This version of the form is not currently in use and is provided for reference only. Download this version of

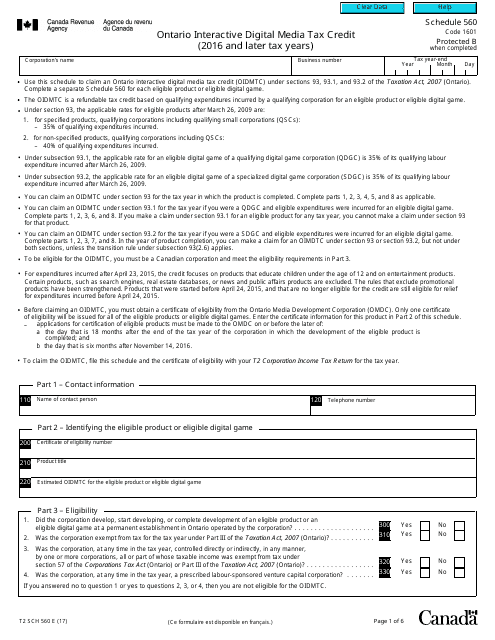

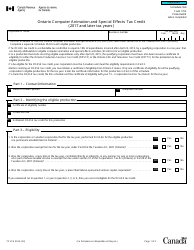

Form T2 Schedule 560

for the current year.

