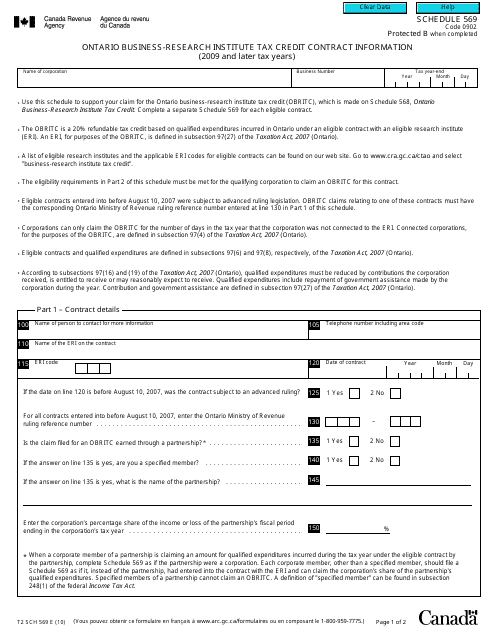

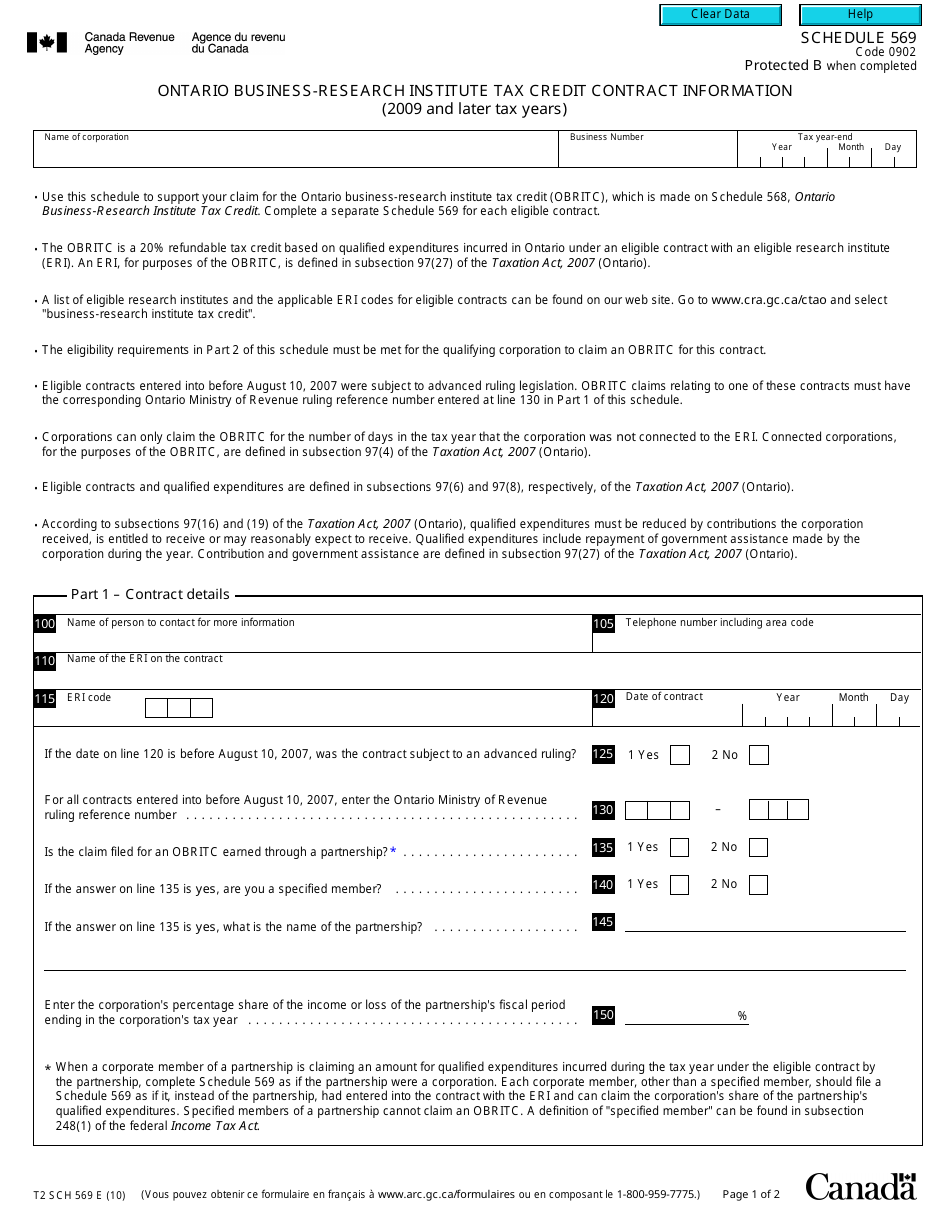

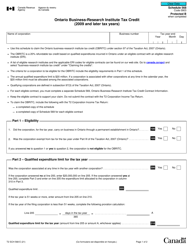

Form T2 Schedule 569 Ontario Business-Research Institute Tax Credit Contract Information (2009 and Later Tax Years) - Canada

