This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2 Schedule 89

for the current year.

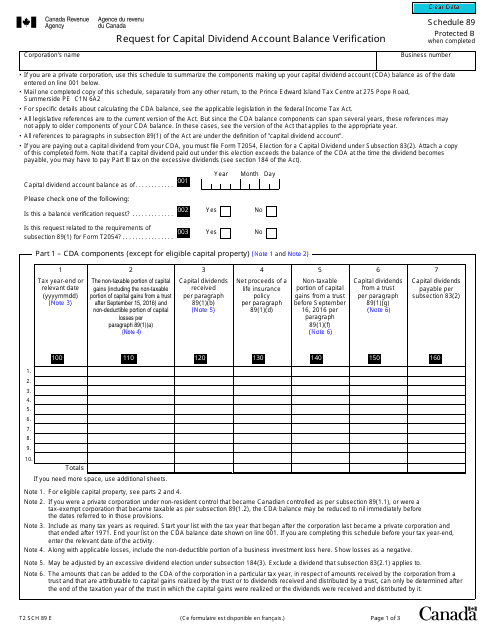

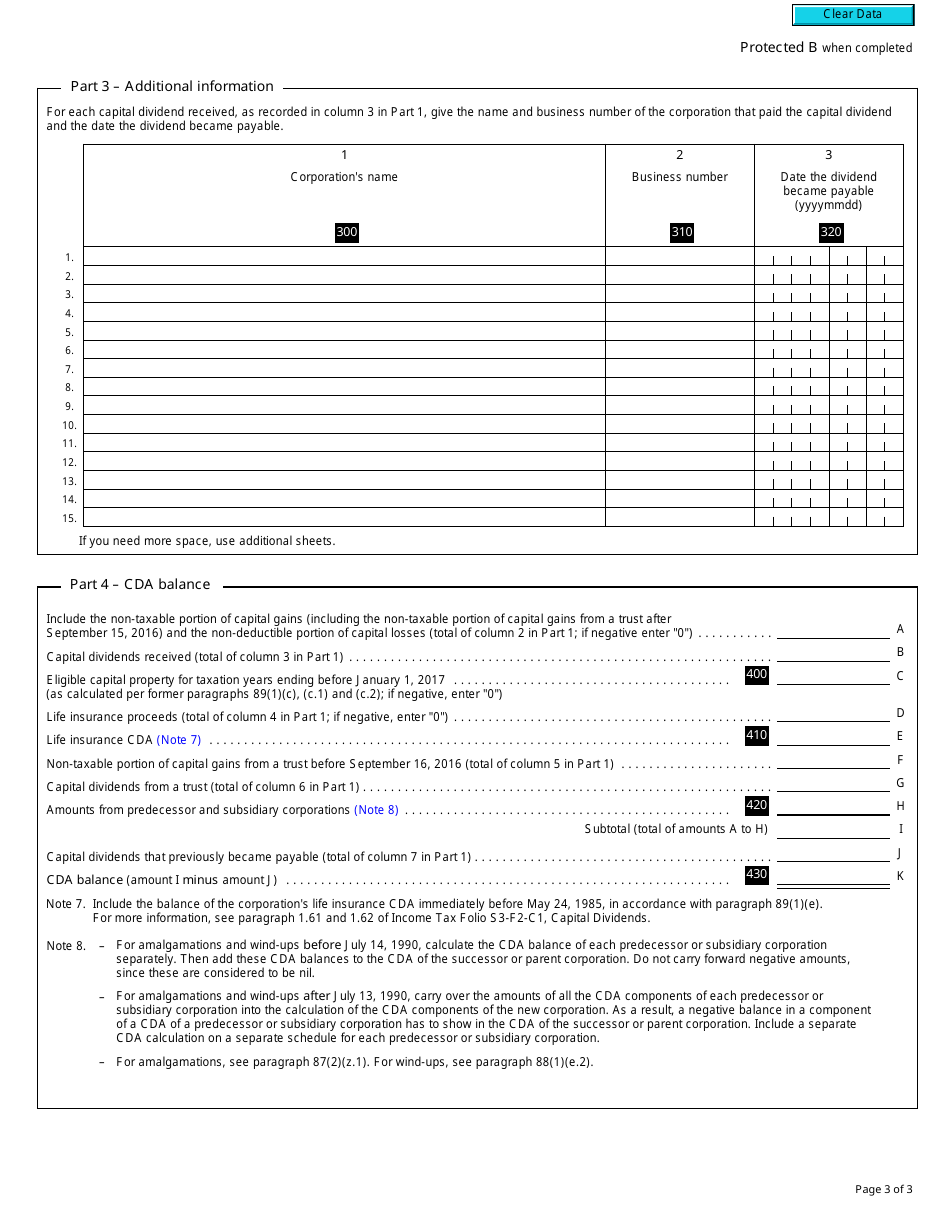

Form T2 Schedule 89 Request for Capital Dividend Account Balance Verification - Canada

