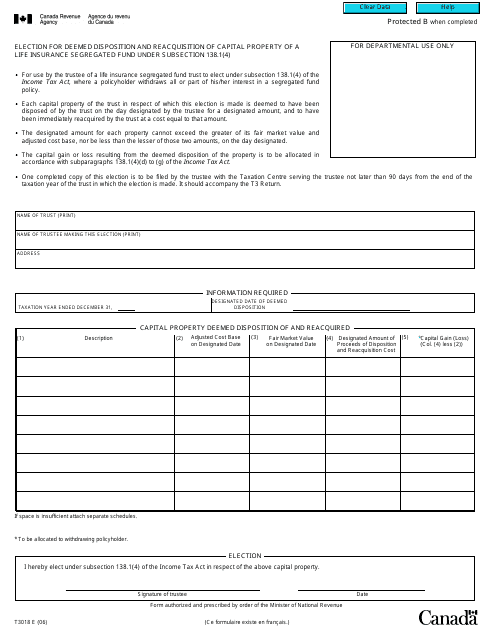

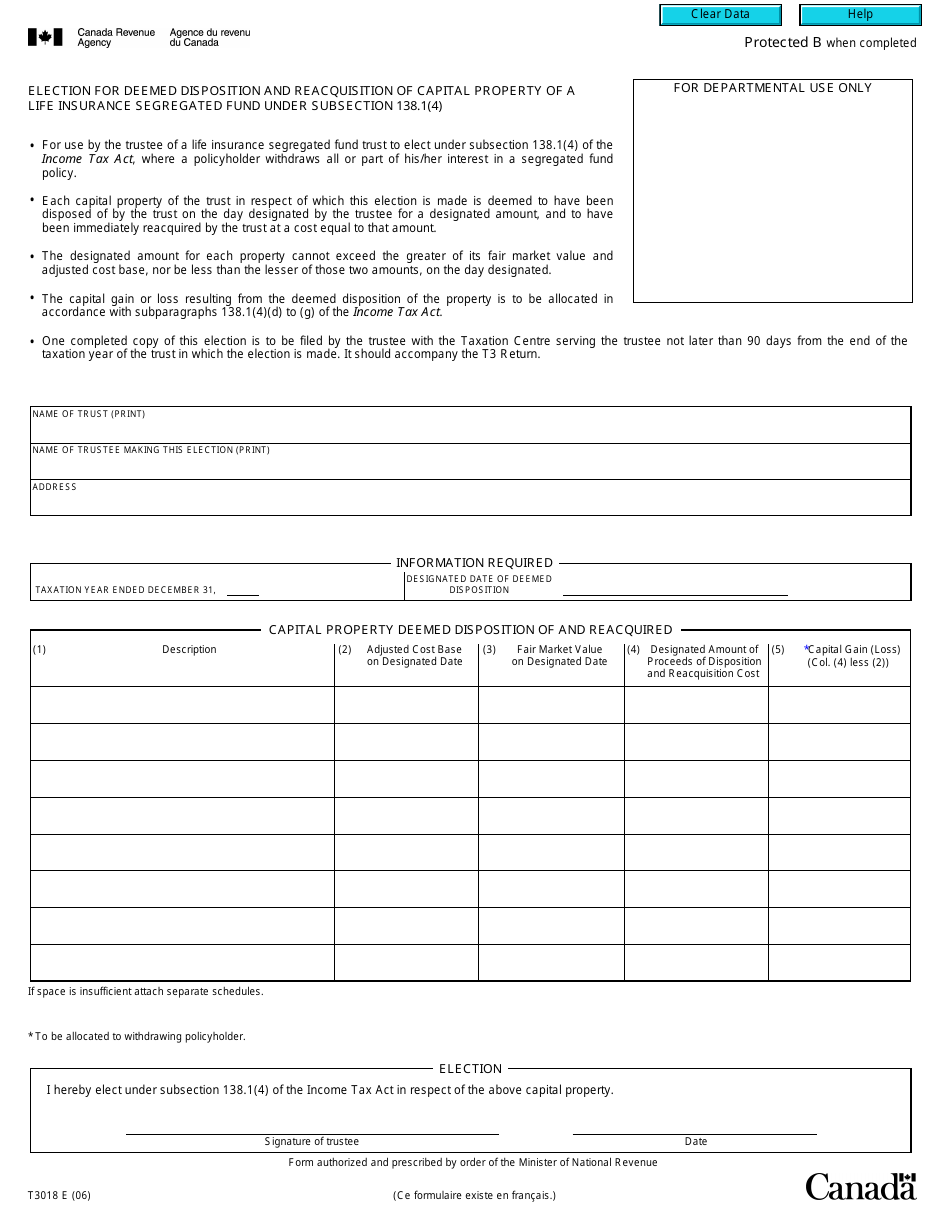

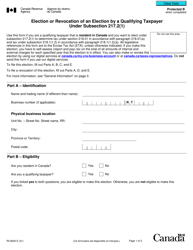

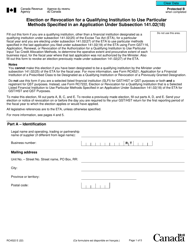

Form T3018 Election Under Subsection 138.1(4) of the Deemed Disposition of Capital Property of a Life Insurance Segregated Fund - Canada

Form T3018 Election Under Subsection 138.1(4) of the Deemed Disposition of Capital Property of a Life Insurance Segregated Fund is used in Canada for electing to defer the taxation on the deemed disposition of capital property within a life insurance segregated fund. It allows individuals to postpone recognizing capital gains or losses until certain events occur.

The policyholder (the person who owns the life insurance policy) files the Form T3018 in Canada.

FAQ

Q: What is Form T3018?

A: Form T3018 is used for making an election under subsection 138.1(4) of the Deemed Disposition of Capital Property of a Life Insurance Segregated Fund in Canada.

Q: What is the purpose of Form T3018?

A: The purpose of Form T3018 is to make an election related to the deemed disposition of capital property of a life insurance segregated fund in Canada.

Q: Who can use Form T3018?

A: Form T3018 can be used by individuals or corporations who wish to make an election under subsection 138.1(4) of the Deemed Disposition of Capital Property of a Life Insurance Segregated Fund in Canada.

Q: When should I file Form T3018?

A: You should file Form T3018 by the due date specified by the CRA, which is usually the same as your income tax return filing deadline.