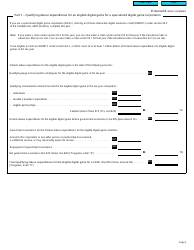

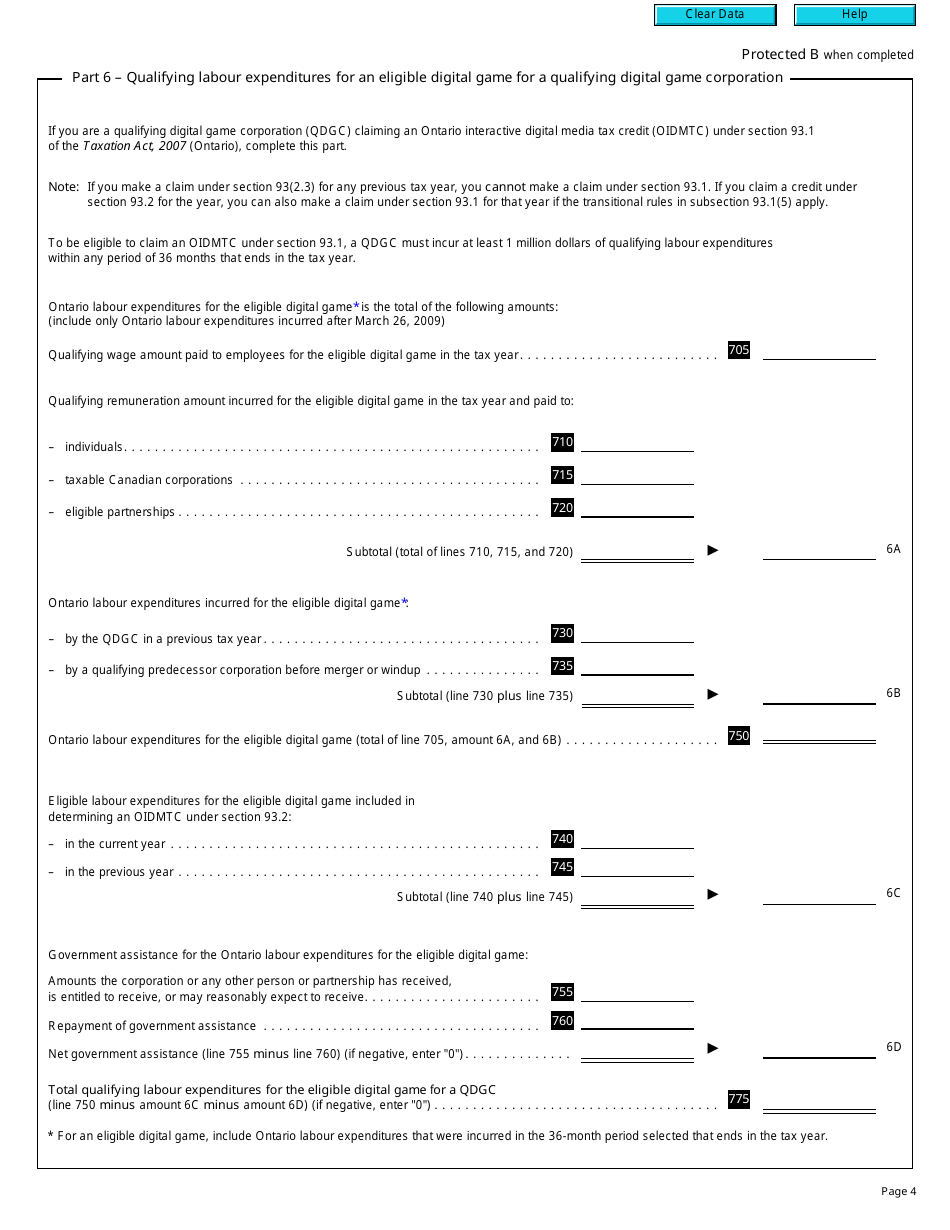

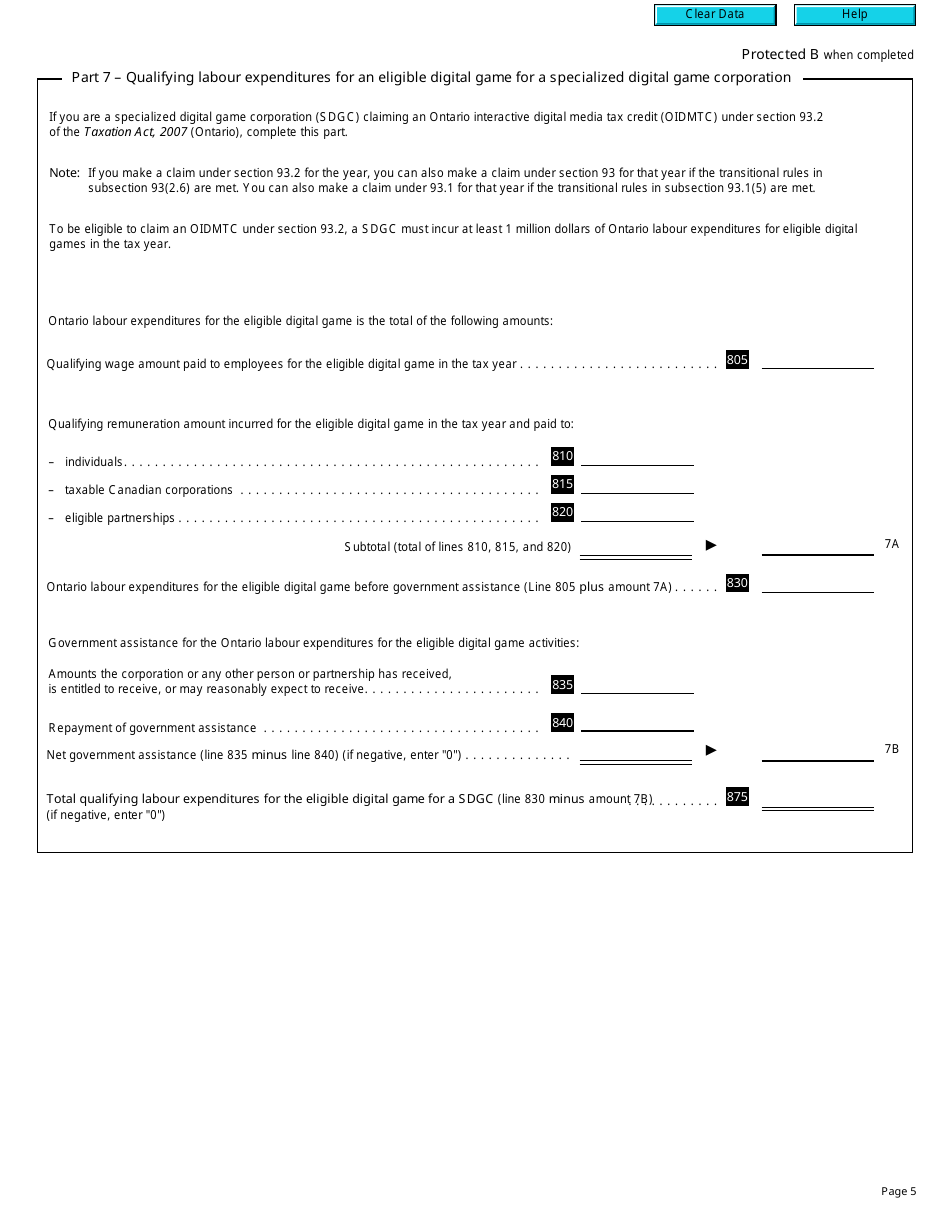

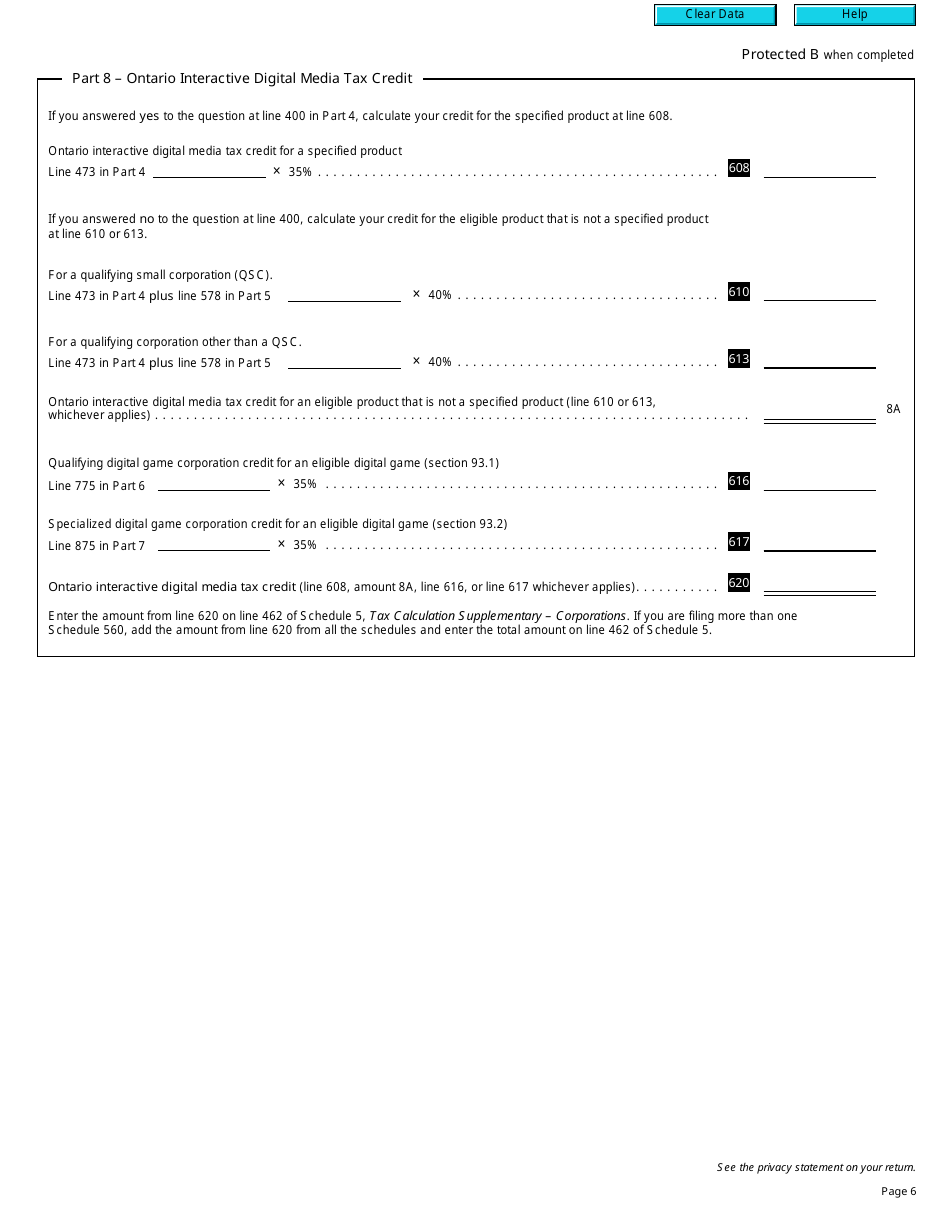

Form T2 Schedule 560 Ontario Interactive Digital Media Tax Credit (2016 and Later Tax Years) - Canada

Form T2 Schedule 560 Ontario Interactive Digital MediaTax Credit is used by Canadian corporations to claim the Ontario Interactive Digital Media Tax Credit for tax years 2016 and later. It is designed to encourage the development of interactive digital media products in Ontario.

