This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2 Schedule 6

for the current year.

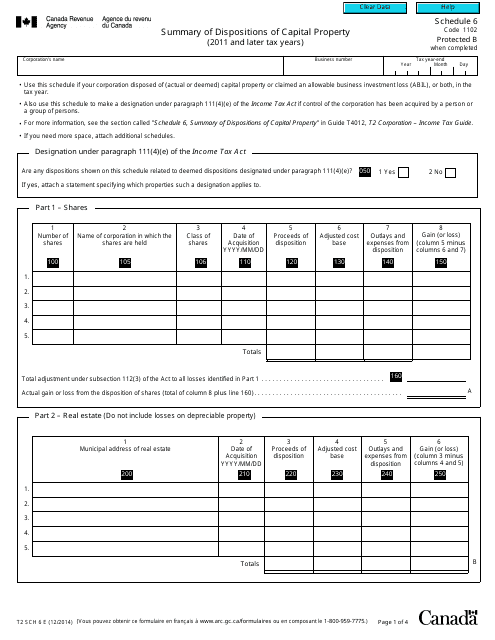

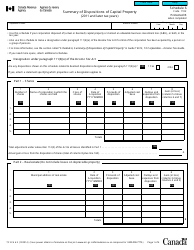

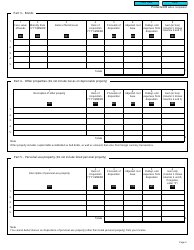

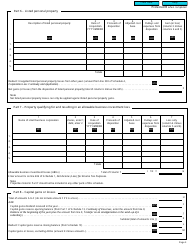

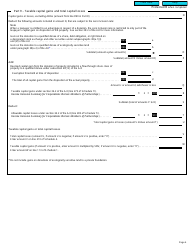

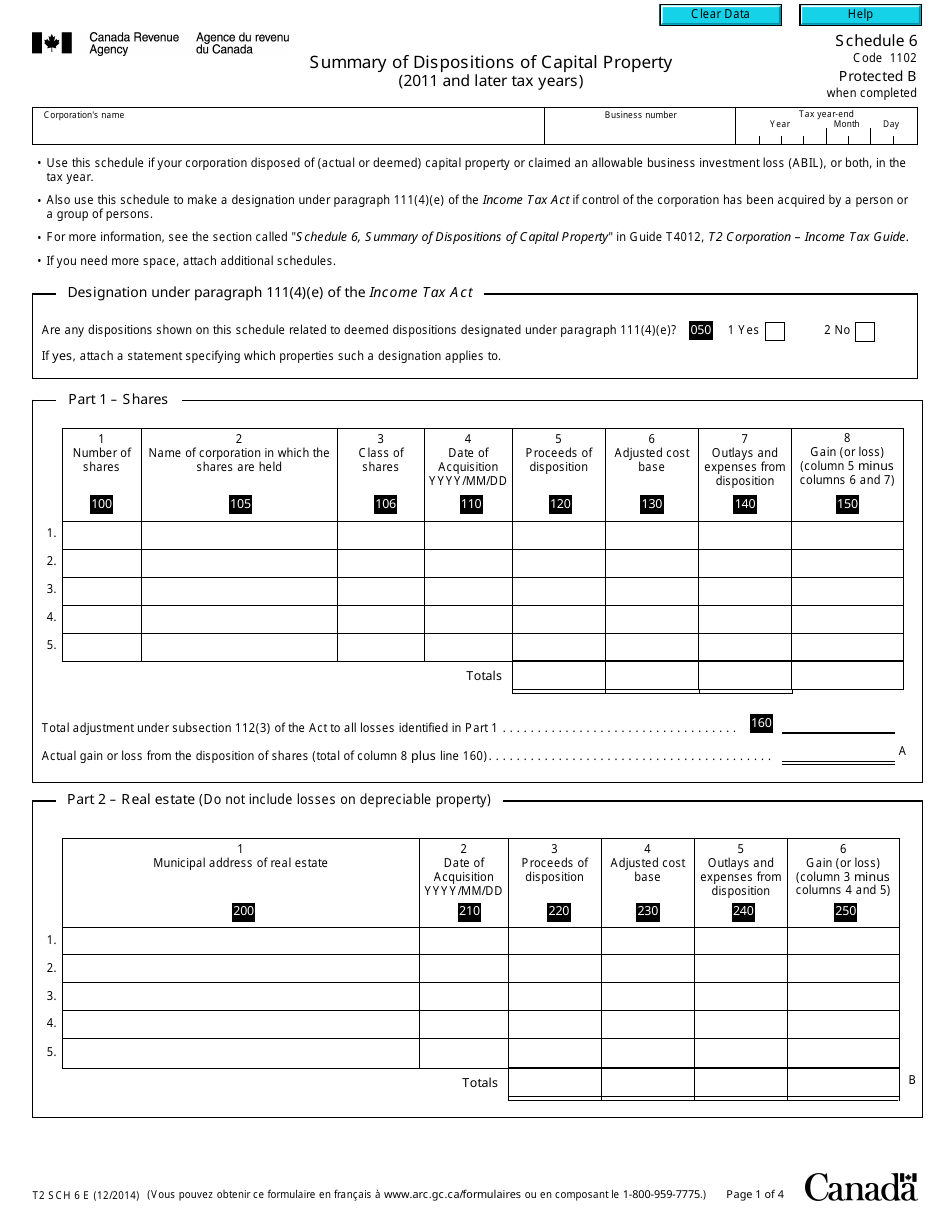

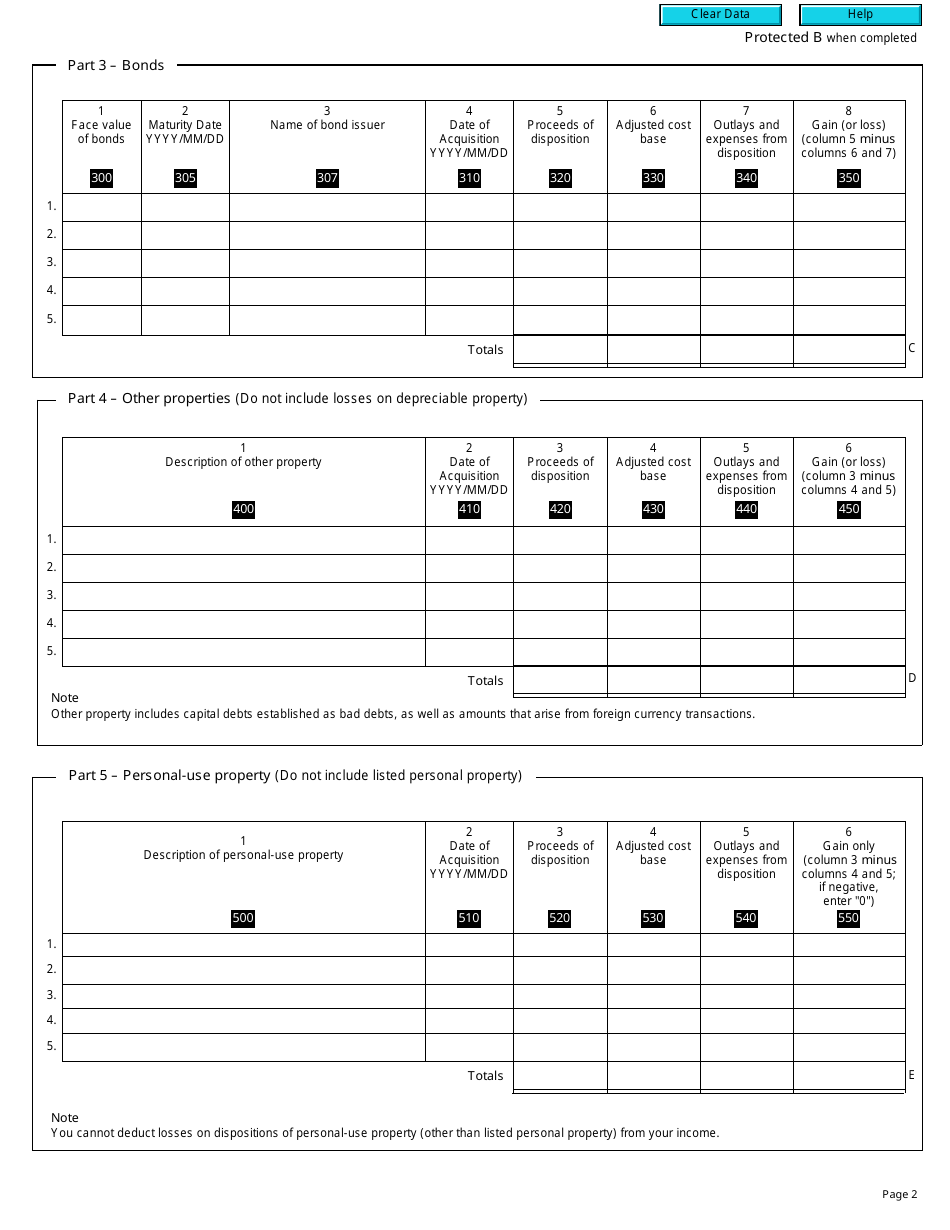

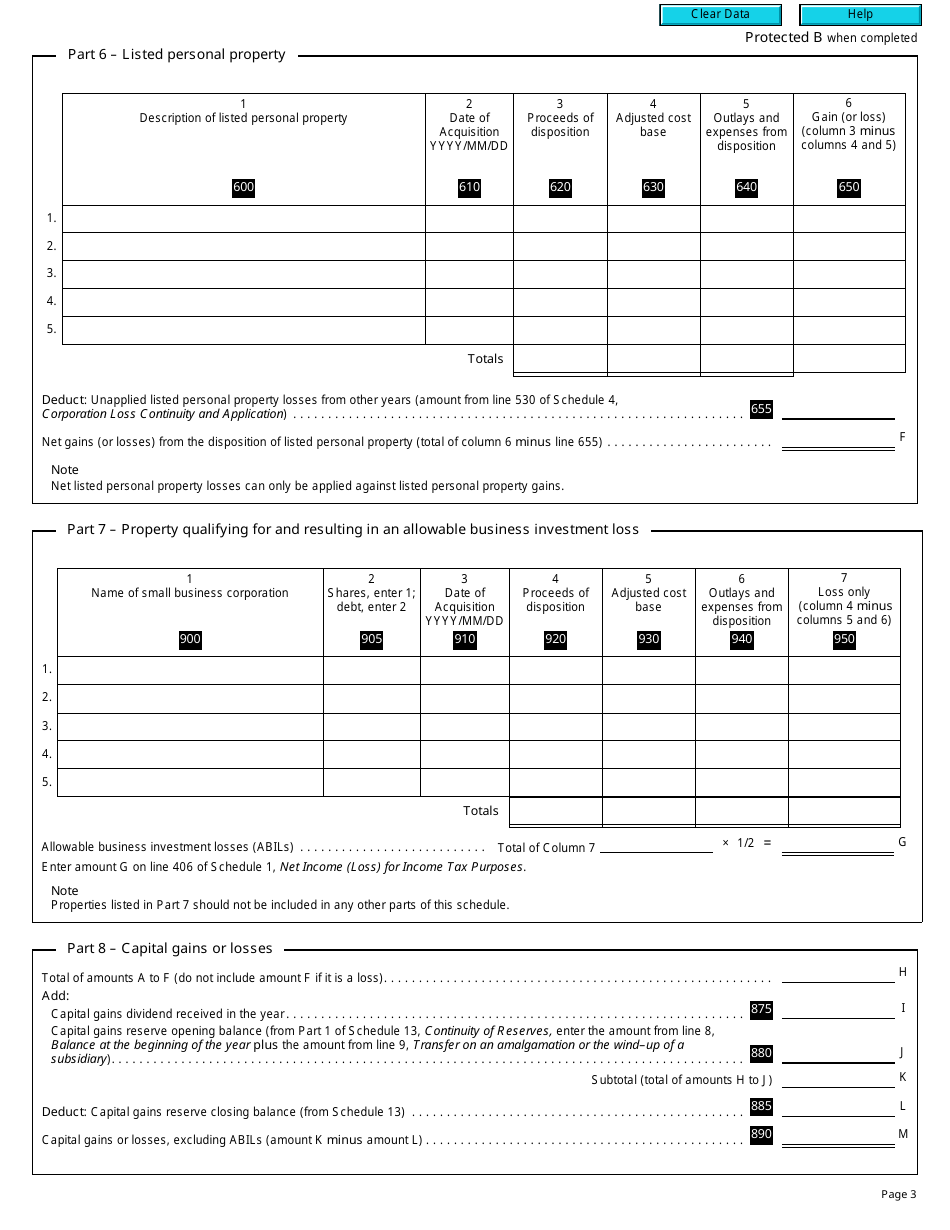

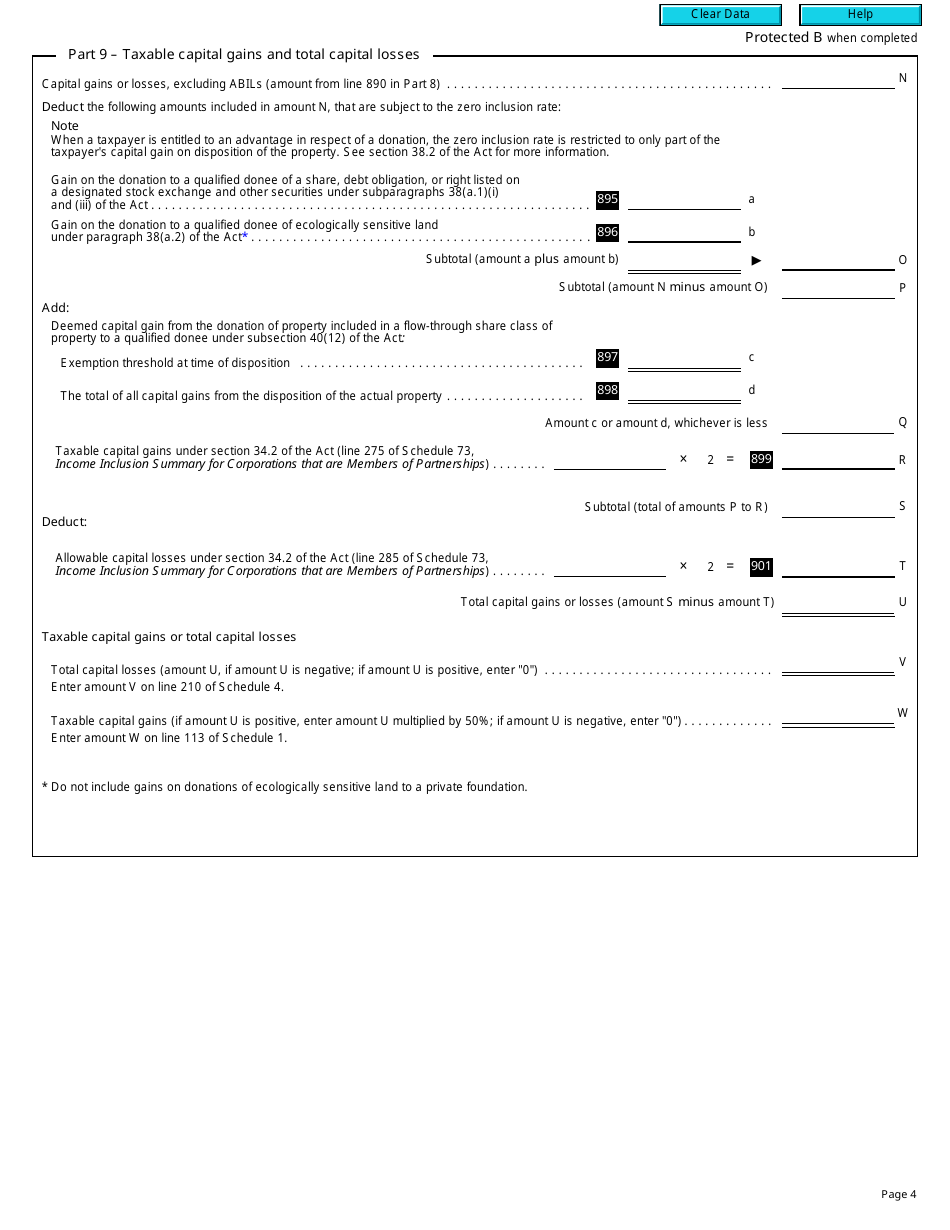

