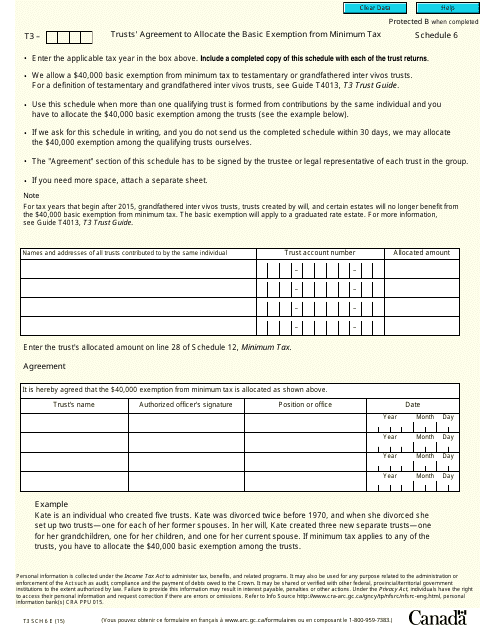

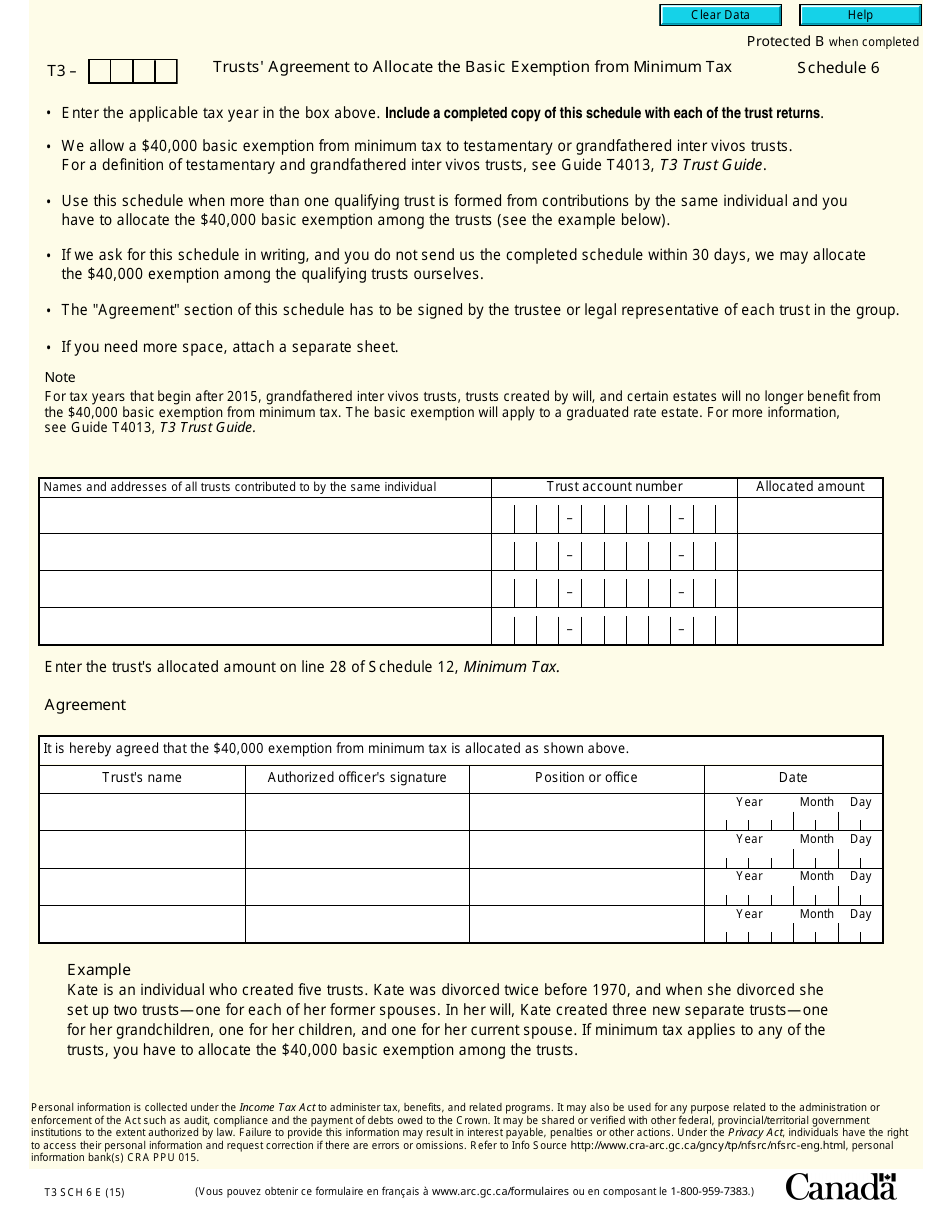

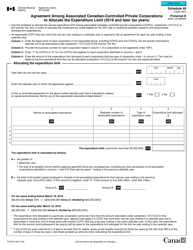

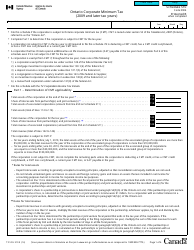

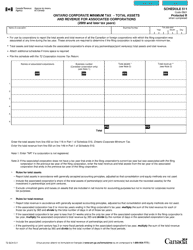

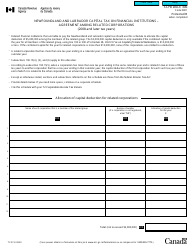

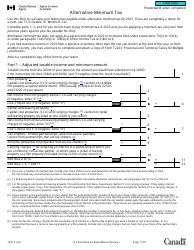

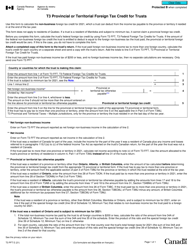

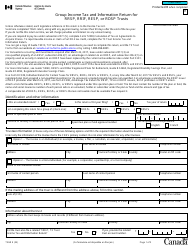

Form T3 Schedule 6 Trusts' Agreement to Allocate the Basic Exemption From Minimum Tax - Canada

Form T3 Schedule 6 Trusts' Agreement to Allocate the Basic Exemption From Minimum Tax in Canada is used by trusts to allocate the basic exemption from minimum tax among the trustees.

The trust files the Form T3 Schedule 6 Trusts' Agreement to Allocate the Basic Exemption From Minimum Tax in Canada.

FAQ

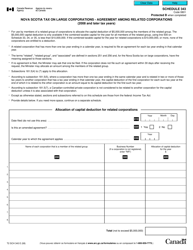

Q: What is a Form T3 Schedule 6?

A: Form T3 Schedule 6 is a tax form used in Canada for trusts to allocate the basic exemption from minimum tax.

Q: What is the basic exemption from minimum tax?

A: The basic exemption from minimum tax is an amount that can be exempt from minimum tax calculations in certain cases.

Q: Who needs to use Form T3 Schedule 6?

A: Trusts in Canada that are subject to the minimum tax and want to allocate the basic exemption need to use this form.

Q: How do I fill out Form T3 Schedule 6?

A: You need to provide information about the trust, calculate the allocation of the basic exemption, and attach it to your T3 Trust Income Tax and Information Return.