The Form T2 Schedule 560 Ontario Interactive Digital Media Tax Credit is filed by corporations in Canada that are eligible for the tax credit.

FAQ

Q: What is Form T2 Schedule 560?

A: Form T2 Schedule 560 is a form used in Canada for claiming the Ontario Interactive Digital Media Tax Credit.

Q: What is the Ontario Interactive Digital Media Tax Credit?

A: The Ontario Interactive Digital Media Tax Credit is a tax credit offered to companies that produce interactive digital media products in Ontario.

Q: Who is eligible to claim the Ontario Interactive Digital Media Tax Credit?

A: Companies that develop interactive digital media products in Ontario may be eligible to claim this tax credit.

Q: What is the purpose of the tax credit?

A: The tax credit is designed to promote the development and growth of the interactive digital media industry in Ontario.

Q: When can this tax credit be claimed?

A: This tax credit can be claimed for the 2016 and later tax years.

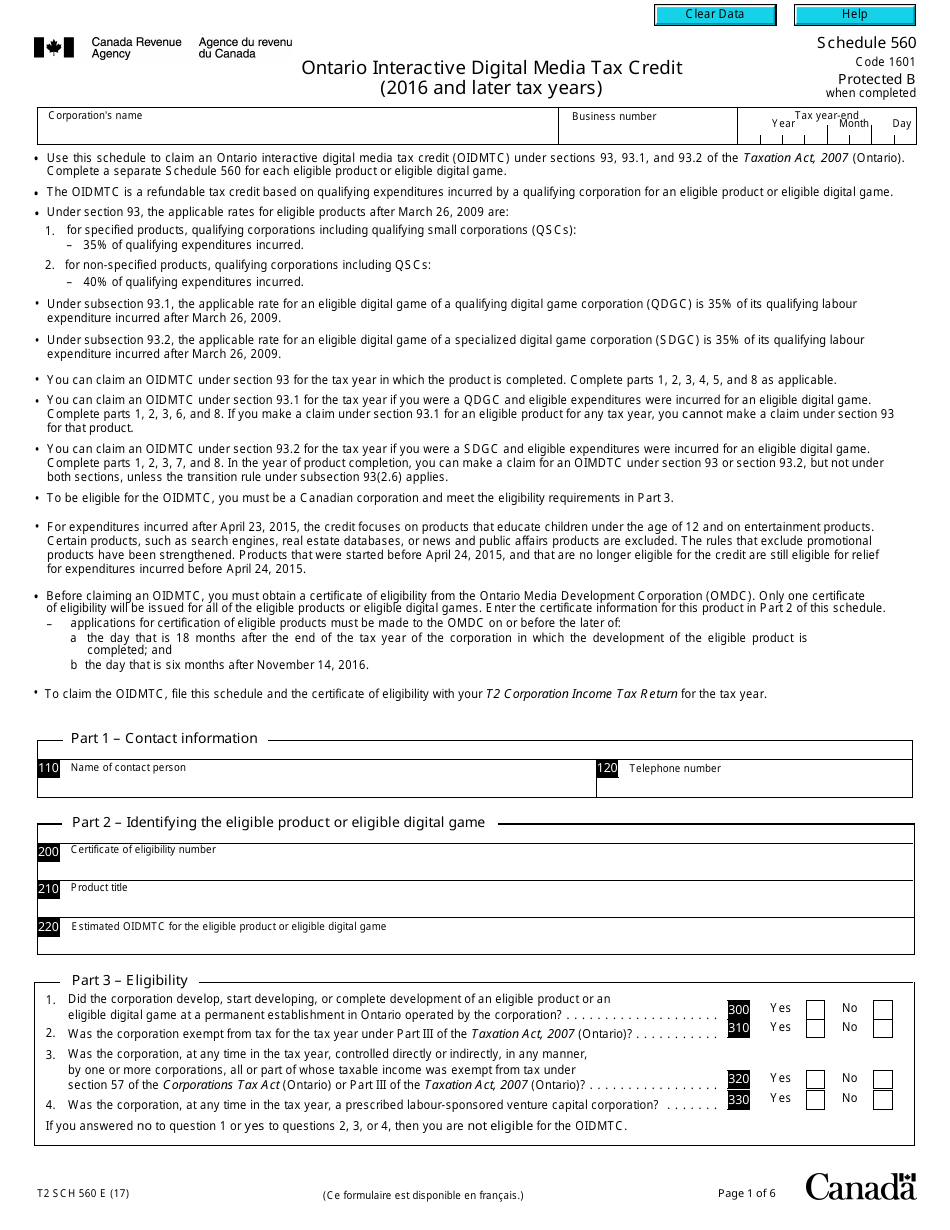

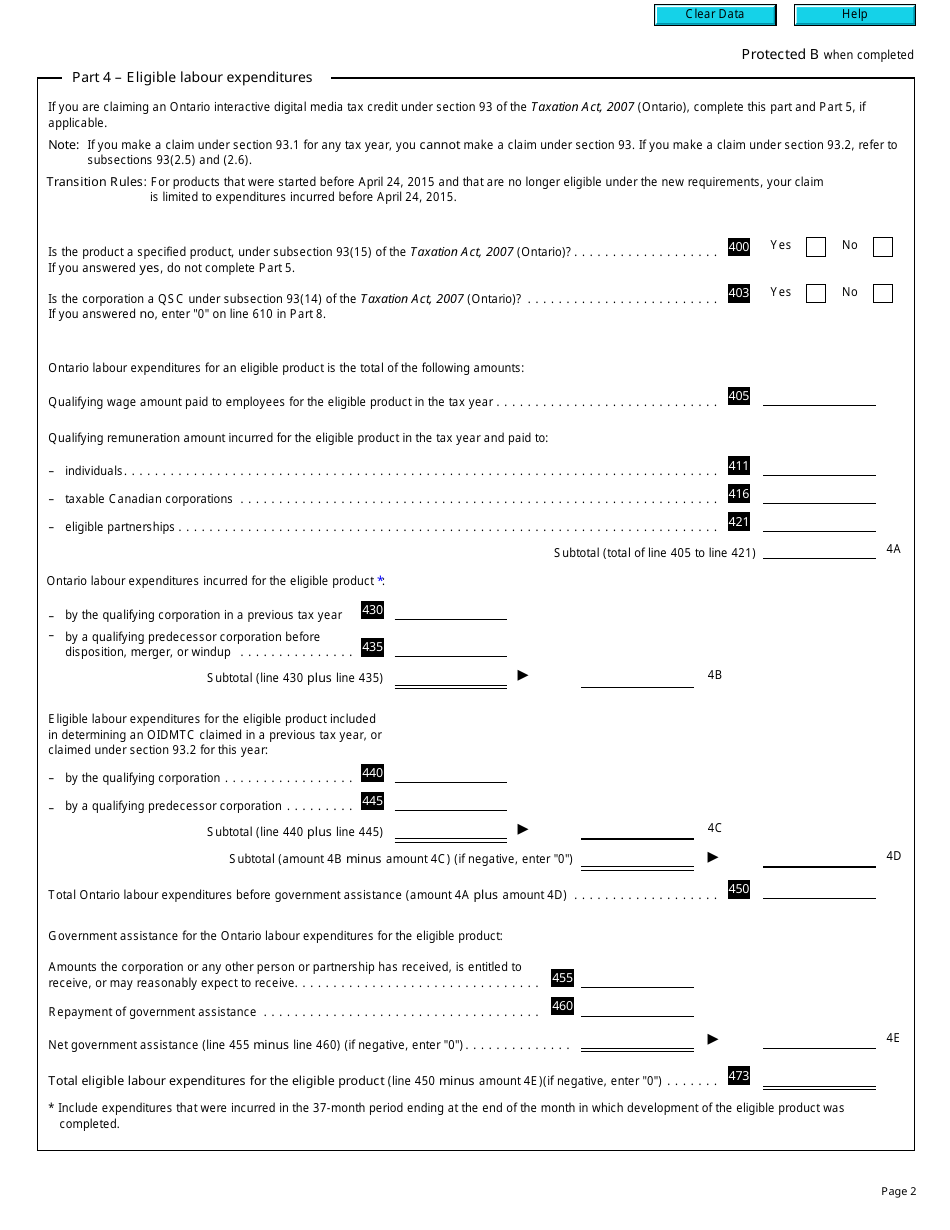

