This version of the form is not currently in use and is provided for reference only. Download this version of

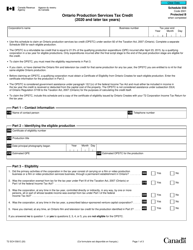

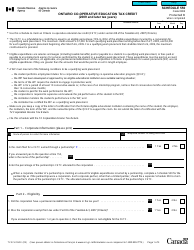

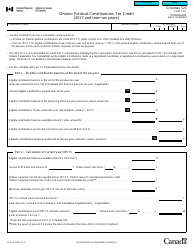

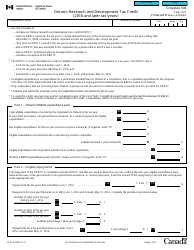

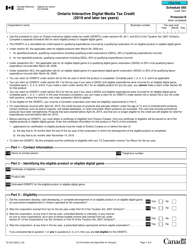

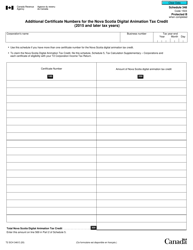

Form T2 Schedule 554

for the current year.

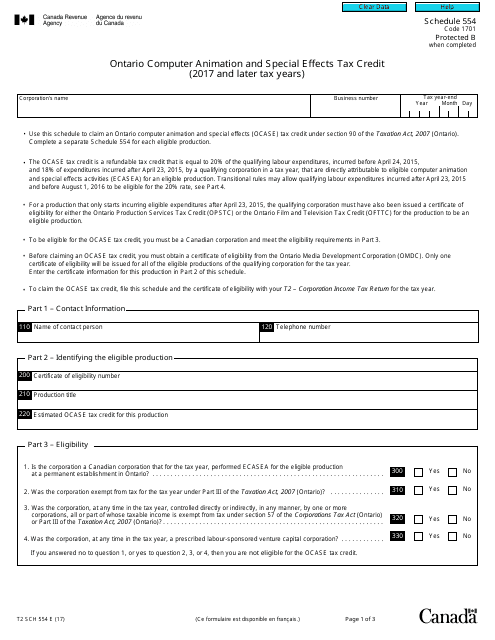

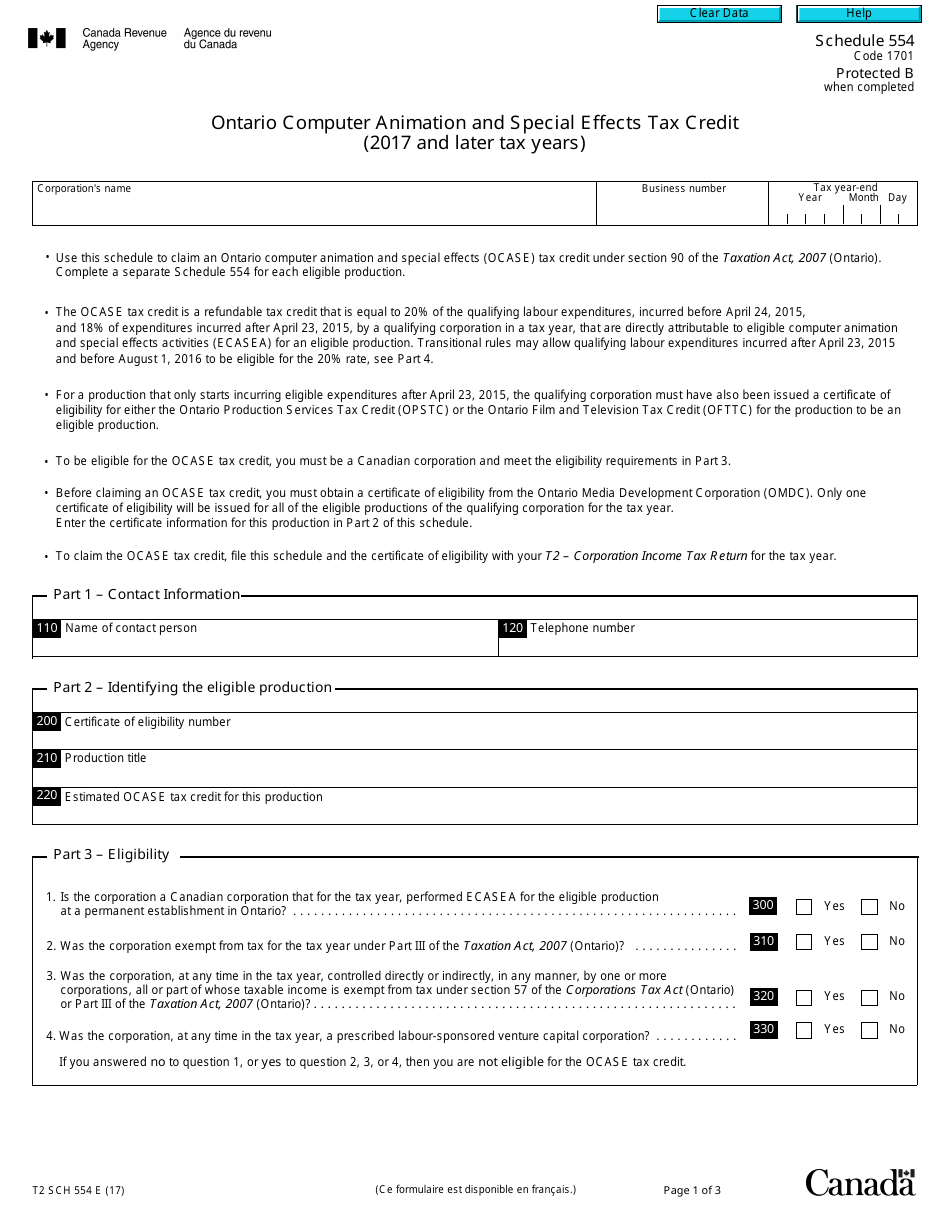

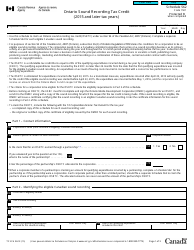

Form T2 Schedule 554 Ontario Computer Animation and Special Effects Tax Credit (2017 and Later Tax Years) - Canada

Form T2 Schedule 554 is used for claiming the Ontario Computer Animation and Special EffectsTax Credit in Canada for the tax years 2017 and later. This credit is available to eligible corporations engaged in computer animation and special effects activities in Ontario.

The Form T2 Schedule 554 Ontario Computer Animation and Special Effects Tax Credit in Canada is filed by eligible corporations operating in the province of Ontario.

FAQ

Q: What is the T2 Schedule 554?

A: The T2 Schedule 554 is a tax form in Canada that is used to claim the Ontario Computer Animation and Special Effects Tax Credit.

Q: What is the Ontario Computer Animation and Special Effects Tax Credit?

A: The Ontario Computer Animation and Special Effects Tax Credit is a tax credit in Canada that is available to corporations engaged in computer animation and special effects activities in Ontario.

Q: Who is eligible for the Ontario Computer Animation and Special Effects Tax Credit?

A: Corporations that carry out computer animation and special effects activities in Ontario are generally eligible for this tax credit.

Q: What is the purpose of the Ontario Computer Animation and Special Effects Tax Credit?

A: The purpose of this tax credit is to encourage and support the growth of the computer animation and special effects industry in Ontario.

Q: How do I claim the Ontario Computer Animation and Special Effects Tax Credit?

A: To claim this tax credit, you must complete and file the T2 Schedule 554 along with your corporate tax return.

Q: When can I claim the Ontario Computer Animation and Special Effects Tax Credit?

A: You can claim this tax credit for eligible expenditures incurred in tax years beginning on or after January 1, 2017.