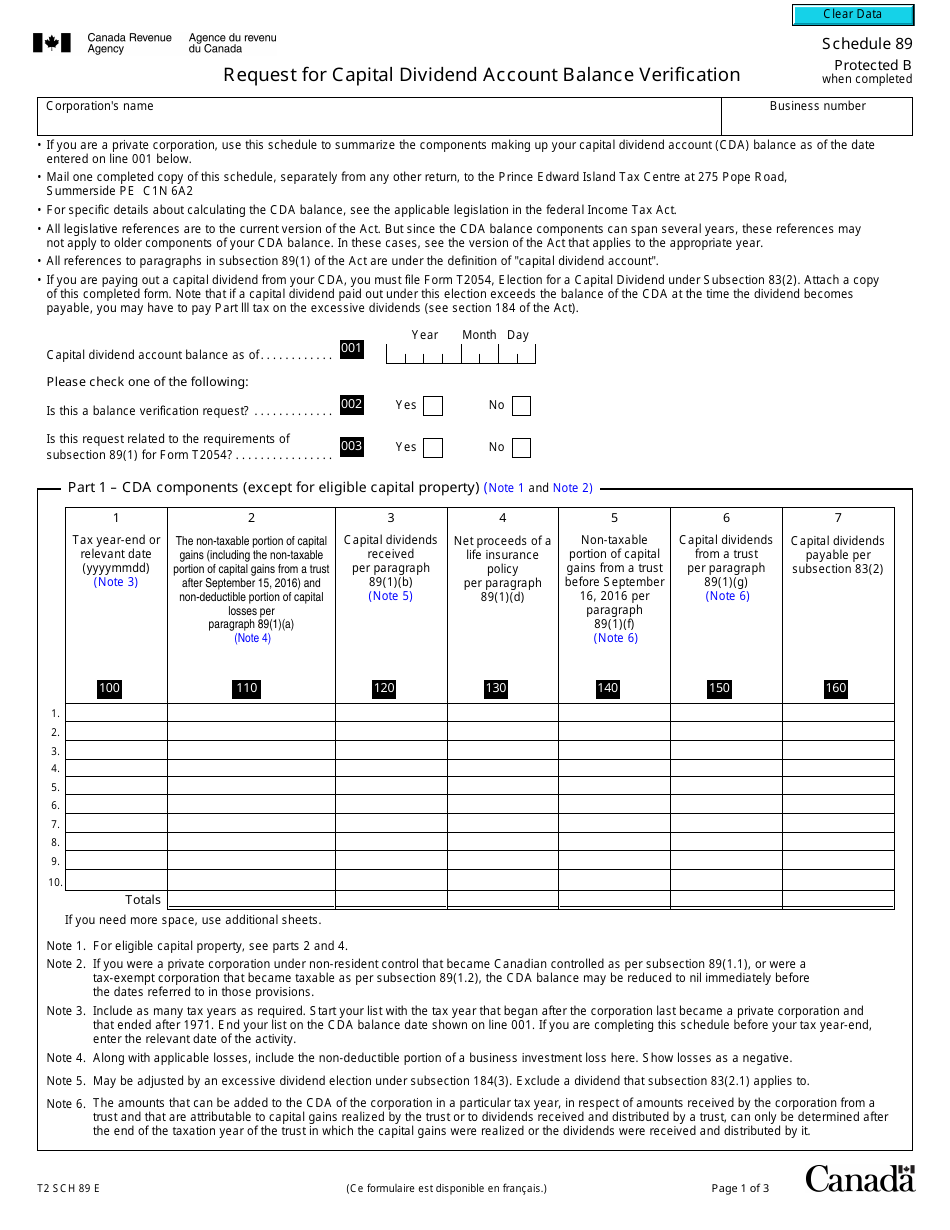

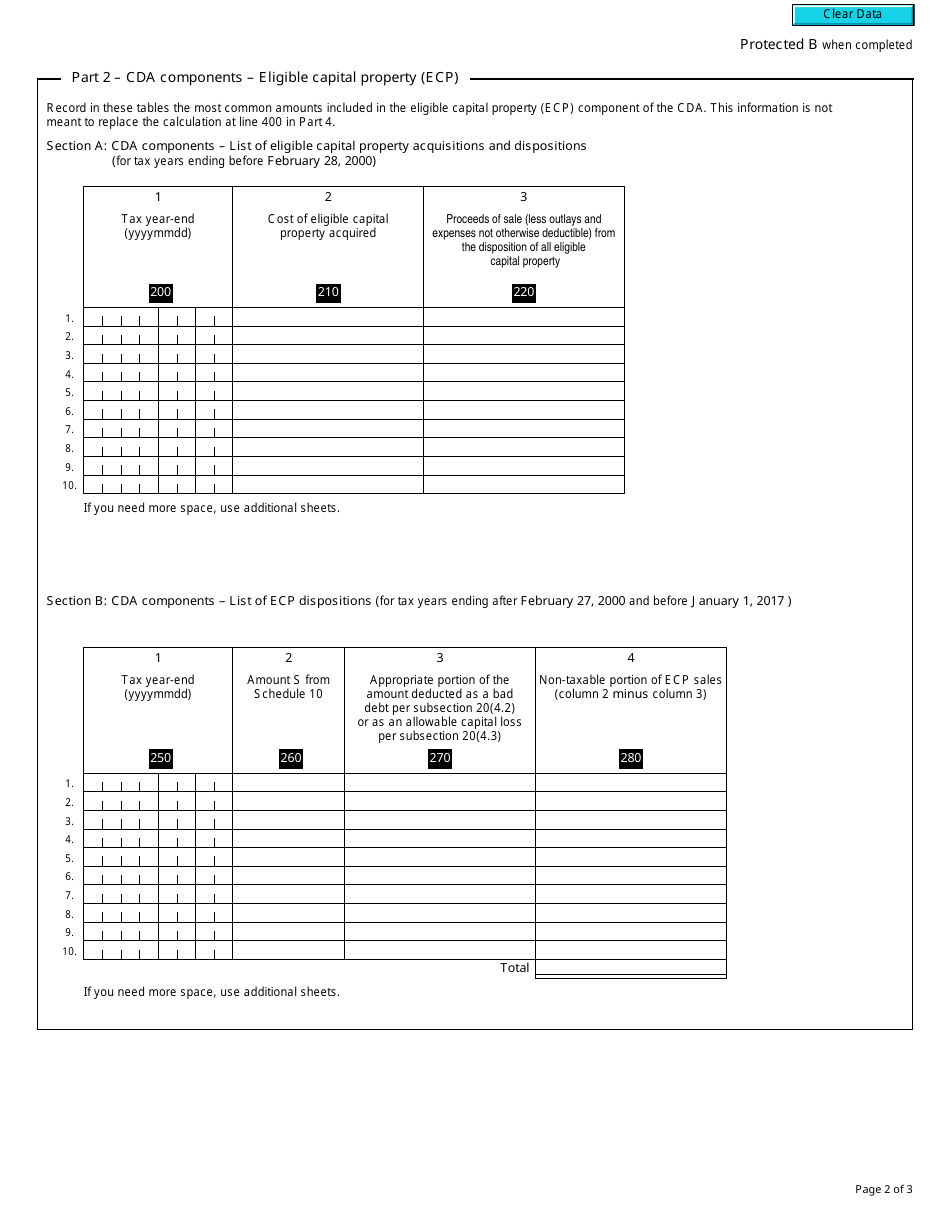

Form T2 Schedule 89 - Request for Capital Dividend Account Balance Verification is used in Canada by corporations to obtain confirmation of the balance in their Capital Dividend Account (CDA) from the Canada Revenue Agency (CRA). The CDA is an account where tax-free dividends can be distributed to shareholders.

The Form T2 Schedule 89 is filed by corporations in Canada to request verification of their Capital Dividend Account balance.

FAQ

Q: What is Form T2 Schedule 89?

A: Form T2 Schedule 89 is a form in Canada used for requesting verification of the Capital Dividend Account balance.

Q: What is the purpose of Form T2 Schedule 89?

A: The purpose of this form is to request verification of the Capital Dividend Account balance for tax purposes.

Q: Who needs to file Form T2 Schedule 89?

A: Any corporation in Canada that wants to verify its Capital Dividend Account balance needs to file this form.

Q: What information do I need to provide on Form T2 Schedule 89?

A: You will need to provide your corporation's name, address, tax year-end date, and the requested verification period.

Q: Is there a deadline for filing Form T2 Schedule 89?

A: The deadline for filing this form depends on your corporation's tax year-end date. It is usually due within 90 days of the end of the requested verification period.

Q: What happens after I file Form T2 Schedule 89?

A: After you file this form, the CRA will review your request and provide you with a verification of the Capital Dividend Account balance.

Q: Are there any fees associated with filing Form T2 Schedule 89?

A: There are no specific fees for filing this form, but your corporation may be subject to other tax obligations or penalties as determined by the CRA.