This version of the form is not currently in use and is provided for reference only. Download this version of

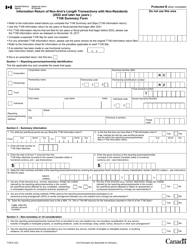

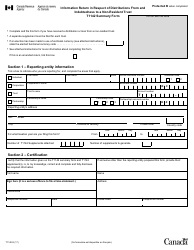

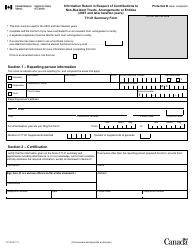

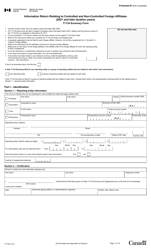

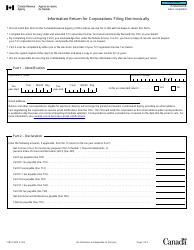

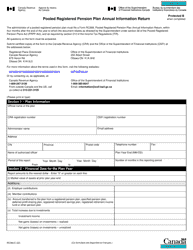

Form T3F

for the current year.

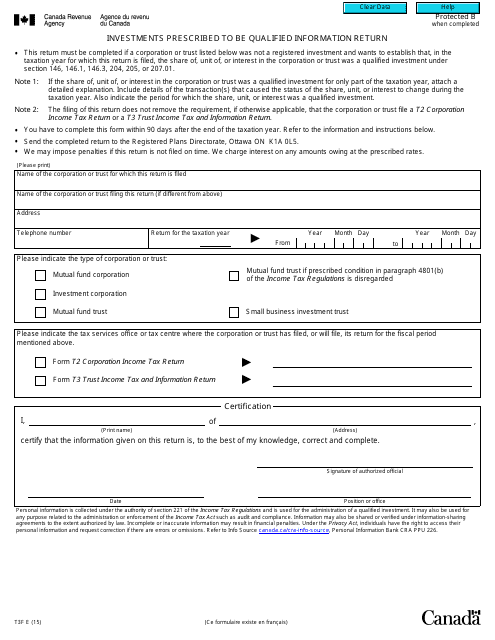

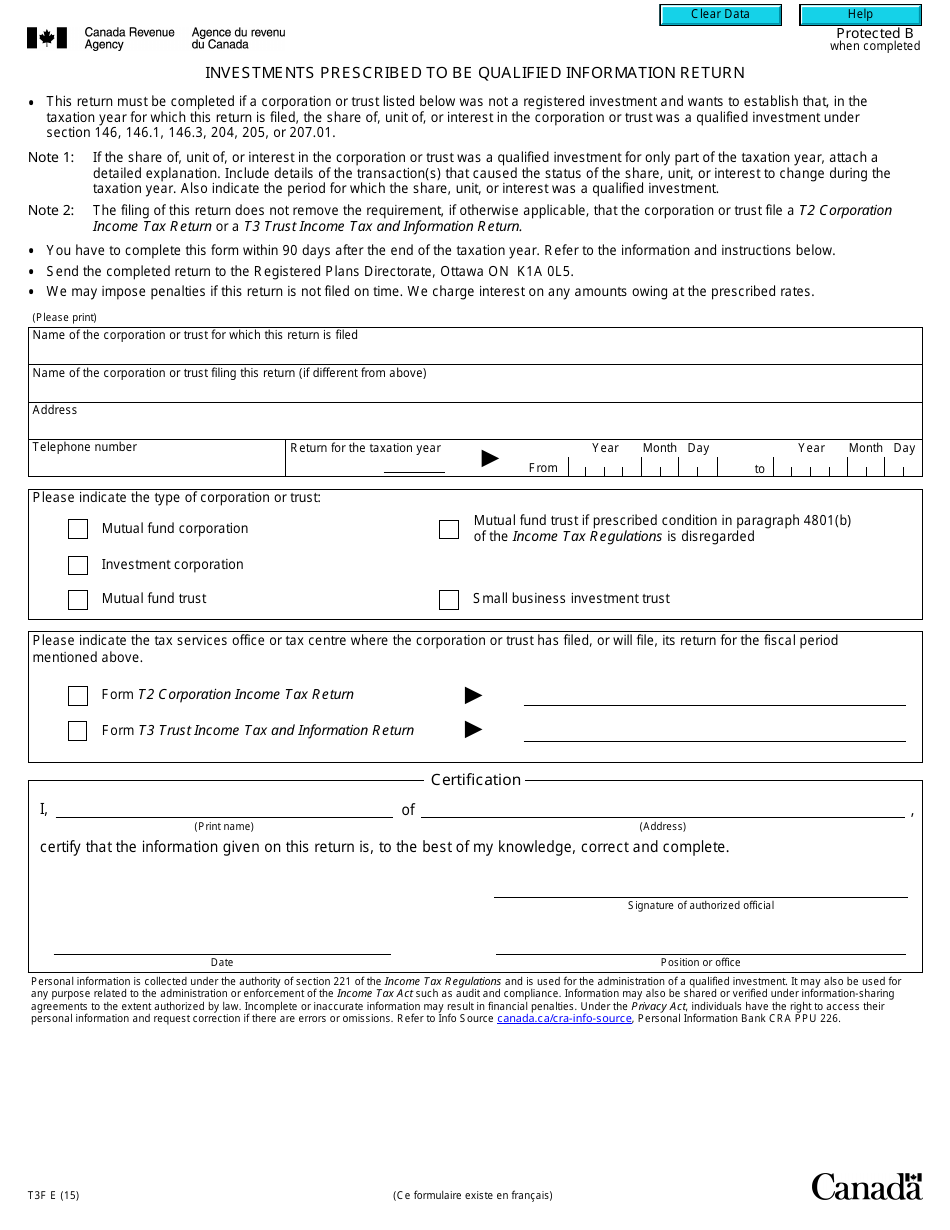

Form T3F Investments Prescribed to Be Qualified Information Return - Canada

Form T3F Investments Prescribed to Be Qualified Information Return in Canada is used by a trust to report the income earned and distributions made to beneficiaries. It provides important information to the Canada Revenue Agency (CRA) about the trust's investments and helps ensure compliance with tax regulations.

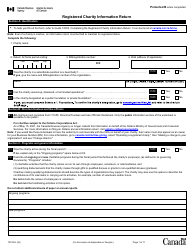

The Form T3F Investments Prescribed to Be Qualified Information Return in Canada is typically filed by trustees of qualifying trusts.

FAQ

Q: What is Form T3F?

A: Form T3F is an information return in Canada.

Q: What does Form T3F report?

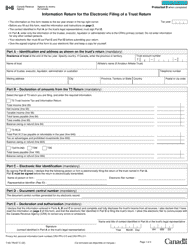

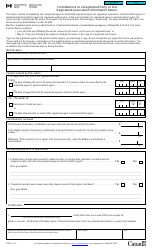

A: Form T3F reports prescribed investments that are qualified for registered plans.

