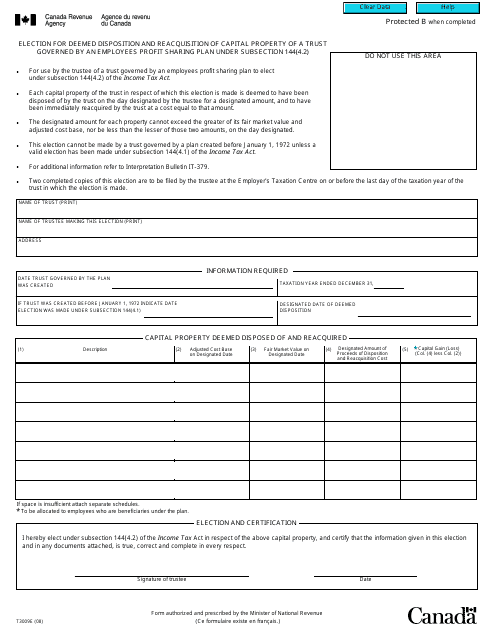

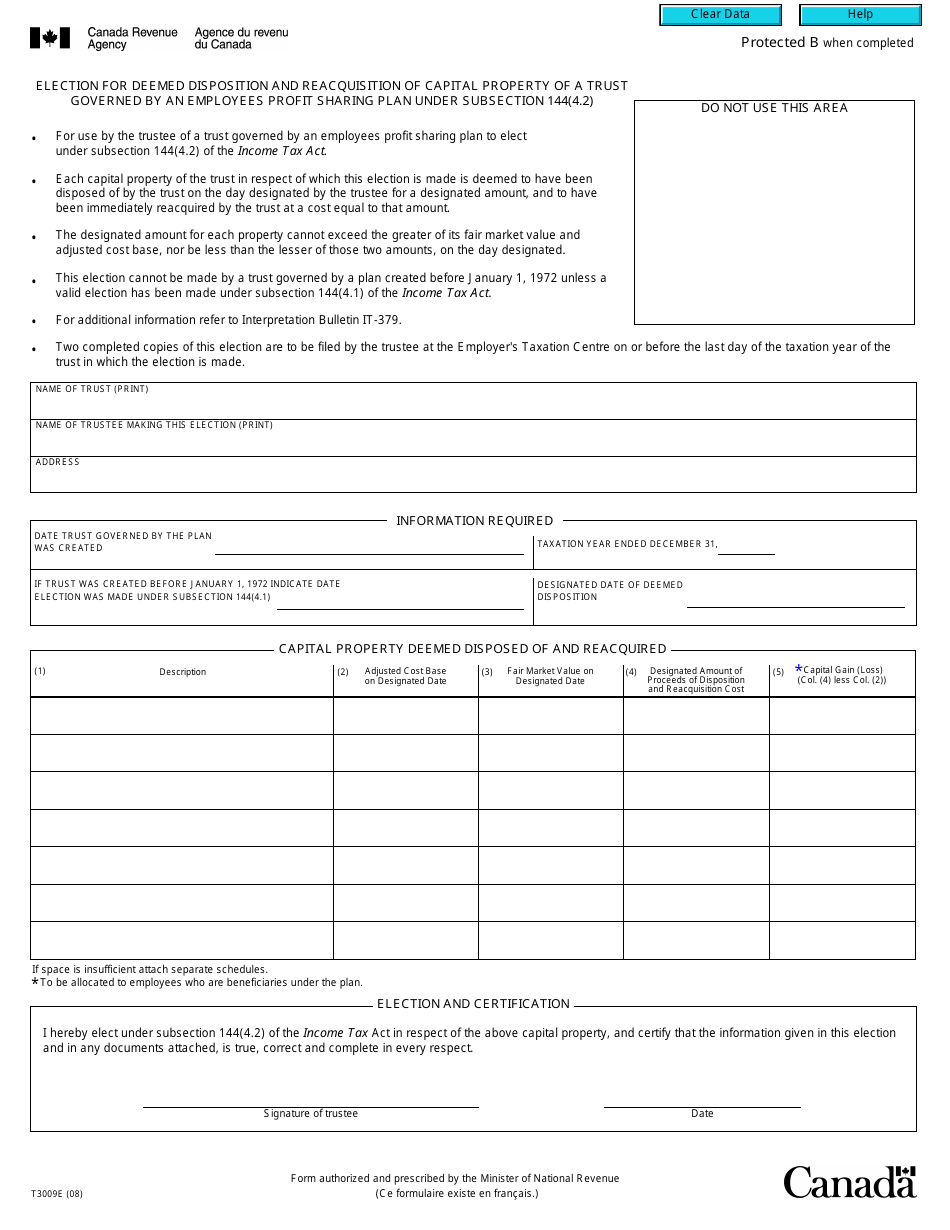

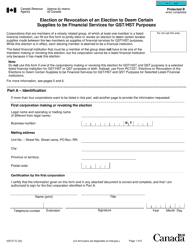

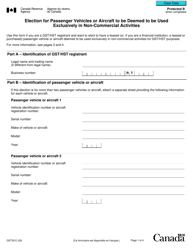

Form T3009 Election From Deemed Disposition and Reacquisition of Any Capital Property of an Employees Profit Sharing Plan Under Subsection 144.(4.2) - Canada

Form T3009, Election from Deemed Disposition and Reacquisition of Any Capital Property of an Employees Profit Sharing Plan Under Subsection 144.(4.2) is a form used in Canada for certain tax purposes related to profits sharing plans. The form is used to elect to defer the deemed disposition and reacquisition of certain capital property held in an employee's profit sharing plan, as allowed under subsection 144.(4.2) of the Canadian Income Tax Act. This form is specific to Canada and does not apply to the United States.

The employer files the Form T3009 Election From Deemed Disposition and Reacquisition of Any Capital Property of an Employees Profit Sharing Plan Under Subsection 144.(4.2) in Canada.

FAQ

Q: What is Form T3009?

A: Form T3009 is a tax form used in Canada to report the election for deemed disposition and reacquisition of any capital property of an employee's profit sharing plan.

Q: What is a deemed disposition?

A: A deemed disposition refers to the fictional sale or transfer of your property for tax purposes, even though no actual sale or transfer has taken place.

Q: What is reacquisition?

A: Reacquisition refers to the act of acquiring back the property that was previously disposed of.

Q: Who should use Form T3009?

A: Form T3009 should be used by individuals who want to make an election for deemed disposition and reacquisition of any capital property of an employee's profit sharing plan.

Q: What is an employee's profit sharing plan?

A: An employee's profit sharing plan is a type of retirement savings plan that allows employees to share in the profits of the company they work for.

Q: What is the purpose of making this election?

A: The purpose of making this election is to defer the tax consequences of a deemed disposition and reacquisition until a later date.

Q: Is the use of this form mandatory?

A: Yes, if you want to make the election for deemed disposition and reacquisition of any capital property of an employee's profit sharing plan, you must use Form T3009.

Q: When should Form T3009 be filed?

A: Form T3009 should be filed by the deadline specified by the CRA, usually on or before the individual's tax return filing deadline.