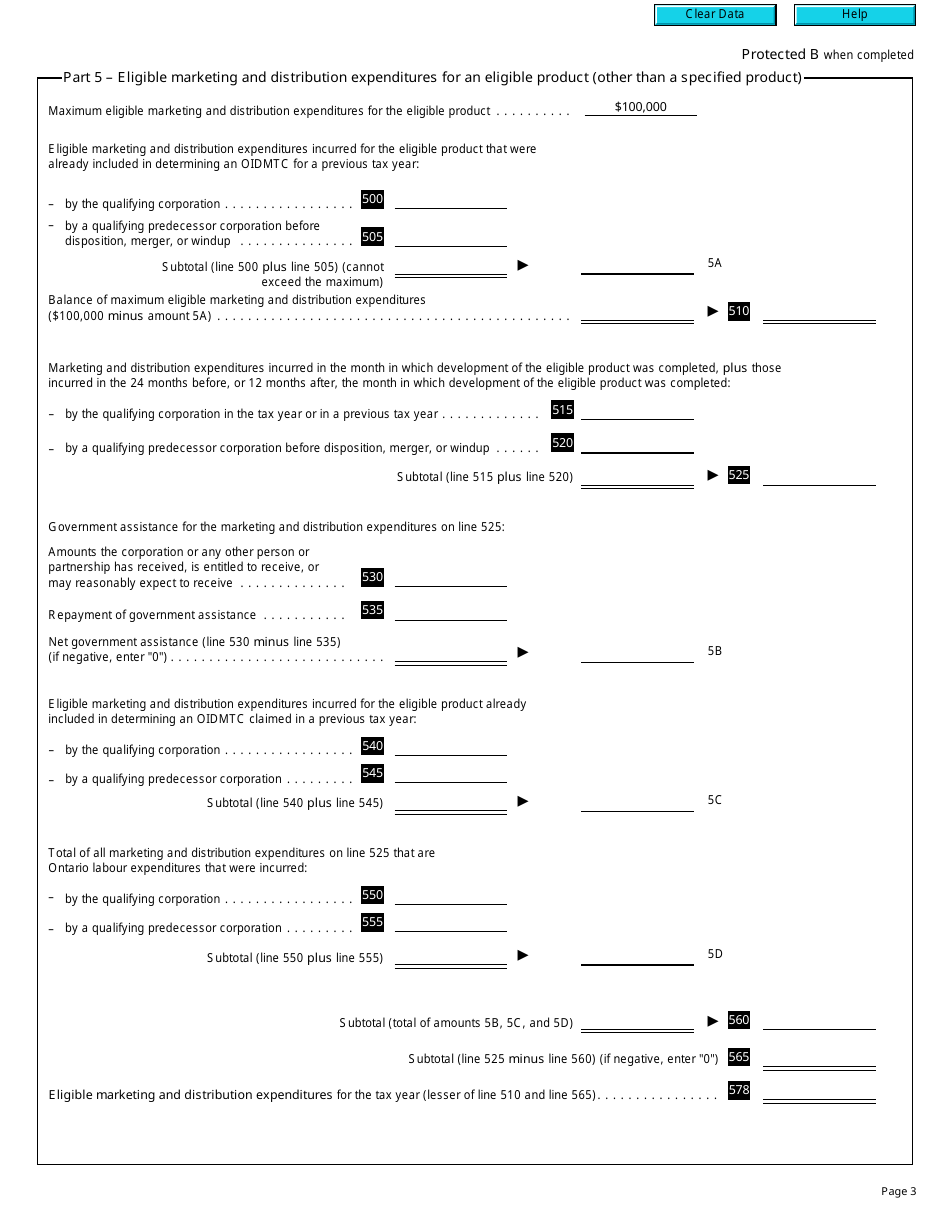

Q: What documents or information do I need to complete Form T2 Schedule 560?

A: You will need to gather information about the interactive digital media products developed in Ontario, including project descriptions and production costs.

Q: Is there a deadline for filing Form T2 Schedule 560?

A: The deadline for filing this form is typically the same as the deadline for filing the corporate tax return in Canada, which is usually six months after the end of the corporation's tax year.