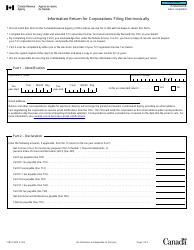

This version of the form is not currently in use and is provided for reference only. Download this version of

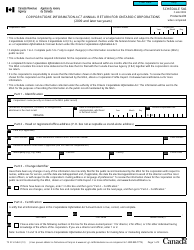

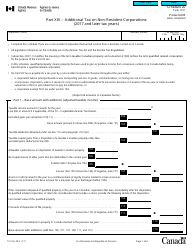

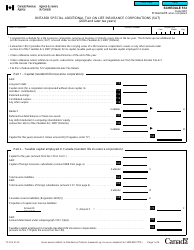

Form T2 Schedule 97

for the current year.

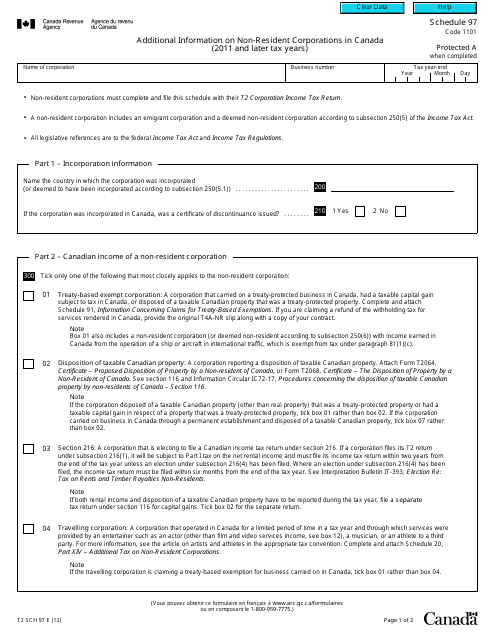

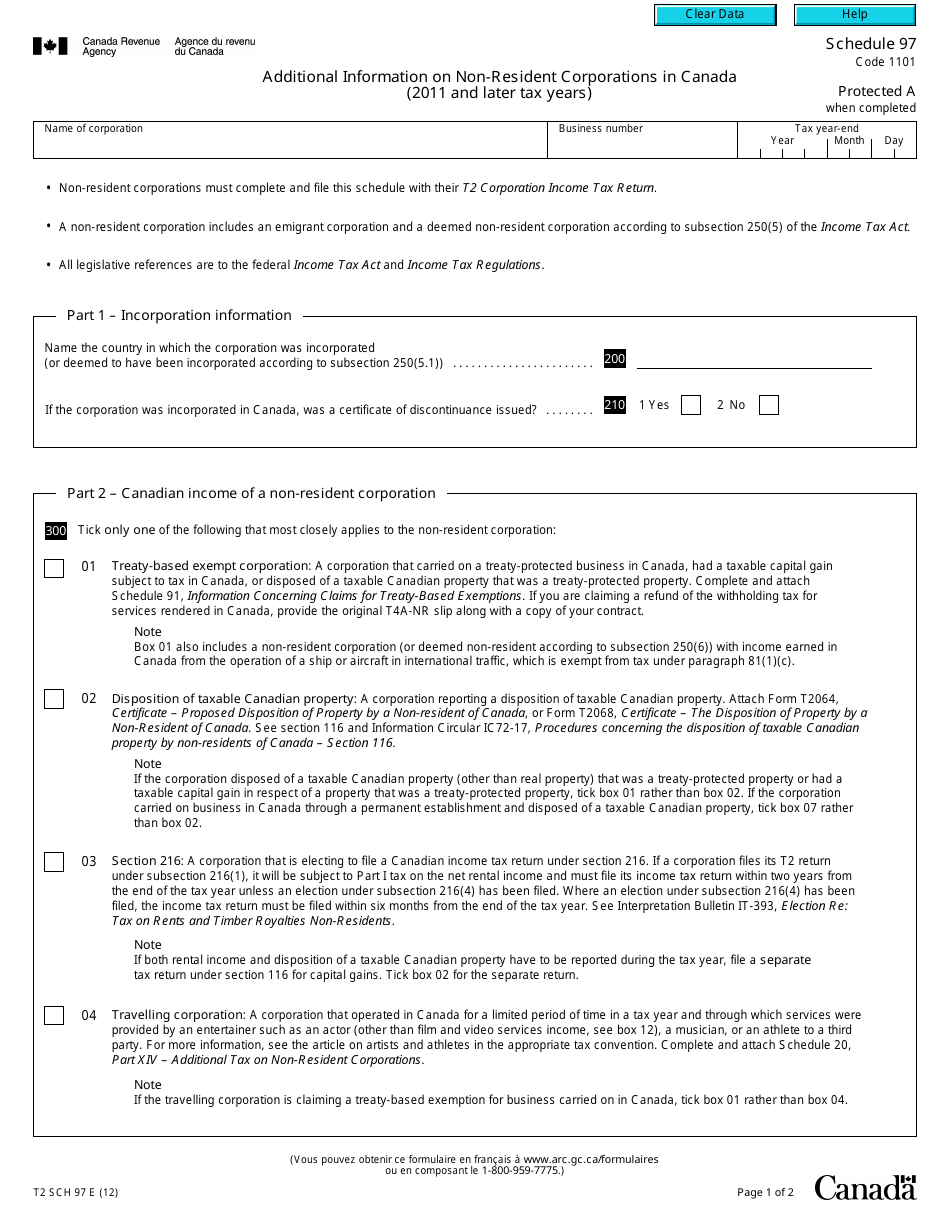

Form T2 Schedule 97 Additional Information on Non-resident Corporations in Canada (2011 and Later Tax Years) - Canada

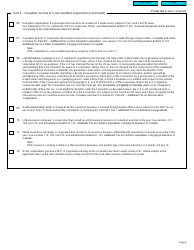

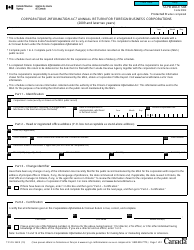

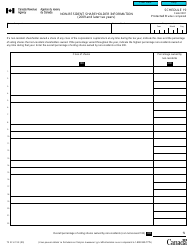

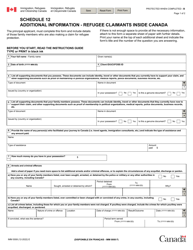

Form T2 Schedule 97 is used to provide additional information on non-resident corporations in Canada for tax years 2011 and later. It is used to report details about the non-resident corporation's activities and income in Canada.

The Form T2 Schedule 97 Additional Information on Non-resident Corporations in Canada is filed by non-resident corporations operating in Canada for the tax years 2011 and later.

FAQ

Q: What is Form T2 Schedule 97?

A: Form T2 Schedule 97 is a form used to provide additional information on non-resident corporations in Canada.

Q: Who is required to fill out Form T2 Schedule 97?

A: Non-resident corporations doing business in Canada are required to fill out Form T2 Schedule 97.

Q: What tax years does Form T2 Schedule 97 apply to?

A: Form T2 Schedule 97 applies to tax years starting in 2011 and later.

Q: What type of information is included on Form T2 Schedule 97?

A: Form T2 Schedule 97 includes information about the non-resident corporation's activities in Canada, income earned in Canada, and taxes paid.