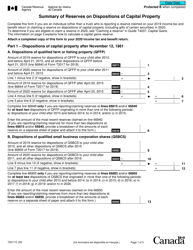

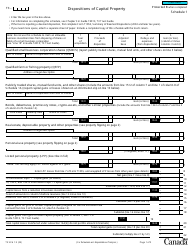

Form T2 Schedule 6 Summary of Dispositions of Capital Property (2011 and Later Tax Years) - Canada

The Form T2 Schedule 6 is used in Canada for reporting the summary of dispositions of capital property for the tax years 2011 and later. It is used by corporations to report any capital assets that have been sold, transferred, or disposed of during the tax year. This form helps calculate the gain or loss on these dispositions for tax purposes.

The Form T2 Schedule 6 Summary of Dispositions of Capital Property is filed by Canadian corporations for the 2011 and later tax years.

FAQ

Q: What is Form T2 Schedule 6?

A: Form T2 Schedule 6 is used to report the summary of dispositions of capital property for tax years 2011 and later.

Q: Who needs to fill out Form T2 Schedule 6?

A: Canadian residents who have disposed of capital property during tax years 2011 and later need to fill out this form.

Q: What information is required on Form T2 Schedule 6?

A: The form requires information about the type of property disposed of, the proceeds from the disposition, and the adjusted cost base of the property.

Q: Is there a deadline to submit Form T2 Schedule 6?

A: Yes, the deadline to submit Form T2 Schedule 6 is within six months from the end of the tax year in which the disposition occurred.