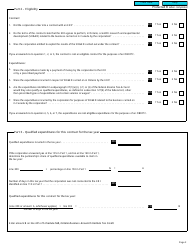

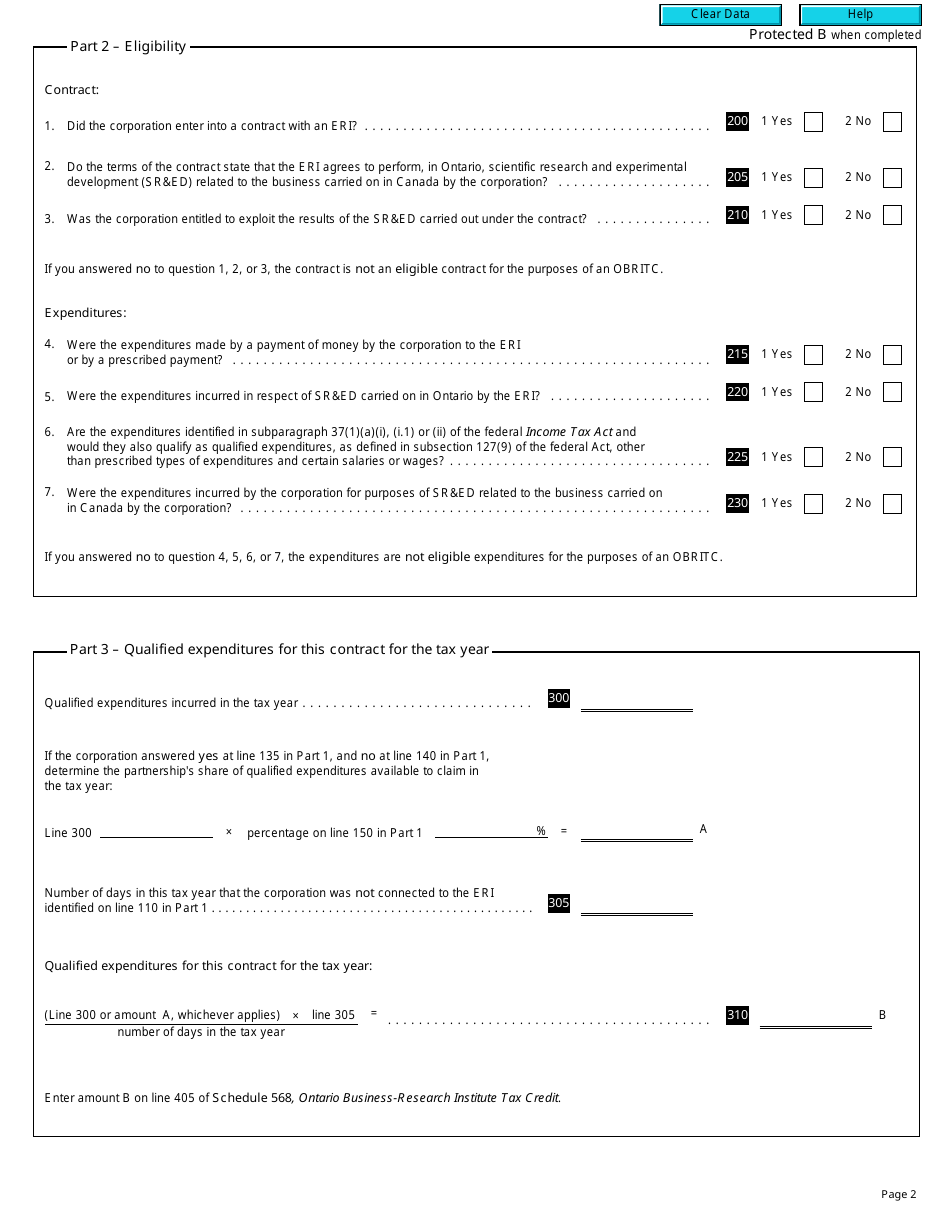

The Form T2 Schedule 569 is used in Canada to provide contract information for the Ontario Business-Research Institute Tax Credit for tax years 2009 and later. This form is used by corporations to claim the tax credit for eligible research and development expenditures incurred under contracts with qualifying business research institutes in Ontario.

The Form T2 Schedule 569 Ontario Business-Research Institute Tax Credit Contract Information is filed by corporations in Canada.

FAQ

Q: What is Form T2 Schedule 569?

A: Form T2 Schedule 569 is a tax form in Canada used to provide contract information for the Ontario Business-Research Institute Tax Credit.

Q: What is the purpose of Form T2 Schedule 569?

A: The purpose of Form T2 Schedule 569 is to claim the Ontario Business-Research Institute Tax Credit.

Q: Who should use Form T2 Schedule 569?

A: Companies and organizations in Canada that are claiming the Ontario Business-Research Institute Tax Credit should use Form T2 Schedule 569.

Q: What tax years does Form T2 Schedule 569 apply to?

A: Form T2 Schedule 569 applies to tax years starting from 2009 and onwards.