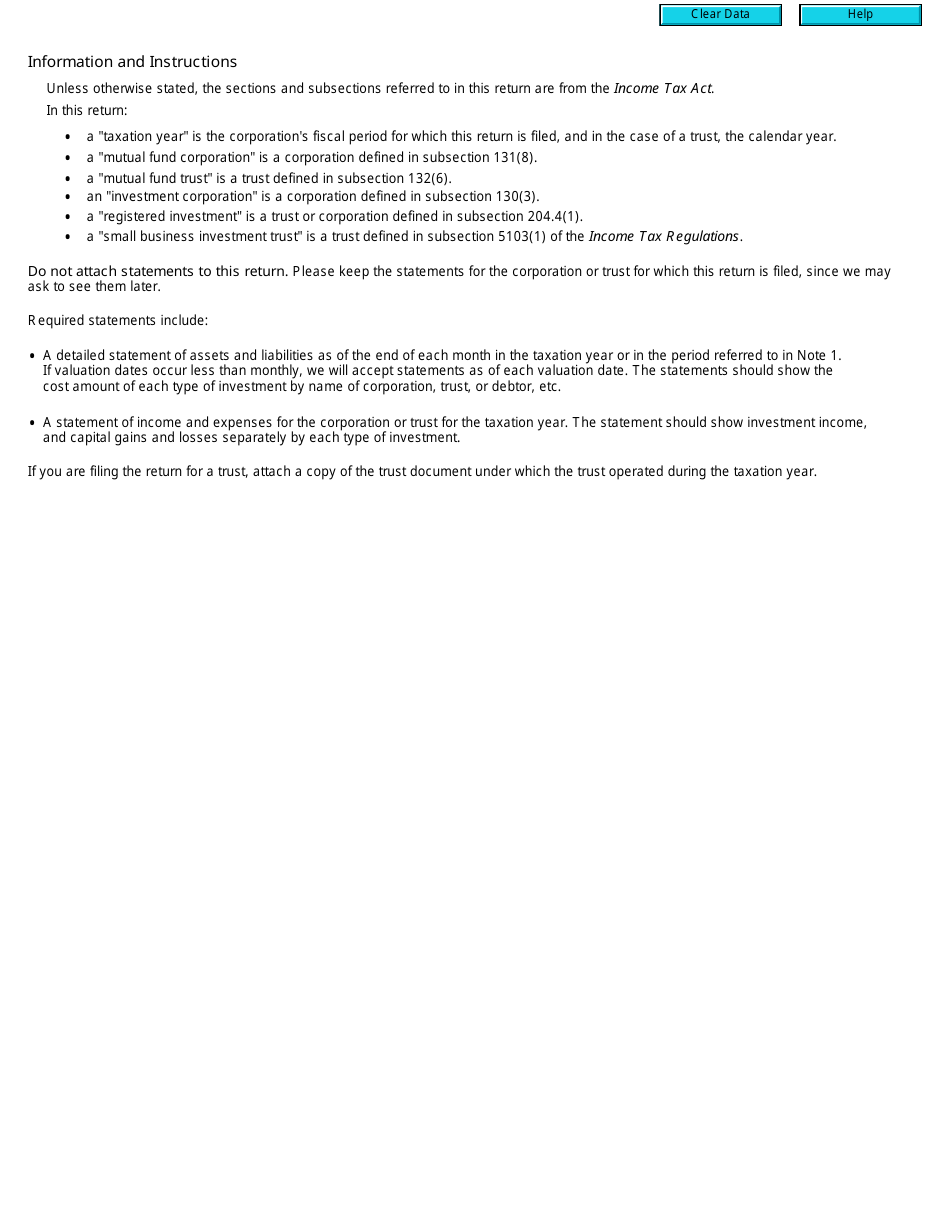

Q: What are prescribed investments?

A: Prescribed investments are specific types of investments that meet the criteria set out by the Canadian government.

Q: What are qualified investments for registered plans?

A: Qualified investments for registered plans are investments that are eligible to be held within registered retirement savings plans (RRSPs) and other similar accounts.

Q: Who is required to file Form T3F?

A: Trustees of registered plans are required to file Form T3F if they hold prescribed investments.

Q: When is Form T3F due?

A: Form T3F is generally due within 90 days after the end of the calendar year in which the investments were acquired or disposed of.

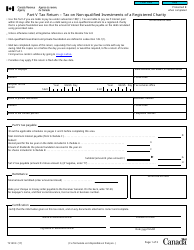

Q: Are there any penalties for not filing Form T3F?

A: Yes, failure to file Form T3F may result in penalties and interest charges imposed by the CRA.

Q: Are there any exceptions to filing Form T3F?

A: There are certain exceptions to filing Form T3F, so it's important to consult the CRA or a tax professional for specific guidance.