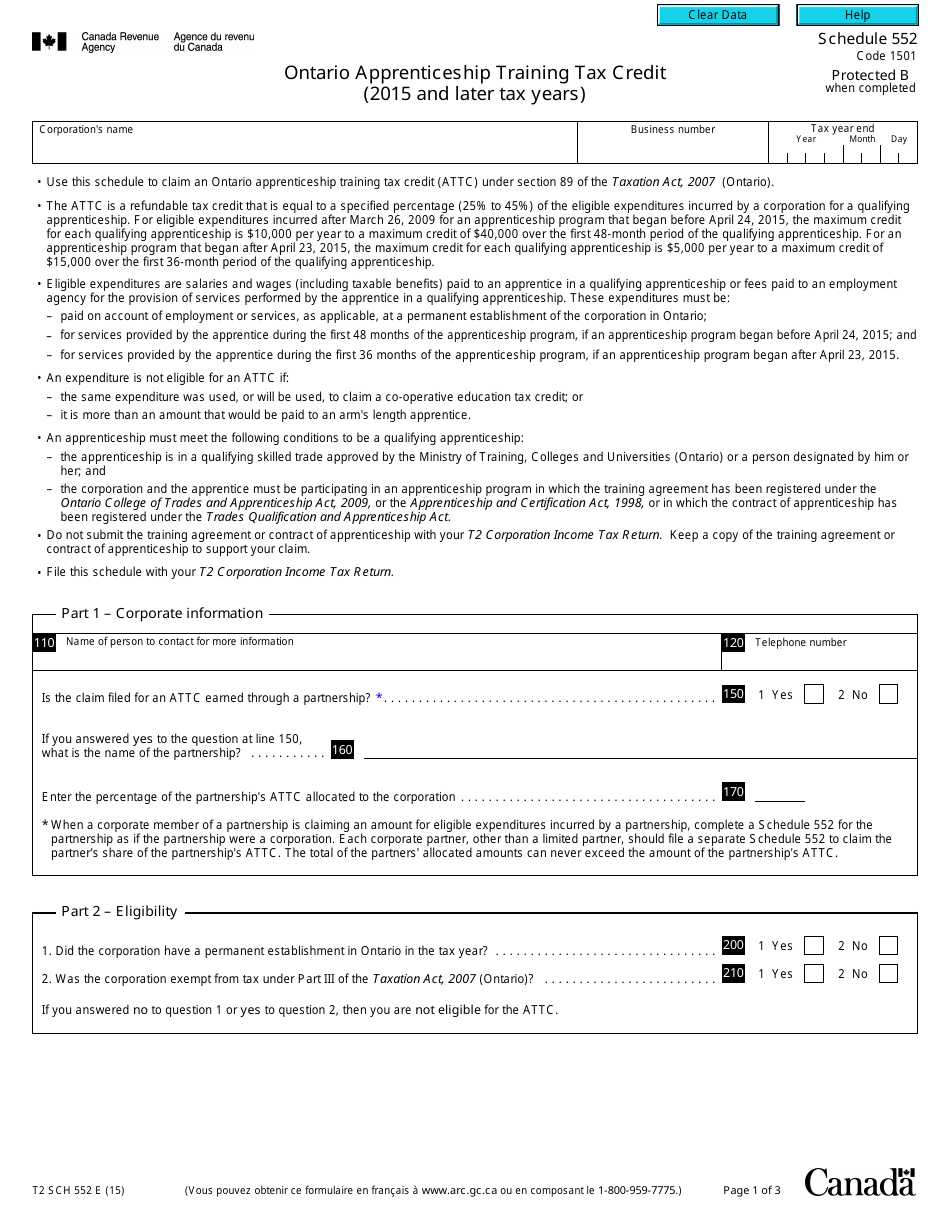

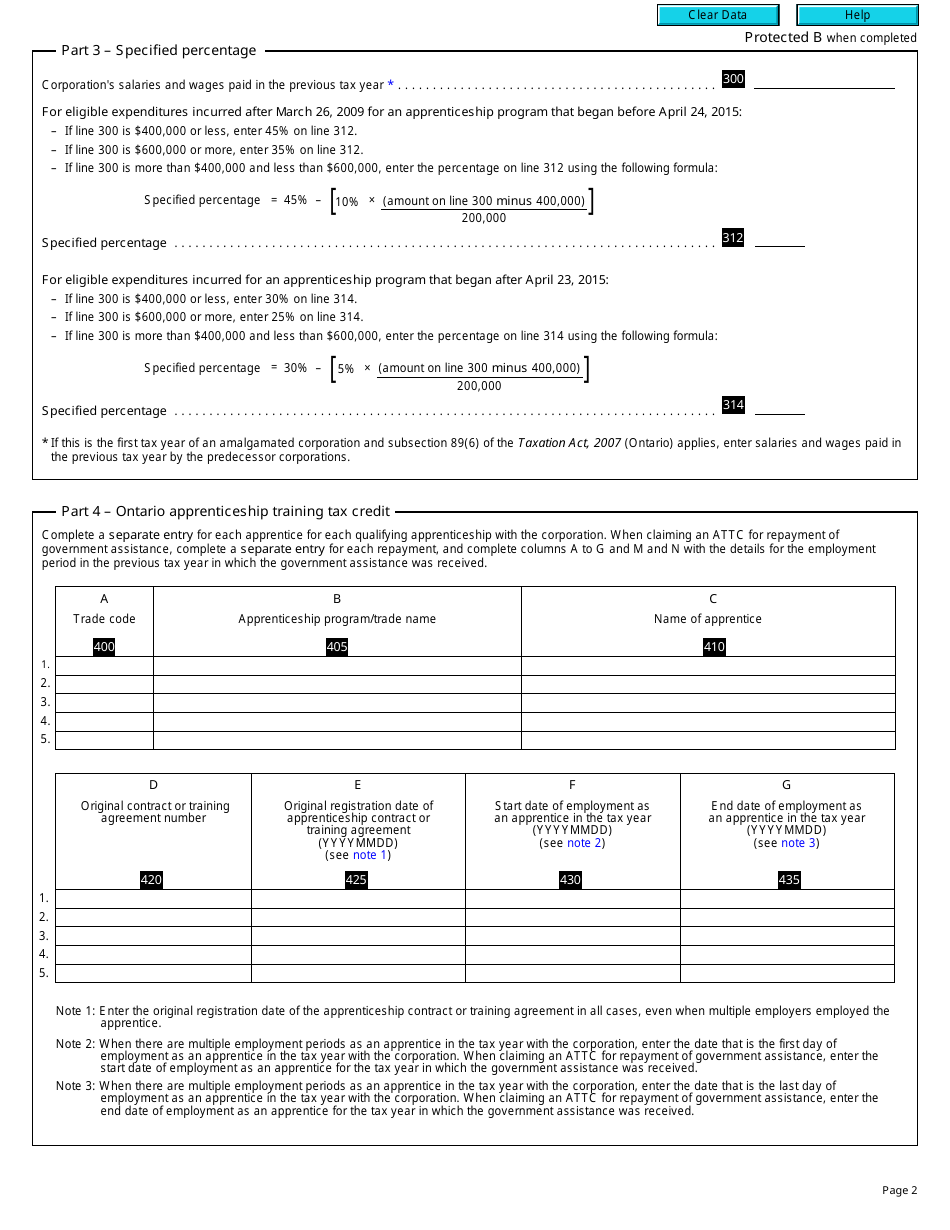

Form T2 Schedule 552 Ontario Apprenticeship Training Tax Credit (2015 and Later Tax Years) - Canada

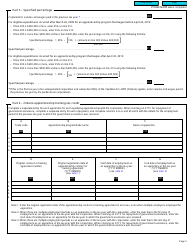

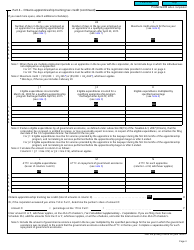

Form T2 Schedule 552 Ontario Apprenticeship Training Tax Credit is used in Canada for claiming the tax credit related to apprenticeship training expenses incurred in Ontario.

The Form T2 Schedule 552 Ontario Apprenticeship Training Tax Credit is filed by corporations in Canada.

FAQ

Q: What is Form T2 Schedule 552?

A: Form T2 Schedule 552 is a tax form used in Canada for claiming the Ontario Apprenticeship Training Tax Credit.

Q: What is the Ontario Apprenticeship Training Tax Credit?

A: The Ontario Apprenticeship Training Tax Credit is a tax credit available to businesses in Ontario that hire and train apprentices.

Q: Who can claim the Ontario Apprenticeship Training Tax Credit?

A: Businesses in Ontario that hire and train apprentices are eligible to claim the Ontario Apprenticeship Training Tax Credit.

Q: Can individuals claim the Ontario Apprenticeship Training Tax Credit?

A: No, only businesses in Ontario can claim the Ontario Apprenticeship Training Tax Credit.

Q: What are the tax years for which Form T2 Schedule 552 is applicable?

A: Form T2 Schedule 552 is applicable for tax years 2015 and later.

Q: Is the Ontario Apprenticeship Training Tax Credit a refundable tax credit?

A: No, the Ontario Apprenticeship Training Tax Credit is a non-refundable tax credit, meaning it can only be used to reduce the amount of taxes owed.

Q: Can businesses claim the Ontario Apprenticeship Training Tax Credit for both full-time and part-time apprentices?

A: Yes, businesses can claim the Ontario Apprenticeship Training Tax Credit for both full-time and part-time apprentices.