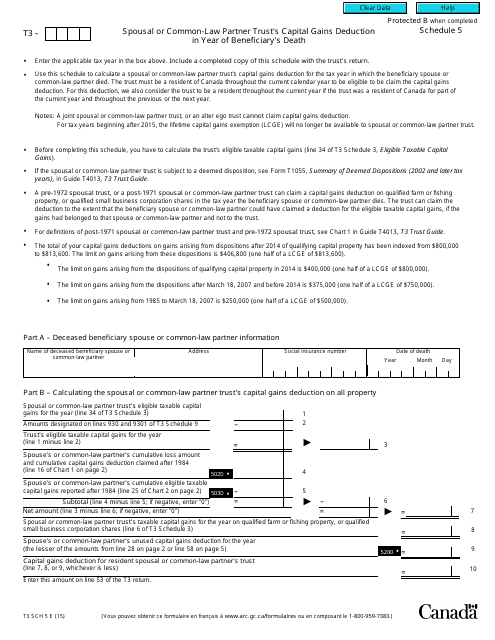

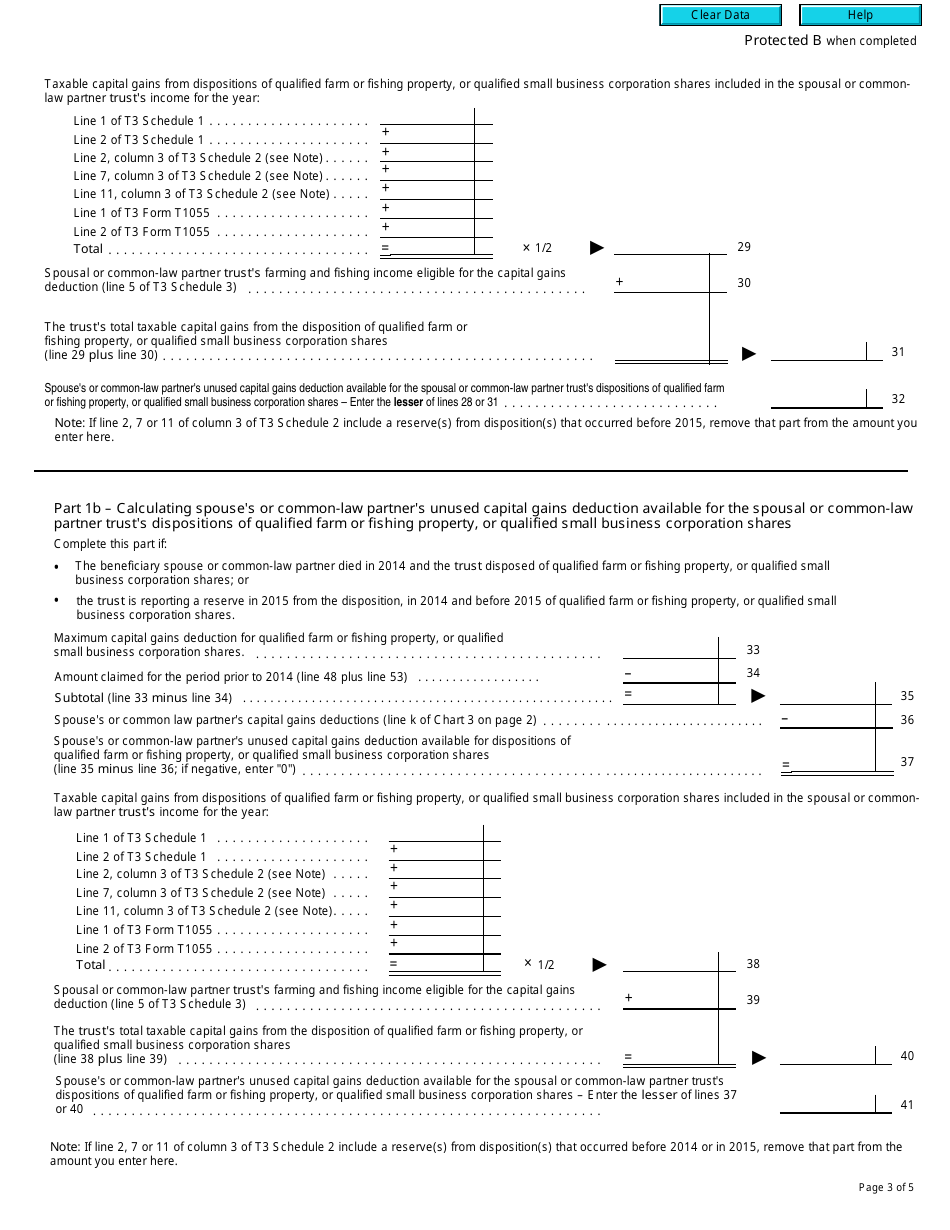

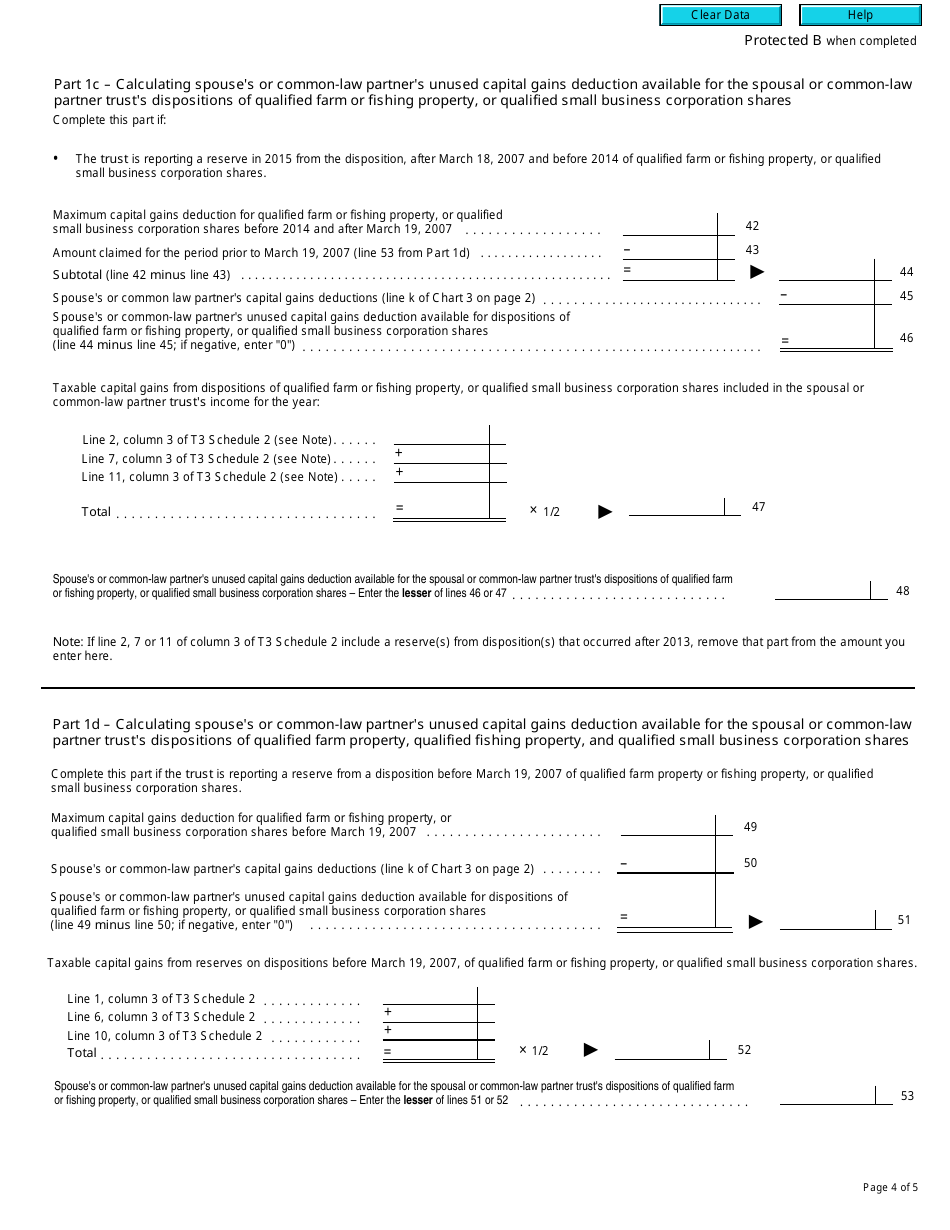

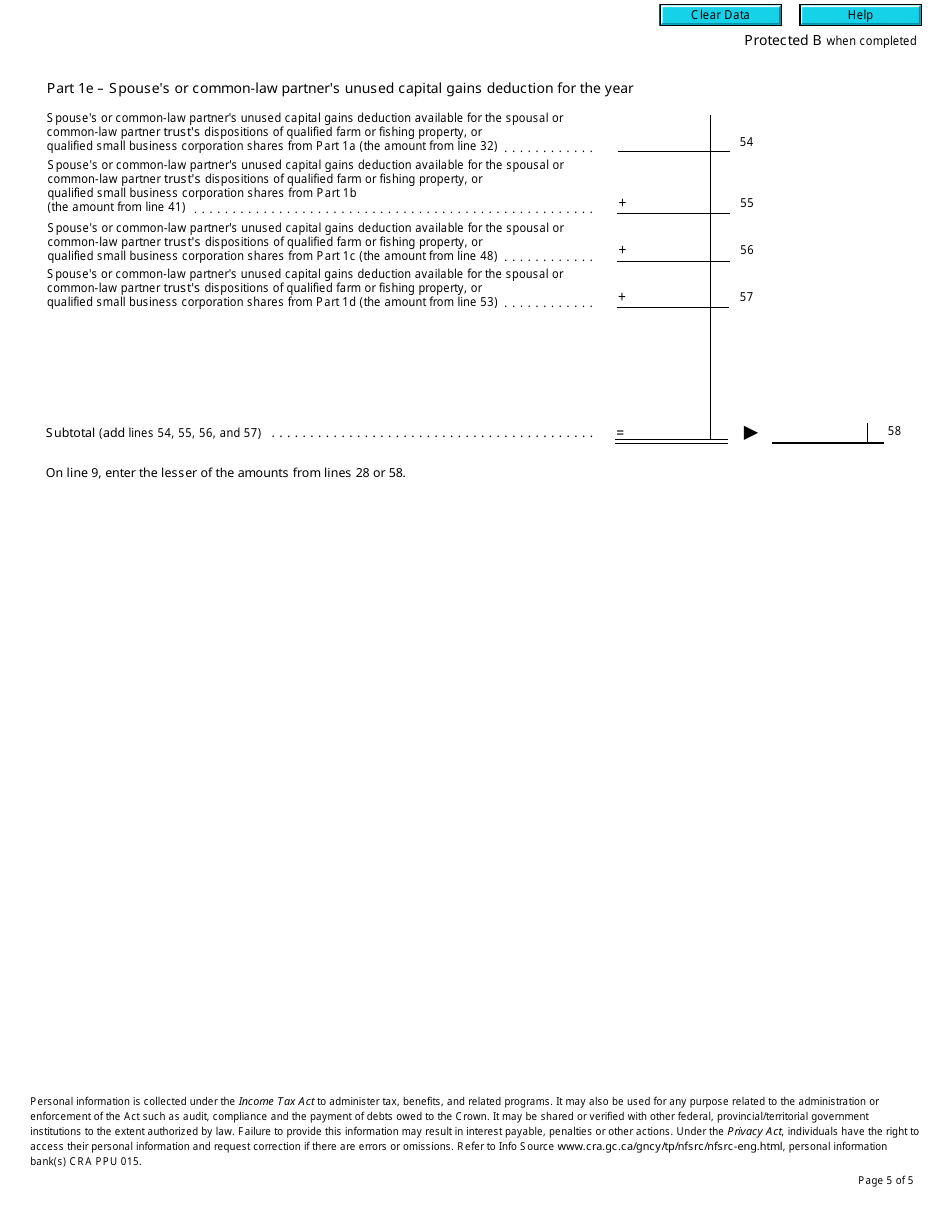

Form T3 Schedule 5 Spousal or Common-Law Partner Trust's Capital Gains Deduction in Year of Beneficiary's Death - Canada

The Form T3 Schedule 5 Spousal or Common-Law Partner Trust's Capital Gains Deduction in Year of Beneficiary's Death is a form used in Canada for calculating the capital gains deduction for a trust in the event of the beneficiary's death. It helps determine any eligible deductions for capital gains tax purposes.

The executor of the deceased person's estate would typically file the Form T3 Schedule 5 Spousal or Common-Law Partner Trust's Capital Gains Deduction in the year of the beneficiary's death.

FAQ

Q: What is Form T3 Schedule 5?

A: Form T3 Schedule 5 is a document used in Canada.

Q: What does Form T3 Schedule 5 calculate?