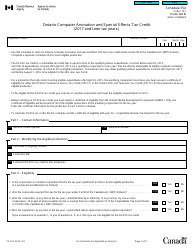

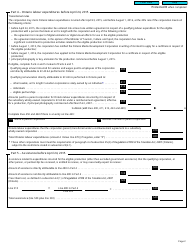

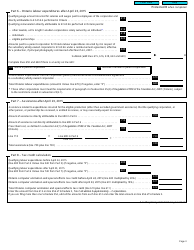

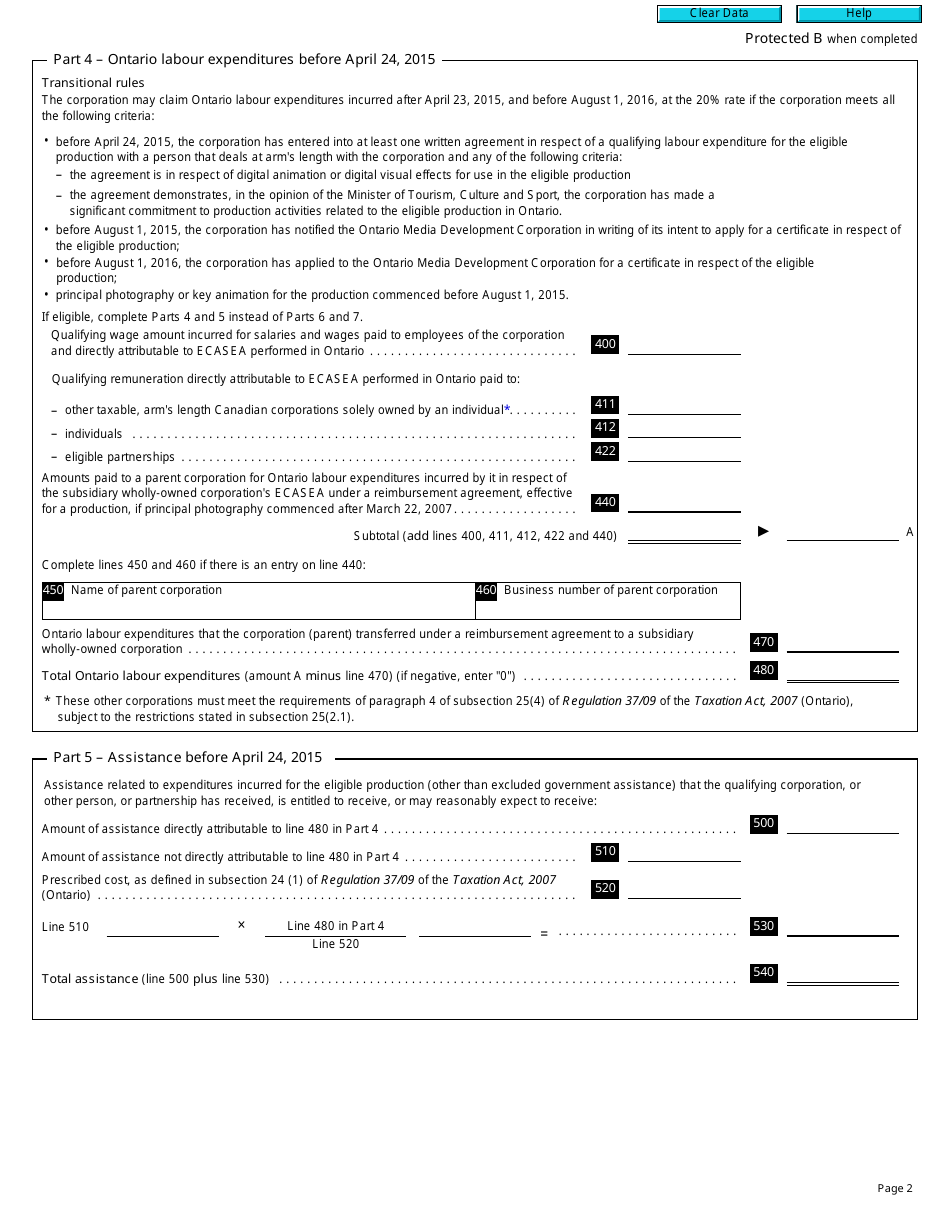

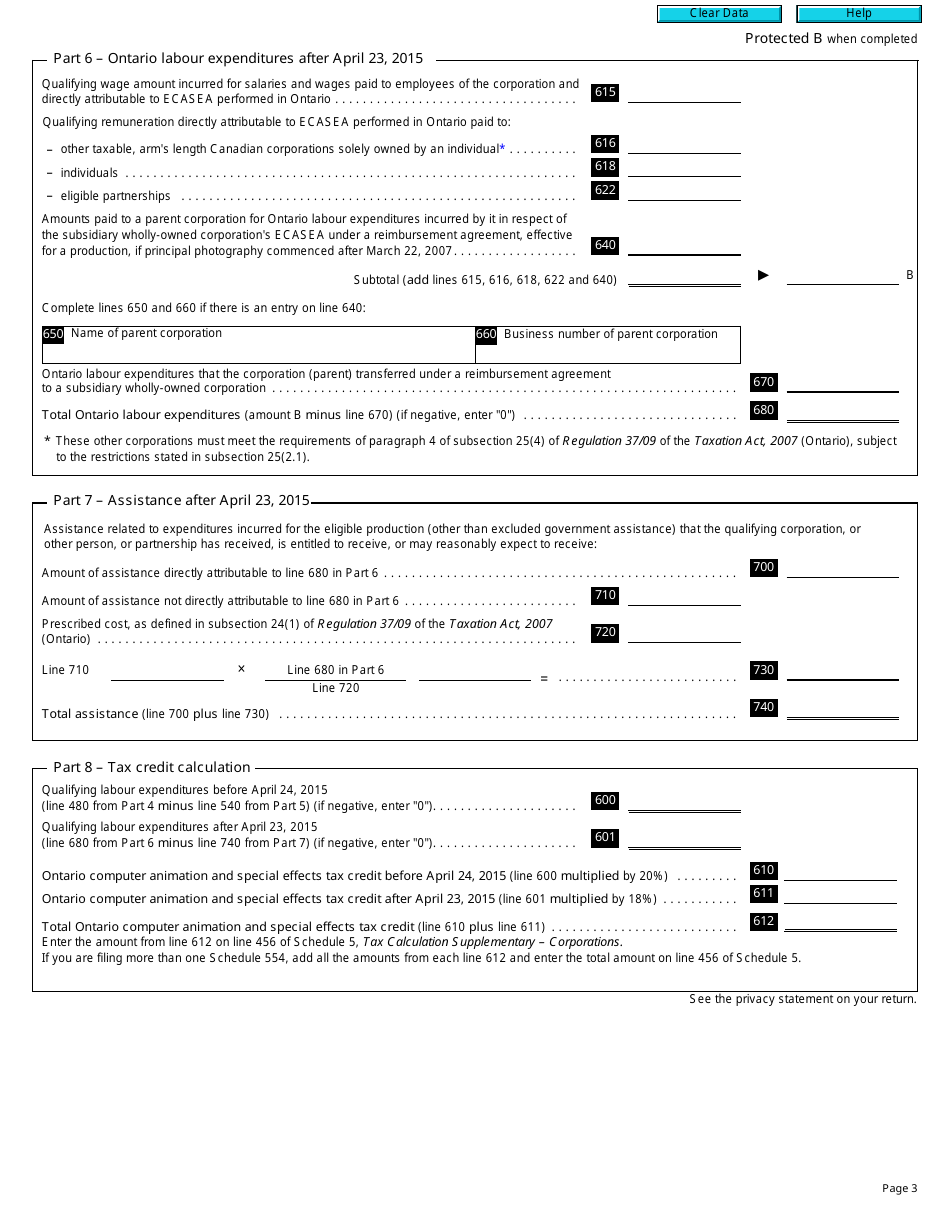

Q: What expenses qualify for the Ontario Computer Animation and Special Effects Tax Credit?

A: Eligible expenses for this tax credit include labor, animation and visual effects production costs, and certain computer system expenses.

Q: Is there a limit to the amount of the Ontario Computer Animation and Special Effects Tax Credit that can be claimed?

A: Yes, there is a limit to the amount of this tax credit that can be claimed. The credit is generally equal to 18% of eligible expenses, but there may be specific limitations depending on the tax year.

Q: Are there any other requirements to claim the Ontario Computer Animation and Special Effects Tax Credit?

A: Yes, in addition to meeting the eligibility criteria and completing the T2 Schedule 554, there may be other requirements such as maintaining proper documentation and providing supporting information.