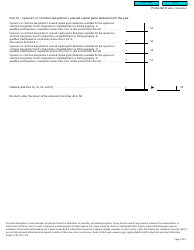

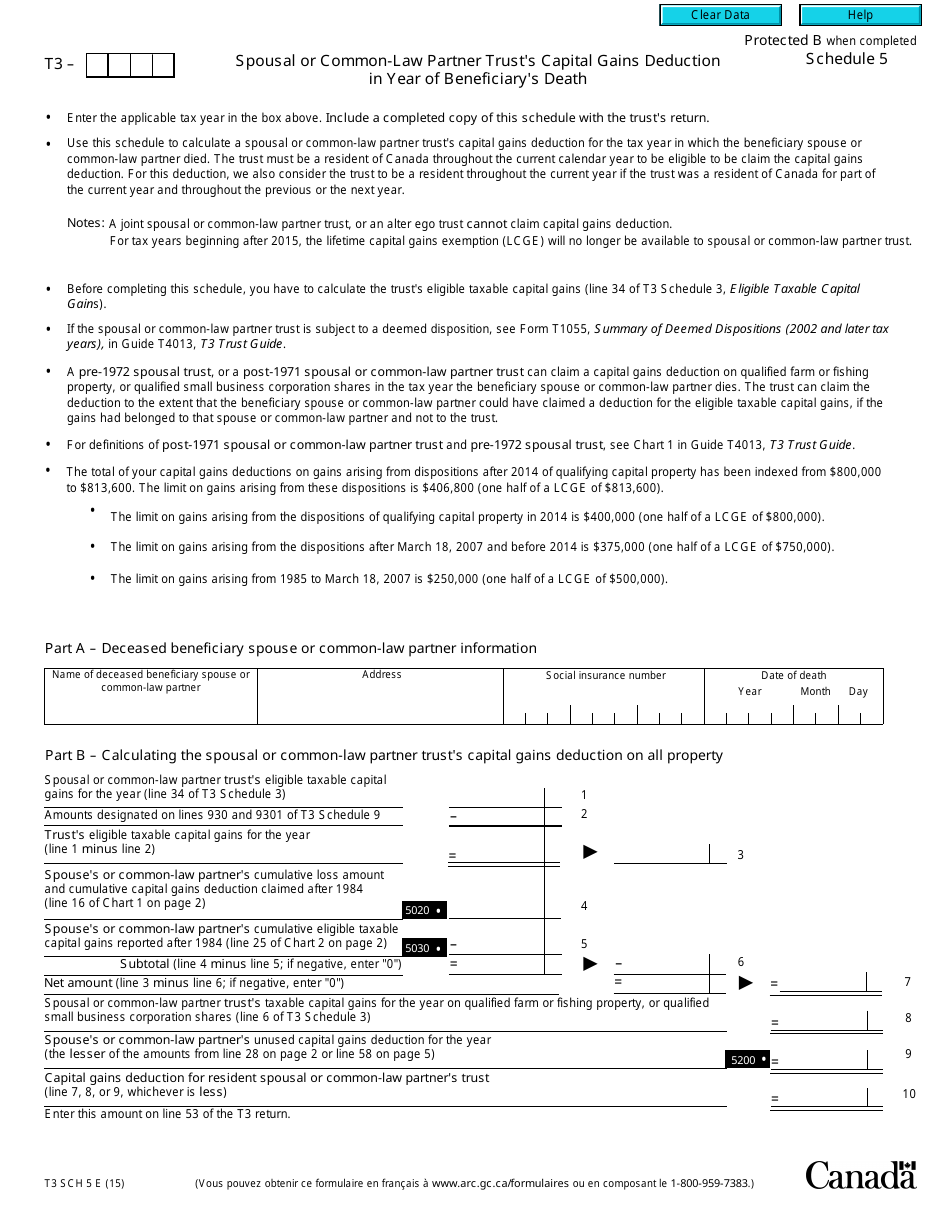

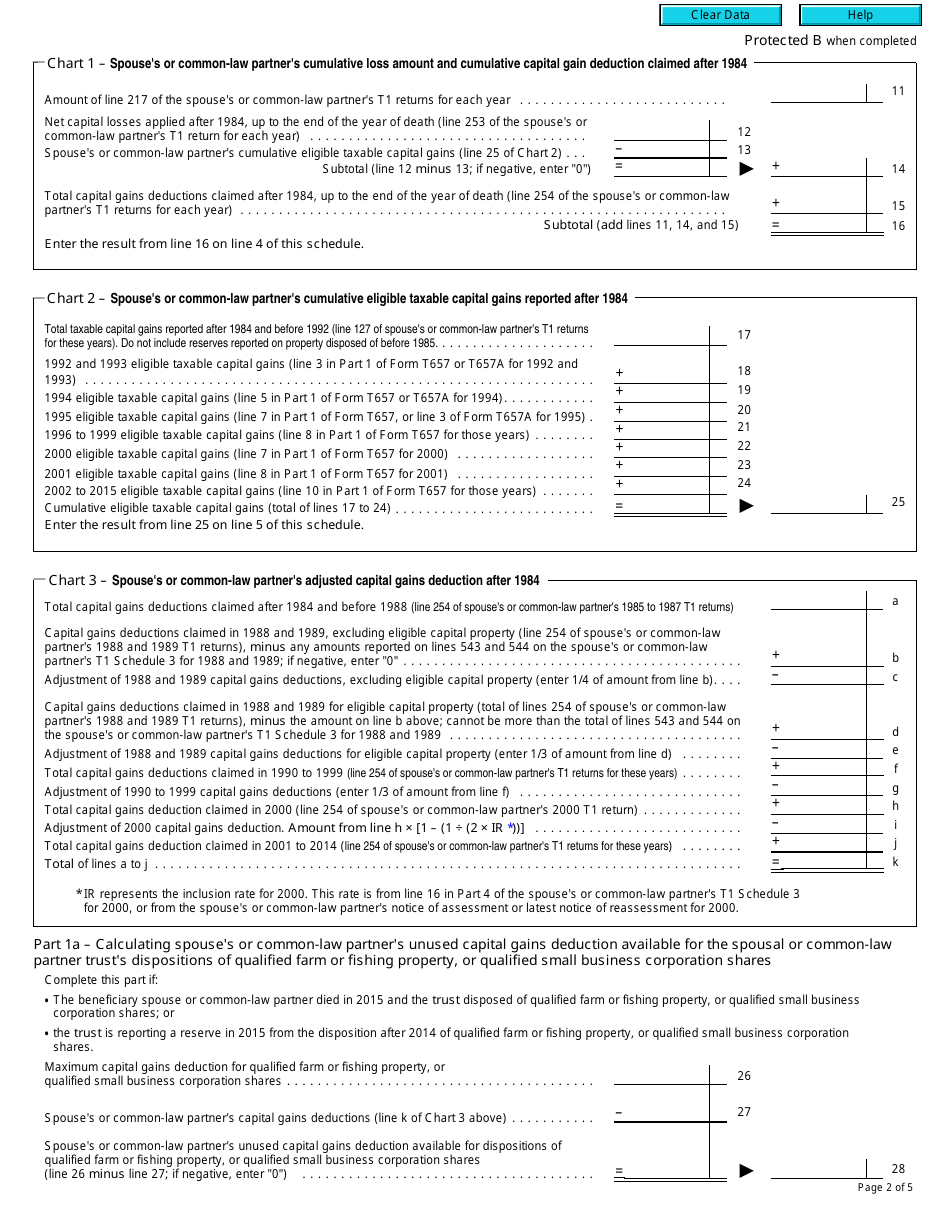

A: Form T3 Schedule 5 calculates the Spousal or Common-Law Partner Trust's Capital Gains Deduction in the Year of Beneficiary's Death.

Q: Who is eligible to use Form T3 Schedule 5?

A: Spousal or common-law partner trusts in Canada are eligible to use Form T3 Schedule 5.

Q: What is a spousal or common-law partner trust?

A: A spousal or common-law partner trust is a type of trust established for the benefit of a spouse or common-law partner.

Q: What is the capital gains deduction in the year of the beneficiary's death?

A: The capital gains deduction in the year of the beneficiary's death is a deduction that can be claimed on certain capital gains realized by the spousal or common-law partner trust.

Q: Why is the capital gains deduction important?

A: The capital gains deduction helps to reduce the tax liability of the spousal or common-law partner trust.

Q: How do I fill out Form T3 Schedule 5?

A: To fill out Form T3 Schedule 5, you will need to provide information about the trust, the deceased beneficiary, and the capital gains realized by the trust.

Q: When is Form T3 Schedule 5 due?

A: The due date for filing Form T3 Schedule 5 may vary depending on the specific circumstances. It is best to consult the CRA or a tax professional for specific deadlines.

Q: What are the consequences of not filing Form T3 Schedule 5?

A: If Form T3 Schedule 5 is not filed correctly or on time, you may face penalties and interest charges.